Arable Market Report - 16 January 2023

Monday, 16 January 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

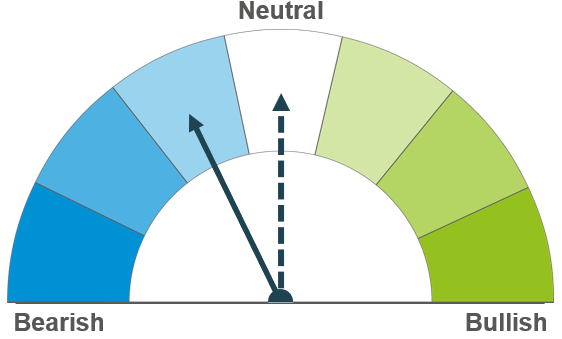

Wheat

Maize

Barley

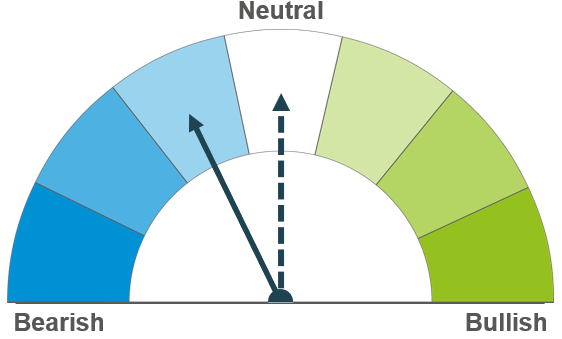

Competitive Black Sea supplies and global recessionary concerns continue to pressure European grain prices in the short term. Chinese demand and the future of the grain corridor deal will be something to watch long term.

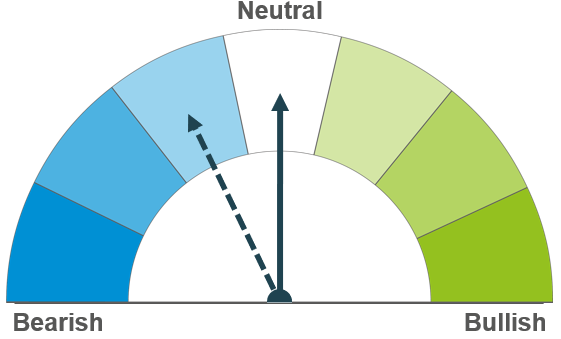

Continental prices continue to track wheat markets. Argentinian weather and tightening global supply and demand remain bullish factors, though a large Brazilian crop could cap any gains.

Barley markets continue to track the wider grain complex.

Global grain markets

Global grain futures

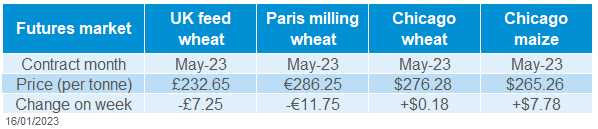

European grain markets continued to feel pressure from competitive Black Sea exports and global recessionary concerns last week. Paris milling wheat (May-23) was down 3.9% over the week (Friday-Friday), closing at €286.25/t on Friday. On the other hand, US grain markets felt some support at the end of the week following some unexpected revisions in the USDA reports released on Thursday.

Despite increases in insurance costs for Russian ships in the new year, Russia was successful in two major purchase tenders from Turkey and Egypt last week, and the country’s grain remains competitive on the global market. Rosstat (Russia’s state statistics body) also announced this morning that Russia’s 2022 wheat crop is estimated to have reached 104.43Mt (Refinitiv), much higher than the USDA’s unrevised figure of 91Mt in Thursday’s World Agricultural Supply and Demand Estimates (WASDE). The International Grain’s Council pegged Russian wheat production at 95.4Mt in a report on Thursday, leaving continued speculation over the size and export potential of the crop. With the extended grain corridor deal due to expire in March, markets will remain reactive to news on the deal.

Chinese demand will remain a watchpoint over the coming weeks. China reported almost 60,000 COVID related deaths since early December, following a surge in infections after the relaxation of lockdown rules. However, there are reports that cases have reached their peak and are beginning to decline. The uncertainty in the country leaves a question mark over Chinese demand for global grains. In Thursday’s WASDE no revisions were made to China’s wheat and maize import figures, though a slight reduction was estimated in coarse grains.

While continental grain prices were under pressure last week, US maize markets were supported. Chicago maize futures (May-23) gained 3.0% across the week, closing at $265.26/t on Friday. Chicago wheat futures (May-23) also stayed supported, up 0.1% over the same period. On Thursday, the USDA released three key reports, the latest WASDE, US quarterly grain stocks as at 01 December, and the area planted to winter wheat for harvest 2023. The main surprise from the reports were cuts to the US 2022 production of maize and soyabean crops, down 5.09Mt and 1.89Mt from last month respectively. US quarterly stocks of maize, soyabeans and wheat were all lower than analysts had anticipated too, providing a bullish sentiment for the US market. As could be expected, due to drought conditions, Argentinian maize production was cut 3Mt from last month, now pegged at 52Mt, in line with analysts’ predictions. For more information, see Friday’s Grain Market Daily.

UK focus

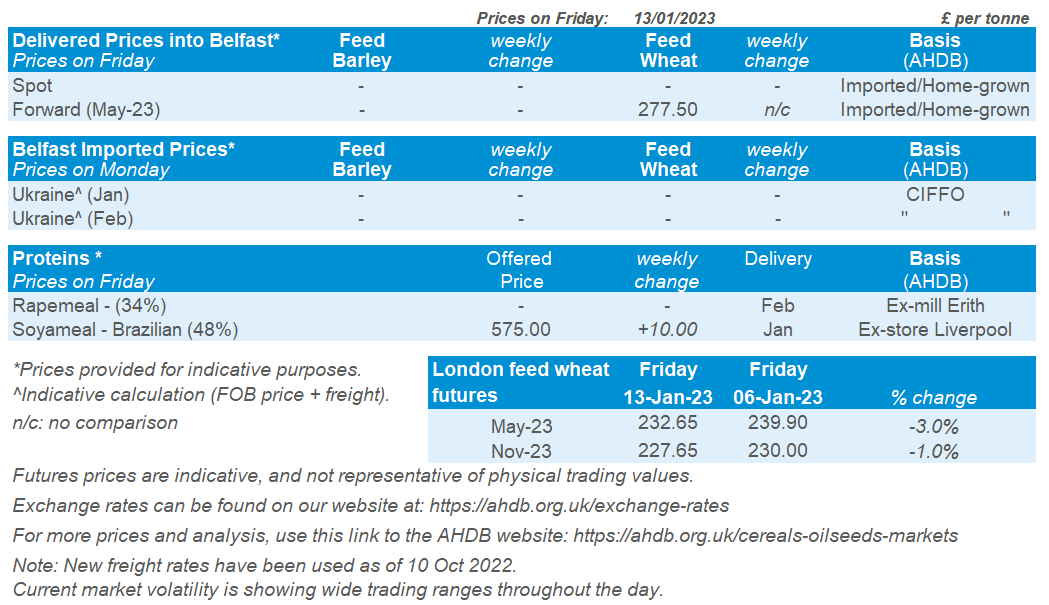

Delivered cereals

Domestic grain prices tracked continental markets last week. UK feed wheat (May-23) fell 3% across last week (Friday-Friday), closing at £232.65/t on Friday. New crop futures (Nov-23) fell 1% over the same period, closing at £227.65/t on Friday.

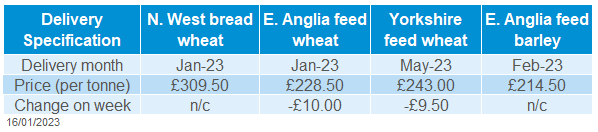

Delivered feed wheat into East Anglia (Jan delivery) was quoted at £228.50/t on Thursday, down £10.00/t on the week. Bread wheat for delivery into the North West for January, was quoted at £309.50/t.

AHDB published the latest cereal usage data last week. GB animal feed production hit a 6-year low from July to November, and was down 5% on year earlier levels, at 5.41Mt (including integrated poultry units). With a reduction in animal feed production comes a fall in cereal usage. For the July-November period, wheat usage in total feed production fell 3%, while barley usage was down 27% on the year.

UK human and industrial usage data was also released last week. Total wheat milled from July-November was down 0.7% on the year. However, barley and wheat usage by brewers, maltsters and distillers was up 5.8% and 13.7% respectively. Find the full set of results here.

Oilseeds

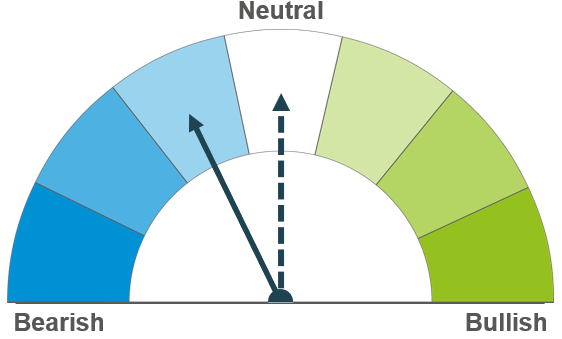

Rapeseed

Soyabeans

Short term, support may filter into rapeseed from Malaysian palm oil, as well as wider support for soyabeans. Though the Australian crop is now coming to market, which may cap gains. Longer-term, a large European rapeseed crop is due.

Argentina remains a key watchpoint for price direction, especially with a tightening global supply. However, the Brazilian crop is forecasted substantial, and global demand concerns remain considering recessionary behaviour and Chinese COVID-19 cases.

Global oilseed markets

Global oilseed futures

Global vegetable oil and oilseed markets saw two different movements across the week, with soyabean’s supported and palm oil pressured. Firstly, Chicago soyabean futures (May-23) felt overall support, up 2% Friday to Friday. This was down to trims to forecasted Argentinian soyabean production and a tightening world supply. Looking ahead, many regions are due to receive some rain across Argentina in the next 7 days, which will be critical to planted soyabeans.

Argentina has been struggling with dry conditions for several months, which has been delaying planting progress and supporting markets. Last week we got further insight the impacts of this drought. The Rosario Grain Exchange cut their Argentinian soyabean production forecast for 2022/23 by 12Mt to 37Mt, due to the ongoing drought. The Buenos Aires Grain Exchange also cut their production forecast for this season, down 7Mt to 41Mt. The IGC pegged their latest Argentinian production estimate at 44Mt.

The USDA, in their latest World Supply and Demand Estimates (WASDE), also trimmed their forecast for Argentinian soyabean production. Though the trim was 4Mt, to 45.5Mt in their January estimates released on Thursday – and therefore, this estimate remains higher than both the Rosario Grain Exchange and Buenos Aires Grain Exchange. Could it go lower?

The latest USDA WASDE made reductions to global production, crush, and trade numbers, leading to a small boost in ending stocks. The reduction in global production was mostly down to the smaller Argentinian crop, though the US crop also saw a cut. However, these cuts were partially offset by higher production in Brazil and China. To find out more about the WASDE and lower than anticipated US stocks at the end of December 2022, follow this link.

Whereas Malaysian palm oil futures (Apr-23) lost 5% Friday to Friday, on demand concerns. On Thursday, the Malaysian government said they could stop exporting palm oil to the European Union (a major palm oil importer). This is in response to a new EU law which aims to protect forests by regulating product sales. Weak January export sales of Malaysian palm oil products also pressured prices. Exports from 1-15 Jan were down 36% from the same period in December, according to independent inspection company AmSpec Agri Malaysia.

However, this week palm oil could see some strength. News has emerged that Indonesia is introducing a B35 mandate from 1 Feb. Therefore, diesel must contain 35% palm-based fatty acid methyl ester, up from the previous 30%. Restrictions on Indonesian exports too have been tightened from 1 Jan, to ensure domestic supply of cooking oil. Exporters will be allowed to export six times their domestic volume sales, instead of the previous eight times (Refinitiv).

Rapeseed focus

UK delivered oilseed prices

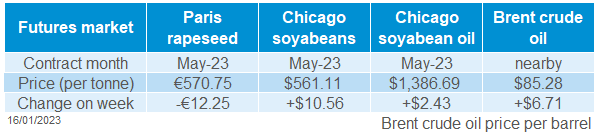

Rapeseed markets followed Malaysian palm oil down last week. On Friday, Paris rapeseed futures (May-23) closed Friday at €570.75/t, down €12.25/t across the week.

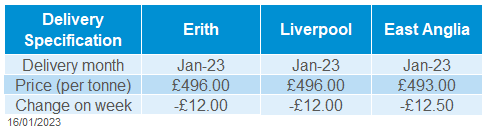

Delivered rapeseed into Erith (Jan-23) was quoted at £496.00/t on Friday, down £12.00/t from the previous week. For harvest the price was quoted at £503.00/t for the same location.

Brent crude oil (nearby) found a little support last week, up $6.71/ barrel to close at $85.28/ barrel on expectations of Chinese demand recovery on easing restrictions. However, COVID-19 case numbers will be important to watch for demand across wider oilseed markets.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.