Arable Market Report - 30 January 2023

Monday, 30 January 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

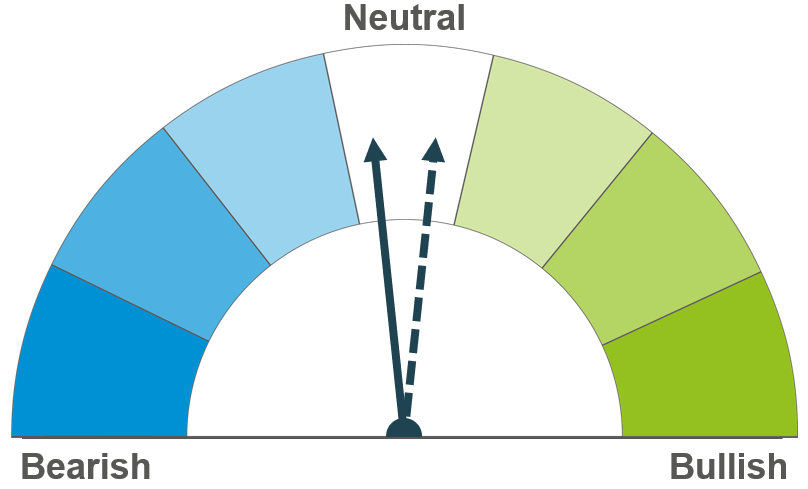

The escalation to the war in Ukraine and concerns over crop conditions in the US remain bullish factors at the moment. However, competitive Black Sea exports continue to pressure markets in the short to mid-term. Longer term, with smaller Russian and Ukrainian crops expected for harvest 2023, the longevity of cheap Black Sea supplies is starting to be questioned.

In the short-term, China’s demand for ‘substantial’ amounts of Brazilian maize will likely support markets. In the longer term, a bumper South American crop continues to add some pressure.

Barley continues to follow the trends in global wheat markets.

Global grain markets

Global grain futures

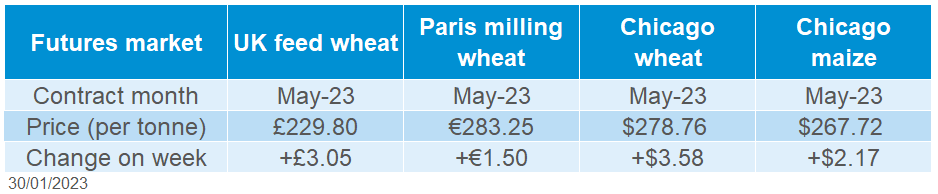

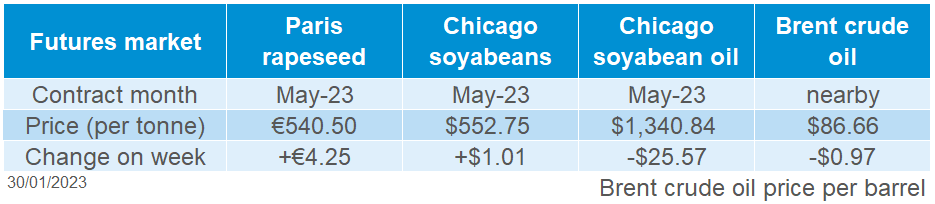

At the start of last week, US markets were pressured by a storm front which hit the US Plains, but by Thursday loses were recovered and gains were made, driven by renewed crop condition concerns in the Plains as well as escalations to the war in Ukraine. Markets did ease on Friday slightly, pressured by Black Sea exports, but closed up week on week. From Friday (20 Jan) to Friday (27 Jan) May-23 Chicago wheat futures gained $3.58/t. European markets followed a similar trend, with May-23 Paris milling wheat futures gaining €1.50/t from Friday to Friday.

Escalations to the war in Ukraine, driven by Germany, the US and the UK all pledging to supply battle tanks, added some support to wheat markets towards the end of last week. While Black Sea exports remain very competitive on the export market, uncertainty around future export prospects have been creeping in. This is because both Russia and Ukraine are expected to have planted less cereals for harvest 2023, leading to questions around the longevity of the competitive supply that has been seen coming out of the Black Sea of late.

Earlier in the week a storm front that brought much needed moisture in the form of snow and rainfall to parts of the US plains, weighed down on markets. However, with extreme dry and cold conditions over the Christmas period, with another cold snap hitting key growing states currently, there remains concerns around the condition of this year’s wheat crop. The USDA are expected to release the latest monthly crop condition reports for key growing states (up to 29 January) either today or tomorrow, which will shed some more light on what impact the recent conditions have had.

Old crop US maize markets also closed the week up. From Friday to Friday, May-23 Chicago maize futures gained $2.17/t. Earlier in the week, prices were pressured by much needed rains in Argentina, before climbing back up through the week. Maize prices were supported by prospects of increased Chinese demand, with the USDA Beijing attaché noting in their latest report, that China will likely import a substantial volume of Brazilian maize this season.

UK focus

Delivered cereals

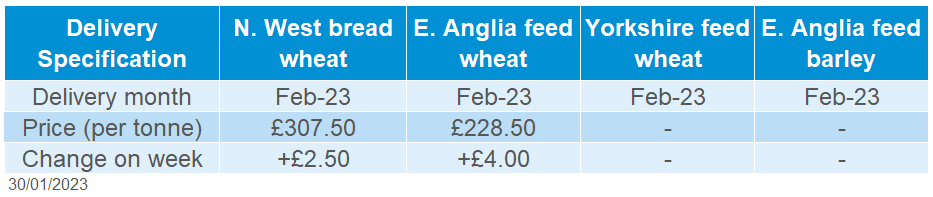

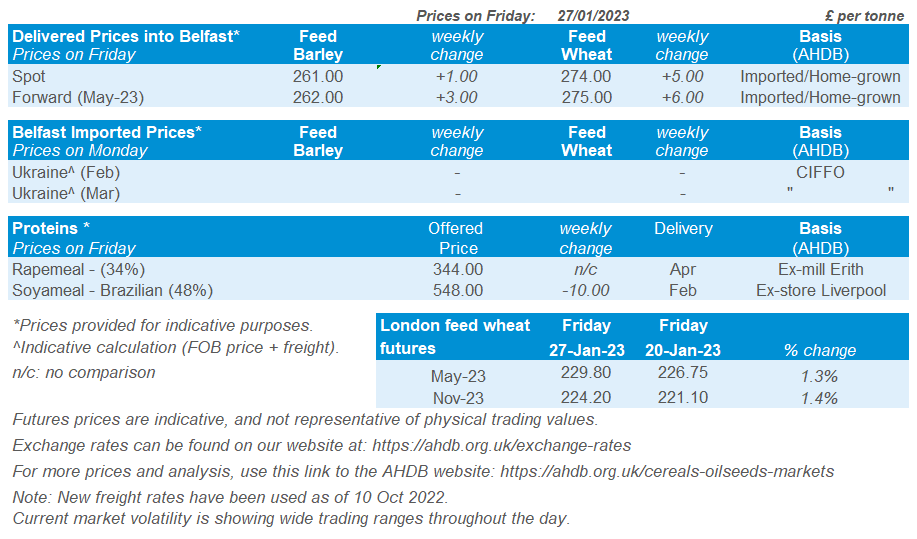

UK futures markets followed the upward movement in global markets, with the May-23 contract closing at £229.80/t on Friday (27 Jan), up £3.05/t from 20 January. Physical prices also recorded similar gains, with feed wheat for spot delivery into East Anglia gaining £4.00/t on the week at £228.50/t. Bread wheat for spot delivery into the North West was at £307.50/t, up £2.50/t week on week.

Last Thursday, AHDB published the latest UK cereal supply and demand estimates for the 2022/23 season, which included estimates for wheat and barley exports and end-season stocks for the first time. While wheat exports are expected to be higher on the year at 1.15Mt and usage is expected to increase, this is outweighed by larger availability this season, leading to the biggest end-season stocks since 2015/16. For barley, with increased production boosting supply, and lower animal feed usage forecast, outweighing stronger H&I demand, the barley balance sheet is heavier in 2022/23, but remains relatively tight historically. To view the balance sheets in full, click here.

Also on Thursday, the Secretary of State for Environment, Food and Rural Affairs set out more detail on both the Sustainable Farming Incentive (SFI) and Countryside Stewardship (CS). Click here to find out more.

Oilseeds

Rapeseed

Soyabeans

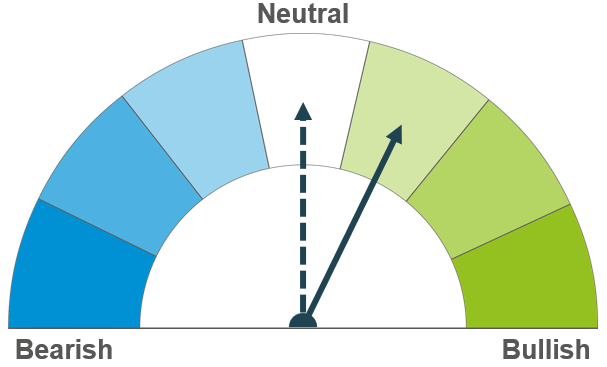

Short-term, the rapeseed market sentiment is going to be largely dictated by soyabeans. Longer-term the EU crop is faring well, with no weather concerns currently.

Parts of Argentina are not going to receive rain over the next week, which will keep the market supported. Long-term, Brazil has now started harvesting their record soyabean crop, which could weigh on prices.

Global oilseed markets

Global oilseed futures

There was a mixture of bullish and bearish news last week. However, all in all, US soyabean markets recorded small gains across the week, with Chicago soyabean futures (May-23) gaining 0.2% to close Friday at $552.75/t.

Forecast rains and improved weather prospects in Argentina caused pressure at the start of the week. However, pulling soyabean markets higher on Thursday, was larger than anticipated US export sales. According to latest USDA data, US soyabean export sales (to week ending Jan 19) were at 1.28Mt, exceeding market expectations which ranged from 600Kt to 1.26Mt. However, on Friday, soyabean markets were pressured once again, following a round of fund selling ahead of the weekend.

Buenos Aires Grain Exchange announced on Thursday that the recent rains brought relief to Argentina’s central agricultural area in the North of the country, preventing any further reductions to the countries soyabean production prospects, which were recently cut off the back of the impact of the drought.

After pressure since the start of 2023, Malaysian palm oil futures (Apr-22) were up 0.3% across the week. Underpinning the support over the last week was floods in Malaysia, following heavy rains, which has led to worries around the impact this could have on palm oil yields.

Focus over the next week will be on South American weather. Over the next seven days, parts of Argentina’s core soyabean regions will not receive any rainfall. This could have potential to keep markets supported, as the impacts of this drought have not been fully alleviated.

Further to that, the Brazilian soyabean harvest is just underway. Latest information from SAFRAS & Mercado, estimate harvest at 4.4% complete as at 20 January, down from 11.3% at the same point a year earlier. Rains in Mato Grosso (where harvest has started) are expected over the week, however this is not cause for huge concern currently.

Rapeseed focus

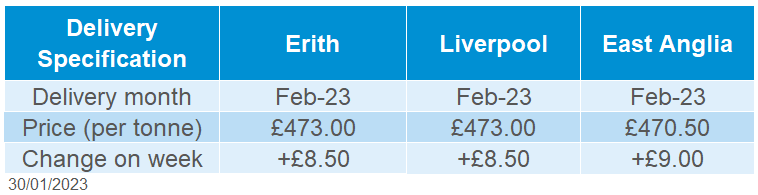

UK delivered oilseed prices

Support for soyabeans and palm oil filtered into rapeseed markets, as Paris rapeseed futures (May-23) closed at €540.50/t on Friday, gaining €4.25/t across the week. Delivered rapeseed (into Erith, Feb-23) was quoted at £473.00/t on Friday, up £8.50/t across the week. The weakening (0.2%) of sterling against the euro across the week added further support to domestic values. Trading closed Friday at £1 = €1.1397.

The latest Stratégie grains oilseed report released on Friday estimates the EU crop at 19.5Mt for harvest 2023, in line with last years output. Rapeseed crops are generally reported to be in satisfactory condition.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.