Arable Market Report − 16 October 2023

Monday, 16 October 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

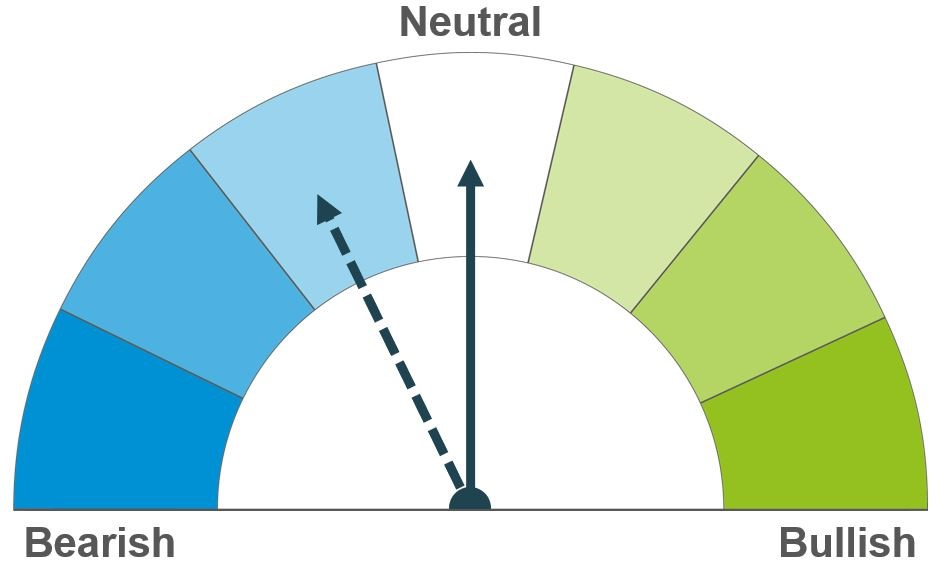

Wheat

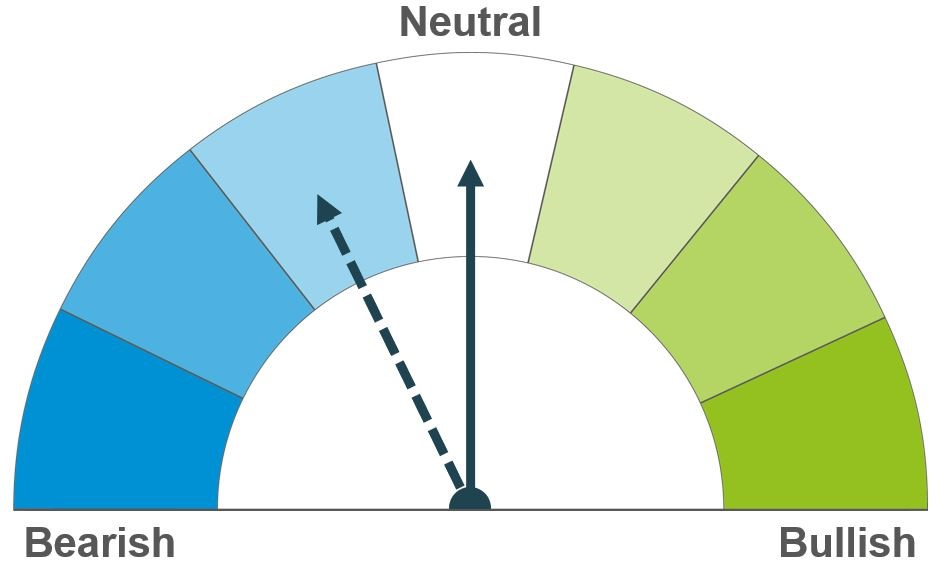

Maize

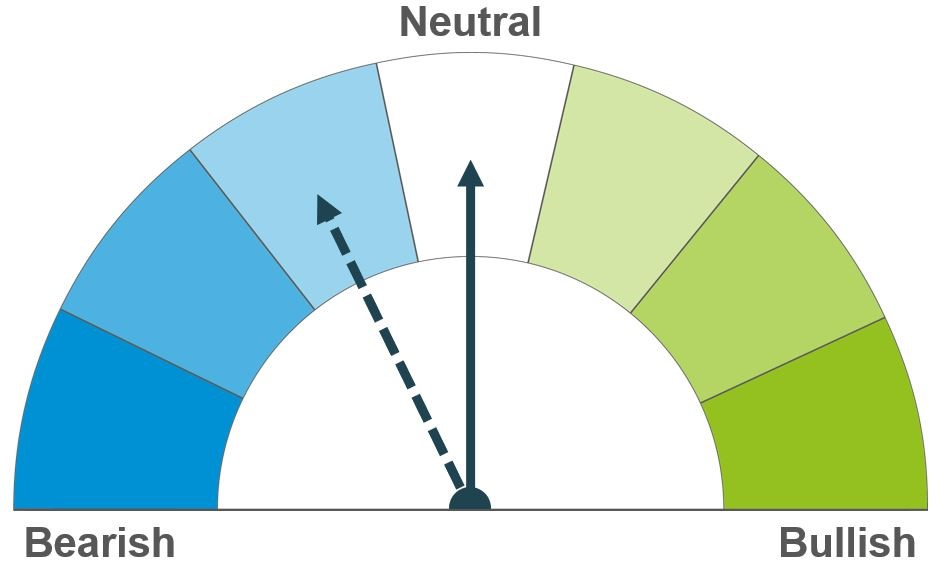

Barley

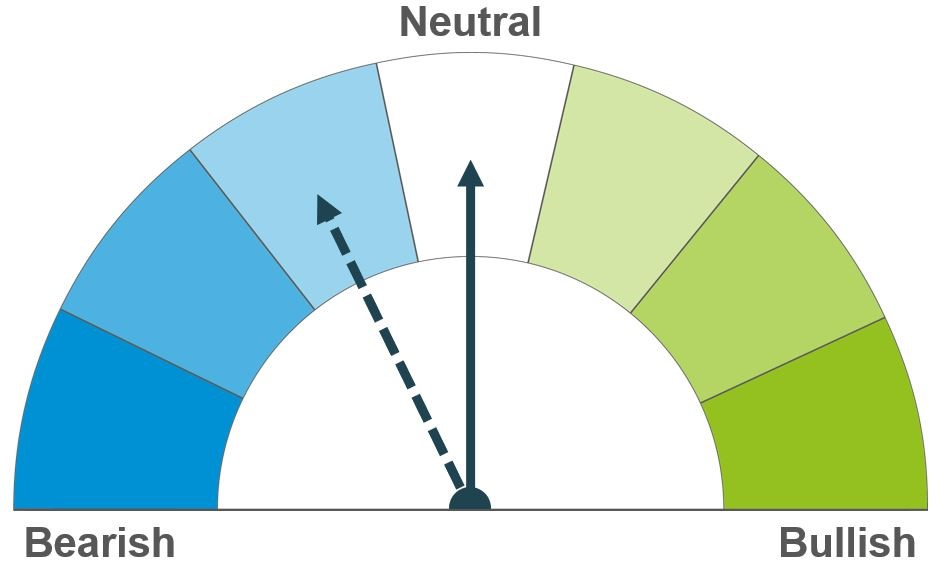

Southern Hemisphere crops remain in focus, considering dry weather trimming the global supply outlook, a watchpoint for longer term price direction. Competitive Black Sea supplies continue to cap gains and are still expected to fulfil global demand.

A key watchpoint will be South American crop sizes going forward, with weather developments supporting markets. Ample global maize supplies are still expected long term currently, despite a trim to the US crop last week.

Like other grains, dry weather especially in Australia remains in focus for global barley supply. Barley continues to follow the same influences as wider global grain markets and, as such, large, anticipated maize supplies will be important longer term for feed grains.

Global grain markets

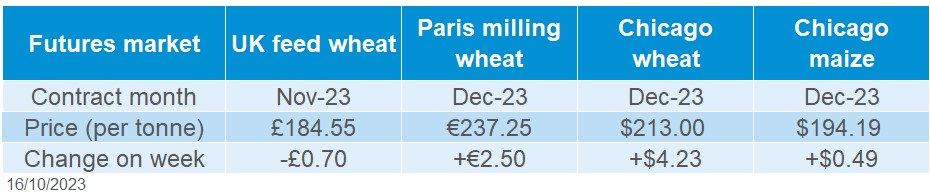

Global grain futures

Global grain prices for Chicago and Paris contracts (Dec-23) felt some support overall last week, buoyed by concerns over Southern Hemisphere maize and wheat crops, as well as the development of the ongoing Israel/Gaza war impacting energy markets. Though availability and competitiveness of Black Sea supply continues to cap large gains in wheat markets.

Last week, the latest World Agricultural Supply and Demand Estimates (WASDE) were released. The global wheat crop was trimmed slightly for this season on account of smaller crops for Australia, Kazakhstan and Ethiopia, and global ending stock forecasts tightened a little further. For maize, the USDA trimmed the US maize crop for this season. Though this reduction was offset by larger crops anticipated in Argentina and France.

Southern Hemisphere crops remain in focus. Despite some rain falling, dry weather continues to present a watchpoint for Australian grain crops considering September was the driest on record (since 1900). In September, Australian grain prices saw some gains from the dry weather and with the removal of Chinese tariffs for Chinese imports (boosting barley prices). As harvest looks to begin, the outlook looks to remain dry in the upcoming months - watch out for any yield information emerging in the coming months.

In Argentina, dry weather is also in focus for wheat crops and maize planting. According to the Buenos Aries Grain Exchange (BAGE) rainfall across key areas will be a clear watchpoint to help planting meet planned acreage. This week, some rain is due across areas of Northern Argentina, though this remains below average for many areas.

Despite this supporting news, Black Sea availability remains in the background of wheat markets capping gains. Again, Egypt bought Black Sea wheat in its latest tender, with the state buying agency GASC, purchasing 470 Kt of wheat last week. This included 300 Kt of Russian, 120 Kt of Romanian and 50 Kt of Bulgarian wheat (Refinitiv).

UK focus

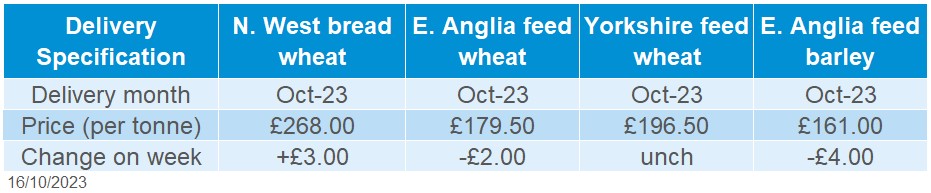

Delivered cereals

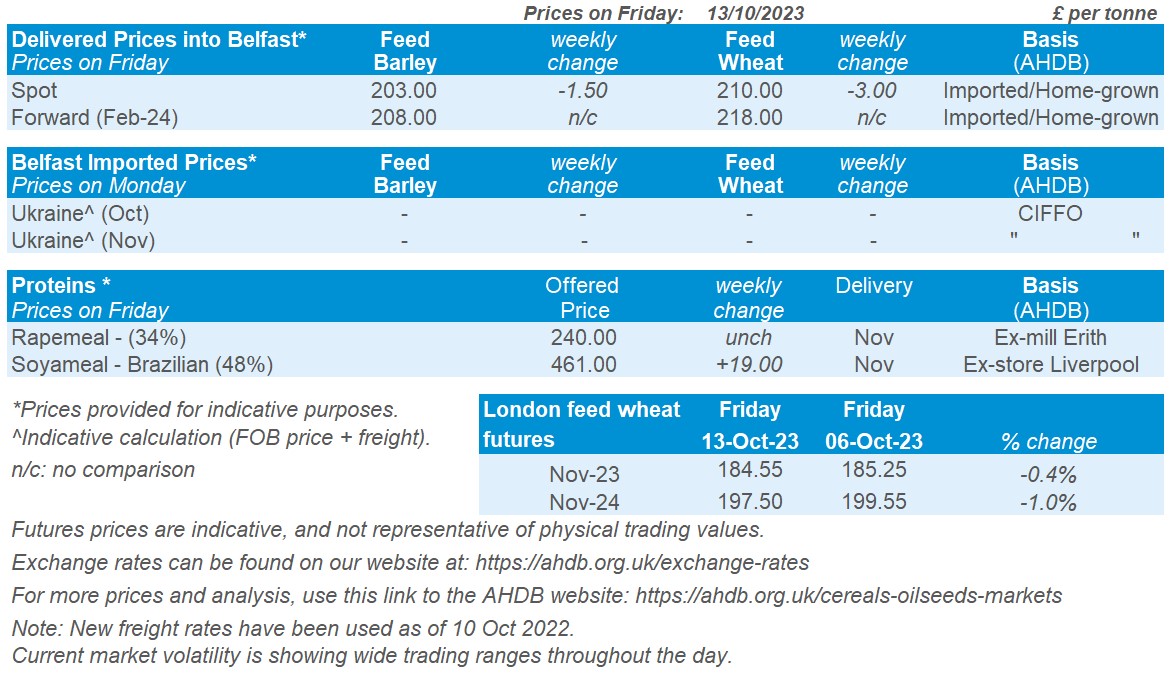

UK feed wheat futures (Nov-23) saw a slight fall last week overall, despite some overall strength for global markets. The Nov-23 contract closed on Friday at £184.55/t, down £0.70/t over the week. Nov-24 futures closed on Friday at £197.50/t, down £2.05/t over the same period. UK futures saw a little rise on Friday, though Thursday saw more muted gains for UK futures compared to US markets, with the USDA report released near the end of the day's session.

UK delivered prices followed futures movements last week (Thursday to Thursday). Feed wheat delivered into East Anglia (October delivery) was quoted on Thursday at £179.50/t, down £2.00/t from the week before.

Bread prices continue to hold firm, rising on the week. On Thursday, bread wheat delivered into the North West (October delivery) was quoted at £268.00/t, up £3.00/t over the week.

Feed barley delivered into East Anglia (October delivery) was quoted on Thursday at £161.00/t. A discount to wheat for same delivery month and destination of £18.50/t.

Last week saw the release of Defra and Scottish government provisional data crop areas, yields and production for 2023. Using this data, UK production for wheat, total barley and oats are estimated at 14.1 Mt, 7.0 Mt and 841 Kt respectively.

Last week saw the release of the latest GB fertiliser prices. Imported AN (34.5%) was quoted for September at £362/t, unchanged from August.

Oilseeds

Rapeseed

Soyabeans

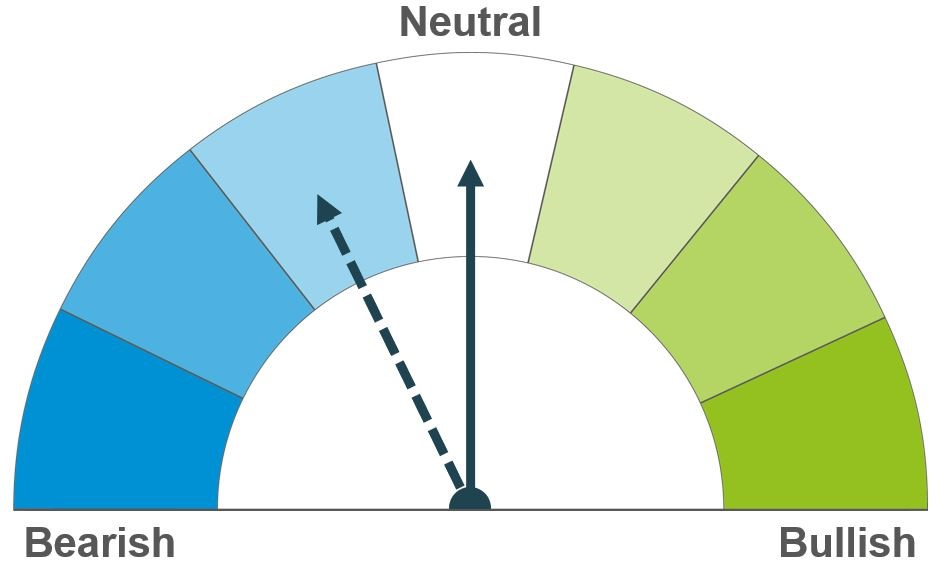

Short-term support in crude oil markets could outweigh the well supplied rapeseed market. Longer-term, rapeseed will be pressured with an expected larger soyabean supply.

Short-term focus is on the US soyabean harvest. Large soyabean areas in South America for 2023/24 combined with no major weather event yet will likely cause pressure on the market longer-term.

Global oilseed markets

Global oilseed futures

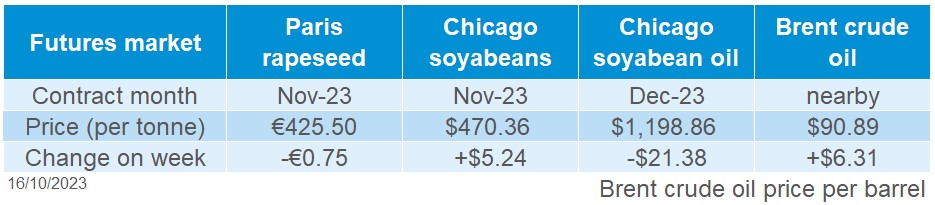

Oilseed markets were mixed last week with an array of both bullish and bearish news. However, Chicago soyabean futures (Nov-23) gained overall across the week by 1% to close Friday at $470.36/t.

At the start of the week, the market felt support from the latest USDA crop progress report, which marginally revised down US soyabean crop conditions. To 8 October, 51% of the crop is now rated good-to-excellent, down 1 percentage point from the week before. In the report, the US soyabean harvest is now estimated at 43% complete – this is up on the 5-year average of 37%. A further update will be released this evening.

Other support came to the market after the latest USDA World Agricultural Supply and Demand Estimates (WASDE) were released. The report cut US soyabean production by 1.1 Mt, with the crop now estimated at 111.7 Mt, which triggered a price rise in Chicago soyabean markets.

Further bullish news feeding into both the oilseed and vegetable oil complex is the conflict in the Middle East; the military clash between Israel and Hamas is deepening political uncertainty and supporting crude oil markets, which is adding some short-term support. Nearby Brent crude oil futures closed Friday at $90.89/barrel, gaining 7.5% across the week.

However, oilseed markets have been kept in check as bearish news from South America continues to dictate longer-term sentiment. Argentina’s Rosario Stock Exchange upped their soyabean production estimate by 2 Mt for 2023/24; Argentina is now expected to produce 50 Mt of soyabeans.

Furthermore, Brazilian government agency Conab estimated the Brazilian soyabean crop at 162 Mt, up 4.8% on last year. This would be a record crop for Brazil, which will come to market in 2024. Plantings have commenced for this crop and, according to Patria Agronegocios, 17.4% of the crop is estimated to have been sown – this is down from last year (22.6%), but remains above the 5-year average (16.8%).

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) were pressured at the start of the week with Malaysian palm oil, but managed to recover near what was lost at the end of the week from the rallying support in crude oil markets. The contract closed at €425.50/t on Friday, down €0.75/t on the week.

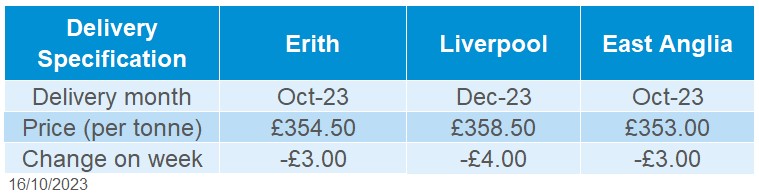

Domestic delivered rapeseed (into Erith, Oct-23) was quoted at £354.50/t on Friday, down £3.00/t across the week.

Defra and the Scottish government released provisional data crop areas, yields and production last Wednesday. Using this data, UK oilseed rape (OSR) production is estimated at 1.2 Mt for 2023, down by 154 Kt from 2022. Despite an increase in area, OSR production is lower on poor yields nationally. There has been huge variation, with yields averaging as low as 2.6 t/ha in the Eastern region of England but as high as 4.0 t/ha in Scotland.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.