Arable Market Report - 24 April 2023

Monday, 24 April 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

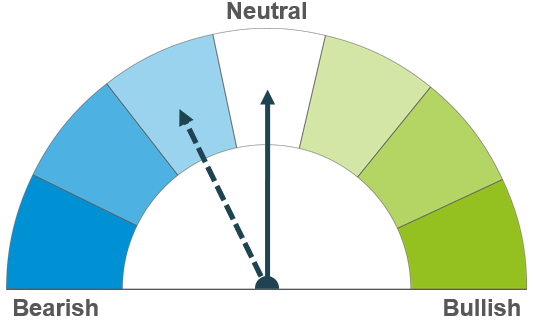

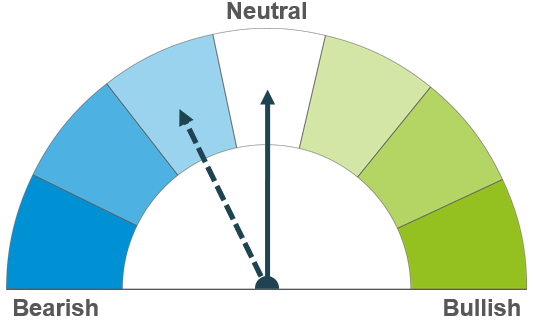

Wheat

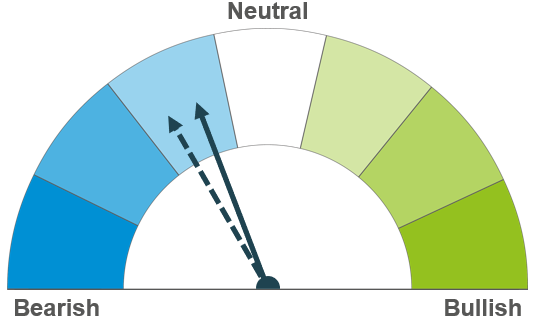

Cheap, ample Black Sea supply continues to weigh on the market short term. Though volatility is expected too, as concerns grow on whether the Black Sea Initiative is renewed mid-May. Longer term, harvest 2023 crop development is key for price direction.

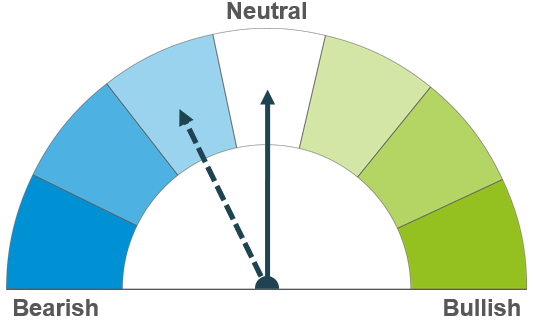

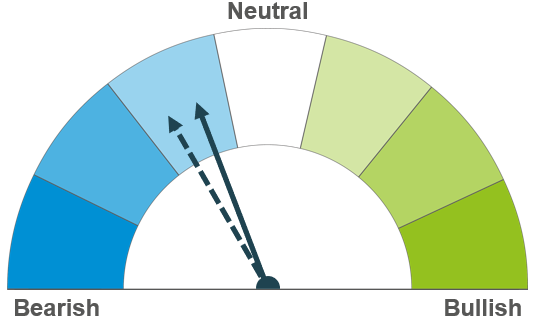

Maize

Similar to wheat, some volatility surrounding the Black Sea Initiative is expected. Short term, markets will await news on US planting and Chinese buying. Longer term, the Brazilian crop will boost supplies and a large US crop is due.

Barley

Wider grain markets continue to lead barley price movement, especially wheat. The discount of ex-farm UK feed barley to UK feed wheat stood at £21.00/t as at 13 April.

Global grain markets

Global grain futures

Global grain markets closed down last week, pressured by favourable weather for US maize planting and resumed Ukrainian grain exports.

US weather looks favourable for planting their large forecast maize crop. Though looking over the next 2 weeks, rain is due across the key maize producing regions in the Midwest. As at 16 April, 8% of maize planting was complete (USDA), ahead of this time last year which at the same point was 4% complete and ahead of the 5-year average at 5% complete. Updated data is due later today.

Further pressuring global wheat prices last week, was the resumption of Ukrainian exports. Last week, Poland, Hungary, Slovakia, and Bulgaria (temporarily), all announced bans on Ukrainian grain imports. In response, the European Commission also introduced emergency preventative measures. Wheat, maize, rapeseed, and sunseed entering Bulgaria, Hungary, Poland, Romania, Slovakia would only be allowed should this grain/oilseed be set for export to other EU members or to the rest of the world. The measure is in place until June.

Last Monday, vessel inspections saw a temporary halt through the Black Sea Initiative but resumed on Tuesday. Focus now is on whether the Black Sea Initiative will be renewed mid-May. Yesterday, former Russian president Dmitry Medvedev said that if the G7 banned exports to Russia (near-total ban on exports to Russia), Moscow would terminate the Black Sea Initiative which allows grain to leave Ukraine by port. The G7 meet next month in Japan.

Looking ahead, the fundamentals of the grain market point to ample supply. Russian consultancy IKAR peg Russian wheat production at 84Mt for harvest 2023, down from 2022 but remaining large. Argentina’s wheat area for 2023/24 is expected to increase near 10% to 6.7Mha according to the Buenos Aires Grain Exchange.

UK focus

Delivered cereals

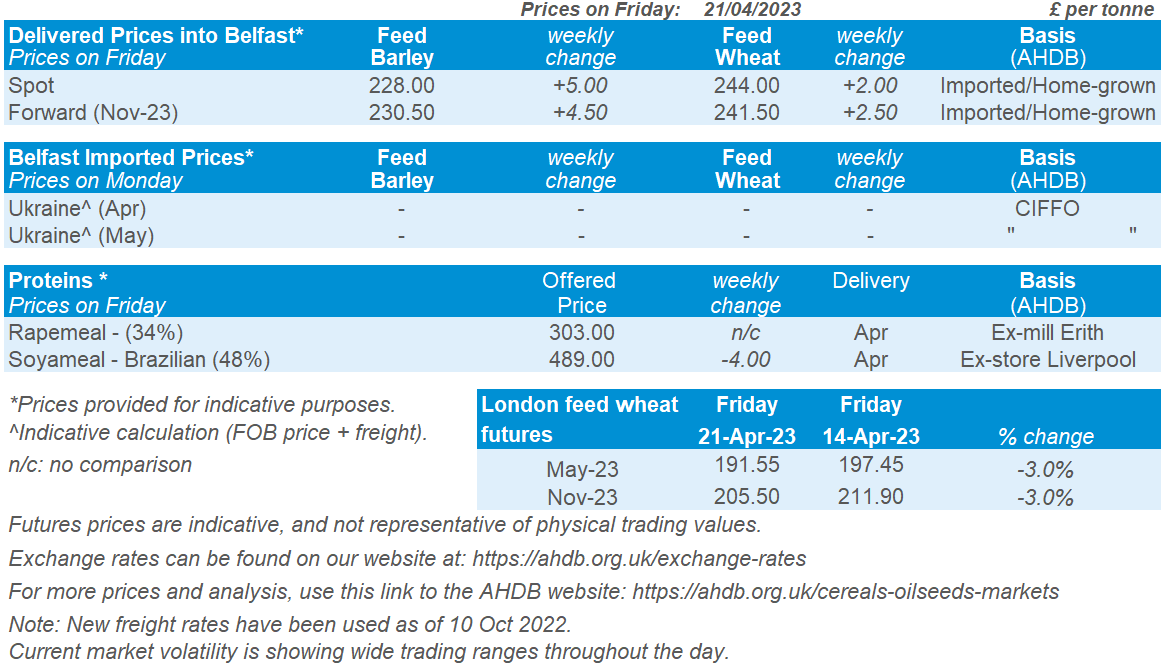

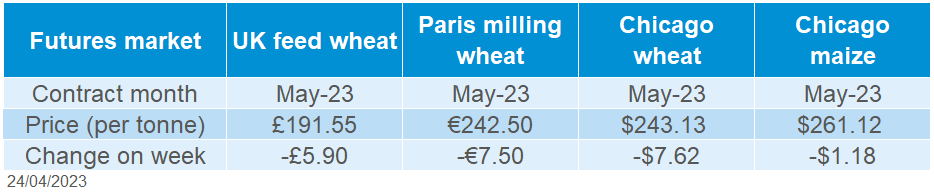

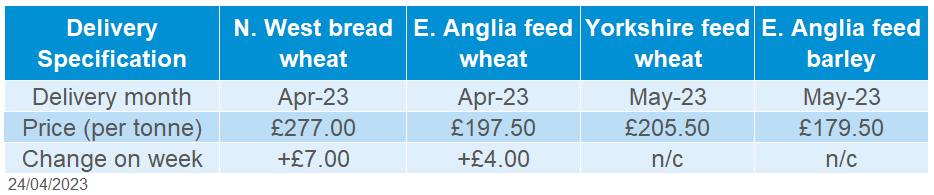

Old crop UK feed wheat futures (May-23) closed on Friday at £191.55/t, down £5.90/t Friday to Friday. New crop futures (Nov-23) closed at £205.50/t on Friday, down £6.40/t over the same period. Domestic futures movements followed global movements down.

Domestic delivered prices gained Thursday to Thursday despite futures market movements down, on anecdotal reports of a lack of selling and concern building for whether the Ukrainian grain export corridor will remain open. On Thursday, feed wheat delivered into East Anglia (April delivery) was quoted at £197.50/t, up £4.00/t on the week.

Bread wheat delivered into the North West (April delivery) was quoted at £277.00/t on Thursday, up £7.00/t on the previous week.

Feed barley delivered into East Anglia (May delivery) was quoted £179.50/t on Thursday.

Oilseeds

Rapeseed

The rapeseed market looks to be well supplied going into the new crop, especially in the EU. Current market focus is on Canadian plantings, which are now starting.

Soyabeans

A large Brazilian crop is currently being exported to the global market, weighing on prices. Long-term, the US soyabean crop is going to be sizable, which could continue to weigh on prices.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures (May-23) were supported at the start of last week, as members of the National Oilseed Processors Association (NOPA) had the largest soyabean crush in 15 months in the month of March. However, as the week progressed, bearish news outweighed this gain and the contract closed at $545.04/t on Friday, down 1% across the week. Pressure came from a weaker US dollar and weaker crude oil prices, lacklustre Chinese demand, and improved weather outlook for US soyabean plantings.

US soyabean export sales (to week ending 13 Apr) were estimated at 100.1Kt, down 73% from the previous week, and 58% down from the previous 4-week average. Significantly lower than market expectations of 250-600Kt. Further to that, Brazilian soyabean port premiums have fallen to historical lows, due to slow Chinese demand and a record soyabean crop. It has been reported that two vessels carrying a combined 79.2Kt of soyabeans is heading for the US which is pressuring the Chicago market (Refinitiv).

Nearby Brent crude oil futures closed Friday at $81.66/barrel, down 5% across the week. There is pressure on crude oil prices as interest rate rises and demand uncertainty weighed, which fed into soyabeans.

Focus now is on US soyabean plantings, there is widespread rains across the US Midwest towards the end of this week which will slow plantings in states such as Arkansas, Louisiana and Mississippi. However, note that in these three respective states planting progression currently is way ahead of last year.

Rapeseed focus

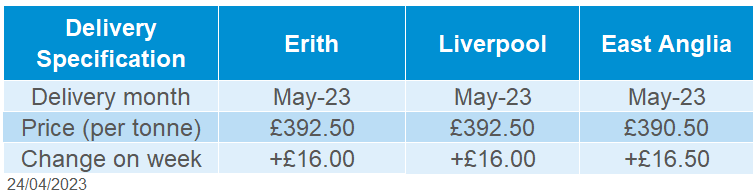

UK delivered oilseed prices

There was support across the week for rapeseed markets as Paris rapeseed futures (May-23) closed Friday at €456.50/t, gaining €17.25/t across the week. Domestic prices shadowed this, as delivered rapeseed (into Erith, May-23) was quoted at £392.50/t on Friday, gaining £16.00/t across the week.

Winnipeg canola futures ended the week marginally up. Supporting the market last week were concerns of cold temperatures in the Canadian Prairies adding to planting delays. This is a key watchpoint as their sowing season is set to start.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.