Cold weather led to a rise in natural gas prices: Grain market daily

Wednesday, 14 December 2022

Market commentary

- UK feed wheat futures moved somewhat sideways yesterday, with the May-23 contract closing the day at £245.00/t, down £0.50/t from Monday’s close. The Nov-23 settled at £230.50/t, up £0.50/t over the same period.

- In November, the UK consumer price index inflation rate eased back from October’s 41 year high of 11.1% to 10.7%, according to latest data released by the ONS this morning. The slight fall in inflation rates has been driven largely by a drop in petrol pump prices.

- Paris rapeseed futures (May-23) closed up by €8.00/t yesterday, to settle at €570.25/t. Rapeseed markets were supported yesterday by upward movements in soyabean markets as bargain buying and strong US export demand supported prices.

Cold weather led to a rise in natural gas prices

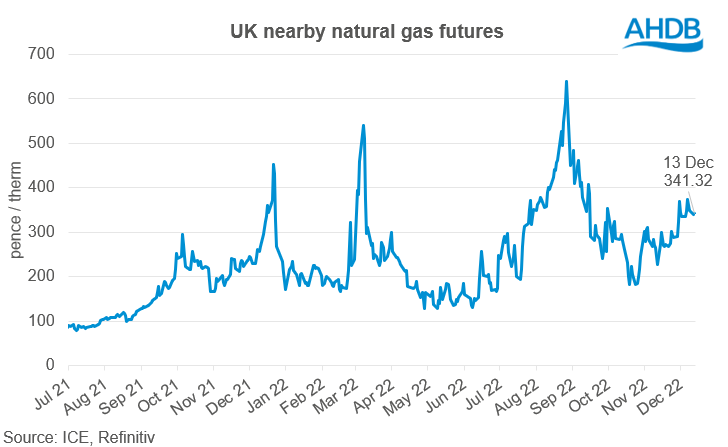

With cold weather leading to higher demand, less output from wind power, as well as French nuclear power plant maintenance, natural gas prices have been on the upward trajectory. Nearby UK natural gas futures closed at 341.32p/therm yesterday, up 68.44p/therm from this point last month (14 Nov), when gas prices were being pressured by increased Norwegian imports amongst other factors.

While natural gas prices have risen over the past month, the forecasted milder weather within the next week, may see demand reduce and add some pressure to natural gas prices in the short term. As well as that, it is expected that there will be more wind towards the end of this week, with increased wind output leading to reduced demand for gas by power stations.

Looking further ahead at supply and prices, last Wednesday the UK struck a deal with the US whereby the US will export 9 - 10 billion cubic metres of liquid natural gas (LNG) to the UK over the next year. While this deal may ease some concerns over supply, it’s worth noting that the UK has imported 11 billion cubic metres from January to November 2022 (Refinitiv). Volatility in natural gas markets is likely to continue, given the ongoing conflict in Ukraine and the continued closure of the Nord Stream 1 pipeline. Furthermore, as we are now in the midst of winter, weather will have a greater impact on demand and price movements as we progress through the next few months.

What does this mean for the cost of fertiliser?

The spot delivered price for imported AN delivered to farm was £741/t in November, according to the latest AHDB GB fertiliser prices. While this price is £129/t down compared with October, it is £103/t higher than November 2021 and more than three and a half times the price recorded in November 2020.

While natural gas prices are unlikely (as it stands) to go back up to the record highs recorded in August, they are likely to remain volatile and somewhat elevated. As such, it is unlikely that fertiliser prices will come back down to the more ‘normal’ levels we saw at just the start of last year.

AHDB have several resources to help growers assess fertiliser applications, including a new GB fertiliser price dashboard, the nitrogen fertiliser adjustment calculator and analysis on different application strategies.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.