Are UK milling premiums to remain high? Grain market daily

Tuesday, 19 July 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £263.00/t, up £5.10/t on Friday’s close. The May-23 contract closed at £268.90/t, up £4.30/t over the same period.

- Speculation over an export deal in the black sea region remains, but UN chief claims there is a long way to go before peace talks.

- Paris rapeseed futures (Nov-22) gained €1.25/t over the weekend to close at €681.25/t yesterday.

Are UK milling premiums to remain high?

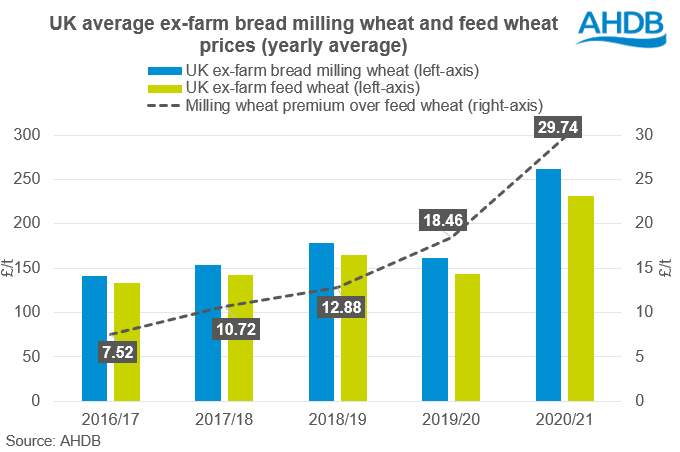

While wheat prices have been coming down over the past few weeks, from the peaks recorded when the conflict began in the black sea, UK milling wheat premiums have remained historically high.

In 2021/22, spot UK ex-farm bread milling wheat prices averaged a premium of £29.74/t over UK ex-farm feed wheat for the season. For comparison, in 2019/20 the premium of UK ex-farm bread milling wheat over feed, averaged £18.46/t. Looking at this season premiums are remaining strong. As at 14 July, UK ex-farm bread milling wheat was £47.90/t above UK feed wheat.

According to the results of the latest planting and variety survey, it is expected that the total UK wheat area for harvest 2022 will be 1% higher on the year at 1807Kha. 2022 is the first year that the planting and variety survey has covered the whole of the UK. It is estimated that 24%, or 437Kha of the total UK area has been planted to Group 1 milling wheat varieties for harvest 2022. In 2021, it was estimated that 29% (512Kha) of the total GB area was planted to Group 1 varieties. While the area planted to Group 1 varieties is down year on year, it is expected that 321Kha has been planted to Group 2 varieties in the UK this year compared with 246Kha in GB last year.

Input costs have risen considerably over the past year and it could be that farmers have chosen to change varieties as a way of improving margins. We are still a week or so away from the wheat harvest getting underway. While we can’t be certain what yields will actually be until the crop is in, the recent dry and hot conditions may have compromised yields slightly.

With a smaller area planted to high spec milling varieties and questions over yield potentials due to weather, milling wheat premiums are likely to stay supported for at least the short term. However, this will be very much dependent on the quality and quantity of the crop when the combines get rolling.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.