Arable market report – 27 November 2023

Monday, 27 November 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

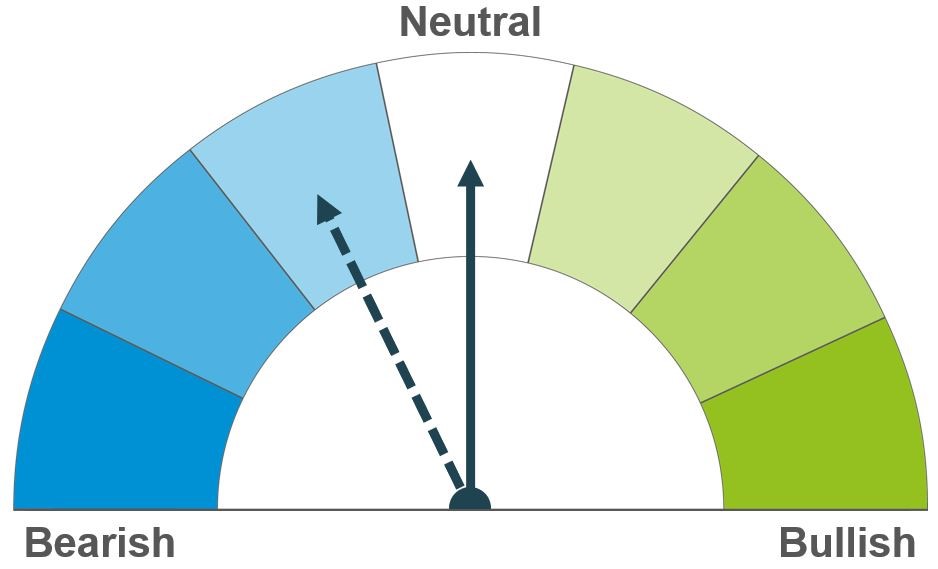

Wheat

The potential for high global maize supplies later this season remains important to market sentiment for wheat. The outlook for northern hemisphere crops for harvest 2024 will be increasingly important over the months to come.

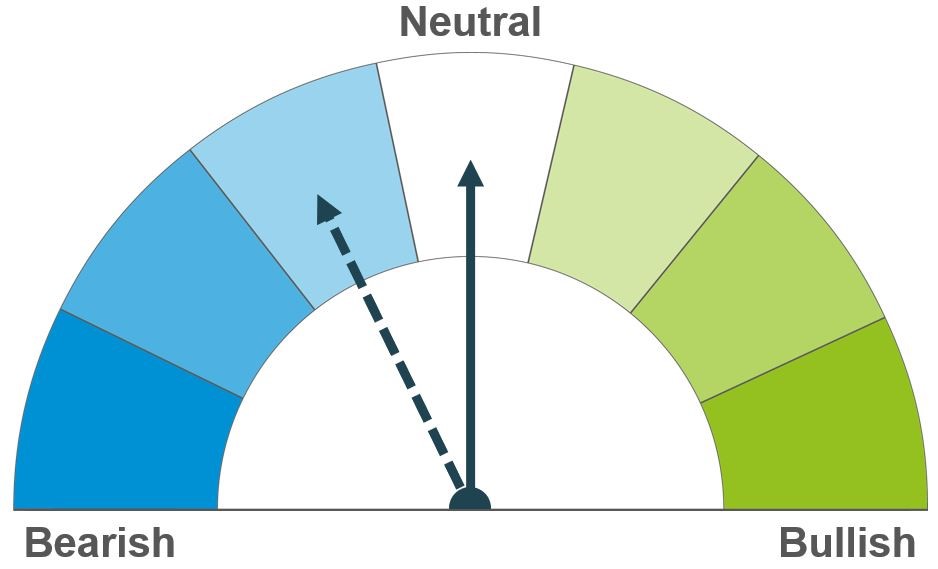

Maize

Still very much a watch and see situation for maize in the short-term. The large forecast Brazilian maize crops are key to the predicted global grain surplus in 2023/24, and if realised, will keep a bearish tone to markets into 2024.

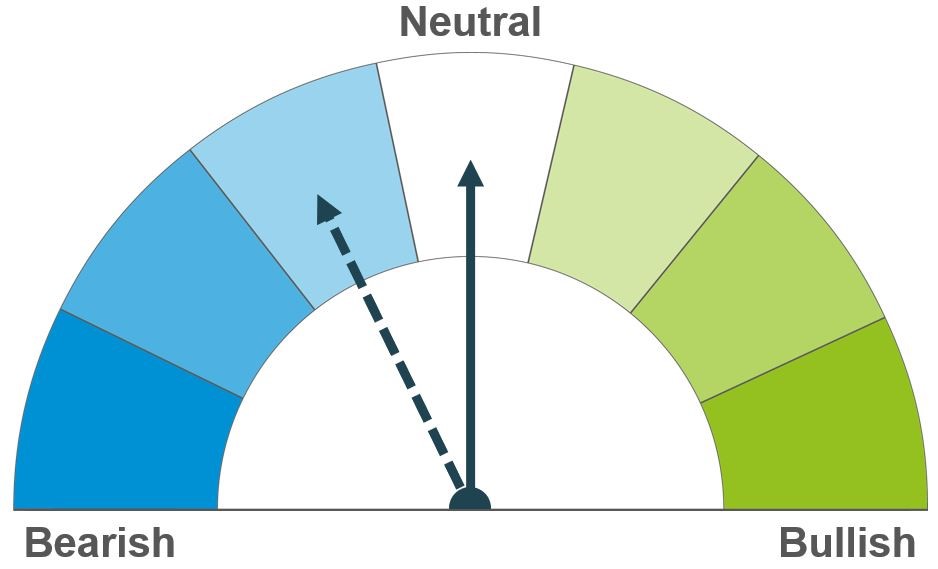

Barley

Barley prices continue to follow wider grain complex for now, with the price relationship to other grains an important influence on animal feed demand this season.

Global grain markets

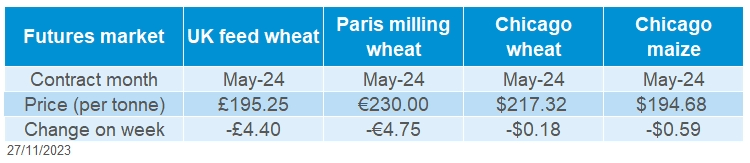

Global grain futures

It was a mixed week for global grain prices last week, as US markets closed on Thursday for Thanksgiving and shifting exchange rates.

Generally, US futures lifted in the run up to Thursday’s US holiday, on Brazilian weather concerns and re-positioning by speculative traders (LSEG). But both Chicago maize and wheat futures dropped back on Friday to end the week mostly unchanged. US wheat export sales remain sluggish, while rain was forecast for Brazil weighing on maize as traders again re-positioned.

Meanwhile, European wheat futures fell Friday-Friday due to worries about ongoing competition from Black Sea supplies, not helped by the euro rising against the US dollar. Speculation that US interest rates have now peaked weighed on the dollar, while signs that the economic slowdown in the eurozone could be easing boosted the euro.

A key area of uncertainty for markets remains South American availability, which is critical to the forecast global grain surplus this season. Markets continue to watch weather conditions in Brazil closely as the bulk of Brazilian maize (its Safrinha crop) will be planted after the soyabean harvest.

In Argentina, maize planting is ahead of last year’s pace though behind the five-year average, with crops planted so far looking good. As of 22 Nov, 96% of crops are in ‘normal’ or ‘good’ condition vs 75% a year ago (Buenos Aires Grain Exchange, BAGE).

Delays planting winter crops in Europe continues to be a feature for harvest 2024 prices, which have gained a premium to old crop prices. There was little progress in French winter crop plantings between 13 and 20 November, FranceAgriMer confirmed on Friday. Planting of winter wheat (exc. Durum) moved on just 3 percentage points (pp) over the week to 74% complete, while winter barley was up just 2pp to 86% complete. Crop condition scores also declined, though many areas experienced drier weather last week.

UK focus

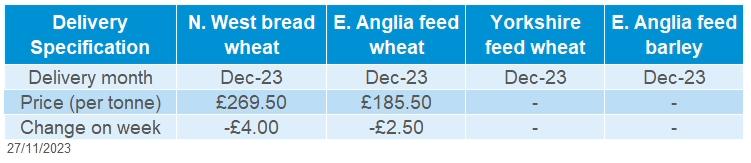

Delivered cereals

UK feed wheat was not excluded from pressure on the European wheat markets. Sterling rose against both the euro and US dollar last week, adding to this pressure.

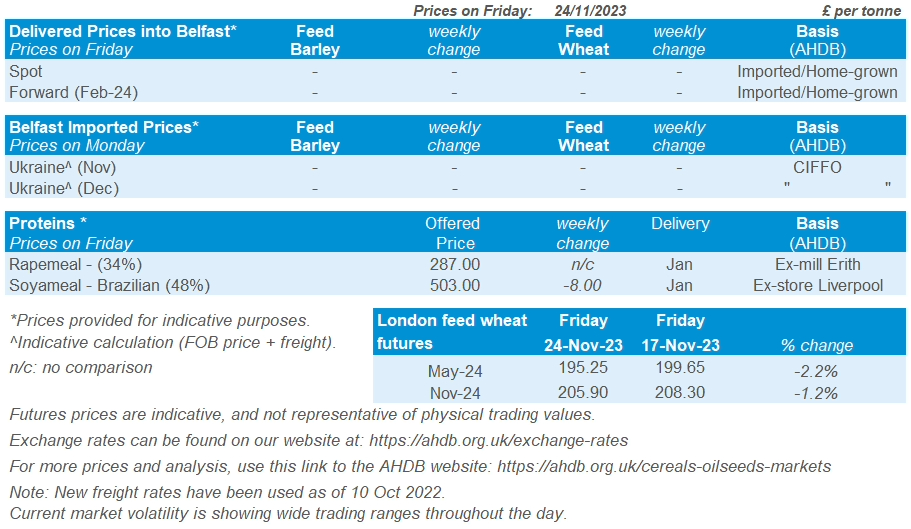

UK feed wheat futures (May-24) closed at £195.25/t on Friday, down £4.40/t from the previous week. New crop prices were partly insulated from the drop due to the ongoing weather issues at home and across northern Europe. The Nov-24 contract fell by £2.40/t over the same period, closing at £205.90/t.

Delivered prices followed futures downward last week (Thursday to Thursday). Feed wheat delivered into East Anglia for December delivery was quoted at £185.50/t, down £2.50/t on the week. Bread wheat delivered into the North West in December was quoted at £269.50/t, falling £4.00/t over the week. But it continued to hold a strong premium over feed wheat prices relative to historical prices.

Like the futures market, new crop delivered prices also experienced more marginal pressure. Feed wheat delivered into East Anglia for November 2024 was quoted at £206.00/t, down only £0.50/t over the week.

Last Thursday Defra updated its Agricultural Price Indices. In September 2023, provisional data shows that the agricultural price index for all inputs increased by 1.1%, after steadily declining so far in 2023. So, despite the rise, the index is still down 10.6% since the beginning of 2023, suggesting that overall, input costs on farm are lower than at the start of the year. The price index for fertilisers and soil improvers increased provisionally by 0.6% in September 2023, but down by 40.4% since January 2023. This supports recent findings that fertiliser prices have begun to stabilise over recent months.

Oilseeds

Rapeseed

Short-term rapeseed markets are going to follow the sentiment of soyabeans. Longer-term the rapeseed market is still well supplied, with a potential boost with Australian supplies due to reach the market in the coming weeks. The next critical watchpoint is European crop conditions.

Soyabeans

Short-term the market is very reactive to Brazilian weather. At the moment on paper the market is well supplied longer-term, which could bring pressure, but this depends on Brazilian weather.

Global oilseed markets

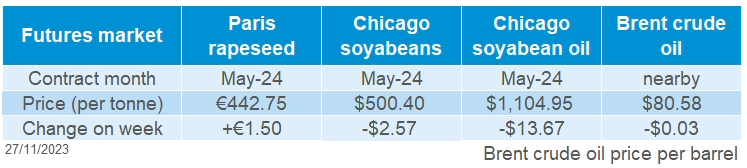

Global oilseed futures

The market is still being dominated by Brazilian weather. Chicago soyabean futures (May-24) were underpinned at the start of last week from on-going weather concerns. Also, a weaker US dollar and the Argentinian election result further offered support to the market.

However, futures subsided at the end of the week as rains were forecast for central and northern parts of Brazil. Across the week Chicago soyabean futures (May-24) closed at $500.40/t, down 0.5% Friday to Friday.

Hot and dry conditions in northern and central Brazil supported the market last week as there were worries over the impact on newly planted crops. Some scattered rains haven’t been enough to ease anxieties over whether Brazil can produce what is currently forecast to be a record soyabean crop.

It’s reported that in parts of Mato Grosso (the largest soyabean producing state) that there may be a need for replanting. Some producers are said to be divided between replanting, waiting to see if the soyabean crops recover, or abandoning part of the crop and planting the second maize crop early at the start of 2024.

Brazilian soyabean plantings still lag, with 74.7% of the crop now planted, down from 88.3% at the same point last year (Patria Agronegocios). Several consultancies have made marginal revisions to forecasts e.g. Safras & Mercado revised its estimate to 161.4 Mt, down from 163.25 Mt previously. So far there haven’t been any large cuts, suggesting there is still confidence in Brazil producing a large crop.

In Argentina, its reported that farmers are holding back soyabean sales ahead of the inauguration of president elect Javier Milei, who has pledged to cut taxes and weaken the peso (LSEG). Soyabean crops in Argentina are reported to be in good condition, with first sprouts looking promising as over one third of the country’s crop has been planted now (Buenos Aires Grain Exchange).

Forward looking; widespread rains are forecast from Thursday over northern and central parts of Brazil. This will bring much needed relief to the soyabean crop and likely will pressure the market.

Rapeseed focus

UK delivered oilseed prices

While the closure of US markets on Thanksgiving Day slowed trading down last week, the weather in South America continues to be a key watch point for how rapeseed markets perform. Pressure in both Chicago soyabean and Malaysian palm oil futures filtered into rapeseed futures across the week.

Paris rapeseed futures (May-24) gained by €1.50/t to close at €442.75/t on Friday. While the Nov-24 closed at €449.50/t, gaining marginally by €0.75/t over the same period.

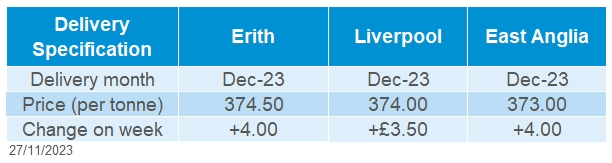

Rapeseed delivered into Erith for December 2023 delivery was quoted at £374.50/t, gaining £4.00/t over the week (Friday to Friday).

Ukrainian winter sowing nears the end for 2024 harvest. For rapeseed, its reported that 1.16 Mha has been sown, it’s expected that 1.2 Mha will be sown for harvest 2024. This is a marginal decrease on the 1.38 Mha sown in 2023 (Ukrainian Agriculture Ministry).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.