Conab forecasts Brazil’s 2025 maize and soyabean harvests: Grain market daily

Wednesday, 16 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £185.10/t yesterday, falling £2.15/t from Monday’s close. The May-25 contract fell £1.40/t over the same period, to close at £200.10/t.

- UK feed wheat futures followed the slide in global wheat markets. Pressure came following forecasts of favourable rain over key wheat-growing regions in Russia as well as the continued elevated pace of the US maize harvest which was reported yesterday at 47% complete as at 13 October, remaining above the five-year average.

- Paris rapeseed futures (Nov-24) closed at €491.25/t yesterday, falling €4.00/t from Monday’s close. The May-25 contract fell €5.50/t over the same period, to close at €497.50/t.

- Paris rapeseed futures fell following losses in the crude oil market (Brent Crude Oil futures (Dec-24) lost 4.14% from Monday’s close). Eased concerns about Israel targeting Iran's crude infrastructure contributed to the fall in oil markets. In addition, Chicago soyabean futures (Nov-24) closed below the support level of $10/bshl yesterday for the second consecutive day.

Conab forecasts Brazil’s 2025 maize and soyabean harvests

Yesterday, Conab (Brazil’s Agricultural Ministry) released their first production estimates for the 2024/25 maize and soyabean crops. With Brazil typically being the second largest maize exporter and largest soyabean exporter globally, the country plays an influential role regarding respective global balances.

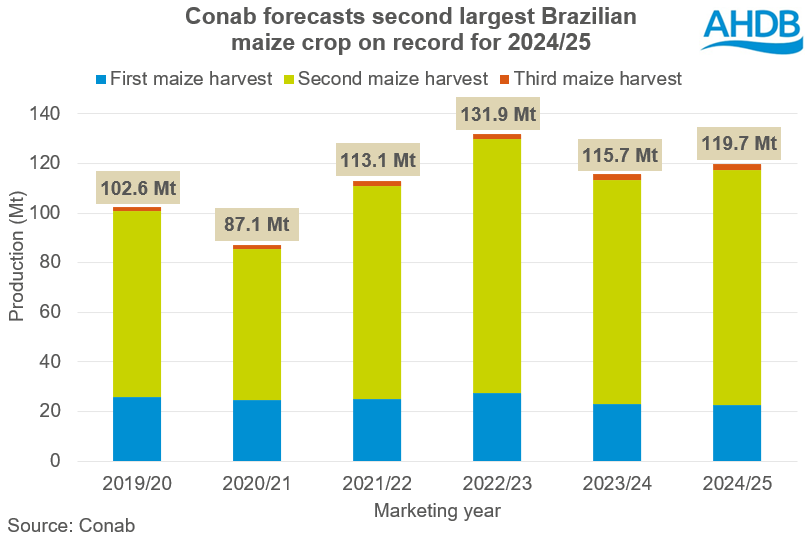

Maize

Conab forecasts total maize production at 119.7 Mt, up 3% on the year and 9% over the five-year average; the second largest maize crop on record (after 2022/23).

As at 13 October, first maize crop planting was 28.8% complete, in line with last year’s pace. While dryness had prevented planting in the central-west and southeast regions, planting in the south had been more viable and crops were reported to have established in good condition; the south is where the majority of first maize crop is produced.

The USDA’s latest estimate put Brazilian maize production at 127.0 Mt, 7.3 Mt greater than Conab’s forecast. The lower forecast from Conab could suggest that the global maize balance could be slightly tighter, however, along with the second largest US maize crop being harvested currently, the global supply remains plentiful.

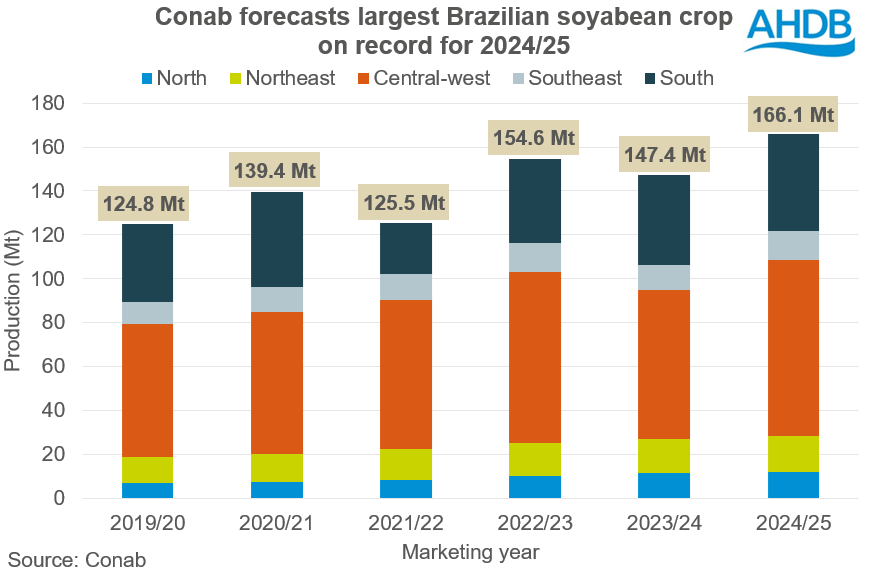

Soyabeans

The margin between the USDA and Conab is narrower for the 2025 soyabean harvest, with Conab at 166.1 Mt, 2.9 Mt less than the USDA. Along with the USDA, Conab have also forecast the largest Brazilian soyabean crop, largely due to increased planted areas which is record high for all five geographic areas in Brazil.

As at 13 October, 9.1% of the soyabean crop had been planted, behind the progression for this time last year of 19.0%. While soyabean crop planting has begun in some states, progress has been delayed in southeast and central-west regions due to insufficient rainfall.

Conab’s latest forecast reassures the sentiment of a sizable Brazilian soyabean crop. As a result, should the record crop be realised, pressure upon the oilseeds complex (including rapeseed) is likely to be seen. However, given the fundamental tightness of rapeseed for the 2024/25 marketing year, the premium rapeseed has over soyabeans could remain supported.

Looking ahead

Further rains forecast over areas which had experienced prolonged dryness has tempered concerns regarding soyabean planting delays, as well as potential delays to the safrinha maize crop too (which usually accounts for 75% of the total maize crop) which follows the soyabean harvest.

As a further matter, the likelihood of a weak La Niña weather event occurring in the next month until potentially March 2025 has reduced from 71% to 60% (National Oceanic and Atmospheric Administration). The La Niña weather event typically causes greater periods of dryness over Brazil, so if this weather event does not establish, growing conditions for Brazil’s soyabean and first maize crops could be more favourable.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.