Delayed winter planting reducing the UK discount: Grain Market Daily

Tuesday, 29 October 2019

Market Commentary

- UK feed wheat futures (May-20) have recorded further gains, closing at £147.50/t yesterday, the highest close price since 13 August.

- The harvest of US maize has progressed at a faster pace over the last week. Although still delayed at 22 percentage points behind average, there is limited precipitation forecast over the next six days for many of the key US states and Chicago maize futures have drifted.

- US Chicago soybean futures have also fallen as harvest has progressed well and favourable harvest conditions are forecast.

Delayed winter planting reducing the UK discount

Delayed and disrupted winter wheat planting has heightened concerns for the 2020/21 harvest and moved UK feed wheat futures higher, up £6.05/t over the last week.

Gaining £13.20/t from the start of September, Nov-20 feed wheat futures closed at £153.50/t yesterday (28 Oct), the highest closing price since harvest finished.

Similar gains however have not been recorded on the continent, with Paris milling wheat futures (Dec-20) trading within a €1.52/t range throughout October.

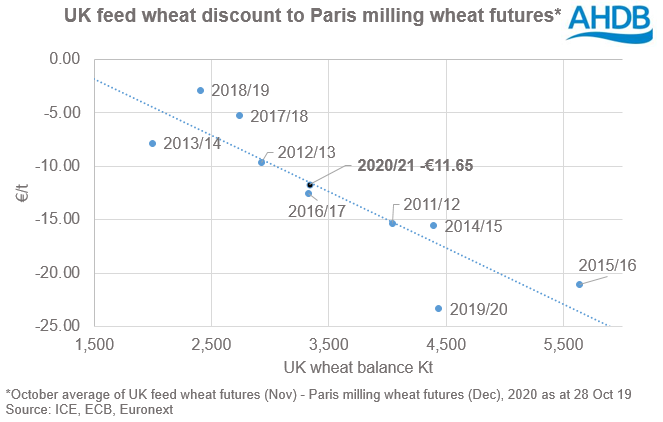

As such the discount of UK feed wheat to Paris milling wheat futures has narrowed over the month from -€20.93/t to just -€11.65/t at yesterday’s close. Comparing this discount to historical trends, the UK market is currently pricing a feed wheat balance for 2020/21 that looks similar to that of 2016/17 at 3.3Mt.

What does this price discount mean?

The discount that UK feed wheat futures have to Paris milling wheat futures is reflective of the UK wheat supply and demand balance. A larger discount incentivises exports in years of surplus, and a reduced discount in years of net import requirement.

The previous year of similarly delayed and disrupted winter planting occurred in 2013/14, which led to a sharp increase in spring barley (which Alice will cover in Thursday’s Analyst Insight).

The reduction in wheat area was combined with a low yield and beginning stocks of 2.2Mt, which led to a UK discount of -€7.82/t during October 2013.

However, owing to the size of the UK surplus this season, and Brexit related export challenges, the potential size of carry-in stocks into 2020/21 could be larger than 2013/14.

With potentially larger carry-in stocks, and no reason as of yet to forecast low yields, the extent to which UK feed wheat futures can move higher towards Paris milling wheat may now be limited unless weather conditions dramatically worsen.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.