Cheddar - Filling the Brexit void

Tuesday, 12 March 2019

By Felicity Rusk

In 2017, AHDB looked into the feasibility of import displacement for a number of dairy products, including cheddar, butter and yogurt. In this report, we look at how the cheddar industry has moved on over the last two years in preparation for Brexit.

Under a No-Deal Brexit scenario, the UK will face the EU common external tariff on all exports to the EU. For cheddar, this would mean a tariff of €1,671 per tonne on UK cheddar exports, making the majority of UK product uncompetitive on EU markets. The Government has recently announced the tariffs that will be imposed on imported products. For cheddar, the tariff is €221 per tonne, significantly lower than the tariff that would be applied to UK cheddar exports.

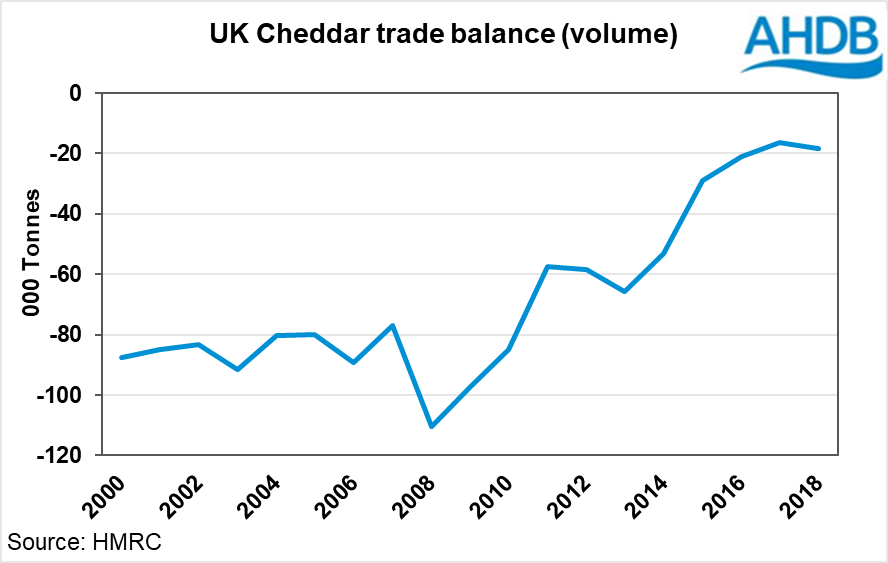

The UK remains a net importer of cheddar, although the extent of the deficit has reduced in recent years as UK exports have increased. The UK had a trade shortfall in 2018, where it imported 18k tonnes more than it exported.

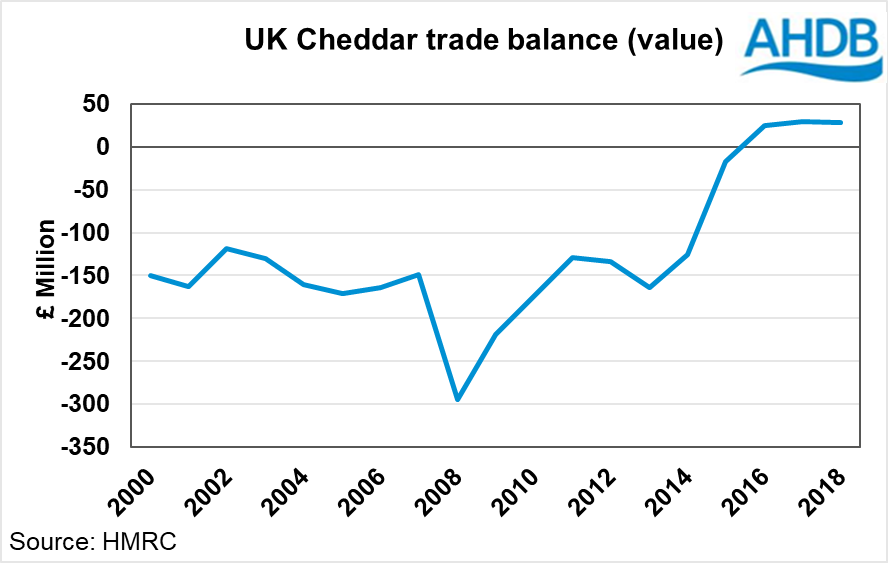

Although in volume terms, the UK has a trade deficit, this is not the case in terms of monetary value. Over the past 10 years, the UK’s trade balance for cheddar has strengthened significantly. In 2008, the UK had a deficit of £294 million. Whereas over the last three years, the UK has had a net surplus in the region of £25-29 million.

In 2018, the average price of exported cheddar was £3,700/tonne, while imported product averaged £2,800/tonne. Part of this difference will be a result of a higher proportion of packed goods being exported compared with imported. The majority of cheddar imported is in bulk format, and is then packed in the UK.

But could the UK dairy industry replace the net volume shortfall?

In terms of bulk product, it would require an additional 170 million litres of milk to produce 18k tonne more cheddar. The elevated level of milk production seen in recent months demonstrates the UK herd is capable of producing this provided there is adequate demand and a market for the milk.

In 2017, one conclusion was the lack of spare processing capacity to produce the extra volume. However, since then, a number of UK cheddar producers have invested, or announced investments to increase capacity, which would allow the extra volume to be produced.

However, it is too simplistic a view to look at the net shortfall of cheddar alone. With an import tariff under No-Deal Brexit at just €221 per tonne, compared with the export tariff of €1,671 per tonne, the impact on imports and exports is likely to be significantly different. Additionally, flavour profiles, recipes and format will be different between what we import and what we export. We also know that a proportion of cheddar exports are then re-imported as other products, such as spreadable cheese. These products do not appear in trade figures under cheddar imports and, as such, add an additional shortfall for UK consumers. Finally, we must not forget that exported cheddar is significantly higher in value per tonne than imported cheddar.

At the time of publishing, it is still unclear what the post-Brexit landscape looks like for the industry. Under a No-Deal scenario, on the face of it, the UK cheddar industry would be well placed to fill any trade void with increased production. However with No-Deal tariff rates for product entering the UK significantly lower than those on UK exports, this could leave UK exporters no home for their cheese, while still allowing product to enter the UK market from the EU.

Such circumstances could have a significant detrimental impact on UK cheddar manufacturers. Not least challenging cashflow; with cheese made and maturing in store, but with no export home to go to. The level of the impact on individual businesses will be determined by what proportion of their cheese is exported, and what back-up plan they have put in place during these uncertain times.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.