Crop development report posing optimism for wheat yields: Grain market daily

Tuesday, 7 December 2021

Market commentary

- UK wheat futures (May-22) closed yesterday at £231.20/t, down £0.05/t on Friday’s close. While the Nov-22 contract found support closing up £0.60/t at £204.00/t.

- UK wheat futures have followed trends in Paris wheat futures. The gain on old (May-22) Paris futures wasn't as high as the new crop (Dec-22) value in euro terms, so when coupled with strengthening sterling, meant domestic old-crop prices were pressured slightly. Sterling also strengthened against the US dollar on Monday.

- Both Chicago wheat (May-22) and Paris wheat (May-22) closed higher yesterday from Friday’s close. Despite hesitation in markets due to Omicron news, there is still signs of strong export demand for wheat, which is underpinning these prices.

- EU rapeseed output is expected to increase by 6% year-on-year to 18Mt in 2022, cited in Stratégie Grains’ latest report. Area is set to increase, likely off the back of high prices.

Crop development report posing optimism for wheat yields

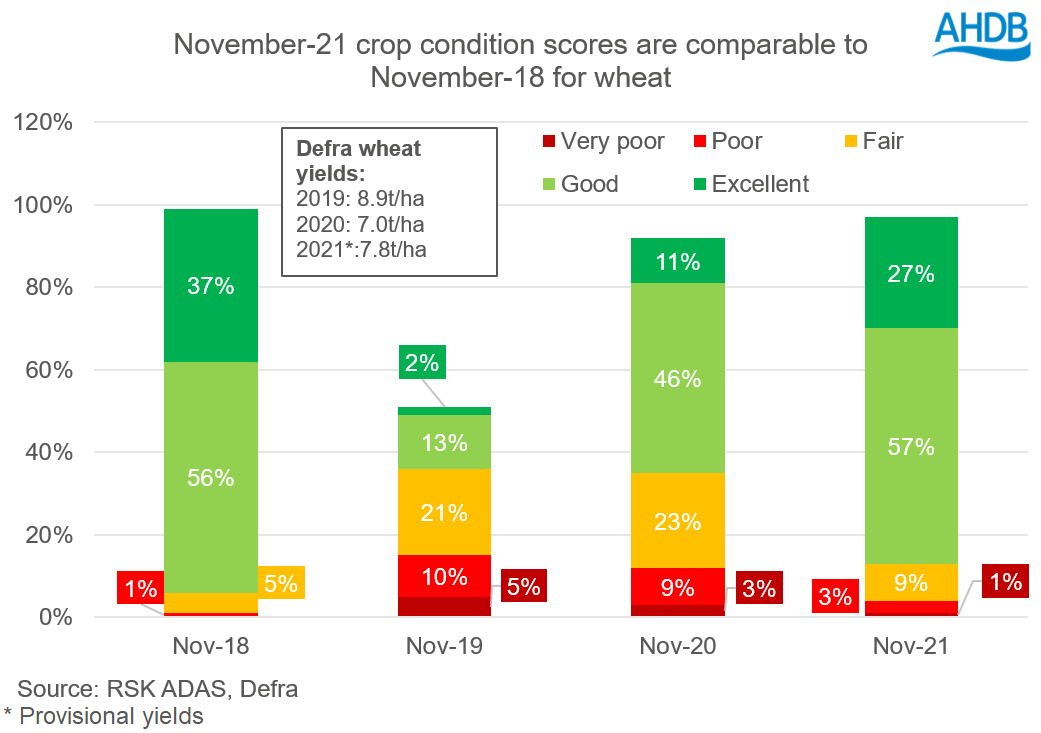

The latest crop development report published last Friday (03 Dec) estimated winter wheat conditions significantly better year-on-year.

In the latest report, 84% of wheat was rated good-excellent, up from 57% at the same point last year. Only 9% was rated fair, versus 23% last year.

The last two Autumns (2019 and 2020) have been relatively wet, especially 2019, which hindered autumn drilling campaigns. At this same point in November 2019, just under 60% of the intended GB wheat area had been drilled. This then lead to a seismic shift to spring cropping. Further to that, crop conditions as of November 2019 were poor, with a mere 15% of winter wheat rated good-excellent.

However, do crop conditions in November correlate with the final yield of the crop?

November crop development scores and final wheat yields

A “successful” drilling campaign generally leads to good establishment of the crop. In turn this likely means favourable crop conditions. Therefore, it could be suggested that there is a correlative link between November crop condition scores and final yields, that’s if extreme weather event’s do not follow.

Currently, in the longer-term forecast up to 04 January the Met Office predict temperatures to be milder than earlier in the month and near to or above averages. It is likely to become more settled around the New Year with increased chance of overnight frost during clearer spells.

Current crop condition scores are most comparable to November 2018 when 99% of the wheat crop had been planted and 93% of the crop was rated good-excellent. Yields that year were pegged at 8.9t/ha, leading to a bumper crop of 16.2Mt.

As our latest Early Bird Survey result estimated, intended area for 2022 harvest is also similar to that of harvest 2019, but it does not necessarily mean we are heading towards a bumper crop. However, with 99% of our 2022 winter wheat production in the ground, the UK is in a good position to produce a sizable crop.

What is critical to note though, is that a lot can change from now until harvest 2022. Although current conditions pose optimism for yields, timely rains and sunshine hours will be critical to achieve good yields.

Recent weather events show extreme weather conditions are becoming more common; autumn 2019 had excessive rains whereas spring/summer of 2018 experienced drought.

Fertiliser costs and availability may also pose risk to yields this year. The AHDB has issued new guidance on recommended nitrogen applications. Also available is a nitrogen fertiliser adjustment calculator for cereals and oilseeds. This is a tool used to establish the economic optimum amount of nitrogen to apply to crops. For more information, sign up to the AHDB webinar ‘Mitigating high fertiliser prices’ on 16 December.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.