Continued price stability for AN prices in November: Grain market daily

Thursday, 21 December 2023

Market commentary

- UK feed wheat futures (May-24) closed at £195.60/t yesterday, gaining £0.85/t from Tuesday’s close. The Nov-24 contract closed at £208.15/t, gaining £1.00/t over the same period.

- Higher Ukrainian grain prices are helping to support the European wheat markets. New crop futures gained as France’s 2024 wheat harvest is forecast to be the country’s lowest production this century at 4.24 Mha, due to heavy rainfall earlier in the year (Argus).

- Paris rapeseed futures (May-24) closed yesterday at €433.50/t, gaining €1.75/t from Tuesday’s close. The Nov-24 contract closed at €439.25/t, also gaining €1.75/t over the same period.

- Paris rapeseed futures followed the Winnipeg canola market up yesterday as a lack of farmer selling pushed up prices. Rapeseed futures also gained as a result of increased net short and long positions.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Continued price stability for AN prices in November

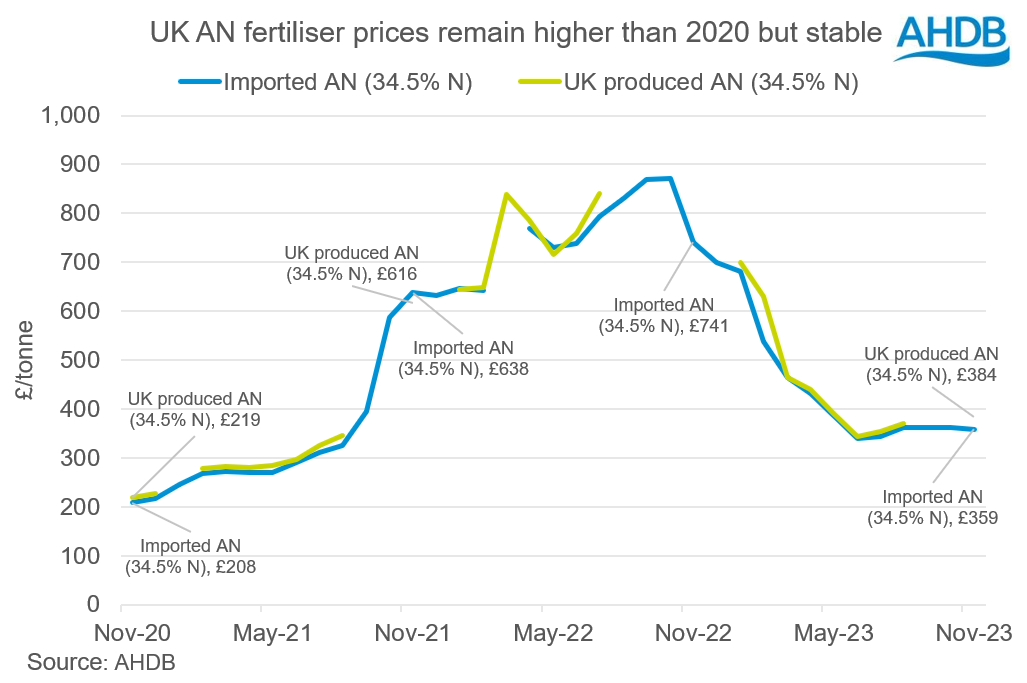

Nitrogen fertiliser prices continue to be relatively stable following the latest GB fertiliser prices, released this week. Imported ammonium nitrate (AN) for November was quoted at £359/t, near unchanged (down £2/t) from October, staying relatively in line with values since August. While UK produced AN was quoted for November at £384/t. This is the first published price since August, and up £14/t since August.

In comparison to last year, the price for imported AN has fallen 52%, with Nov-22 prices quoted at £741/t, following natural gas prices down. Also feeling a little supported by the recent strengthening of the pound making imports relatively cheaper. However, despite this, AN fertiliser is yet to return to prices before the European energy crisis in 2021 and outbreak of war in Ukraine at the start of 2022. Prior to Europe’s natural gas crisis from mid-2021 to late 2022, imported AN for November 2017 – 2020 averaged £239/t, £120/t (33%) less than November 2023.

Natural gas price stability in recent months

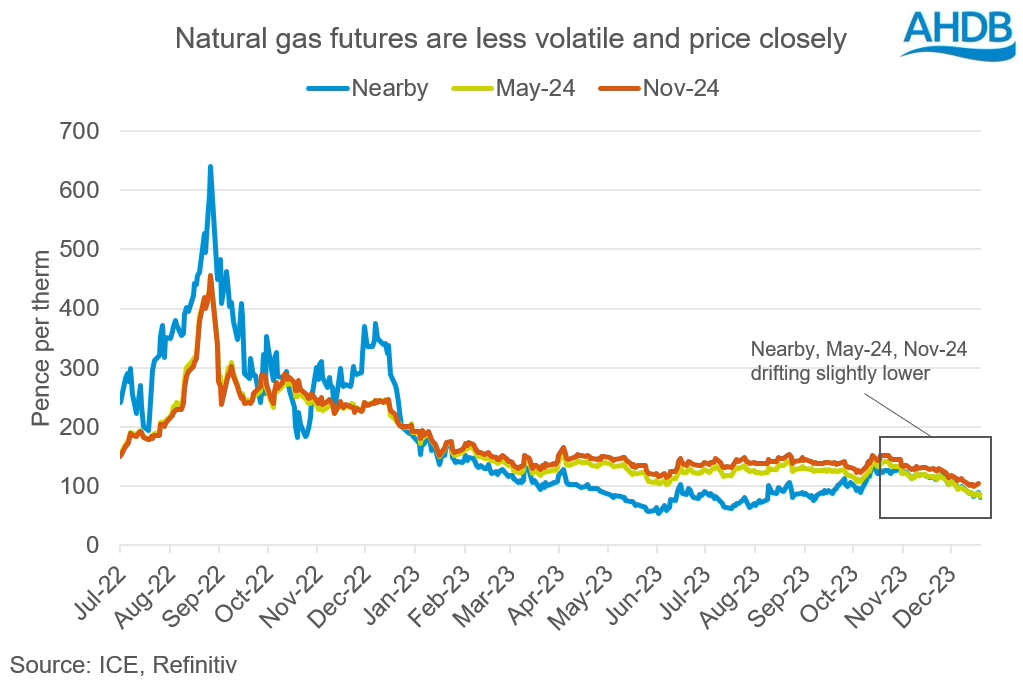

The stability of nitrogen fertiliser prices in recent months is strongly linked with the recent stability of UK natural gas futures too, with natural gas accounting for approximately 60% of nitrogen fertiliser production. Since the previous fertiliser update in October, Nearby, May-24 and Nov-24 natural gas futures are continuing to remain stable. While the Nov-24 contract is priced marginally higher than the Nearby and May-24 contracts, since late-October, all contracts are falling in price at a near similar rate.

Ample natural gas stocks in Europe have helped to support the stability of natural gas prices. As of 18 December, gas stocks for the EU were 88%, up 5% from last year and 20% over the three-year average (2020-2022) (Gas Infrastructure Europe). One key reason for high stocks is the warmer European autumn which has reduced industrial gas use on the continent, helping to reduce demand on natural gas inventories.

Furthermore, ample liquid natural gas (LNG) stocks for Europe and North Asia are offsetting LNG supply concerns following reports that a ship was attacked on the Suez Canal linked to conflict in the Middle East.

Future outlook

Europe’s natural gas market has been drifting lower, as current natural gas supplies are at historically high levels. Gas inventories are said to be ample enough such that they will not reach critically low levels regardless of the weather over the winter period (LSEG). Though with Nov-24 natural gas futures higher than spot, this does provide some support in the outlook for natural gas markets going forward.

So, while nitrogen fertilisers will continue to react to natural gas prices, ample natural gas supplies on the continent look to keep some price stability in fertiliser markets short term.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.