Arable Market Report 18 July 2022

Monday, 18 July 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

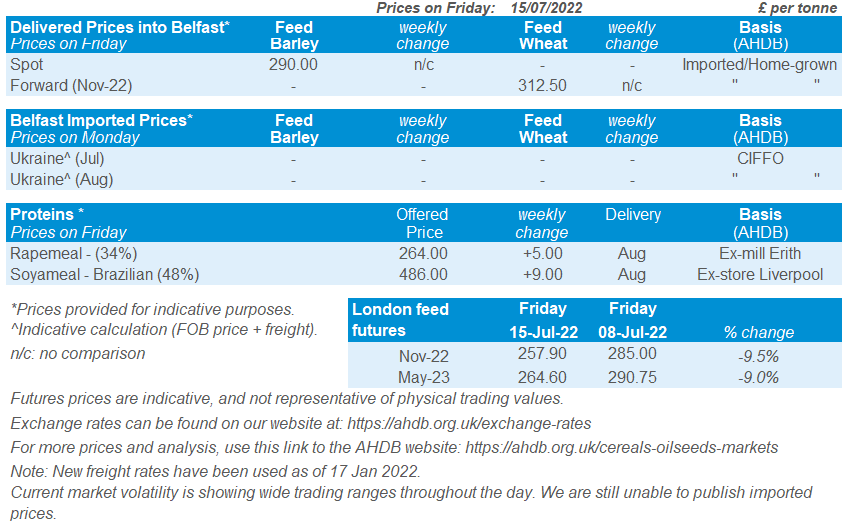

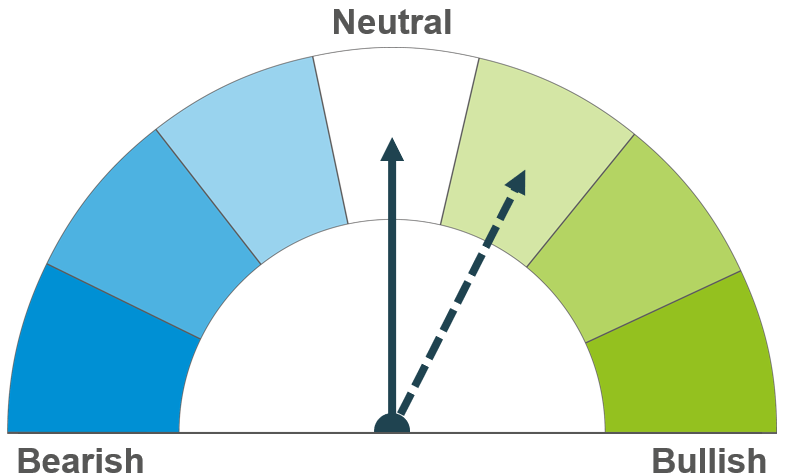

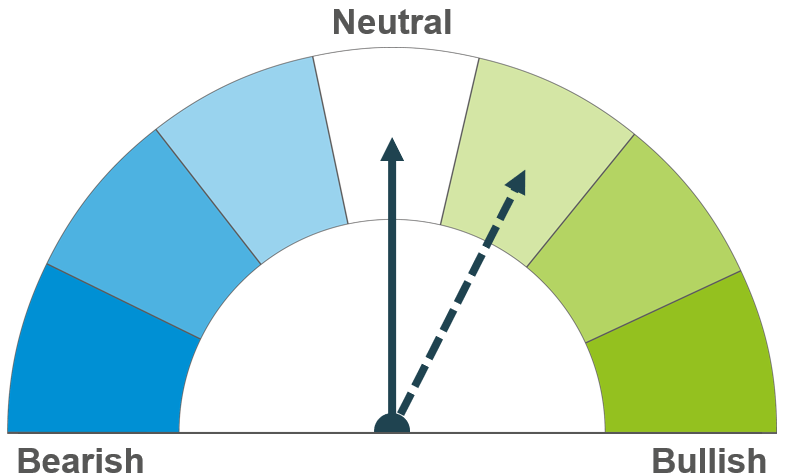

Grains

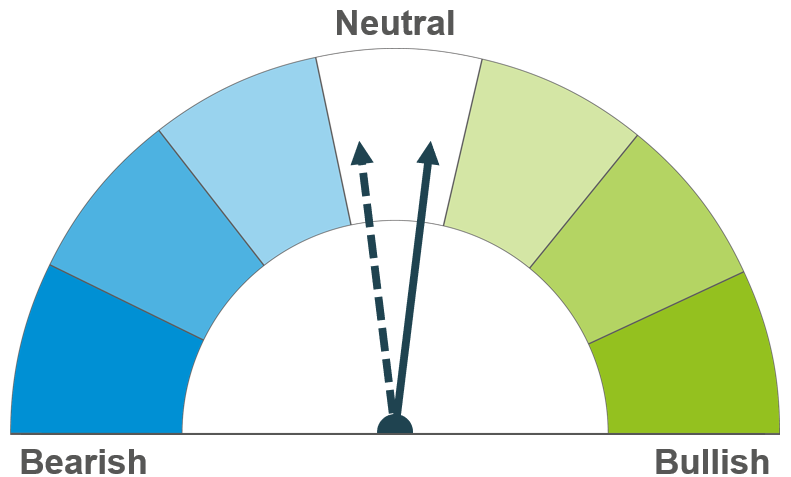

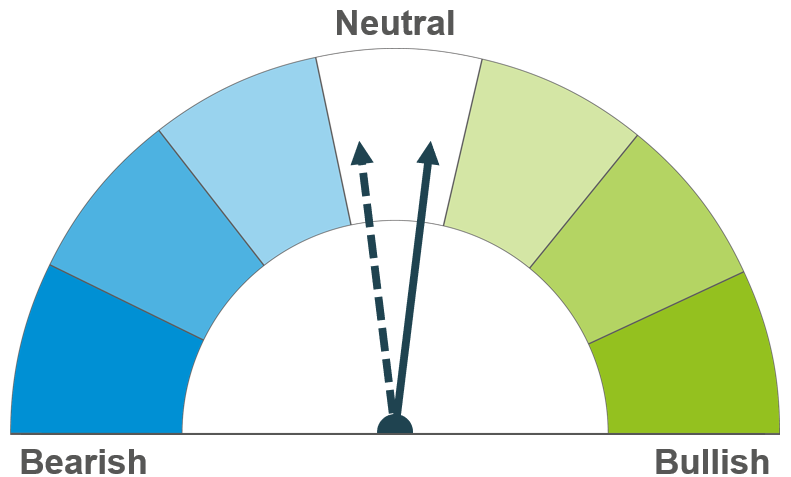

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

The short-term wheat outlook is neutral, as the prospect of returning Ukrainian supply is offset by yield and quality concerns in key producer regions, amid hotter and drier weather conditions. Those supply uncertainties are expected to lend long-term support amid strong global demand.

Despite a neutral short-term outlook prompted by upward revisions to global output and ending stocks last week, the long-term outlook is mildly bullish on concerns that hot weather conditions in the EU and US Midwest could hamper crop development prospects.

The global and domestic balance remains tight and is expected to remain so into next season. Prices are expected to continue to follow the sentiment in the wider international grain markets.

Global grain markets

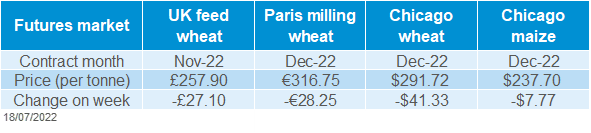

Global grain futures

Global wheat markets continued to slide sharply across the past week. Dec-22 Chicago futures ended the week at $291.72/t, down by $41.33/t Friday-Friday, to reach their lowest level since mid-February.

The downturn was led by rising optimism that Ukrainian grains shipments could soon return to the global supply chain, following advanced UN-brokered talks to end the blockade during the past week. Although the outcome is not yet certain, an announcement by Russia is expected this week (Refinitiv).

However, notwithstanding a deal being reached on Ukraine’s grain shipments, availability may still be hampered by deteriorating wheat yields. Latest Ministry of Agriculture data show that new-crop wheat yields so far are averaging around 2.88t/ha (Refinitiv), which is down from 4.53t/ha from a year earlier. This is as Ukrainian farmers have struggled with importing fertilizer inputs and other materials because of the prolonged seaport blockade and because of unfavourably hotter and drier weather conditions hampering crop development.

Drought conditions in Argentina are also weighing on wheat crop prospects, which could see thinner supplies from the region. The Rosario Grain Exchange last week cut its output projection to 17.7Mt. This is down from the 18.5Mt it projected last month and down from the 19.5Mt projected in the USDA’s latest WASDE report last week.

Meanwhile the heatwave in Europe has prompted French farmers to accelerate the wheat harvest during the week ending 11 July. Latest data from FranceAgriMer shows that around 50% of the soft wheat crop has now been harvested, compared with just 14% a week earlier.

European markets tracked lower in response to the faster harvest and wider optimism about returning Ukrainian grain shipments. Paris milling wheat futures (Dec-22) ended the week at €316.75/t, down by €28.25/t on the week.

Looking forward, maize crop development will be a key concern among EU as well as US producers amid the current hot and dry weather conditions in both regions. Temperatures across the US corn belt are forecast abnormally high for the next 7 days, with only scattered rainfall expected. US and EU maize crop is currently in pollination phase, so cooler and wetter conditions would be more optimal.

UK focus

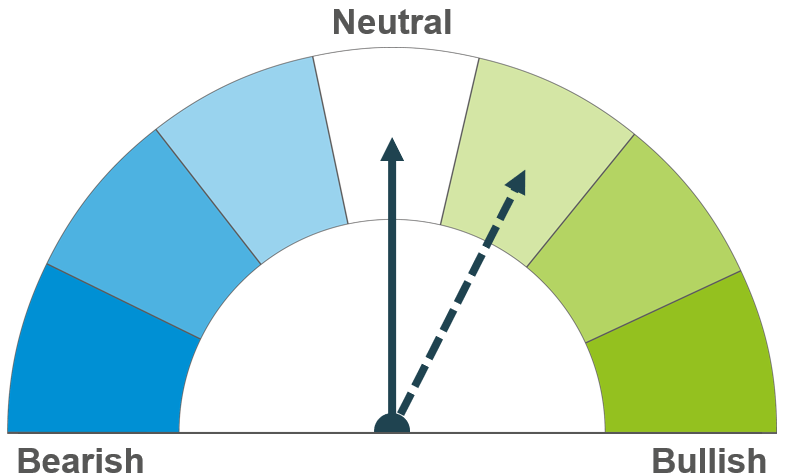

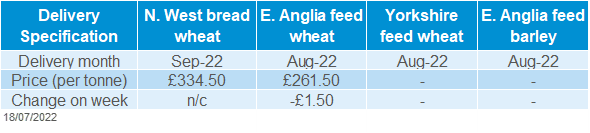

Delivered cereals

Domestic markets extended their losses during the past week, prompted by harvest pressure as well as movements in the wider global markets.

UK feed wheat futures (Nov-22) closed at £257.90/t. This was down by £27.10/t Friday-Friday and the contracts lowest close since 29 March.

Delivered feed wheat prices (into East Anglia, Hvst-22) were quoted at £261/t on Thursday, down by £1.50/t on the previous week. This is despite UK (Nov-22) feed wheat futures gaining £1.25/t over the same period (Thurs-Thurs). Harvest prices can sometimes feel the pressure slightly as combines start to roll.

Our latest UK crop development report shows that crop senescence has started early this year because of the continued hot and dry weather conditions this month, which could result in lower than expected yields.

Oilseeds

Rapeseed

Soyabeans

Rapeseed prices have tracked the wider oilseed complex lower recently. Looking ahead, Canadian weather prospects look more optimistic than last year, with Canada expecting a sizeable production increase year-on-year, meaning that rapeseed sentiment will follow soyabeans closer.

Soyabeans have tracked lower in the short term. US weather is currently in focus as the crop develops into critical yield phases in the coming weeks. Long term, Brazilian production is currently forecast to reach a record high, which could weigh on the market.

Global oilseed markets

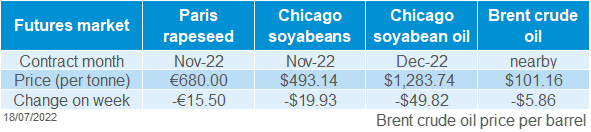

Global oilseed futures

Chicago soyabeans futures (Nov-22) were pressured across the week, closing down 3.9% at $493.14/t. Commodity funds were net-sellers of Chicago soyabean futures over the week.

With the potential for exports resuming out of Ukraine, agricultural commodities were pressured across the week, which filtered into the oilseed complex.

Unusually hot weather across the US Midwest has not offered support to soyabean prices as currently a large majority of the crop isn’t yet in the critical development stage (setting pods).

Furthermore, soyabean processors in the US crushed 4.5Mt of soyabeans during June, down from 4.7Mt in May. This was more than expected, but the smallest in nine months (National Oilseed Processors Association).

In other news, Indonesia has stopped its export levy on all palm products until 31 August. This is in an attempt to boost exports and work down domestic inventories. This could further pressurise the palm oil market. Malaysian palm oil futures (Oct-22) were down 13.7% over the last week.

However, from 1 September a progressive palm oil export levy system will be back in place to stabilise cooking oil prices and fund the Indonesia bio-diesel programme. The levy will depend on prices at the time, but will range between $55/t to $240/t.

Russia has announced that it will increase its quota for sun oil and meal exports to 1.9Mt and 850Kt, respectively/ This is an increase of 400Kt and 150Kt respectively, with the Russian government citing sufficient domestic supplies have allowed them to increase their exports.

SAFRAS & Mercado now estimate Brazilian soyabean area at 42.88Mha, up 2.6% year-on-year, with the production estimate at 151.56Mt, up 20.3% on the year, from likely improved yields. This exceeds the USDA current estimate of 149Mt.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) closed Friday at €680/t, down €15.50/t across the week. This broadly followed the pressure in the soya oil and crude oil markets, as nearby Brent crude oil closed Friday at $101.16/ barrel, down 5.5% across the week.

Warm favourable weather in the Canadian prairies at the moment is set to advance crop development and there aren’t any significant weather concerns at the moment but it is slightly hotter than seasonal averages in parts of the Prairies over the next week.

Last Friday we were unable to publish delivered oilseed prices due to insufficient quotes to calculate the published average.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.