Arable Market Report – 20 October 2025

Monday, 20 October 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

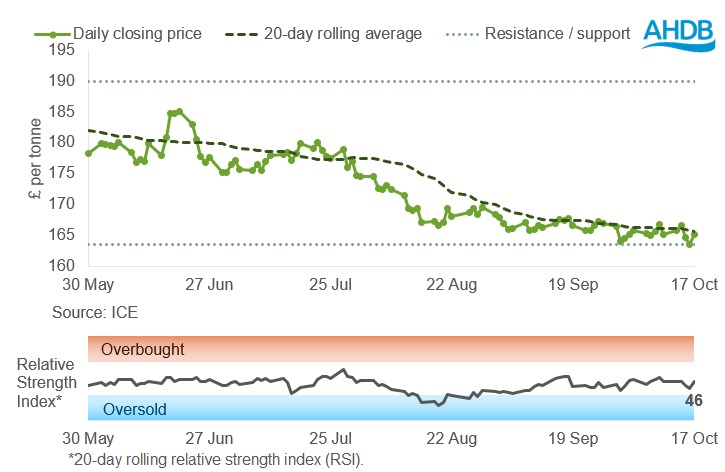

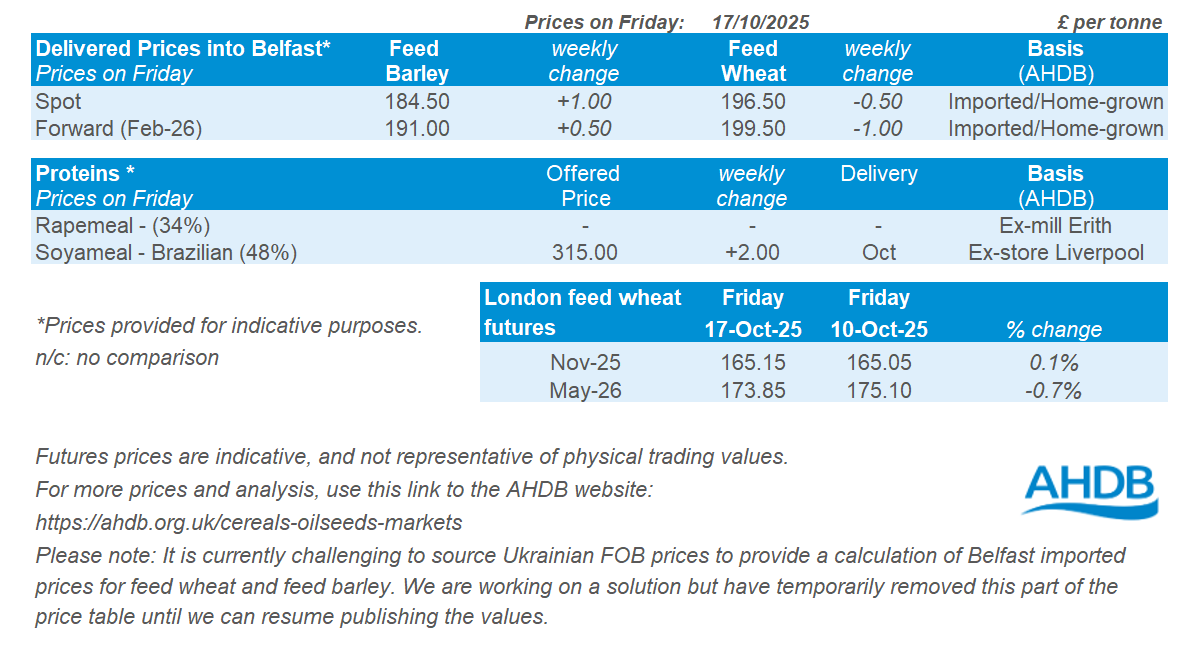

November 2025 UK feed wheat futures reached a new contract low of £163.50/t last week (10–17 October), which is now the new support level. Prices finished slightly below the 20-day moving average.

The relative strength index (RSI) remained at 46 throughout the week, indicating that there was no change in momentum compared to the previous week. There is no clear indication of the direction of future price movements.

Find out more about the graphs in this report and how to use them.

Market drivers

Global grain futures were mixed last week. Uncertainty due to a lack of key information from the USDA was a key driver of some of the marginal support across the week. Chicago maize futures were supported by the prospect of a lower yield than previously forecast in the September WASDE, as harvest has progressed over the last few weeks, there are questions to whether yields are as big as initially forecast. Further to that, US farmers have been inactive in selling new crop supplies.

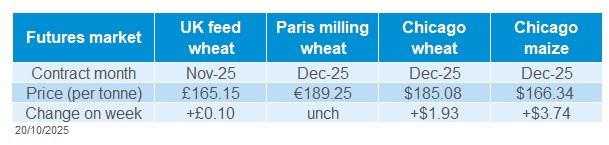

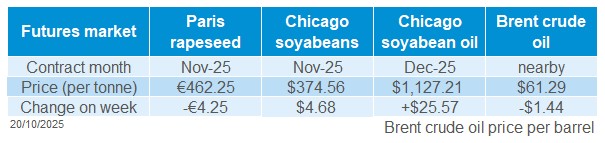

Chicago wheat futures (Dec-25) increased by 1.1%, while Paris milling wheat futures (Dec-25) remained unchanged. Chicago maize futures (Dec-25) were the main driver last week, closing 2.3% up.

UK feed wheat futures (Nov-25) finished the week at £165.15/t up £0.10/t (0.1%) on the week. In addition to being influenced by the global grain market, domestic feed wheat futures were also affected by sterling strength against both the US dollar and the euro. Under pressure from a stronger sterling and a decrease in open interest, Nov-25 futures contract reached a new contract low of £163.50/t at last Thursday's close.

Despite nearby Paris milling wheat futures being unchanged week-on-week, there was pressure in the forward market due a stronger euro against the US dollar and competition from other sources in the export market. Competitively priced Argentinian wheat attracted demand in Morocco. This dampened export sentiment following recent French shipments.

FranceAgriMer published that, by 13 October, 27% of soft wheat had been planted for harvest 2026. This was well ahead of the 10% recorded at the same time last year, when wet weather hindered autumn sowing, and above the five-year average of 22%.

The Russian agricultural ministry is reducing the export tax on wheat from the period of 22–28 October. These taxes are lower than those introduced in the previous period, which will continue to lower the floor price of the global wheat market, as Russian supplies become more competitive and exports could increase.

A key watchpoint for the Black Sea region over the next couple of weeks is the Ukrainian maize harvest, which could further be delayed as there are widespread rains forecast in key maize areas, which could pose a delay to harvest and impact maize price sentiment.

UK delivered cereal prices

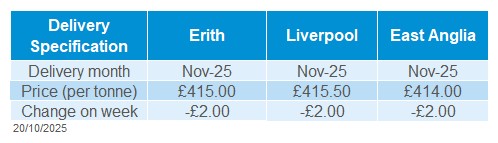

Feed wheat delivered into East Anglia for November delivery was quoted at £168.50/t on Thursday, down £1.50/t from the previous week.

December delivery into the North West for bread wheat was quoted at £200.50/t on Thursday.

December delivery of bread wheat into Northamptonshire was quoted at £189.00/t, down £1.50/t from the previous week. The biscuit wheat (Dec-25) delivered into Northamptonshire was quoted at £178.50/t on Thursday.

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

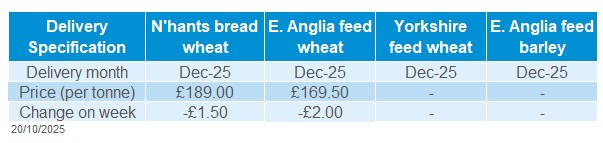

In £/t terms, Nov-25 Paris rapeseed futures traded below the 20-day moving average last week (10–17 October), closing near the £400/t support level.

The relative strength index (RSI) fell from 47 to 39, signalling weaker market momentum. This points to a bearish outlook unless fresh demand or market support emerges.

Find out more about the graphs in this report and how to use them.

Market drivers

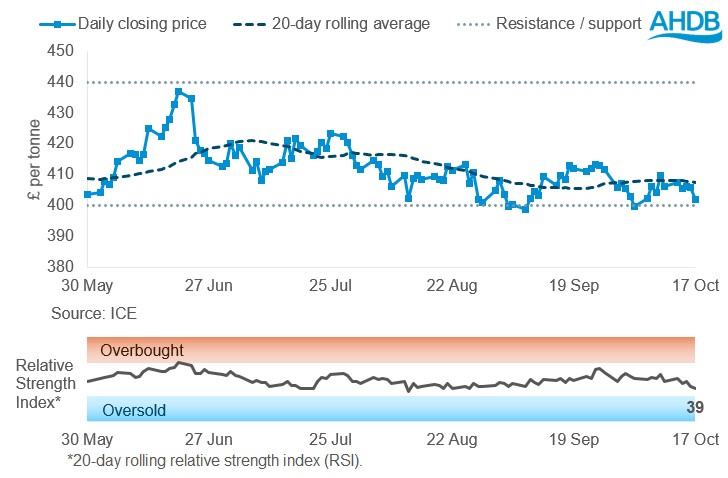

Rapeseed prices eased last week (Friday–Friday), with Nov-25 Paris rapeseed futures down €4.25/t to €462.25/t. The decline was mainly driven by the completion of Canada’s canola harvest, pressure in brent crude oil, and nearing the start of Australia’s canola harvest, where production is optimistic and this is weighing on the market.

In contrast, Chicago soya bean futures (Nov-25) rose by 1.3%, supported by stronger-than-expected US soya bean September crush figures from the National Oilseed Processors Association (NOPA). Market sentiment also improved after President Trump announced plans to meet China’s president later this month, boosting hopes for better US-China trade relations.

China maintained strong soya bean imports, mainly sourcing from South America due to ongoing trade tensions with the US. In September 2025, imports reached 12.87 Mt, up 4.8% from August and 13.2% higher year-on-year. Between January and September 2025, total imports stood at 86.19 Mt, compared to 81.85 Mt during the same period in 2024 (China customs data – LSEG).

In the EU, soya bean imports between 1 July and 12 October reached 3.41 Mt, slightly down from 3.68 Mt last year. Rapeseed imports fell sharply, down 53% to 1.09 Mt, reflecting the highest EU rapeseed crop since 2014 of 19.9 Mt (EU Commission).

Looking ahead Brazilian soya bean plantings will start to become a critical market sentiment driver. Brazilian soya beans plantings are estimated at 24% complete (as of 16 Oct), up from 14% reported a week earlier (AgRural). Further to that, Brazil’s crop agency Conab expects a record soya bean harvest of 177.64 Mt in 2025/26, up from 171.50 Mt last year. The rise in production is driven by a 3.6% increase in planted area.

In Australia, the Grain Industry Association of Western Australia (GIWA) has raised its canola forecast to 3.8 Mt, up from 3.3 Mt previously, with Western Australia remaining the country’s leading export region. By comparison, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) projected 3.3 Mt for Western Australia in September, production increases could be expected by ABARES in December.

UK delivered rapeseed prices

Delivered rapeseed prices fell with Paris rapeseed futures last week. November delivery into Erith was quoted at £415.00/t on Friday, down £2.00/t on the week. In East Anglia, November delivery was £414.00/t, also £2.00/t lower week-on-week.

Although it’s worth noting that these prices are based on surveys typically conducted mid to late Friday morning. As a result, they may not always reflect movements seen in Paris futures by the close of trading.

Extra information

AHDB has provided an initial insight into the UK’s 2025 crop production, using provisional data from Defra (England) and the Scottish Government. Figures for Wales and Northern Ireland are assumed to match last year’s levels until official data is released in December. The provisional estimates suggest higher wheat and oilseed rape (OSR) production compared to the previous season, while barley production is expected to be lower due to reduced spring barley area and yields. Read the full details and analysis here..

UK trade data for August 2025, released last Thursday (16 October), shows cereal and oilseed imports and exports by country. Cumulative wheat and maize imports for July and August were down 26% and 49% respectively compared to the same period in 2024/25.

AHDB will release its first estimates of wheat and barley UK supply and demand for the 2025/26 season later this week. See estimates for past seasons here.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.