Are we going to see further reductions to OSR? Grain Market Daily

Tuesday, 14 July 2020

Market commentary

- UK wheat futures (Nov-20) closed yesterday at £166.90/t, down £1.60/t on Friday’s close.

- Paris milling wheat futures (Dec-20) closed yesterday at €185.75/t, down €2.25/t on Friday’s close. Losses were limited in the domestic market as sterling weakened against the euro to close yesterday at £1 = €1.1066.

- The latest USDA crop progress report has rated 69% of US maize in good-to-excellent condition, down 2% from last week. While 68% of the US soyabean crop was rated good-to-excellent, down 3% from last week. Recent dry weather has contributed to this downgrade, next week’s temperatures are above normal, however there is some precipitation, this will be a key watch point.

- Agriculture consultancy IKAR has downgraded its forecast for Russia’s 2020 wheat crop from to 76.5Mt from 78Mt. Crop prospects in the Southern, Central and Volga regions are not as good as initially expected. Forecast temperature in the South of the Urals (large spring wheat cropping) within the next week are above normal with precipitation expected in the coming week.

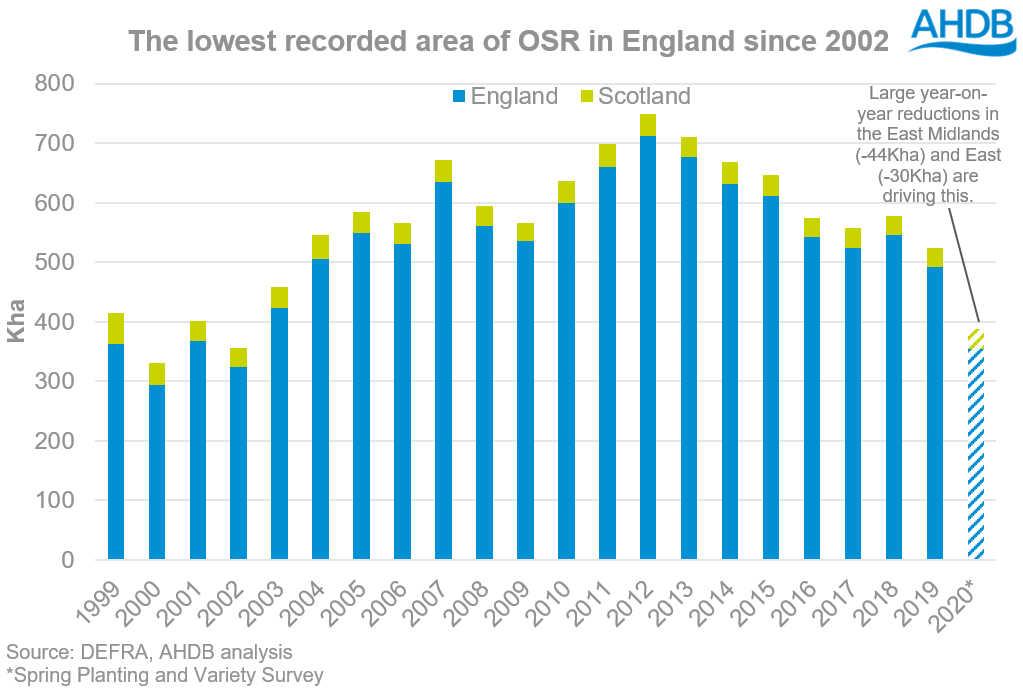

Are we going to see further reductions to OSR?

Our latest PVS result does not pose significant optimism for oilseed rape being grown in the UK. We have seen a large year-on-year decline of 28% with noticeable reduction in key producing areas such as the East Midlands and the East.

Year-on-year reductions in areas were limited in regions such as the North East and West (down 2kha) and Yorks and the Humber (down 4Kha). There were even gains (+1Kha) recorded in Scotland.

Early indications suggest growers are not favouring OSR in future rotations. When looking at cropping alternatives, there is more than just spring barley and oats. But, awareness of longer-term changes to direct payments and new trade policy, mean that any move away from OSR needs to be carefully considered.

However, some growers persist with OSR as it offers some great rotational benefits and will take the gamble that the crop will not be dissipated by pests.

Poor yields for 2020?

Aside from large scale reductions this year there is scepticism over yields. The latest crop development report stated that 41% of OSR was rated ‘very poor’ or ‘poor’.

With harvest commencing we will see if yields have been severally impacted from pest infestation. Early indications show large variation in yields from below 1.0t/ha to over 3.0t/ha depending on region.

Will you be growing oilseed rape again?

Recently in the AHDB regional webinars we have been asking our participants an informal survey on whether they will be growing OSR for 2021. Although this data is very limited and huge assumptions cannot be made off it, the results show how people are weary of growing OSR, especially in southern regions.

The survey suggests that 46% of respondents expect to reduce acreage, 37% will keep the area similar to 2020 harvest and 16% will increase area. From this survey we can observe that the southern regions, which conventionally produce a significant amount of OSR are decreasing their area year-on-year. While in the Northern region’s growers are increasingly attracted to increase their area as OSR can offer great rotational benefits and a great cash crop if all goes to plan.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.