Defra release first production estimates Grain Market Daily

Tuesday, 8 October 2019

Market Commentary

- The UK Government has released an update to the proposed import tariff rates in the event of a no-deal Brexit. While grain imports remain at 0%, there are proposed import tariffs for the livestock sectors and bioethanol.

- Forecasts for poor French maize yields are being realised, with France’s farm ministry downgrading production forecasts to just 12.5Mt, requiring yields to be over 7% lower year on year at just 8.2t/ha.

- UK feed wheat futures (Nov-19) have continued to drift lower so far this week, against the global upward trend, closing at £137/t.

Defra release first production estimates

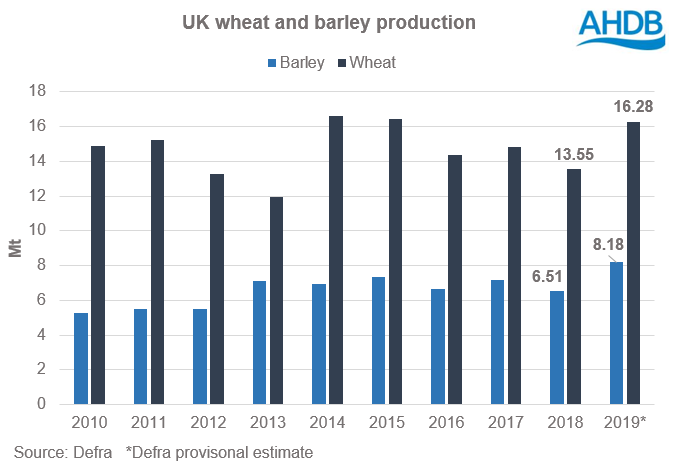

Defra released its first estimates of 2019 UK wheat and barley production this morning.

Wheat production at 16.283Mt has come as little surprise given the yields recorded and crop prospects. Yet this does cement the export requirement and ongoing need for UK markets to be globally competitive for the foreseeable future.

However, UK barley production figures have come out higher than industry and our expectations for between 7.5-7.7Mt. At 8.180Mt, this would be the largest barley crop in at least 30 years, requiring significantly higher yield figures than our own harvest surveys had suggested. With domestic consumption of barley typically around 6Mt, this would create a 2Mt exportable in a year of potential trade disruptions.

Greater clarity as to the factors and data behind the larger than expected barley production figure will be released on Thursday, as will other crop production estimates and regional yield data.

Maize delays and freezing forecasts

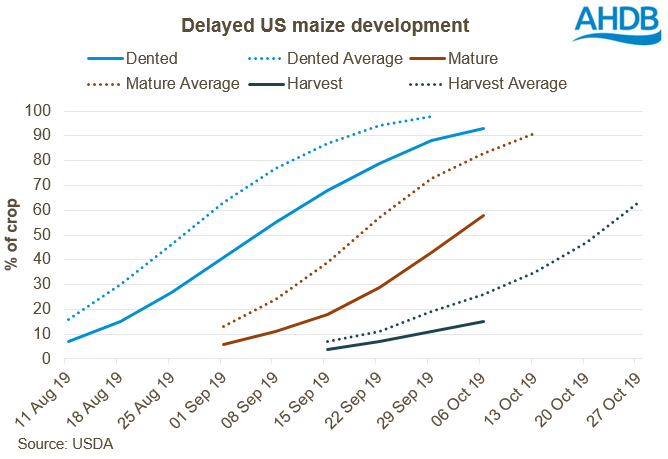

In the latest USDA Crop Production report, the spring maize planting delays have been impacting the rate of maturity and harvest progress.

Up until now, the maize delays have been of limited impacts to markets amid good supply prospects, but have raised questions over the final yield.

But at only 58% of the crop now having reached maturity, development has now fallen to the second slowest on record, and well behind the 85% historical average.

With the addition of freezing conditions and blizzards in the northern plains, where development has been the most delayed, there is the potential for harvest delays and crop damage.

As harvest has reached just 15% nationally, and states such as Illinois over 33 percentage points behind average, there is now a real potential for maize price support.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.