Arable market report - 27 March 2023

Monday, 27 March 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

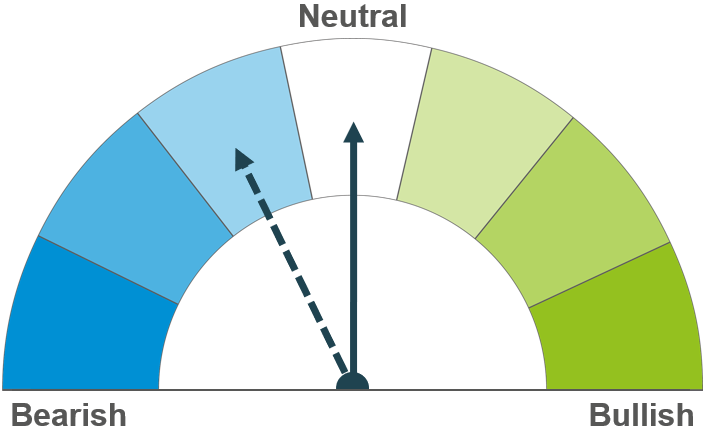

Both short and long-term, competitive supplies from the Black Sea region continue to pressure global wheat markets. Though while prices are being pressured, volatility will likely remain as the long-term future of the Ukraine export deal is uncertain.

Strong Chinese demand is capping any losses in US maize markets currently, with a large Brazilian crop expected. Though longer term, the US is due a large crop and cheaper Brazilian supplies could put pressure on global prices.

Barley prices continue to be weighed on by movement in wheat markets. Discount of ex-farm UK feed barley to UK feed wheat stood at £15.50/t as at 16 March.

Global grain markets

Global grain futures

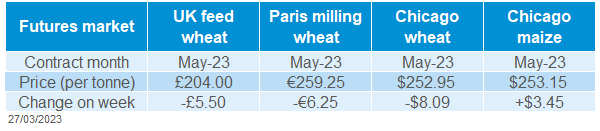

Global grain markets remained volatile last week. Global wheat futures generally lost ground across the week, though saw some support on Friday as markets reacted to rumours around a potential halt in Russian exports. Chicago wheat futures (May 23) ended the week down 3.1% (Friday-Friday). Chicago maize futures (May-23) on the other hand were up 1.4% over the same period, and were less volatile, as any losses were outweighed by an uptick in Chinese demand.

On Friday, Russian business newspaper Vedomosti reported that Moscow had plans to temporarily halt wheat and sunflower exports. However later on that day, it was confirmed that Russia would not halt exports but that it wants exporters to ensure a high enough price is paid to farmers to cover average cost of production (Refinitiv).

Discussions are also ongoing surrounding the future of the grain corridor deal in the Black Sea region. The Kremlin said on Saturday that President Putin had held a call with his Turkish counterpart and discussed Russia’s desire to remove barriers for the country’s agricultural products. Moving forward, the ongoing talks and uncertainty over the future of the grain corridor agreement will likely keep markets volatile, and poses the question of how low wheat prices can go.

The May-23 Chicago maize contract reached its highest price since the end of February on Friday, ending the session at $253.15/t. The falling prices as of late have sparked a flurry of Chinese purchases of US maize, as the world’s biggest buyer of the grain begins to make up for a slow start to this seasons import programme. The latest Chinese purchase, announced on Friday by the USDA, was for 204Kt of US maize. In the week ending 16 March (latest data), net export sales of US maize to China totalled 2.245Mt (USDA). This is the third biggest weekly total on record (Refinitiv). With this year’s Argentinian maize crop severely impacted by the ongoing drought, it’s also thought that the US will remain the main supplier for China until Brazil’s second crop is harvested in the coming months.

UK focus

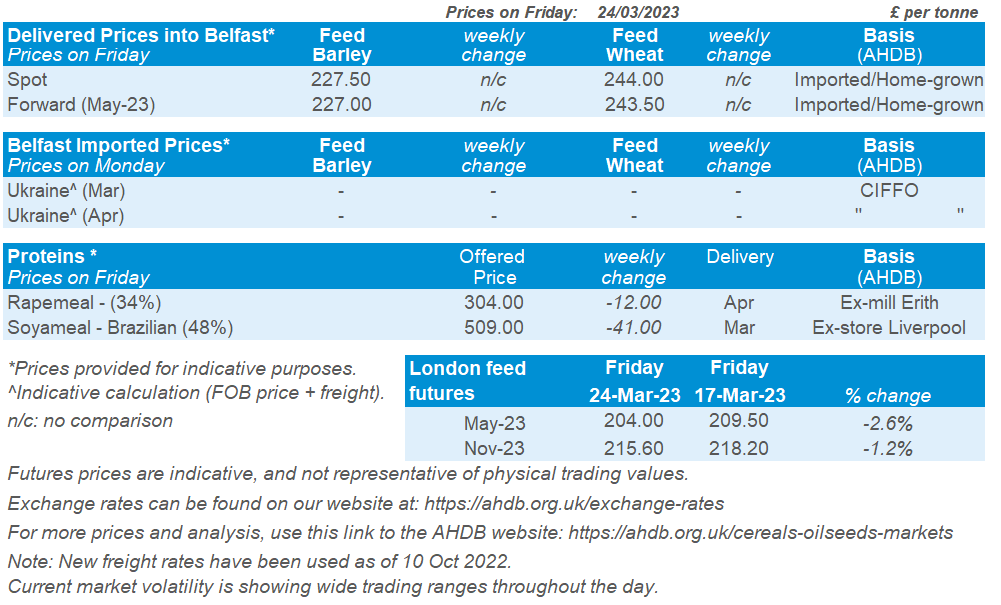

Delivered cereals

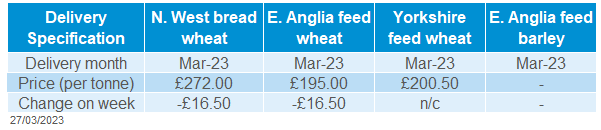

Over last week, UK feed wheat futures (May-23) followed movements in global wheat markets, ending the week down 2.6% Friday-Friday. New crop prices (Nov-23) also felt some pressure, down 1.2% over the same period. Gains seen on the UK feed wheat futures for old and new crop on Friday offset some of the losses seen Monday to Thursday.

Delivered prices followed futures movement last week (Thursday-Thursday), before UK feed wheat futures felt some support on Friday. Feed wheat delivered into East Anglia (March 23 delivery) was quoted at £195.00/t on Thursday, down £16.50/t from the previous week. For the same destination, harvest 23 feed wheat was quoted at £201.50/t.

Bread wheat delivered into the North West for March 23 delivery was quoted at £272.00/t, down £16.50/t on the week.

UK barley continues to price competitively within Europe, and our export campaign as of late has been strong. As at 20 March, so far this season the EU had imported 824.6Kt of UK origin barley, up from 605.8Kt at the same point last season (European Commission Customs Surveillance data).

AHDB’s next UK supply and demand estimates are due to be published on Thursday (30 March), and will include revised figures based on updated usage data and HMRC trade data. Find January’s estimates (and updated estimates from Thursday onwards) here.

Oilseeds

Rapeseed

Soyabeans

Bearish sentiment continues for rapeseed with the EU crop faring well. This bearish tone is expected to continue as rapeseed supplies on the continent are forecast to increase.

Short-term the record Brazilian harvest is weighing on the market, and this is expected to continue going forward, outweighing the supply concerns from Argentina.

Global oilseed markets

Global oilseed futures

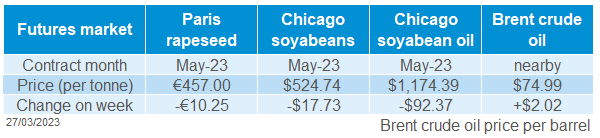

Last week saw continued pressure on oilseeds, as Chicago soyabean futures (May-23) were down 3.3% across the week closing Friday at $524.74/t. Pressure continues for Chicago soyabeans as speculators liquidate long positions in the market, as the market looks bearish long term, and as a record Brazilian soyabean crop comes to market, which to some extent has eased the concerns of crop losses in Argentina.

The Brazilian soyabean harvested area is now estimated at 70.9%, slightly down from the same point last year at 77.1% (Patria Agronegocios). Brazilian soyabean crop estimates were increased last week by Brazilian consultancy Agroconsult, who estimate the crop at 155Mt, up from 153Mt previously.

Brazil’s soyabean crop will now be competing against US supplies, signalling the US export campaign will slow. There was disappointing weekly export data (up until 16 March) for US soyabeans, with sales estimated at 351.5Kt (both old and new crop), below the trade expectations of 400Kt to 1.1Mt, this has added to the bearish market tone.

There has been sizable amount of pressure on vegetable oils across the week from a sell off, despite brent crude oil support. Malaysian palm oil prices recorded their biggest weekly drop in four months, with palm oil prices (three months delivery from spot) at their lowest point since October. This will give rape oil the further space to be pressured too.

Rapeseed focus

UK delivered oilseed prices

Pressure in the oilseed complex weighed on rapeseed prices last week. Paris rapeseed futures (May-23) closed Friday at €457.00/t, down €10.25/t across the week.

Delivered rapeseed (into Erith, Mar-23) was quoted on Friday at £385.50/t, down £22.50/t across the week. Losses were greater on our domestic market due to timings of our delivered survey, which captured the prior week’s prices (17 March) higher than the Paris market close, see more information in last week’s report.

Crop conditions in the EU appear to be progressing well. The trade association Coceral now estimate EU+UK 2023 rapeseed production at 21.1Mt, up from 20.4Mt in December’s report.

There will be an update on UK crop conditions on the AHDB crop development page, provisionally due to be published this coming Friday (31 March).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.