Brexit lift for UK wheat? Grain Market Daily

Wednesday, 28 August 2019

Market Commentary

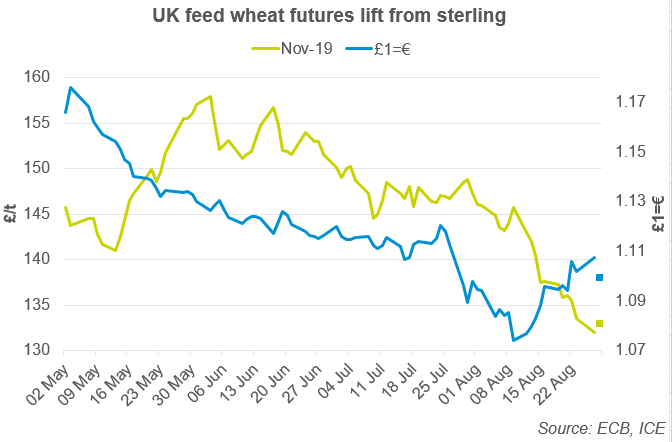

- UK feed wheat futures (Nov-19) continued to decline yesterday, falling a further £1.50/t to close at £132.00/t. Futures are hugely oversold, however fundamentals alone leave little room for a reversal.

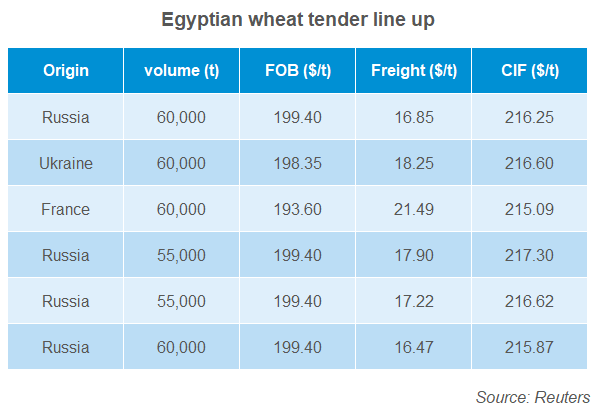

- Yesterday’s GASC tender was won primarily by Russian wheat with additional cargoes from Ukraine and France. The French offer was the cheapest of the three origins at $215.09/t CIF.

- With UK feed wheat (FOB, October) quoted at £136.50, assuming an inland £18.40/t milling premium (based upon corn returns) and similar freight costs to France, UK wheat appears to be competitive on the global stage at circa $211.67/t CIF.

Brexit lift for UK wheat?

- Sterling has fallen with the prospect of a no deal Brexit increasing.

- The fall in sterling has supported UK wheat futures against falling EU wheat prices.

With just 65 days until the UK leaves the European Union, the direction of sterling continues to drive the direction of UK grain and oilseed futures.

Sterling has so far lost the ground that it made up yesterday on news that a group of opposition party leaders had agreed upon a way forward to block no deal. However, today’s announcement that the Prime Minister is looking to suspend parliament has sent sterling reeling.

While sterling is still above early-August levels, it had fallen back to £1=€1.0986 at 10am, pricing in the increased likelihood of a no-deal Brexit. The move lower for sterling has supported grain prices early this morning with Nov-19 futures sitting at £133.00/t, up £1.00/t from yesterday’s close.

Prices have subsequently moved back to yesterday’s level, protected against a move lower in Paris wheat by the weaker sterling.

Looking ahead a lot of the direction of currency will be centred on Brexit. Anything increasing the likelihood of a no-deal will move sterling lower and grain and oilseed prices higher. Conversely, should the likelihood of a deal, or delay, improve sterling will strengthen, effectively weakening grain and oilseed prices.

EU soft wheat exports improve

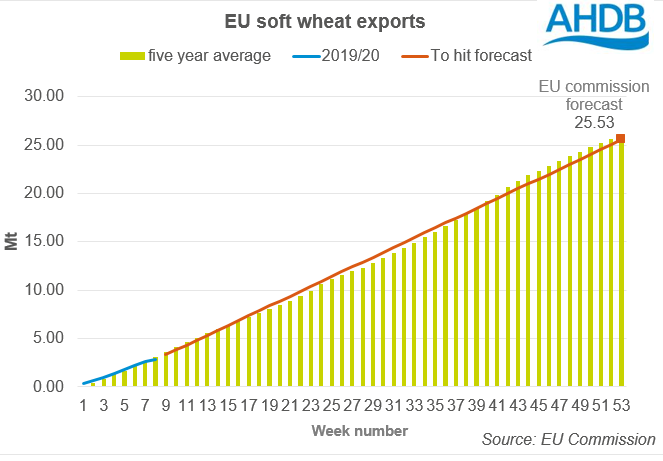

- EU soft wheat exports have increased significantly in recent weeks.

- Further support for EU exports from the latest GASC tender.

- However, still a lot of EU wheat to be moved, French consultancy Agritel estimate French exportable surplus at 20Mt.

The pace of EU soft wheat exports has improved considerably since we last discussed them. Strong exports from Eastern European nations to North Africa have resulted in exports moving up towards the five year average level.

Further support for EU exports was seen yesterday with French wheat the cheapest offered origin in the latest GASC (Egyptian state grain buyer) tender (full line up above). A cargo of French wheat was offered $215.09/t, further highlighting the ample availability of EU soft wheat this season.

While the demand from Egypt offers temporary support for prices, the weight of global grain supplies could tell later in the season. French consultancy Agritel highlighted a 20Mt exportable surplus of French wheat for this season, adding to the weight of global markets, and pressuring prices in the longer term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.