Australian rapeseed area expands to four year high: Grain market daily

Tuesday, 8 June 2021

Market commentary

- Nov-21 UK feed wheat futures gained £1.80/t yesterday to close at £178.90/t. This followed a rise in US maize prices. Maize prices traded higher on worries about hot, dry weather forecast over the next two weeks, which could stress growing crops.

- Paris rapeseed futures for Nov-21 also rose. It gained €4.50/t to €535.50/t due to worries about dry weather negatively impacting the Canadian canola and US soyabean crops.

- After the UK and European markets closed, the USDA released its latest crop progress report. As at 6 June, 72% of the US maize crop was rated good or excellent, down from 76% a week earlier and 75% at this point last year. It was also below the market expectation of 74% in a Refinitiv poll.

- The report also included the first assessment of 2021 soyabean crop conditions. 67% of the crop was rated good or excellent, below last year’s 72% and the trade expectation of 70%.

Australian rapeseed area expands to four year high

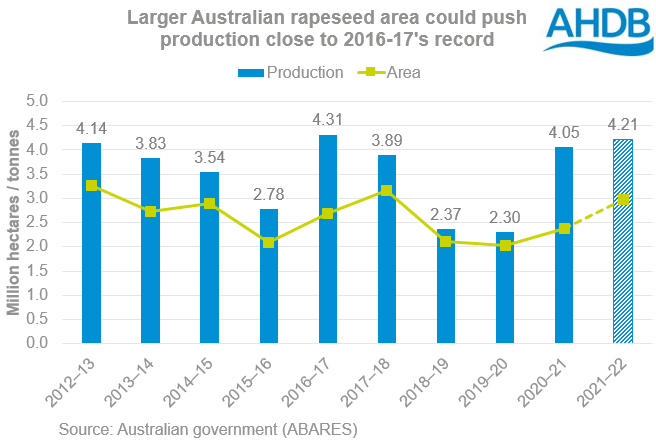

Australian farmers could plant the largest area to canola (rapeseed) since 2017-18. This is according to the Australian government department ABARES. High prices and good soil moisture in many states are encouraging farmers to plant rapeseed. At 2.97Mha, the area is 596Kha more than for the 2020/21 season and potentially the third largest on record.

Yields are expected to be above average after good rain in Western Australia, New South Wales and Queensland. Currently, these good conditions are expected to offset a drier period for crops in Victoria and South Australia. These two states are reliant on winter rainfall. But, the outlook is for above average rainfall in most growing areas over the next three months.

Above average yields would put production at 4.21Mt, 4% higher than 2020/21. There’s a long way to go but if confirmed, this would be the second biggest crop on record, behind 2016/17 (4.31Mt). It is also some way above the initial forecast from the USDA last month of 3.5Mt.The next USDA forecasts are due on Thursday at 5pm.

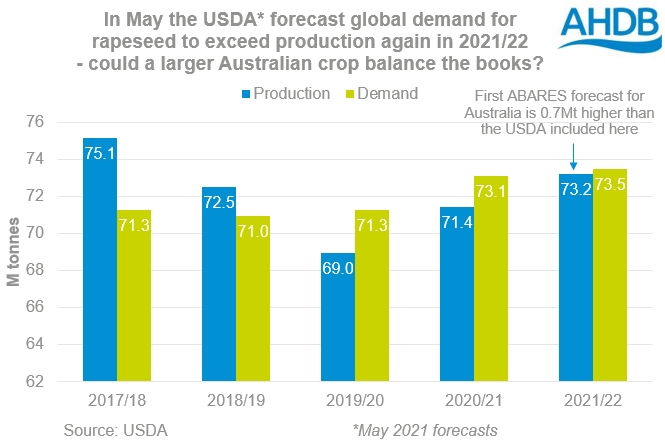

If confirmed, a bigger Australian crop could boost global rapeseed supplies in 2021/22. The rapeseed market is very tight this season (2020/21) and expected to remain so into 2021/22. The market is reliant on a bigger Canadian crop to try and balance demand.

A bigger Australian crop could add a late season boost to supplies. This could potentially reduce the premium for rapeseed over other oilseeds. But, there’s still a long way to go before the crop is confirmed.

Highlights for other crops:

- For 2021/22, the Australian government expects slightly more wheat (+0.6%), but less barley (-4.0%) and oats (-7.0%) to be planted than in 2020/21.

- Wheat, barley, and oat yields are expected to be lower than last year’s very high levels, but still above average.

- The 2021/22 wheat, barley, and oat crops are all forecast to be lower than this season’s high levels. But, the initial forecasts from the Australian government are above those from the USDA. If nothing else changes, this could boost global grain supplies slightly.

- Wheat production is forecast at 27.8Mt, barley at 10.4Mt, and oats at 1.62Mt. These are 0.8Mt, 366Kt, and 320Kt respectively above the initial USDA forecasts.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.