Arable Market Report – 26 January 2026

Monday, 26 January 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (May-26)

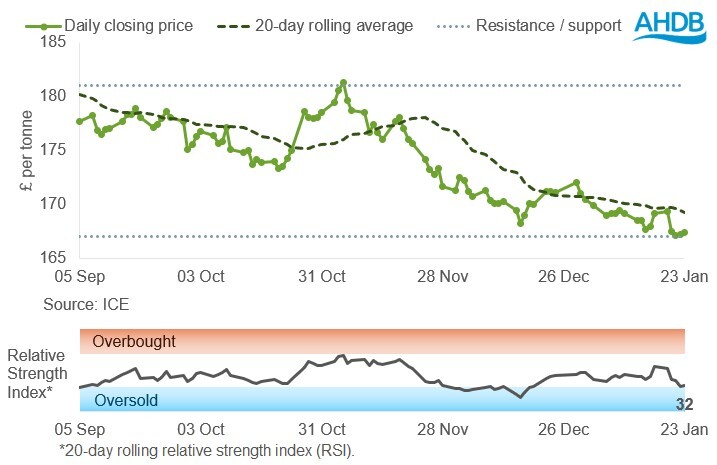

UK feed wheat futures (May-26) remained below the 20-day simple moving average at the end of last week. The nearest support level of £167/t, which was put under strong pressure last week, is still in place.

The relative strength index (RSI) fell to 32 on Friday from 54 the previous week, which is near the oversold zone.

Find out more about the graphs in this report and how to use them

Market drivers

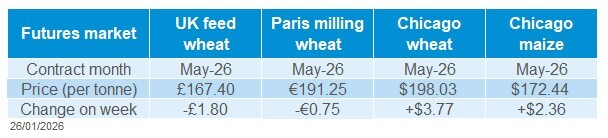

May-26 UK feed wheat futures prices decreased by £1.80/t (1.1%) last week (16–23 January) to £167.40/t. Paris milling wheat futures decreased by 0.4% over the week, while Chicago wheat futures (May-26) gained by 1.9%. Domestic feed wheat futures were under pressure from Paris futures and stronger sterling. On Friday, sterling reached its highest level against the euro for a week (£1 = €1.1526) and against the US dollar since September 2025 (£1 = $1.3641, LSEG).

Chicago wheat futures for May 2026 increased last week to their highest level since 12 December 2025 due to a weaker US dollar, weather concerns for the winter crop in the US, and improving export data. The US dollar index (nearest contract) fell 1.8% from Friday-to-Friday last week. The forecast is for abnormally cold weather and snow in the US, but it is difficult to conclude what the real impact on the winter wheat crop will be at this stage.

On Friday, the USDA’s weekly export sales report showed, as of 15 January, net sales of wheat (618 Kt) and maize (4.0 Mt) that were both well above the upper end of trade estimates. This supported the Chicago futures markets at the end of last week.

Last week, Paris milling wheat futures fell due to the stronger euro against the US dollar, as well as strong competition from wheat in the Black Sea region and Argentina. The Algerian wheat tender showed a preference for Argentinian wheat over European.

As of 23 January, Ukraine's grain exports for the 2025/26 season, which started in July, were still well below last year's figures (Economy Ministry). This could result in higher ending stocks at the end of this season. Wheat exports reached 8.4 Mt, compared to 10.6 Mt last season. Maize exports reached 8.0 Mt, compared to 11.8 Mt last season.

In the near and medium term, futures prices could react to concerns regarding the weather for winter wheat in the Northern Hemisphere and maize in Brazil and Argentina. Currency influences are also present in the grain market. However, the ample global grain supply remains a key factor in market pressure.

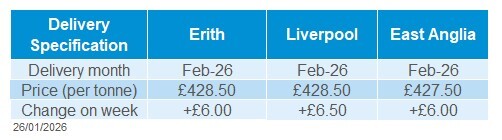

UK delivered cereal prices

Feed wheat delivered to East Anglia in February was quoted at £170.50/t, which is £0.50/t lower than the previous week. Meanwhile, the price of bread wheat for delivery in February to the North West and Northamptonshire was quoted at £192.50/t and £181.50/t respectively, both of which were down by £1.00/t.

Rapeseed

Paris rapeseed futures in £/t (May-26)

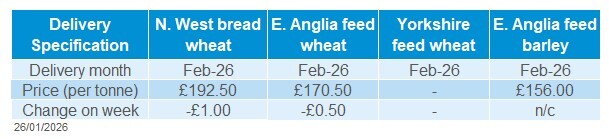

May-26 Paris rapeseed futures in £/t rose 2.2% last week to end the week at just under £414/t. The contract also moved above the 50-day moving average, which now could act as a support line.

The relative strength index (RSI) rose from 50 to 70 Friday-Friday showing greater upward momentum in the market. This suggests that the contract is on the edge of being overbought and indicates time to watch prices more closely.

While the weekly change in May-26 prices is similar in euros and sterling, volatility in the exchange rate impacted price changes through the week. £1 dropped as low as €1.1459 mid-week before recovering to end the week at €1.1526 (LSEG).

Find out more about the graphs in this report and how to use them

Market drivers

The May-26 contract gained €9.75/t (2.1%) last week and reached €476.50/t, its highest price since early December. Meanwhile, the Nov-26 contract gained €9.50/t to close Friday at €464.25/t.

Increased demand for vegetable oils ahead of Ramadan and the Chinese Spring Festival (New Year) helped push prices up. The Chinese New Year and the expected start of Ramadan are on 17 February. Meanwhile, nearby Brent crude oil futures rose 2.8% last week, to $65.88/barrel after the US announced increased sanctions on Iran and that it has military ships on route to the area.

These factors more than offset news that Indonesia has cancelled its planned move from B40 (a blend of 40% biodiesel and 60% conventional diesel) to B50. LSEG reports that the cancellation is due to funding and technical concerns. The rise would have increased the amount of palm oil required for biodiesel in the world’s top producer of the oil.

Meanwhile, Chicago soyabean futures found support from US exports and a weaker US dollar; the May-26 contract gained 1.0% Friday-Friday. But again, the large, expected South American soyabean crops limited price gains.

The US confirmed that China has bought 12 Mt of US soyabeans since late-October’s deal and ahead of the March deadline. Geopolitical tensions, including over the US and Greenland, pushed the US dollar lower again against other key currencies.

The Brazilian soyabean harvest is in its early stages, though rain showers are reported to have slowed progress in some areas. However, more rain is needed to support crops in key areas of Argentina as they enter critical growth stages (Rosario Stock Exchange).

UK delivered rapeseed prices

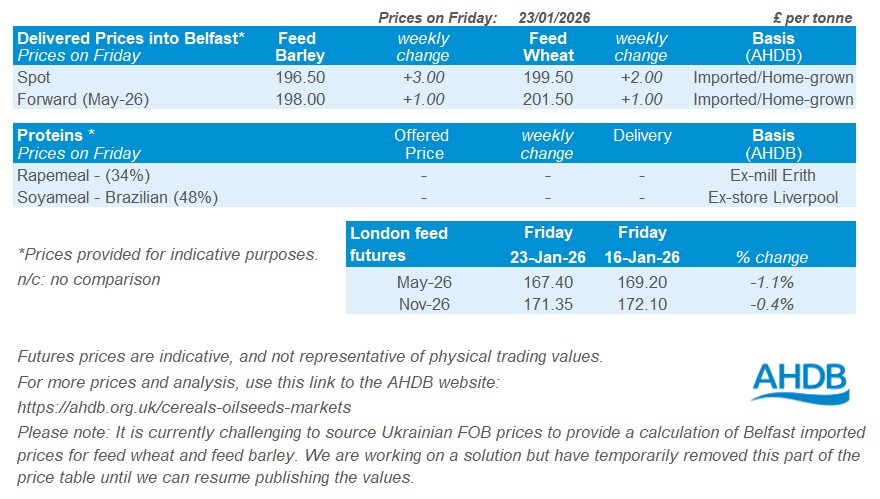

In last Friday’s survey, rapeseed delivered to Erith in February was quoted at £428.50/t, a rise of £6.00/t from the previous week. The price for November delivery to Erith was up by £5.50/t to £413.50/t.

These gains were similar to those recorded for the May-26 and Nov-26 Paris rapeseed futures in £/t terms at the time of the survey. But this may not fully reflect the change in the closing prices for the futures market.

Extra information

On Thursday (29 January), AHDB is due to release the next forecasts of UK cereals supply and demand in 2025/26. Get the key changes direct to your inbox by signing up to our Grain market update in the AHDB Preference Centre.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.