Arable Market Report – 27 May 2025

Tuesday, 27 May 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

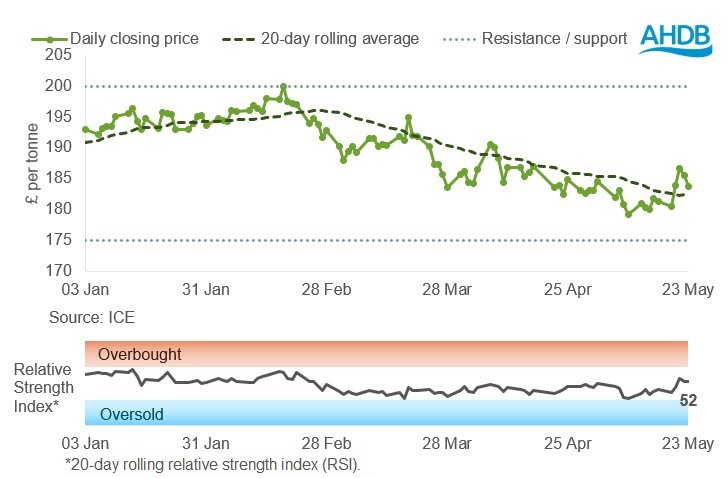

UK feed wheat futures (Nov-25)

Nov-25 UK feed wheat futures gained last week (Friday–Friday), crossed the 20-day moving average and is attempting to stabilise near it. The relative strength index (RSI) at 52, up from 42 the previous week, suggests prices could find some relative stability.

Find out more about the graphs in this report and how to use them here.

Market drivers

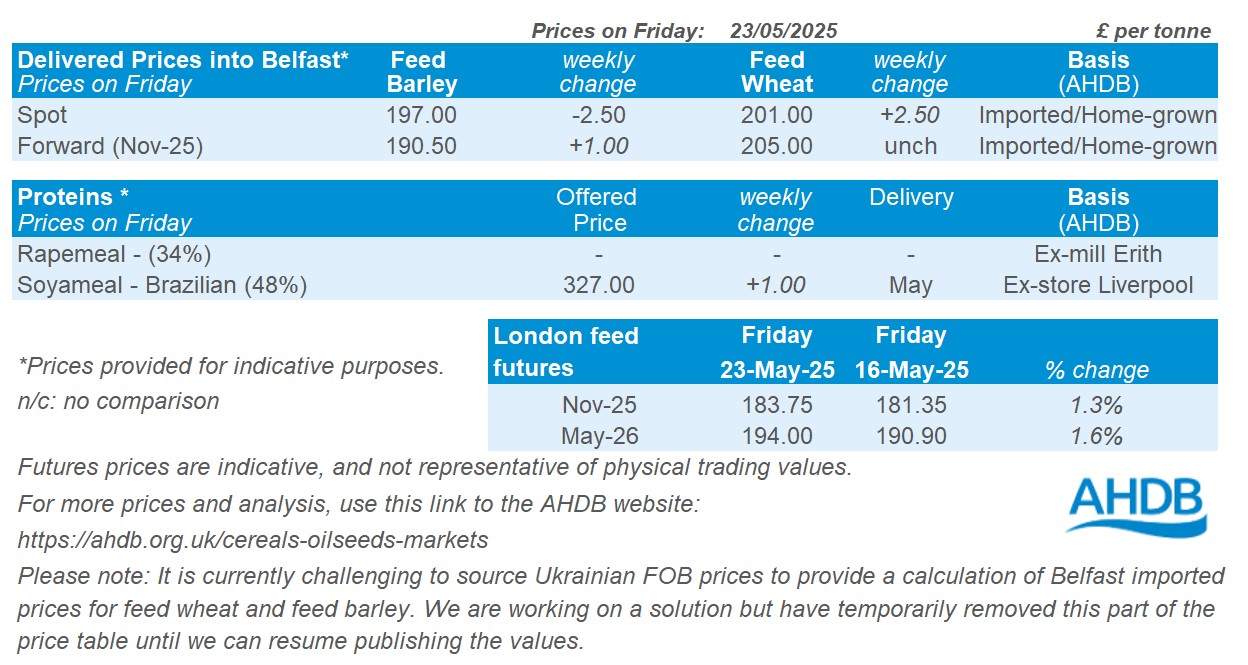

UK feed wheat futures (Nov-25) increased by £2.40/t (1.3%) last week (16–23 May), closing at £183.75/t on Friday. Domestic prices followed global markets up, with Chicago wheat and Paris milling wheat futures (Dec-25) rising by 3.6% and 1.5% respectively.

Last week, concerns about weather risks in the US, northern Europe, China and Russia helped to push up the price of global wheat futures. Additionally, the funds have high levels of net short positions in Chicago and Paris contracts, supporting prices when these positions were covered last week.

The UK's domestic wheat futures could come under pressure compared to the global market in the near future, due to sterling strengthening against the US dollar (three-year high) and the euro (seven-week high).

The EU’s crop monitor MARS increased its forecast for the average soft wheat yield in 2025 to 6.04 t/ha, from last month's projection of 6.03t/ha. It is above the five-year average of 5.77t/ha. The report reveals that while some regions are facing drought challenges, favourable weather conditions are benefiting others.

FranceAgriMer estimated that 71% of French soft wheat was in good or excellent condition as of 19 May, down from 73% the previous week. For winter and spring barley, crops rated as good or excellent fell by 2% and 6%, respectively.

Last week, the USDA reported a decrease in winter wheat conditions in the US, with 52% rated as in good or excellent condition as of 18 May, compared to 54% the previous week.

The Rosario Grains Exchange is forecasting that the 2025/26 wheat harvest in Argentina could be the second largest on record at 21.2 Mt, given favourable weather forecasts and ideal soil conditions for planting.

The IGC left its forecast for global wheat production in 2025/26 unchanged at 806 Mt, while increasing its forecast for global maize production to 1 277 Mt, up 3 Mt from April. However, the IGC showed a decrease in the forecast global consumption of wheat and maize, both by 1 Mt.

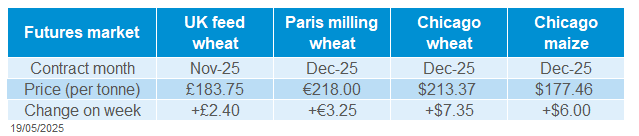

UK delivered cereal prices

Domestic delivered wheat prices gained Thursday to Thursday, following domestic futures. Bread wheat delivered into Northamptonshire for November 2025 was quoted at £226.50/t, up £4.50/t. Feed wheat for delivery in East Anglia for May 2025 was quoted at £166.50/t, up £3.00/t.

Rapeseed

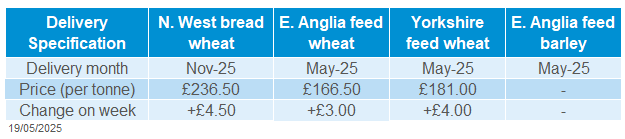

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris rapeseed futures (in £/t) traded between the resistance level and the 20-day moving average last week. A small week-on-week rise in RSI (52 vs 49) suggests slightly stronger momentum.

Find out more about the graphs in this report and how to use them here.

Market drivers

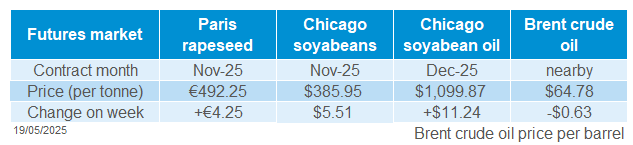

Global oilseed markets edged up last week (Friday-Friday). Paris rapeseed futures (Nov-25) rose €4.25/t to €492.25/t. Chicago soyabeans, soyabean oil and Canadian canola also posted weekly gains, driven mainly by weather concerns in Argentina, strong US export demand and tight Canadian canola stocks.

In Argentina, heavy rainfall in northern Buenos Aires raised concerns about flooding and further delays to soyabean harvest, which is already behind schedule. As at 21 May, 74.3% of the crop had been harvested, compared to 87.9% at the same point last year (Buenos Aries Grain Exchange). However, drier weather is forecast in the coming days, which may ease concerns.

US soyabean net export sales for 2024/25 season reached 307.9 Kt in the week ending 15 May, up 9% from the previous week and above the range of analysts’ estimates. Soyabean oil sales also rose slightly week-on-week to 13.7 Kt.

In Canada, tight canola (rapeseed) supplies and strong export demand pushed Winnipeg canola futures (Nov-25) up 2.2% over the week. Canadian rapeseed exports have reached 8.19 Mt so far in the 2024/25 marketing year, compared with 5.14 Mt last year.

In Europe, LSEG raised Ukraine’s 2025/26 rapeseed crop forecast to 3.25 Mt, up 1.5% from its last estimate, due to recent rains, though this is still below the 2024/25’s output. Germany reports a 1.5% rise in the winter rapeseed area for 2025/26 to 1.1 Mha, according to the national statistics agency. Meanwhile, EU crop monitor MARS revised its 2025 EU-27 rapeseed yield forecast slightly lower to 3.17 t/ha, now aligning with the five-year average.

Looking ahead, markets are closely monitoring the possible 50% US import tariff on EU goods, now delayed to July.

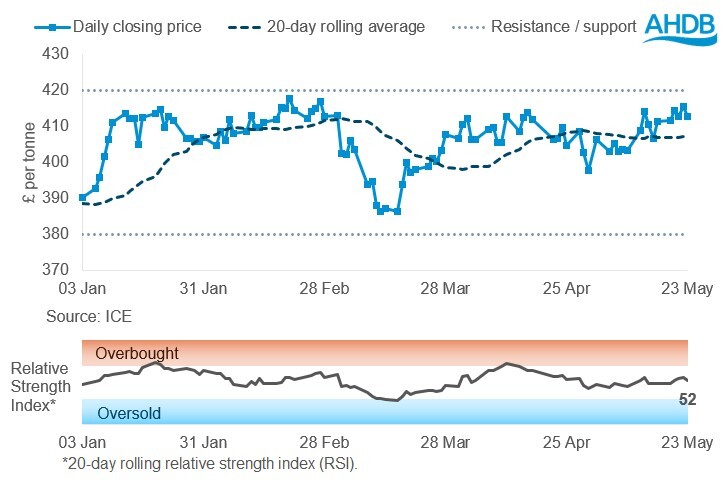

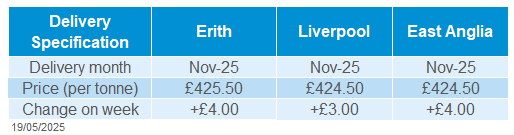

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in November was quoted at £425.50/t on Friday, up £4.00/t from the previous week. Delivery to East Anglia in November was quoted at £424.50/t, also gaining £4.00/t. Domestic delivered prices followed the upward movement in Paris rapeseed futures, but gains were limited by a slightly stronger sterling against the euro.

Extra information

AHDB's next UK cereals supply and demand estimates will be published on Thursday (29 May) and the next crop development report will be published on Friday (30 May).

Applications for 3,000 unfinished SFI applications will be allowed to proceed, although these will be subject to restrictions.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.