Are we heading for another 2015 import demand slump?

Wednesday, 14 April 2021

By Patty Clayton

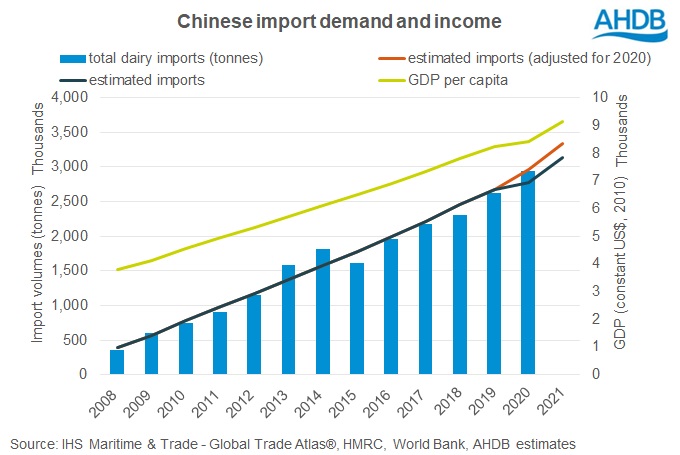

Historically there has been a strong relationship between China’s economic growth (as measured by GDP per capita) and their level of dairy imports. So much so, that comparing the two trends can give an indication of stock building, and flag risks that import demand will fall away.

In 2013 and 2014, Chinese dairy imports were ahead of this long-term trend, and were followed by an import demand slump and collapse in global dairy prices.

Is the same about to happen again?

Demand has been instrumental in keeping dairy product prices on a firm footing through 2020 and so far in 2021, with China’s import demand playing a central role.

In 2020, China’s imports were up 12% year on year, despite the challenges presented by the pandemic and delays in shipping. In the first two months of 2021, imports grew by 28% compared to the same period in 2020.

At first glance, import demand in 2020 looked to be slightly higher than what would have been expected given income growth, similar to 2014. This would normally flag a risk of stock building, and potentially weaker import demand.

However, economic growth in 2020 was curtailed by the pandemic, and only reached 2.3%, significantly lower than the long-term trend of 6-7%. Had incomes grown at a more normal rate, then the volume of imports in 2020 would be in line with demand expectations.

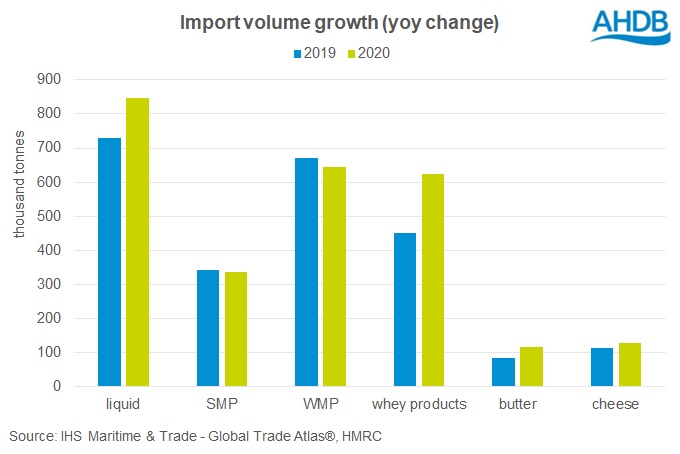

Recent buying patterns also differed to those in 2014. When we look at imports by product type for 2020, most of the growth in volumes occurred in imports of fresh liquid milk and whey products.

The higher volumes of liquid milk imports is likely the result of government messaging around the health benefits of milk in relation to coronavirus, while higher whey imports will have been driven by the rebuilding of the nation’s pig herd.

In 2014, the growth in import volumes was dominated by WMP, with stocks building up through 2013 and 2014.

What does this mean for China’s import demand later this year?

While dairy imports appear to be at elevated levels so far in 2021, they are not out of line with expectations.

Based on predicted economic growth[1] of 8.4% for 2021, import volumes would be expected to increase by around 13%, reaching 3.34 million tonnes. At that level, total imports in the first two months of the year would equate to 20% of the annual volumes, in line with the typical import patterns. These two months tend to account for a higher share of imports as buyers look to take advantage of favourable tariff-rate quotas.

Although the trends look reasonable, there are some areas to watch. Import demand could be dampened by good growth in domestic milk production, which his currently being supported by good farmgate prices. Demand for whey powder could drop down through the year if there is a slowdown in rebuilding the pig herd. Continued issues with shipping congestion and customs delays may also have an impact on imports.

Conclusion

Overall, the demand outlook looks favourable although there are some risks to this which could serve to weaken imports. With limited growth expected in global milk production, it will be demand developments which dictate future price direction.

[1] International Monetary Fund GDP projection

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.