Brexit, Forex and Supply, Where are UK Futures? Grain Market Daily

Friday, 6 September 2019

Market Commentary

- Commodity markets gained support yesterday owing to the news that China agreed to resume trade talks with the US.

- UK feed wheat futures also continued to push higher (+£1.75/t), gaining for a third consecutive day, closing at £134.25/t.

- However, UK feed wheat futures (Nov-19) gained more than both Paris and Chicago wheat futures, despite a strengthening of the pound. As such, UK futures may have to pull back slightly as UK feed wheat needs to continue to discount relative to other European origins.

Brexit, Forex and Supply, Where are UK Futures?

With UK wheat production likely to be in the region of 16Mt, as previously highlighted, there could well be a wheat balance in the region of 3.9Mt. Domestic prices need to price competitively against European origins.

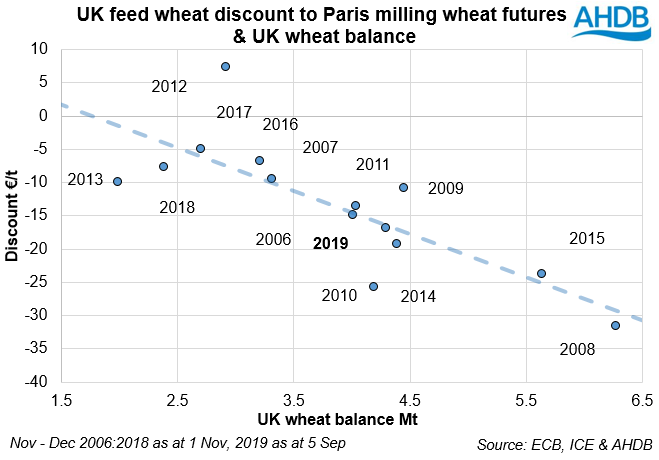

The supply and demand picture for the UK is reflected in the degree to which UK futures discount to Paris milling wheat futures.; the larger the balance in the UK the larger the discount.

The discount of UK feed wheat futures (Nov) to Paris milling wheat futures (Dec) needs analysing in euro terms not pounds. With a discount of €16.98/t (£15.25/t) on the 5 September, UK feed wheat futures are pricing within the historical trend for the likely UK feed wheat balance.

Exchange rate risk

The pound is still trading near historically low levels against the euro, which provided support to UK domestic markets during the falling global market.

In the event of a deal with the EU, the value of the pound could rebound. However, the discount of UK feed wheat to Paris milling wheat futures would likely continue in the €15 - €20/t range.

Should the value of the pound make a recovery to £1 = €1.17, where the pound was trading prior to the summer, then November futures would trade closer to £125.00/t to maintain the current €15 - €20/t discount.

Brexit price risk

With feed wheat futures currently trading within historical trends, potential tariffs and Brexit trade complications have not yet completely been priced into UK feed wheat markets.

With a potential €12/t tariff to be applied to all UK wheat exports to the EU, the discount to Paris milling wheat futures could widen to near €30/t. The pound would require near parity with the euro to negate the tariff impact on UK feed wheat prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.