Arable Market Report - 24 October 2022

Monday, 24 October 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

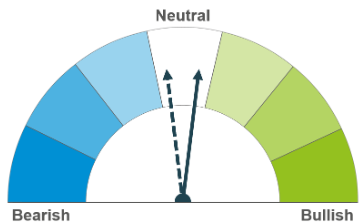

Markets continue to follow news on the Ukrainian export corridor, keeping prices volatile but supported short term. Longer term, Southern Hemisphere production and recessionary concerns remain watchpoints for market direction.

A tight global supply picture, as well as news on the Ukrainian export situation, keeps prices supported currently. Longer term, recessionary behaviour and South American plantings could relax a tight S&D balance.

Barley markets continue to follow wider grain movements, supported by supply outlooks remaining tight.

Global grain markets

Global grain futures

Global grains overall felt some pressure last week. The Ukrainian export corridor continued to be the key factor driving global grain markets, as well as US dollar movement and continued recessionary concerns which could have impacts on demand.

News on talks between the UN and Russia to extend the Ukrainian export corridor continues to keep volatility in the market. The UN are looking to extend the 4-month deal, which expires late November, for a full year. It is believed this deal will be renewed, though not yet agreed. Vessels continue to leave Ukraine, with seven reportedly departing on Sunday from Odessa, Chornomorsk and Pivdennyi, carrying 124.3Kt of foodstuffs. Of this, one vessel carried 40Kt of wheat to Yemen, from Chornomorsk.

Some rain arriving in Argentina may have calmed some concerns about the dry conditions last week, as every little helps at this stage. But conditions remain dry. Maize plantings for 2022/23 are estimated at 17% complete (as at 19 October). This is down 9.3% compared to the same point last year according to Buenos Aires Grain Exchange, down to dry weather. Regions may receive a little more rain this week. Is it too late for their wheat crop? Due to start harvest next month, the USDA’s official estimates for October reduced their forecast for 2022/23 wheat crop, down 1.5Mt to 17.5Mt.

Demand also remains a key underlying driver for grain movements. US wheat and maize markets fell on Wednesday last week, due to weak export demand. US dollar strength looks to make exports less competitive. Today, Saudi Arabia’s state grain buyer SAGO said they have purchased 566Kt of milling wheat to arrive March to April 2023. Origins offered included EU, Black Sea region, North American, South American, and Australian with the seller’s choice on origin supplied.

On Friday, the USDA Attaché for Australia released their latest grain report, which flagged the risk of rainfall at harvest causing quality downgrades. In the report, wheat, and barley production for 2022/23 is pegged at 34Mt and 12.2Mt respectively – still very large crops historically. Last week, weekly rainfall totals were more than 150mm in parts of Queensland and New South Wales according to the Australian Government Bureau of Meteorology. In some areas of Queensland, totals exceeded 350mm. South-western parts of Western Australia received weekly totals of 25mm plus. Significant growing areas of wheat and barley, something to watch.

UK focus

Delivered cereals

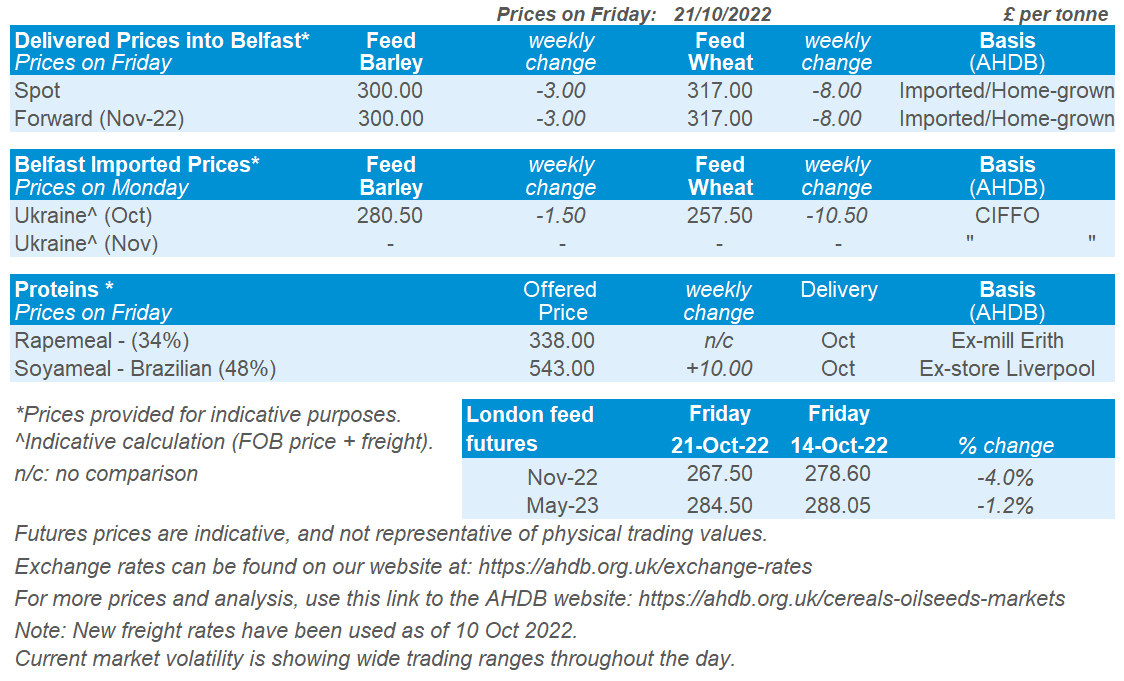

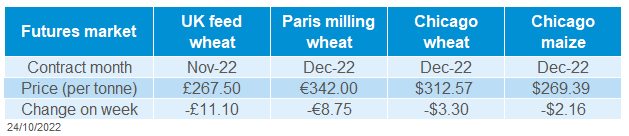

UK feed wheat futures movements continued to follow global contract movements last week.

UK feed wheat futures (Nov-22) fell £11.10/t last week, to close on Friday at £267.50/t. The May-23 contract fell only £3.55/t over the same period, to close at £284.50/t. New-crop futures (Nov-23) fell even less again, down £2.95/t to close at £267.05/t.

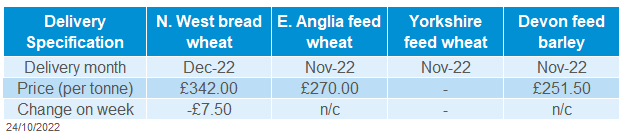

Domestic delivered prices for feed wheat into East Anglia were quoted on Thursday at £270.00/t for November delivery. Bread wheat prices for December delivered into the North West were quoted at £342.00/t.

The pound sterling strengthened against the US dollar overall across last week by 1.2%, despite some fluctuation, to close on Friday at £1 = $1.1302. This morning has seen further gains. Exchange rate movements remain sensitive to UK political developments. Rishi Sunak is set to be the next prime minister as announced today. With this news known, this could settle markets. Though, next Monday’s (31 Oct) fiscal announcement and OBR forecast will be a watchpoint for financial markets.

On Thursday, the early balance sheets for 2022/23 were released for wheat and barley. Key points show a large surplus for wheat this season is forecasted, despite higher wheat usage forecasted too. For barley, lacklustre animal feed demand and higher production have led to a larger surplus. Though, the barley remains historically tight.

Oilseeds

Rapeseed

Soyabeans

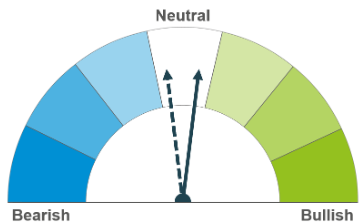

In the short-term, rapeseed markets remain supported by a strong wider vegetable oil market, and news on the Ukrainian corridor. Longer term, recessionary concerns and soyabean markets could pressure prices.

South American weather continues to influence soyabean markets in the short-term and planting progression over the coming weeks is key for longer term direction.

Global oilseed markets

Global oilseed futures

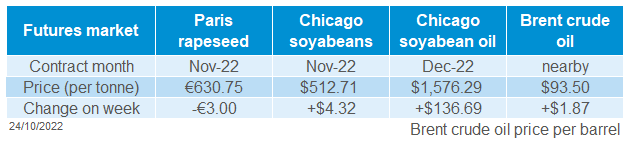

Chicago soyabean futures (Nov-22) were up $4.32/t across the week (Friday to Friday), closing at $512.71/t. This is down to strong US export data and hopes that overseas demand will continue. The USDA export sales (week ending 13 Oct) were pegged at 2.34Mt this biggest weekly total in a year. Furthermore, last week the USDA confirmed export sales of 333Kt through its daily reporting system with 201Kt of that sold to China, with the rest 'unknown'.

Meanwhile Chicago soyabean oil futures (Dec-22) were up 9.5% Friday-Friday, due to higher crush margins and palm oil strength supporting vegetable oils. Soyabean oil is now at a premium to other vegetable oils enabling it to dictate the price ceiling.

Malaysian palm oil futures (Nov-22) gained 5.1% across last week, Friday to Friday. Prices have strengthened from concerns over rainstorms and resulting floods reducing palm oil production in Malaysia and Indonesia, and fears that India will raise import taxes. This has maintained the floor of support for the vegetable oil complex. With heavy rainfall forecasted for the next week, this support looks to continue.

Focus going forward is now on South American soyabeans. Brazil have currently sown 21.5% of their soyabean crop (as at 15 October) and Conab are forecasting record production at 152Mt this season. Long-term this could weigh on markets. Rainfall is forecasted for Brazil over the next week, with between 1 and 5 inches forecasted in one of the key producing regions Paraná, and key areas of Mato Grosso may receive up to 1.5 inches. Rainfall is also forecasted for Argentina over the same period which will benefit the soyabean plantings.

Nearby brent crude oil futures rose 2% across last week, closing at $93.50/barrel on Friday. The US continues to release crude oil stocks (currently at 57% capacity), as President Biden tackles high prices but these stocks will be replenished at some point (Refinitiv). This comes after OPEC+ cut daily oil production by 2M barrels earlier this month.

Rapeseed focus

UK delivered oilseed prices

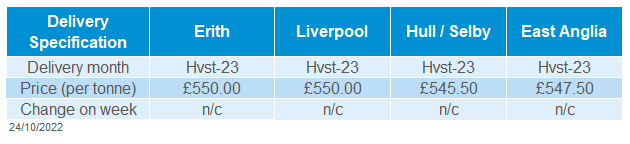

Paris rapeseed futures (Nov-22) tracked sideways across the week (Friday to Friday), slightly down by €3.00/t to close at €630.75/t.

The Aug-23 contract closed at €633.25, down €0.50/t over the same period. Delivered rapeseed into Erith for harvest 2023 (August) delivery was quoted on Friday at £550.00/t. With sterling slightly weakening by 0.3% across the week to close at £1=€1.147, this would have supported domestic rapeseed prices slightly.

Across the week we saw concentrated rains between 0.1 and 1 inch in key canola producing regions in Canada, namely Alberta and Saskatchewan. Rains of up to 5 inches are forecast for Saskatchewan for the coming week as well. Though with canola harvest almost complete in these regions, this should not impact the crop massively.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.