Arable Market Report - 24 June 2024

Monday, 24 June 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

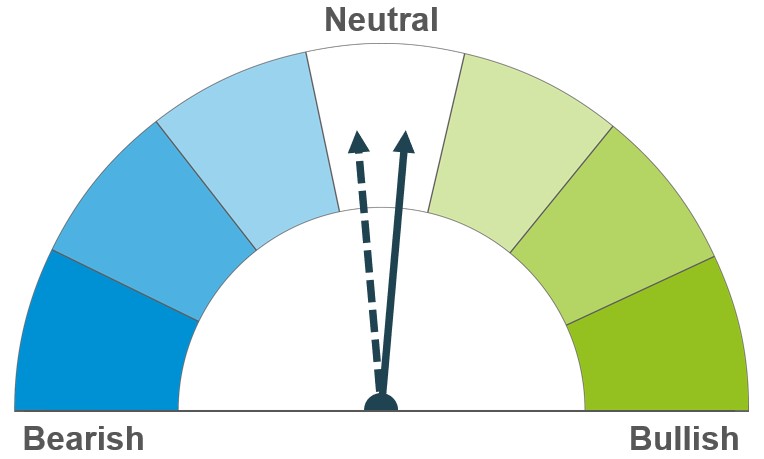

Wheat

Maize

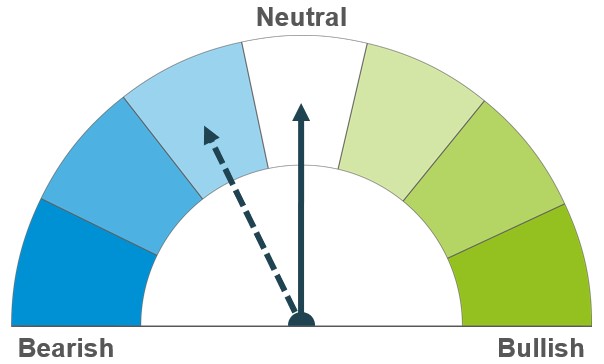

Barley

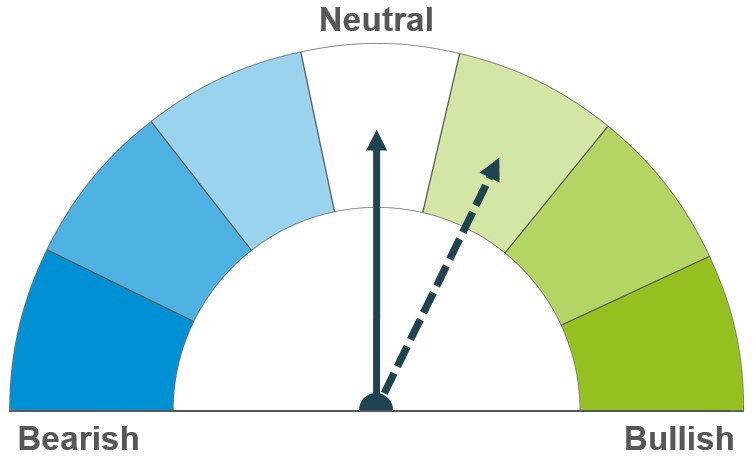

Northern Hemisphere weather is a key driver short term, with concerns in the Black Sea region and the US weighing against harvest pressure. Longer term, expectations of smaller crops in key exporting countries remain.

Weather conditions in the Black Sea and US maize belt remain in focus. Longer term, there are still expectations of plentiful supplies, though this is dependent on favourable weather conditions in key development stages.

Expectations of a yearly climb in global supplies persist. Barley prices are likely to continue to follow wider grains price movements.

Global grain markets

Global grain futures

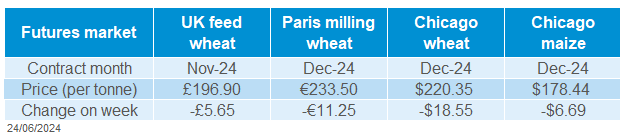

Global grain markets were pressured last week, on the back of improved weather and minimal changes to crop expectations in Europe and the Black Sea region. Harvest pressure across the Northern Hemisphere was a factor as well. Chicago wheat futures (Dec-24) closed at $220.35/t on Friday, down 7.8% on the week. Paris milling wheat futures (Dec-24) were down 4.6% over the same period, closing on Friday at €233.50/t.

Last week, Russian consultancy firm IKAR increased its 2024 Russian wheat crop estimate to 82.0 Mt, from 81.5 Mt previously. Germany’s association of farm cooperatives put its latest German wheat crop forecast at 20.34 Mt, down 5.5% on the year, but relatively unchanged on its previous estimate.

Despite an improved outlook last week, extreme weather remains a concern across the Northern Hemisphere. Forecasts in the Black Sea region suggest parts of both Russia and Ukraine will be impacted by dryness over the coming weeks, which is expected to impact predominantly maize and sunflower crops. Dry weather in the region could have a greater impact due to the lack of soil moisture already present following limited precipitation over the last six weeks.

Meanwhile in the US, following near-record high temperatures as of late, forecasts for heavy rain in parts of the Midwest are fuelling flooding concerns. Rains could also delay winter wheat harvest in the US. Last Monday, in its weekly crop progress report, the USDA reported that 27% of the US winter wheat crop had been harvested in the week ending 16 June. This was well ahead of analyst estimates, and the five-year average of 14% complete at that point in the season. More information on US harvest progress and crop conditions will be released later today – something to watch out for.

UK focus

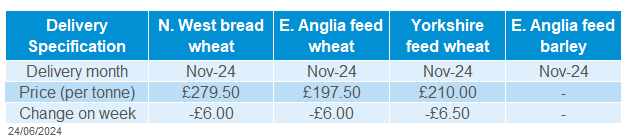

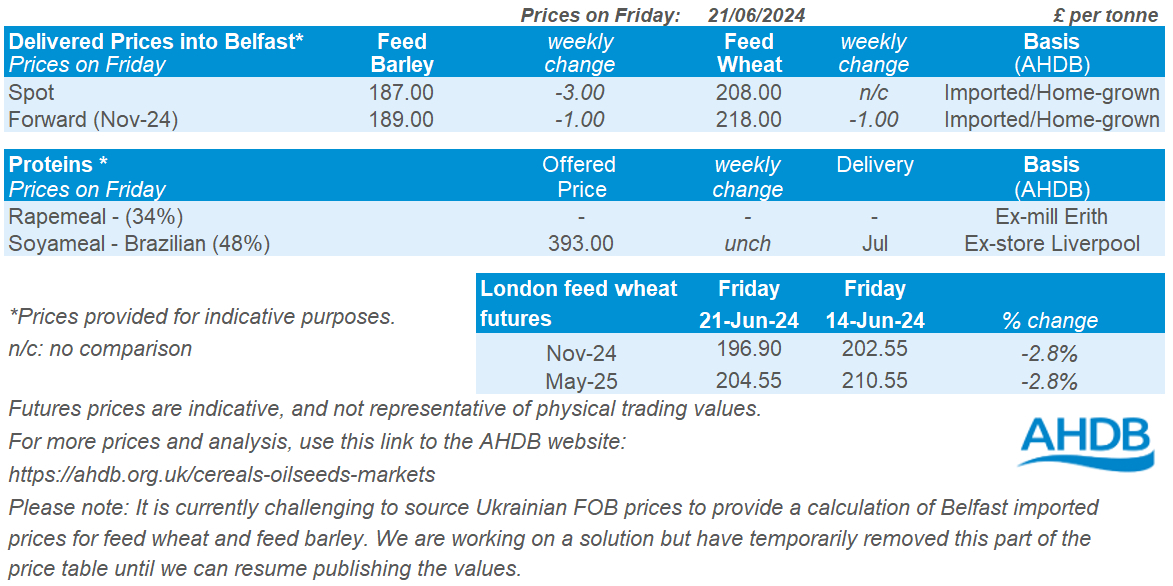

Delivered cereals

Domestic wheat prices followed global wheat markets down last week. UK feed wheat futures (Nov-24) closed at £196.90/t on Friday, down £5.65/t on the week. The May-25 contract fell £6.00/t over the same period, ending Friday’s session at £204.55/t.

Domestic delivered prices also followed suit. Feed wheat delivered into East Anglia for harvest delivery was quoted at £190.00/t on Thursday, down £7.50/t on the week. Bread wheat delivered into the North West (for harvest delivery) was quoted at £273.50/t, down £6.00/t week-on-week.

Presently, under the Renewable Energy Directive (RED II), UK-grown wheat is one of the many biofuel feedstocks which can be used to supply biofuel into the EU. However, the UK could soon lose its recognition under RED II. Last week, AHDB released some analysis on what this could mean for UK wheat growers; find the full analysis here and highlights here.

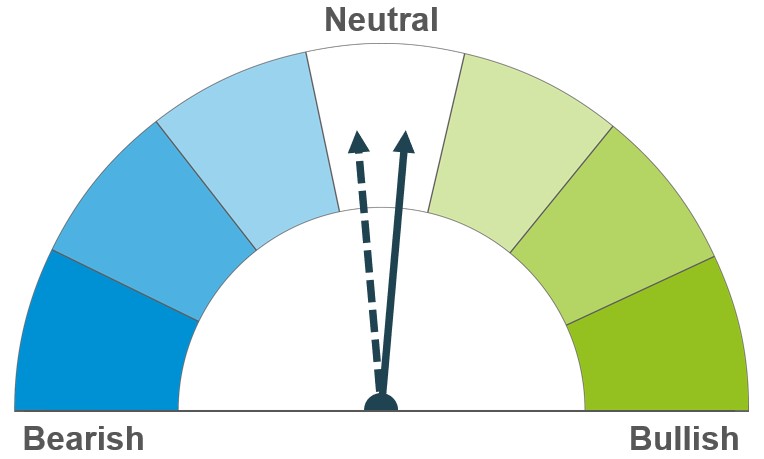

Oilseeds

Rapeseed

Soyabeans

Rapeseed may be influenced by the sentiment in the soybean market. Meanwhile the expectations of tighter global supplies, driven by EU and Australia, could limit losses.

The US is making strong progress with planting, but this is being balanced out by concerns about the weather. Despite this, there is still an expectation of ample supply in the market for the longer-term.

Global oilseed markets

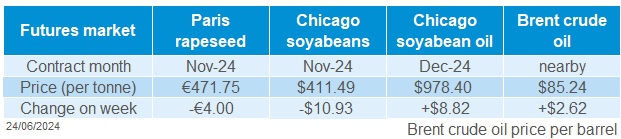

Global oilseed futures

Global oilseeds markets were pressured last week last week (Friday to Friday). Chicago soyabean futures (Nov-24) closed at $411.49/t on Friday, down by $10.93/t for the week. Lowered crop condition rating in the US were offset by the strengthening of the dollar and forecast of rainfall in regions affected by the heat wave.

The National Oilseed Processors Association (NOPA) reported a rebound in the US soybean crush in May from a seven-month low in April. The association, responsible for processing around 95% of the soybeans crushed in the United States, saw an 8.4% increase in May compared to April crush and a 3.2% rise compared to the same period last year.

Planting of soyabeans in the US is progressing well according to USDA. As at 16 June, 93% of the crop had been planted, up from 87% the week before, and the five-year average of 91% at this stage of the season. However, crop condition saw a slight decline as the rating of good to excellent dropped to 70% from 72% the week before. The release of the next crop condition report, due later today, will be a key watch point for the markets.

Malaysian palm oil futures were also pressured last week, tracking the wider oilseeds market. Weekend profit-taking followed weaker Chinese vegetable oil prices; a reduction in Malaysian exports also weighed on prices. Exports of Malaysian palm oil products from 1-20 June fell by between 8.1% and 12.9% from the same period a month earlier according to inspection companies in the country.

Rapeseed focus

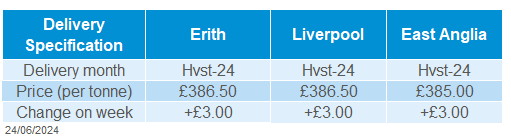

UK delivered oilseed prices

It was a week of fluctuations for the Paris rapeseed futures with the Nov-24 contract closing at €471.75/t, down €4.00/t across the week. The contract reached its weekly low of €467.00/t on Monday and a weekly peak at €474.75/t on Wednesday.

Despite losses in global oilseed markets, the UK’s delivered prices gained on the week. The domestic market had a quiet week; the weakening of the pound against the euro might have provided some support to prices. Rapeseed delivered into Erith for Harvest delivery was quoted at £386.50/t on Friday, up £3.00/t on the week. For November delivery, rapeseed was quoted at £398.50/t, up £4.00/t Friday to Friday for the same location.

The weather situation in key producing countries remains a key watch at this time of the season. In the province of Saskatchewan in Canada, crop development is being delayed by cooler temperatures and excess moisture. Seeding is nearly finished, with only one percent of acres remaining unsown by 17 June.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.