August dairy market review

Thursday, 15 September 2022

By Patty Clayton

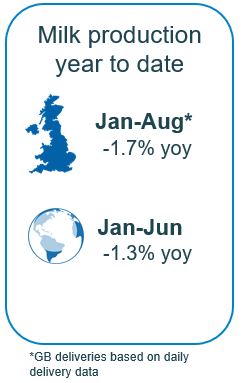

Milk production

GB milk deliveries in August were 1.4% behind previous year levels, based on our daily deliveries data. In August 2021, deliveries were down just under 1%, and at a five-year low.

This brings GB production for the season to date to 5.3 billion litres, 1.7% (90 million litres) behind the same period in 2021.

How production progresses over the remainder of the year will be highly dependent on how input costs develop, as well as whether milk prices can continue to compensate for further cost inflation.

An updated forecast for the 2022/23 season will be published later this month, informed by feedback at our recent Milk Forecasting Forum.

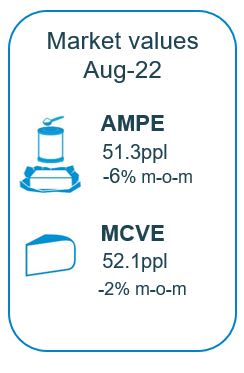

Wholesale markets

The summer lull in demand was still in effect for most of August, and all products averaged lower prices than in July, albeit on very thin trade. While trade was very limited overall, interest picked up towards the end of the period as buyers started returning to the market.

Lower returns pulled AMPE and MCVE down for August, but both remained above the 50ppl mark. The average milk market value (MMV) for August fell 1.44ppl to 51.91ppl.

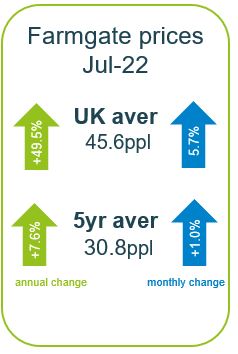

Farmgate prices and input costs

Increases to farmgate milk prices were fewer and smaller for September than in previous months.

The change in the size and abundance of milk price changes is likely a reflection of the increased difficulty in obtaining higher prices for dairy products from the market. Global markets are starting to show signs of strain from high prices, with prices at the Global Dairy Trade auction weakening since mid-March.

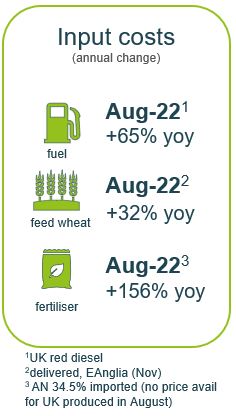

On the other side of the equation, input costs continue to increase, reflecting the direct impact of the war in Ukraine. The recent announcement by one of the UK’s main fertiliser producers of a temporary halt to ammonia production highlights the risk of further pressure on fertiliser prices.

Adding to this, the hot dry summer has dented forage availability, pushing up working capital requirements over the winter – not to mention the impact of the forecasted spike in UK energy prices this winter.

Overall, the final quarter of 2022 looks set to be a challenge with both supply and demand under pressure from historically high inflation rates.

Sign up for regular updates

You can subscribe to receive Dairy market news straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.