DEFRA’s June survey aligns with the AHDB Planting and Variety Survey: Grain Market Daily

Friday, 27 September 2019

Market Commentary

- Paris milling wheat futures gained €2.25/t, to close yesterday at €173.00/t and continued to rise further this morning. The weakening of the euro is the main driver, closing yesterday at its lowest value against the US dollar since May 2017.

- UK feed wheat futures followed suit, gaining £0.65/t to £136.40/t, continuing to rise this morning.

- Sterling has tumbled from Thursday to Thursday. The dollar has strengthened in that time, causing the pound to drop 1.61% over the week to £1=$1.232 at yesterdays close. Brexit uncertainty has also weakened the pound against the euro, closing yesterday at £1=€1.128.

DEFRA’s June survey matches the AHDB Planting and Variety Survey

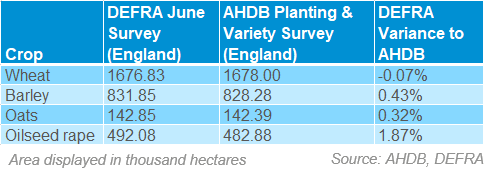

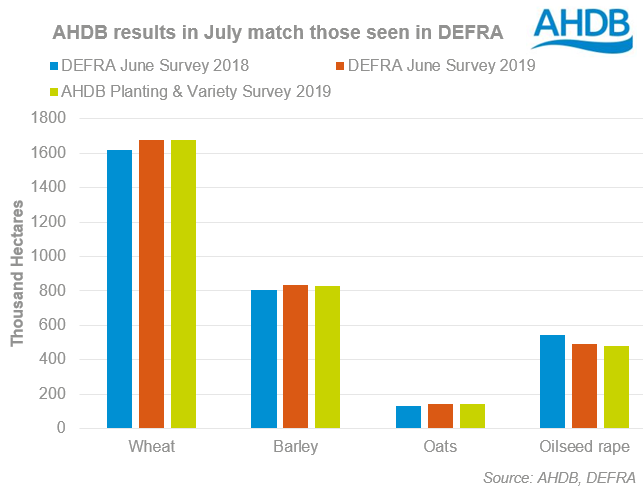

DEFRA released the final June Survey figures yesterday covering English agricultural plantings for 2019. These figures correlate to AHDB’s Planting and Variety survey areas, released in early July.

Planted English oilseed rape area for 2019 harvest remains the lowest area since 2006 based on either survey. This is primarily caused by re-plantings that took place for the OSR crop due to crop failure. Failure occurred from poor establishment in autumn due to dryness and cabbage stem flea beetle damage or pigeon damage.

The English wheat, barley and oats area have increased year-on-year. This could be partly lead by the replanting’s of oilseed rape into some cereal crops.

Production estimates

Little change to overall average yields for GB crops is seen in the final ADAS 2019 harvest report, released today.

Harvest has ended for most of Great Britain, with relatively settled weather in England and Wales over the past few weeks allowing good progress in northern regions. However, the more unsettled weather experienced in Scotland has resulted in a small amount left uncut, as of 24 September.

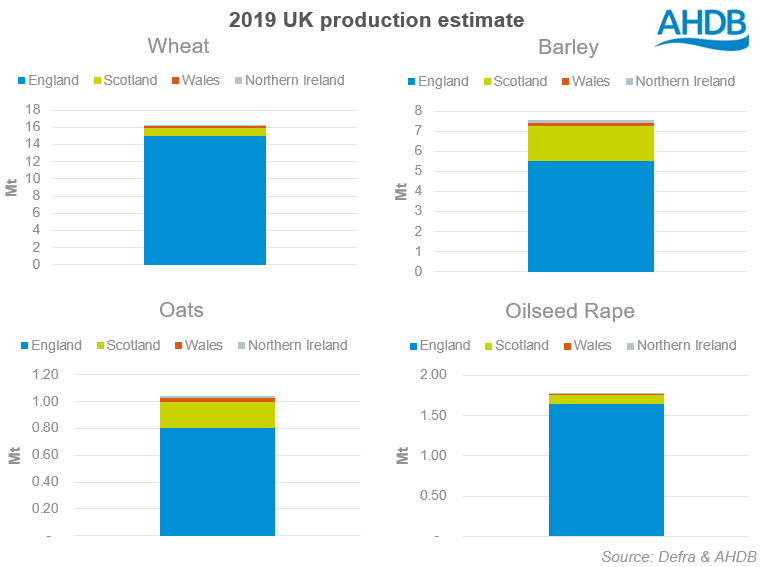

Based on the average yield results of the final harvest report, we can make some estimates regarding UK production for 2019.

- Wheat at 16.19Mt - the largest wheat crop since 2015

- Barley at 7.53Mt - the largest crop on record

- Oats at 1.04Mt - the largest crop on record

- Oilseed rape at 1.77Mt - the smallest crop since 2004

The large wheat and barley crops will undoubtedly push us into a net-export trade position for both. The prospect of a no-deal Brexit is concerning when we face a large exportable surplus. We have done a number of analysis pieces regarding the effects of a no-deal Brexit, which can be found on our Analyst Insight page.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.