Arable Market Report – 22 September 2025

Monday, 22 September 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

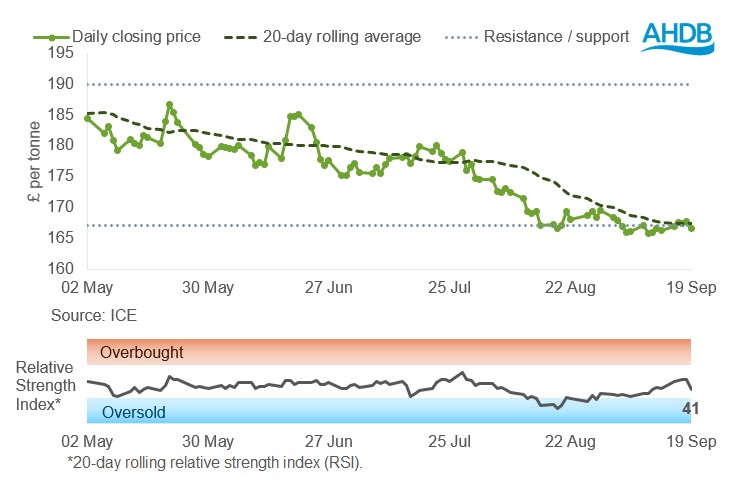

UK feed wheat futures (Nov-25)

UK feed wheat futures saw a slight increase last week (Friday to Friday) and continued to trade near the support level of £167/t. The market is trying to determine the direction of future price movements.

The Relative Strength Index (RSI) remains at 41, unchanged from last week, and is not indicating any market momentum.

Find out more about the graphs in this report and how to use them.

Market drivers

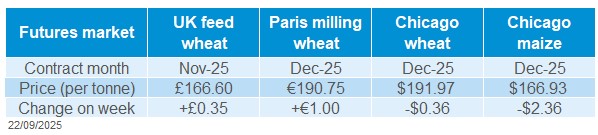

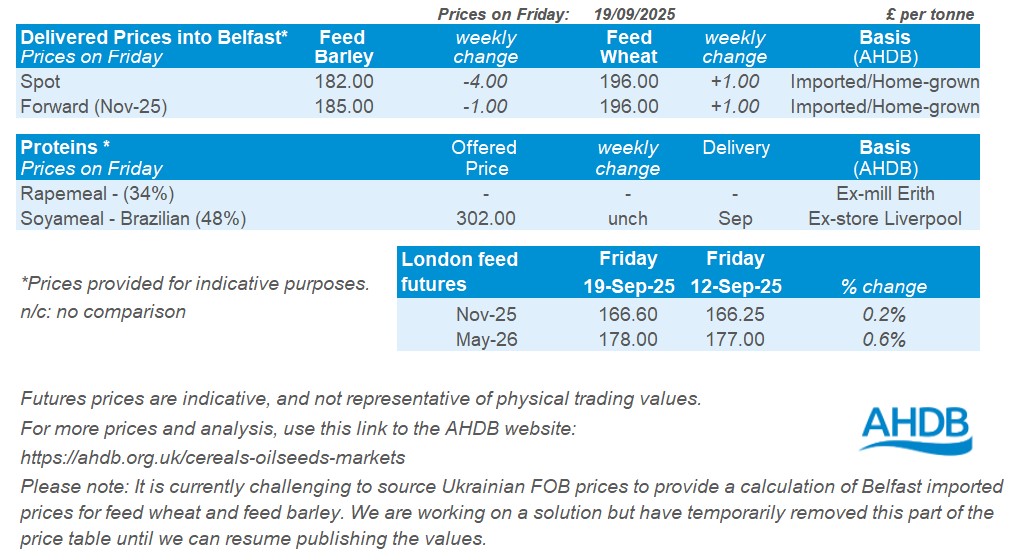

UK feed wheat futures (Nov-25) closed at £166.60/t on Friday, up £0.35/t (0.2%) on the week. Meanwhile, Paris wheat futures (Dec-25) rose by 0.5%, while Chicago wheat futures fell by 0.2%.

Last week, currency movements influenced the market due to interest rate decisions by the US Federal Reserve (a decrease of 0.25%) and the Bank of England (no change). At the start of the week, the US dollar was weaker than the euro, supporting Chicago prices. However, by the end of the week, the euro had fallen, supporting Paris futures.

The International Grains Council has raised its forecast for 2025/26 global wheat production by 8 Mt to 819 Mt (USDA 816 Mt). The monthly update had also trimmed its 2025/26 world maize production outlook by 2 Mt to 1,297 Mt (USDA 1,287 Mt).

COCERAL, the European trade association, has increased its estimate of EU and UK soft wheat production for 2025 to 147.4 Mt, compared to 143.1 Mt in June. This is mainly due to increased forecasts for France, Germany, Poland, and south-eastern Europe. Conversely, the forecast for maize production fell from 60.6 Mt to 56.7 Mt.

According to Statistics Canada, wheat production is estimated at 36.6 Mt, which is a 1.9% increase on last year's figure of 35.9 Mt.

Russia has harvested 84 Mt of wheat so far in 2025, according to the Agricultural Minister. This is a higher than last year’s crop with some fields still to harvest. Combined with a lower export rate than in the previous season, this could put additional pressure on the global wheat market in the coming months.

US maize harvest progress and ethanol consumption will be in focus the near future. The market has become more unpredictable following the US Environmental Protection Agency's (EPA) proposal on Tuesday, which failed to clarify how biofuel blending obligations would be reallocated under the government's Small Refinery Exemption programme (LSEG).

UK delivered cereal prices

Feed wheat delivered into East Anglia for October delivery was quoted at £170.00/t on Thursday, up £2.50/t from the previous week.

However, there were smaller gains for bread wheat prices. October delivery of bread wheat into Northamptonshire was quoted at £189.50/t, up just £0.50/t from the previous week.

Rapeseed

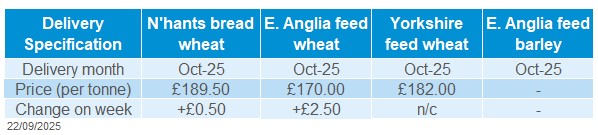

Paris rapeseed futures in £/t (Nov-25)

Last week (5–12 September), Paris rapeseed futures (in £/t) held above the 20-day moving average, finishing at slightly over £412/t. This is despite global negativity in global oilseed markets due to a weakening sterling.

Technical indicators signalled remained steady, with the relative strength index (RSI) edging down from 50 to 49 over the week.

Find out more about the graphs in this report and how to use them.

Market drivers

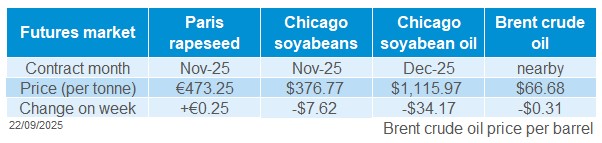

Globally, the oilseed complex was largely under pressure last week, through weak Chinese demand and comfortable global supplies. Chicago soyabeans (Nov-25) were down 2.0% on the week. Paris rapeseed (Nov-25) finished at €473.25 up €0.25 (0.05%) with some support coming from the euro losing value against the US dollar over the same period $1 = €1.1744 on Friday (LSEG).

In Brazil, Conab have forecast a 3.6% increase in soyabean production to 177.7 Mt for the 2025/26 season, due to an increase in planted area of 3.7%.

In the US, soyabean futures fell on the week amid harvest pressure and weak Chinese demand. A phone call on Friday between the US and Chinese presidents was hoped to ease trade tensions and provide positive information on soyabean trade but no news was reported from the talks.

Issues with the documentation for the Ukrainian 10% export duty on key oilseeds are slowly being resolved. Analysts from ASAP Agri stated that shipments have started to move in small quantities as of Wednesday last week. Ukrainian exports for the first half of September are sharply down on 2024 for both soyabeans and rapeseed (UkrAgroConsult).

StatsCan expects output of Canadian rapeseed (canola) in 2025 at 20.0 Mt up 4.1% on the year. However, some traders believe this understates the crop.

Imports of key oilseeds into the EU are down on the year. Soybean imports were at 2.7 Mt by 14 September against 2.8 Mt at the same time last year, while rapeseed imports totalled 0.63 Mt, against 1.1 Mt last year. Rapeseed and soyabean production are up compared to last year across the EU and demand subdued, this combination explains some of the downward pressure we have seen in oilseed prices recently.

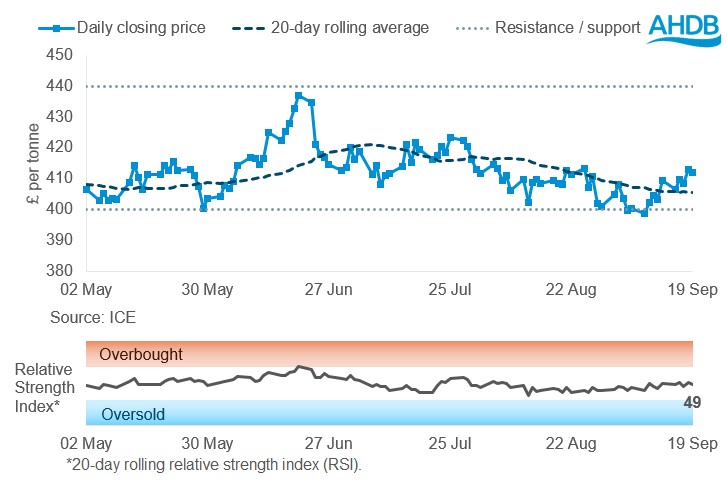

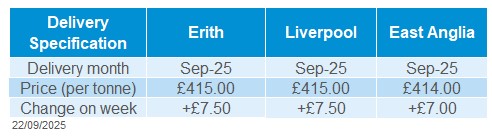

UK delivered rapeseed prices

Delivered rapeseed prices moved upwards last week, supported by a dip in the value of sterling against the euro. It’s also worth noting that Paris rapeseed futures came under pressure from the US market after this survey was conducted.

Rapeseed for November delivery into Liverpool was quoted at £417.50 up £6.00 on the week. In East Anglia, November delivery was quoted at £415.60/t, marking a £5.50 increase week-on-week.

Extra information

AHDB’s final harvest progress report of 2025 will be released on Friday 26 September.

AHDB’s Barley Yellow Dwarf Virus (BYDV) management resources for winter cereals include cereal aphid monitoring activity, weather-based management tool and pest control guidance. These can help keep you one step ahead of yield-robbing BYDV.

The final balance sheet for the 2024/25 season is to be released later this week, showing cereal supply and demand for the UK.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.