Brexit deadline elevates export volumes: Grain Market Daily

Wednesday, 25 September 2019

Market Commentary

- UK feed wheat futures (Nov-19) eased slightly to close at £135.75/t, a fall of £0.50/t from yesterday.

- Paris milling wheat futures (Dec-19) also declined to close at €170.25/t, a fall of €1.50/t in the same period.

- In South America, Argentinian wheat yield forecasts have been revised back due to a continued lack of rain across wheat producing regions. The dry conditions have also hampered corn planting schedules.

- The main Egyptian grain buyer (GASC) opened a tender seeking an unspecified volume of soft wheat for October-November delivery, with results published later today. In the most recent tender (18 Sept), 180Kt of Russian wheat was purchased.

Brexit deadline elevates export volumes

As the imminent Brexit deadline creeps closer, grain prices have seen bigger pressures to remain competitive on the export scene. With larger production figures this year and lower domestic demand, the threat of tariff-rate quotas on exports has put greater emphasis on export volumes before the deadline.

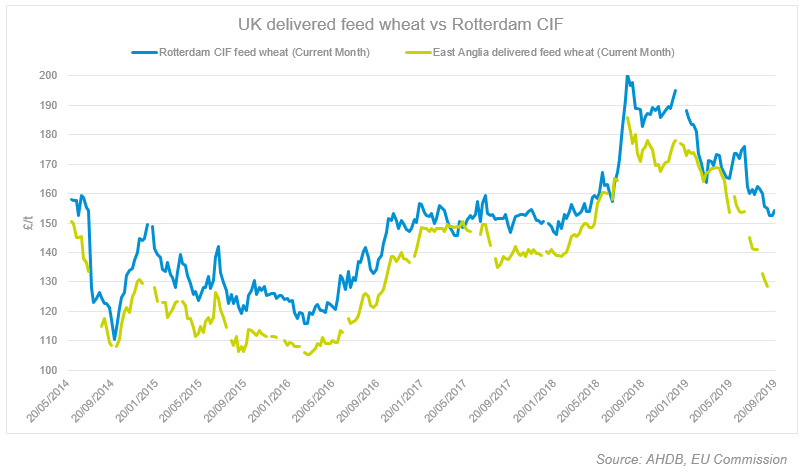

This season, the spread between UK FOB and Rotterdam CIF prices has tracked wider to become competitive, better counteracting sterling’s rise. The spread as of Friday 20 September was £14/t, meaning when average freight costs of £15/t are added, the prices become alike.

In previous seasons, when domestic demand has been more prevalent, UK FOB prices have had a smaller discount to European prices as the incentive to export was less attractive. This was seen last season, as drought conditions lowered UK wheat production figures. Lower domestic supplies meant incentives to keep wheat in the country were higher than export markets. Earlier this year (15 March), UK FOB prices were £3.00/t higher than the Rotterdam CIF price, the further addition of freight costs prevented volumes of feed wheat from leaving the country.

The UK typically sends around 90% of its wheat exports to Europe, according to HMRC data. The lack of concrete information surrounding export tariffs has hampered large purchases of grain for export post-October with many buyers not wanting to take the risk. Our latest corn return figures (19 September) detail 51.1Kt of feed wheat purchased for October movement (domestic and export). This is the largest October volume since 2014. Conversely, 9.8Kt has been booked for November-December – 2.4Kt below the five year average for this period, an average that includes the low production seasons of 17/18 and 18/19.

Through September, sterling has risen against the euro from near-record lows. Export prices have had to ease to remain competitive.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.