Currency saviour in a bearish global market: Grain Market Daily

Wednesday, 18 March 2020

Market Commentary

-

Yesterday recorded a surge in May-20 UK feed wheat futures, closing at £153.00/t, gaining £2.35/t (1.56%). Gains were also recorded in May-20 Paris milling wheat, jumping by €4.00/t (2.23%), closing at €179.25/t.

-

Prices were supported by a fall in the value of the pound, relative to the dollar, from £1 = $1.2266 to £1 = $1.2050, down 1.76% yesterday. Domestic markets are being isolated somewhat from global market sentiment.

Currency saviour in a bearish global market

Driving the gains in UK and Paris wheat futures yesterday was yet again currency, a surge in the value of the dollar and subsequent loss in the value of the pound and euro, shielding the domestic market from the overall continued bearish global sentiment.

Yesterday, the value of the Euro relative to the dollar fell from €1 = $1.1181 to €1= $1.0996, down 1.65% over the course of the day.

The pound continued to fall too, relative to the dollar, from £1 = $1.2266 to £1 = $1.2050, down 1.76% yesterday.

From 9 March, the pound has now lost over 8% of its value relative to the dollar as fears for the global economy have led to a safe haven attitude toward the US dollar, further buoyed yesterday by US fiscal stimulus announcements. During the 2008 financial crash, as the global economy slowed and investment into the U.K. fell, the pound fell by 28% relative to the dollar from the 1 July to 31 Dec 2008.

However, this recent currency led bounce may well prove to be only a temporary pause in what has been, and remains a bearish global grain market. US export sales and oil markets continue to influence global grain market direction.

US export sales

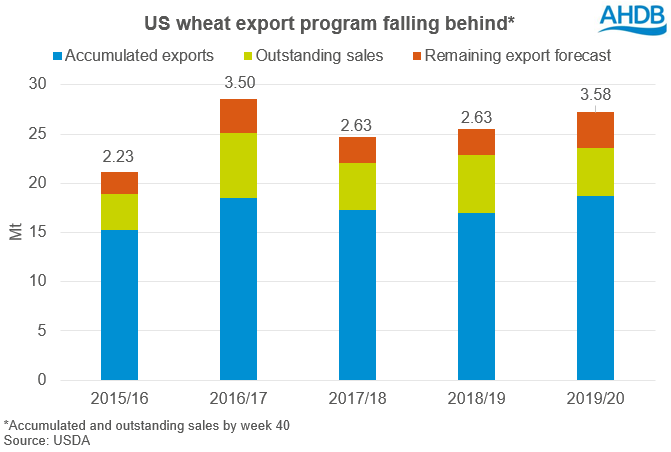

Continuing to add to the global bearish tone in US wheat markets are minimal export figures. At 18.7Mt of wheat exported by the first week in March (week 40), accumulated sales of wheat are up year on year and the largest volume at this point in the season in the last 5 years. However, outstanding sales, are not so encouraging. Combining accumulated exports, with outstanding sales, then overall US export sales as at 23.63Mt are the furthest away from the USDA export forecast for the entire 2019/20 season, in at least the last 5 seasons. Should the Covid-19 pandemic lead to further reduced global demand, a delayed overall US export sales pace could provide additional pressure.

Oil price wheat market implications

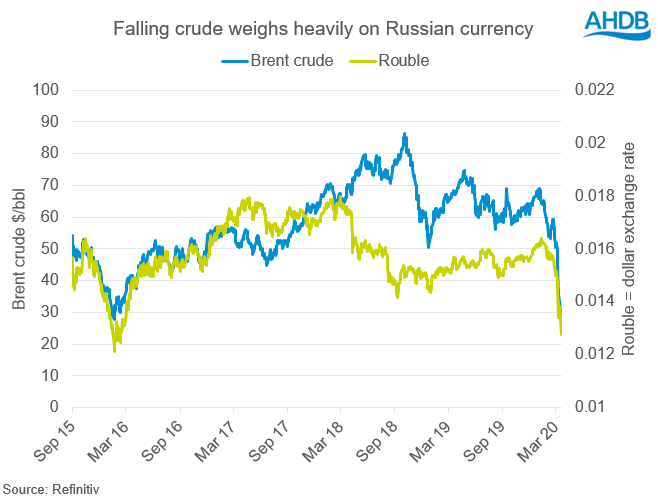

The Russian economy and currency is heavily linked to the oil market, as such as the oil market has continued to fall, so has the rouble. As the rouble falls, the Russian wheat export price becomes more competitive adding pressure to global export markets. As oil demand continues to contract, further losses to crude markets will continue to add further wheat market pressure.

Yesterday, some price support was seen from the suggestion that Russia could limit exports of some products. As mentioned previously, while there is no deficit of grain, Russia maintains the ability to halt and prevent exports in order to protect domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.