Opportunities for further lamb growth in more menu presence

Wednesday, 16 September 2020

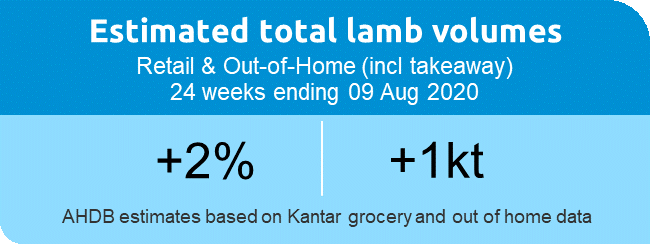

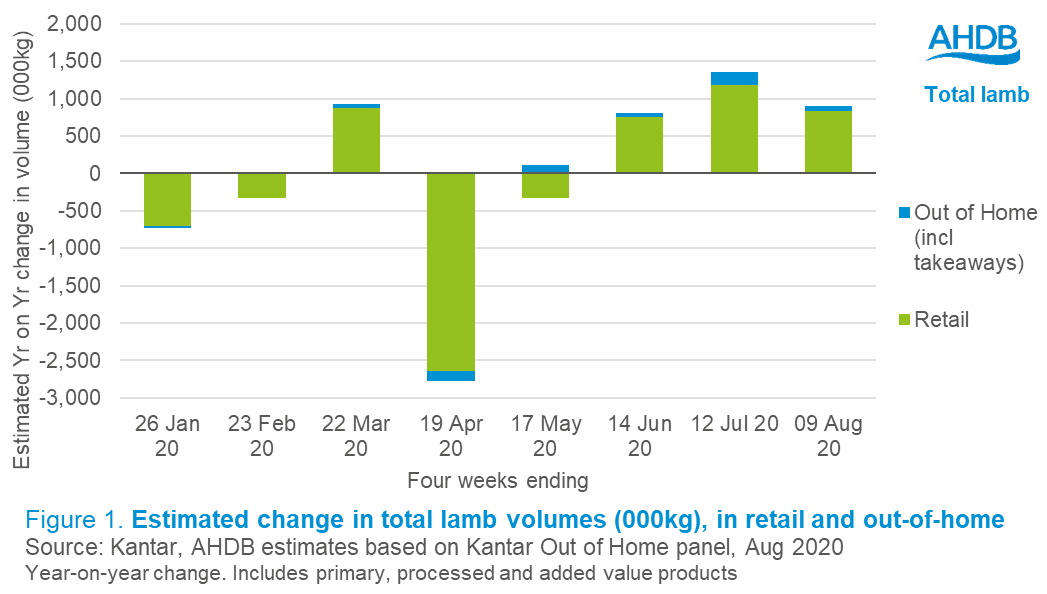

The timing of lockdown so close to Easter may have hampered lamb volumes in April, but improved performance in subsequent months, as well as growth in lamb takeaways, resulted in slight volume growth in the six months to 9 August, according to AHDB estimates based on Kantar data.

Retail volumes

In the 24 weeks ending (w/e) 9 August, retail sales volumes of lamb rose by 1% year-on-year (YOY). This is well behind the total food and non-alcoholic drink uplift of 14%, but it is encouraging that retail sales have recovered to the extent that Easter losses have been recouped.

Mince and chops made the greatest contribution to growth over the 24-week period, growing by +31% (983t) and +25% (973t) respectively. Due to its reliance on the Easter weekend, lamb leg roasting joint volumes were down 18% (-2,280t).

Out-of-home volumes (including takeaways)

Lamb is the least reliant sector on dine-in consumption, with around a 50:50 split between takeaways and non-takeaways. This means that the closure of pubs and restaurants between March and July had less of an impact on the lamb sector, and estimated lamb total out-of-home volumes actually rose by 5% (+358t) in the 24 w/e 9 August.

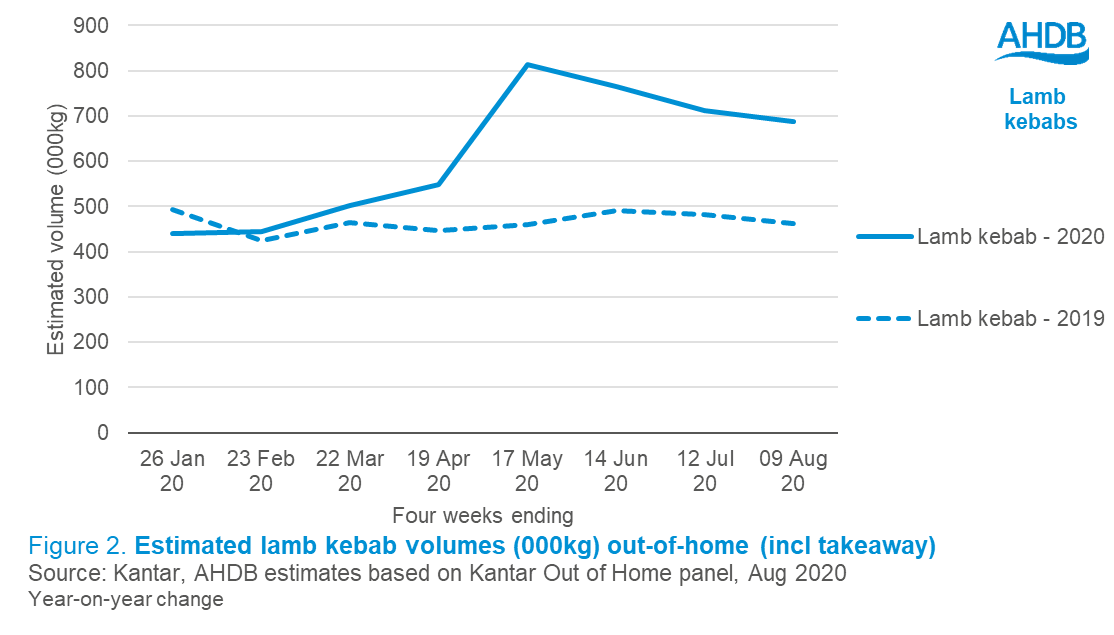

This uplift was driven by an increase in takeaways, mainly in the form of kebabs. In every month since lockdown began, estimated lamb kebab volumes were well ahead of 2019. Overall, in the 24 w/e 9 August, lamb kebab volumes were estimated to be 43% (+1,200t) higher YOY.

In addition to kebabs, lamb curries and lamb burgers also grew. However, dishes more suited to dining-in, rather than takeaway, did not fare so well. Lamb-centred meals, which include roasts and shepherd’s pie, declined by 58% (-1,100t), likely impacting higher-quality cuts.

Lamb will need to regain volumes lost from the closure of the eating out market, to avoid over-reliance on takeaways and open up the market for higher quality cuts. The Eat Out to Help Out scheme may have encouraged consumers to trade into lamb, provided it is on the menu. Menu tracking research from Lumina Intelligence suggests that average menu sizes have been reduced by 32% year-on-year, when comparing Spring/Summer menus. Not only did lamb already lack presence on menus, prior to the pandemic, mentions of lamb on these Spring/Summer menus have declined at a faster rate than the average, so more must be done to ensure lamb is available to diners.

Read more about how lamb compares to other categories in our main update.

Notes:

Out-of-home volumes include takeaway, dine-in and on-the-go.

Public Sector (e.g. schools, hospitals) not captured

Sectors: