Arable Market Report – 29 September 2025

Monday, 29 September 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

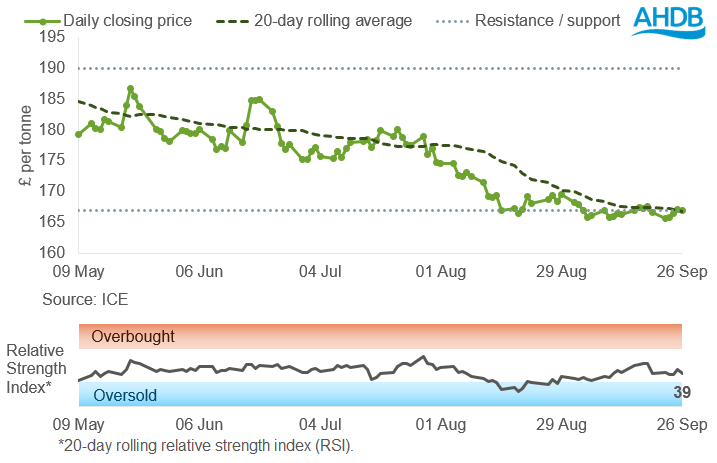

UK feed wheat futures saw a slight increase last week (Friday to Friday) and continued to trade close to the support level of £167/t.

The Relative Strength Index (RSI) fell from 41 to 39, indicating weakening momentum and reflecting the neutral to slightly bearish territory in markets at the moment.

Find out more about the graphs in this report and how to use them.

Market drivers

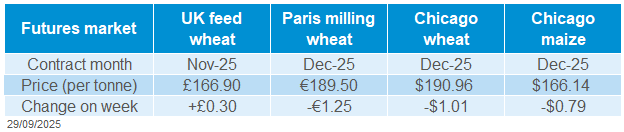

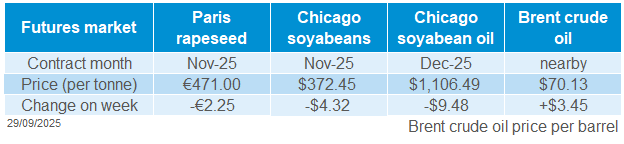

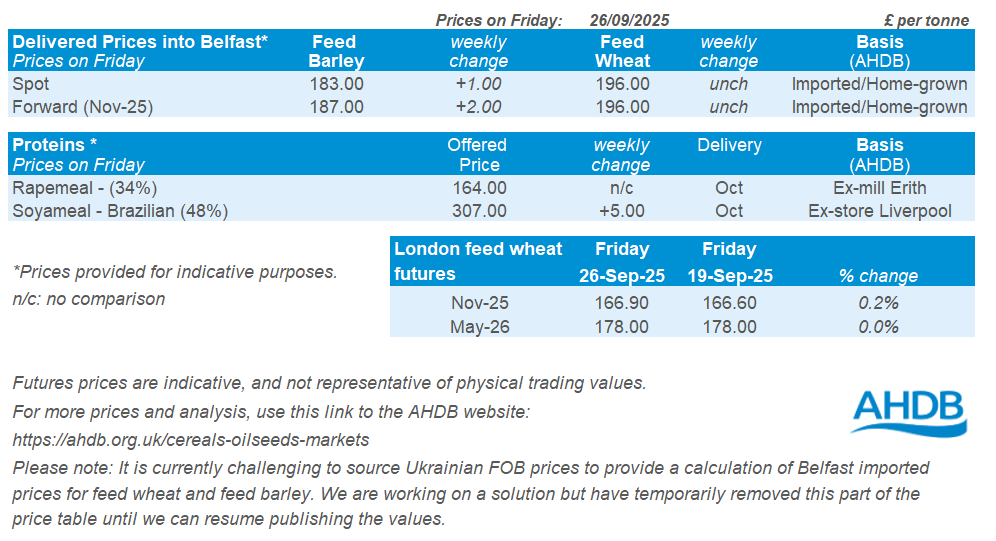

UK feed wheat futures (Nov-25) closed at £166.90/t on Friday, up £0.30/t (0.2%) on the week, supported by a weaker pound. In contrast, Chicago wheat and Paris milling wheat futures (Dec-25) fell by 0.5% and 0.7% respectively, as global markets remain pressured by abundant supply.

Russia’s 2025 wheat production forecast was revised slightly higher by IKAR to 87.5 Mt (USDA: 85 Mt; SovEcon: 87.2 Mt), with export estimates also raised marginally to 44.1 Mt.

The EU Commission increased its 2025/26 soft wheat production forecast to a ten-year high of 132.6 Mt (up from 128.1 Mt), driven by better outlooks in Germany, France and Romania. EU soft wheat exports are now forecast at 30.1 Mt.

Crop monitoring service MARS has cut its EU maize yield forecast to 6.88 t/ha, down from 6.93 t/ha last month and 3% below the five-year average, due to drought in south-eastern Europe. In France, FranceAgriMer rated 62% of maize crops in good or excellent condition as at 22 September, unchanged from the previous week but down from 79% a year ago.

Ukrainian wheat exports so far this season (1 July–24 September) total 4.2 Mt, down from 5.6 Mt a year ago. Dry weather has delayed 2026 sowing, with only 14.1% of the expected wheat area drilled by 22 September, compared to 19.6% at the same point last season.

In the US, net export sales of wheat for 2025/26 totalled 539.8 Kt for the week ending 19 September, exceeding the average analysts’ estimate of 450 Kt (LSEG). Winter wheat planting was 20% complete as at 21 September, just below the five-year average of 23%. The maize harvest is 11% complete, with 66% of crops rated in good to excellent.

Markets now await the USDA’s quarterly US stocks report, due tomorrow (30 September), with wheat stocks expected to rise by 2.6% year-on-year. Meanwhile, maize stocks are projected to fall by 24% compared to last year, potentially reaching a four-year low (LSEG).

UK delivered cereal prices

Feed wheat delivered into East Anglia for November delivery was quoted at £169.00/t on Thursday, down £2.50/t from the previous week. November delivery of bread wheat into the North West was quoted at £201.00/t, down £0.50/t from the previous week.

October delivery of feed barley into East Anglia was quoted at £145.50/t, while biscuit wheat for October delivery into Northamptonshire was quoted at £178.00/t.

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

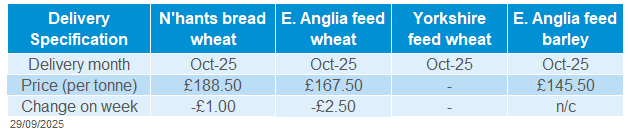

Last week (19 - 26 September), Paris rapeseed futures (in £/t) held above the 20-day moving average, finishing at slightly over £411/t. This is despite global bearish sentiment in global oilseed markets due to Argentine supplies.

The relative strength index (RSI) showed an uptick in market momentum shifting from 49 to 58 over the week, suggesting it’s a key time to be monitoring markets.

Find out more about the graphs in this report and how to use them.

Market drivers

Global oilseeds have been under pressure over the last week driven by access to cheaper Argentine soyabean supplies. Some support came from an increase in brent crude oil futures (Nov-25), which gained 5.2% on the week, but weaker rivals counteracted any positive movement. Paris rapeseed futures (Nov-25) fell by €2.25/t (0.5%) to €471.00/t on the week.

Argentina's soyabean exports are expected to reach a seven-year high of 10.5 Mt after a brief tax pause on beans, meal, and biodiesel, which ended early as the $7.0 billion sales target was hit in just three days.

Chicago soyabean futures (Nov-25) took a hit off the back of this, down 1.2% on the week. Greater falls were seen in Chicago soyabean meal futures (Dec-25) down 3.3% on the week, the lowest since the beginning of August.

Elsewhere, Brazil's soybean crushers plan to invest $1.11 billion over the next year to meet increased biodiesel demand, boosting national crushing capacity. Biodiesel production has expanded consistently globally over the last 9 years, with 2025 being the first year of a slight decrease due to falls in the US and EU.

Indonesia and the EU signed a 2025 trade pact cutting tariffs and expanding market access, with duty-free refined palm oil and sustainability safeguards. It is expected to take effect in January 2027.

The EU is also expected to delay its deforestation policy implementation (EUDR) for yet another year. The regulation would see a ban on imports such as soya and palm oil that is linked to deforestation.

Analysts at APK-Inform have cut Ukraine's 2025 sunflower seed harvest forecast for the second time this month to 12.9 Mt from the previous 13.6 Mt.

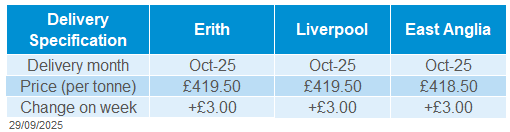

UK delivered rapeseed prices

Delivered rapeseed prices ticked up last week. These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play.

Rapeseed for November delivery into Liverpool was quoted at £420.50/t on Friday, up £3.00/t on the week. In East Anglia, November delivery was quoted at £419.00/t, marking a £3.00 increase week-on-week.

Extra information

The 2025 cereals and oilseed rape harvest is complete for those surveyed for AHDB’s harvest report. Anecdotal reports suggest small areas remain in Northern Ireland and North Scotland. Yield variability, both within and between regions, was the defining feature of this challenging harvest season. Read the final report of 2025, which was published on Friday, by clicking here.

AHDB’s cereal usage data is to be released this week (2 October), covering UK human and industrial usage, as well as GB animal feed production.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.