Arable Market Report – 16 February 2026

Monday, 16 February 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (May-26)

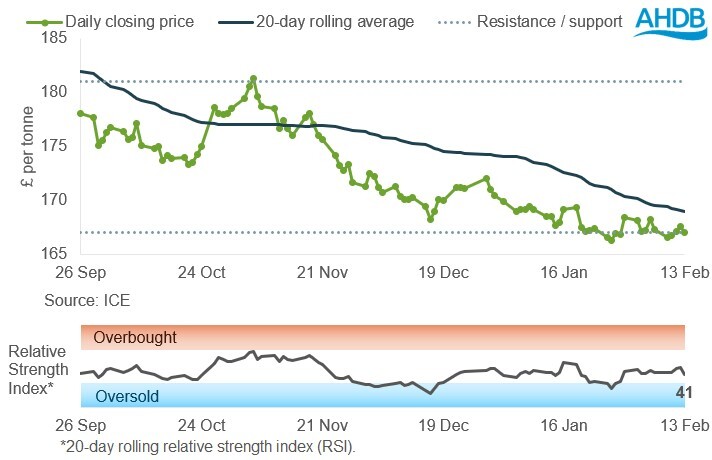

Figure 1. UK feed wheat futures prices, May-26 contract

May-26 UK feed wheat futures ended Friday at £167.00/t, down £0.30/t from 6 February after limited price changes through the week.

The prices (solid green line with markers in Figure 1) continued to hold around the recent support line at £167/t.

The relative strength index (RSI) was also broadly unchanged over the week, moving from 42 to 41 between 6 and 13 February. This indicates limited market momentum.

Find out more about the graphs in this report and how to use them

Market drivers

European wheat futures again recorded small changes Friday–Friday, amid high global supplies and ongoing export challenges. Some signs of higher demand for maize helped prevent losses, while re-positioning by speculative traders boosted US prices.

May-26 Paris milling wheat futures gained 0.5% over the week, while May-26 Chicago maize futures gained 0.7%, with wheat up 1.8%.

Global wheat prices fell ahead of Tuesday night’s World Agricultural Supply and Demand Estimates from the USDA. The USDA reduced its forecasts for global wheat and maize stocks by 0.7 Mt and 1.9 Mt, respectively. While the cuts were more than the market had expected, stocks are still forecast much higher than last season.

Reflecting ongoing intense competition for global exports, Expana cut its forecast for EU-27 soft wheat exports this season by 1.2 Mt to 27.6 Mt. The resulting higher end-of-season stocks more than offset a 0.3 Mt reduction to its 2026 EU crop forecast to 128.3 Mt because of recent cold weather, which could boost 2026/27 supplies.

There was also optimism for some 2026 crops.

IKAR added 3.0 Mt to its forecast of the Russian wheat crop, now at 91.0 Mt versus 88.5 Mt in 2025. FranceAgriMer also reported French soft winter wheat crops to be in the best condition since 2023, and spring barley planting ahead of average at 30% complete. This week’s USDA Agricultural Outlook Forum (19–20 Feb) may provide insights into US crop potential.

Prices found some support later in the week from signs of higher global demand. US net export sales of maize in the week ending 5 February were 2.13 Mt, exceeding expectations of 0.6–1.5 Mt. Reuters also reported that poorer maize crop quality in China is prompting higher imports of barley and sorghum.

South American maize remains a watch point. The rain forecast for Argentina would be very welcome for its later-planted maize crops, which are in reproductive stages. Meanwhile, Conab reduced its forecast of Brazil’s second maize crop by 1.2 Mt to 109.26 Mt due to a lower planted area. The crop is now forecast 3.5% below 2024/25.

Planting has been progressing well but depends on soyabean harvest progress.

Table 1. Global grain futures prices

| Futures market | UK feed wheat | Paris milling wheat | Chicago wheat | Chicago maize |

|---|---|---|---|---|

| Contract month | May-26 | May-26 | May-26 | May-26 |

| Price (per tonne) | £167.00 | €191.50 | $201.52 | $174.02 |

| Change on week | -£0.30 | +€1.00 | +$3.49 | +$1.28 |

UK delivered cereal prices

The domestic market remained relatively quiet last week and delivered prices showed small changes week-on-week.

Feed wheat for Feb-26 delivery into East Anglia was reported at £168.50/t as at Thursday’s close, up £1.00/t from the previous week.

Bread wheat to be delivered in the North West in Feb-26 was £190.00/t, unchanged from the previous week.

Meanwhile, the Feb-26 price for Northamptonshire delivery was down £0.50/t to £178.50/t.

Table 2. UK delivered cereal prices

| Delivery specification | N. West bread wheat | E. Anglia feed wheat | Yorkshire feed wheat | E. Anglia feed barley |

|---|---|---|---|---|

| Delivery month | Feb-26 | Feb-26 | Feb-26 | Feb-26 |

| Price (per tonne) | £190.00 | £168.50 | – | – |

| Change on week | unch | +£1.00 | – | – |

Rapeseed

Paris rapeseed futures in £/t (May-26)

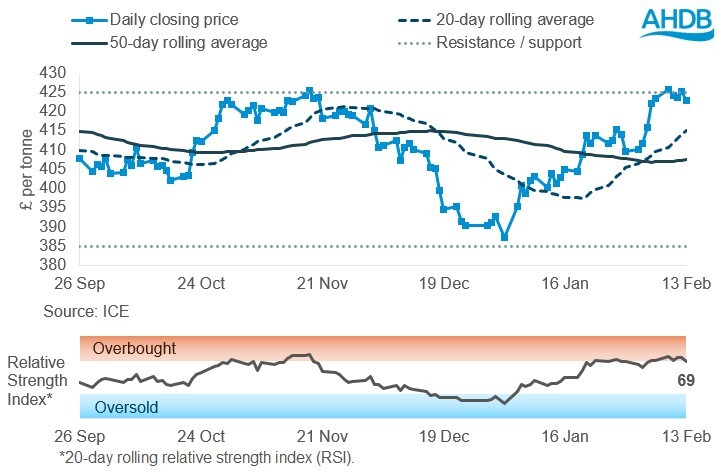

Figure 2. Paris rapeseed futures prices, May-26 contract, in £/tonne

May-26 Paris rapeseed futures in £/t, shown by the solid blue line with square markers in Figure 2, saw a slight fall to £422.94/t on Friday.

Weaker sterling against the euro over the week limited the fall in prices in £/t. Despite being tested during the week, the nearest resistance level remains at £425/t.

The relative strength index (RSI) remained on the edge of being overbought, moving from 70 to 69 Friday–Friday.

Find out more about the graphs in this report and how to use them

Market drivers

Paris rapeseed futures May-26 ended the week 0.5% lower at €485.25/t, while the Nov-26 contract fell 1.1% to €465.50/t. Meanwhile, Chicago soyabean futures and Winnipeg canola futures (May-26) increased by 1.8% and 0.6%, respectively.

Despite an increase in Chicago soyabean futures last week, old crop Paris rapeseed futures fell due to a technical correction and pressure from rapeseed oil prices.

New crop Paris rapeseed futures came under pressure due to higher estimates of the area dedicated to the winter crop in France than previous figures suggested.

Soyabean futures are still being supported by the news that China will purchase additional volumes from the US. There are also some concerns about the quality of the crop currently being harvested in Brazil due to rainfall in some regions. Plus, managed money funds are increasing their net long position in Chicago.

However, on Thursday, the USDA’s weekly export sales report showed, as of 5 February, net sales of soyabean at 282 Kt, which was below the lower end of trade estimates.

Although large soyabean crops are expected in South America as harvest is underway, weather is a key watch point, especially in some parts of Argentina. The Buenos Aires Grains Exchange continues to estimate Argentina’s soyabean crop at 48.5 Mt. Conab estimated Brazil’s soybean crop at 177.98 Mt, an increase of 1.86 Mt from the previous estimate. The latest USDA estimate is 180.0 Mt.

The consultancy firm Patria AgroNegocios reports that Brazilian farmers had harvested 22.3% of the soyabean area planted for the 2025/26 season by Friday. This surpasses the 16.8% harvested at the same time last year, but the pace has slowed recently due to heavy rains (LSEG).

The USDA World Agricultural Supply and Demand Estimates (WASDE) increased global soyabean ending stocks 2025/26 by 1.1 Mt to 125.5 Mt, mainly on higher production for Brazil. Another notable revision for the oilseeds complex is higher 2025/26 palm oil production for Malaysia, up 0.5 Mt to 20.2 Mt.

Following the recent strong rally in Chicago soyabean futures, the competitiveness of soyabeans against maize for planted area in 2026 has increased.

The USDA's annual Agriculture Outlook Forum (AOF) will be held on 19–20 February 2026. This forum traditionally provides the first insights into US spring crops. These figures could substantially impact the parity between the soyabean and maize prices.

Table 3. Global oilseed and oil futures prices

| Futures market | Paris rapeseed | Chicago soyabeans | Chicago soyabean oil | Brent crude oil* |

|---|---|---|---|---|

| Contract month | May-26 | May-26 | May-26 | nearby |

| Price (per tonne) | €485.25 | $421.96 | $1,266.98 | $67.75 |

| Change on week | -€2.50 | +$7.26 | +$35.93 | -$0.30 |

*Brent crude oil price per barrel

UK delivered rapeseed prices

Rapeseed to be delivered to Erith in February was reported at £444.00/t in Friday’s survey, up £5.00/t from the previous week.

The price for November delivery (the 2026 crop) gained £5.00/t to £422.00/t.

These values are based on a survey conducted mid to late Friday morning and may not fully capture movements in Paris futures by the close of trading.

Table 4. UK delivered rapeseed prices

| Delivery specification | Erith | Liverpool | East Anglia |

|---|---|---|---|

| Delivery month | Feb-26 | Feb-26 | Feb-26 |

| Price (per tonne) | £444.00 | £442.50 | £443.00 |

| Change on week | +£5.00 | +£4.00 | +£5.00 |

Extra information

The latest trade data from HMRC, published on Thursday, shows UK wheat (including durum) imports from July to December 2025 reached 1.30 Mt, down 23% on the same period in 2024. Maize imports fell 18% over the same period to 1.17 Mt, while barley exports declined 5% to 243.9 Kt.

July to December 2025 rapeseed imports reached 516.7 Kt, up 5% on the same period in 2024. Meanwhile, soyabean imports decreased by 14%, but soyabean meal imports increased by 11%.

Northern Ireland

Table 5. Delivered prices into Belfast*

| Delivery specification** | Feed barley - spot | Feed barley - forward | Feed wheat - spot | Feed wheat - forward |

|---|---|---|---|---|

| Delivery month | Spot | May-26 | Spot | May-26 |

| Price (per tonne) | £198.50 | £200.50 | £197.50 | £198.50 |

| Change on week | +£1.00 | unch | unch | -£1.00 |

*Prices provided for indicative purposes

**Basis is imported/home-grown

n/c: no comparison

unch: no change in price compared to last week

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.