Black Sea Initiative to keep markets volatile short term: Grain market daily

Wednesday, 15 February 2023

Market commentary

- UK feed wheat futures (May-23) closed at £245.00/t yesterday, up £2.50/t from Monday’s close. The Nov-23 (new crop) contract also gained £2.50/t over the same period to close at £241.50/t. UK markets have followed the direction of the Paris wheat markets.

- Concern over Ukraine’s grain corridor grows, as fighting escalates, lending some support to markets, more on this in today’s analysis.

- A record wheat crop in India is due to be harvested in March, forecast to rise 4% to 112.2Mt according to the Indian government. This is down to high prices incentivising increased area, use of high-yielding varieties and favourable weather. This could replenish depleted stocks and bring down domestic prices, though an extension of the ban on wheat exports (due to expire in May) is still being considered. A record rapeseed crop is also due in 2023.

- Paris rapeseed futures (May-23) settled at €553.50/t yesterday, down €1.75/t from Monday’s close following pressure in US soyabean markets.

- Harvest progress of the record Brazilian soyabean crop continues, with 17% complete on Thursday last week according to consultancy AgRural, putting pressure on US soybean futures. Chicago May-23 soyabean futures fell 0.4% to yesterday’s close.

Black Sea Initiative to keep markets volatile short term

The war between Russia and Ukraine is intensifying, with a spring offensive expected in the coming weeks.

The Black Sea export corridor deal is also coming up for renewal again, the initiative facilitated by the UN and Turkey, which allows the safe navigation of grain, related foodstuffs, and fertiliser from three Ukrainian ports (Odesa, Chernomorsk and Yuzhny). The last renewal took place on 19 November 2022 for 120 days, bringing the date for renewal to around 19 March. We have already seen some reaction in prices to the concerns surrounding whether this deal will be renewed.

Ukrainian officials point to the ‘destructive’ actions from Russia, by intentionally slowing or stopping inspections, asking for unregulated documentation as well as increasing uncontrolled traffic volume through the Azov and Black Sea ports. As we heard in Monday’s market report, this is creating a queue of vessels in the Bosporus.

Russia has said it would be ‘inappropriate’ to extend the deal unless the sanctions are lifted on agricultural exports from Russia, as well as resolving other issues, due to blocks on payments, insurance and logistics impacting grain and fertiliser exports specifically. This is significant for Russia considering its large wheat crop this season, pegged at around 90-105Mt by varying consultancies/agencies.

What is currently leaving Ukraine?

So looking to how much is currently leaving Ukraine, as released by the Ukrainian Agriculture Ministry today, total grain exports in the season to date (July to 15 February) are down 29% on the year at 29.7Mt. This is down to a smaller harvest and logistical difficulties caused by the Russian invasion. In February (to 15 Feb) 2.7Mt of grain had been exported, down from 3.5Mt in same period a year previous.

Road and rail contribute to these exports, though the Black Sea Initiative has been key to a large proportion of exports since the establishment of the deal. Through the initiative, maize has accounted for just under 50% of exports, and wheat just under 30%.

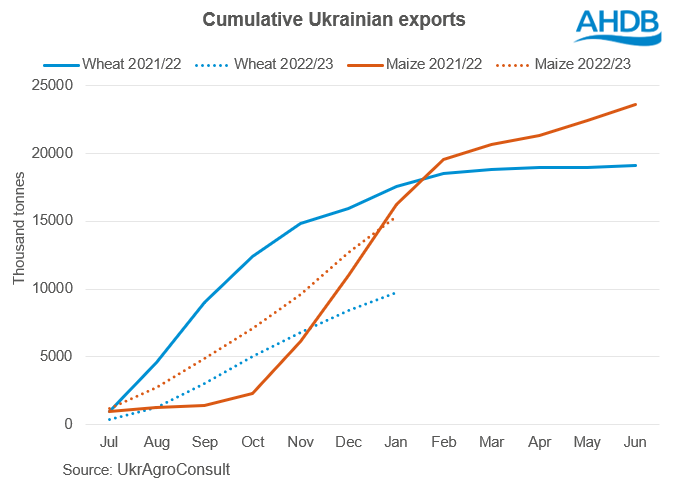

Using UkrAgroConsult data, we can map total Ukrainian exports for wheat and maize this season compared to last.

What does this mean?

In short, expect some volatility in global wheat markets, especially in the coming weeks, as we move closer to the date of the Black Sea export corridor renewal and information emerges on the escalation of the war. News on whether this deal will be renewed and for how long will be key to global availability.

Global grain supply and demand remain tight, and we have seen wheat prices supported despite coming back from the highs seen back in May. Should the deal be extended, and we see Ukrainian grain continue to flow, and Russia continue their aggressive export campaign, any risk and support built in prices in the run up to the renewal could come back. On the maize picture too, the floor to the grain market, Argentinian dryness concerns continue but that Brazilian crop is large and when it arrives could pressure prices. Looking ahead, as we head rapidly towards next season, new-crop conditions will be increasingly in focus.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.