Arable Market Report - 14 November 2022

Monday, 14 November 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

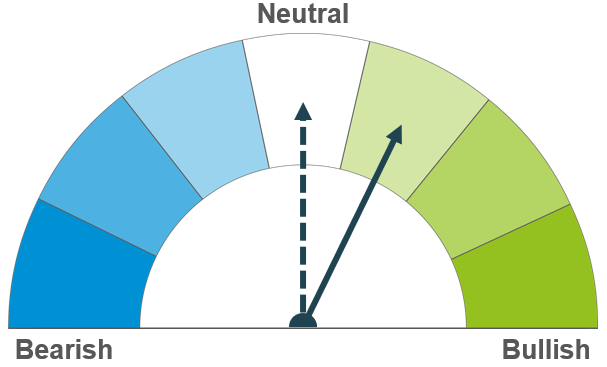

Wheat

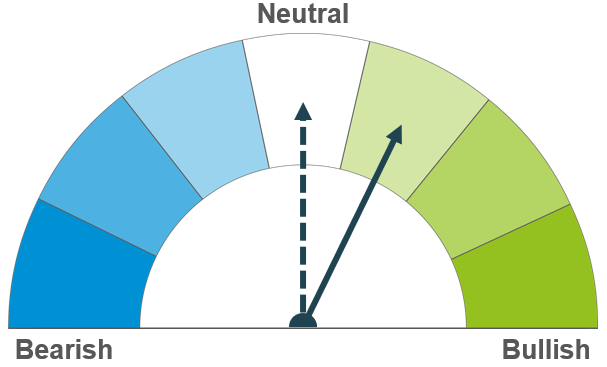

Maize

Barley

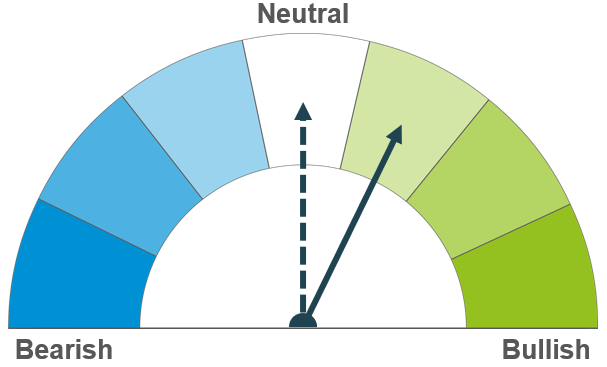

Renewal of the Ukrainian export deal will be key to price direction short and long term. Volatility is expected as the market awaits news this week. Longer term, Southern Hemisphere supply and recession impact on demand will be key.

A tight global supply and demand balance, supports maize markets short and longer term. Short term, the market remains reactive to news from Ukraine. Longer term, South American crop size will be important to price direction.

Barley markets continue to follow the wider grain complex, supported by tight supply and demand outlooks.

Global grain markets

Global grain futures

Global grain futures felt pressure last week due to competitive Russian wheat exports, general optimism for a renewal of the Ukrainian grain export corridor, and positioning/reactions to the USDA World Agricultural Supply and Demand Estimates (WASDE), see more below.

A deal has still not been met between Russia, Ukraine, and the United Nations to extend the grain export corridor from Ukraine. The deal is set to end on Saturday (19 November). In negotiations, Russia is reportedly calling for a Russian state bank to be reconnected to the international SWIFT payment system. This is to boost Russian exports of grain and fertiliser that have been impacted by western sanctions (Refinitiv). The G20 meeting in Indonesia is taking place this week, which could bring increased rhetoric to renew the deal. The renewal of this corridor will be a key driver of global grain prices this week, are global prices oversold for this position?

With uncertainty over the Ukrainian deal, global importers have been tendering. Today, Saudi Arabia’s state buyer SAGO announced they had purchased just over 1Mt of 12.5% protein wheat, for delivery between April and June 2023. The average price was $382.56/t, origins offered included EU, Black Sea, North American, South American, and Australian. This comes after global tenders last week, in which competitively priced Russian wheat pressured markets. Algeria’s OAIC purchased 510Kt wheat on Wednesday, for December shipment.

Last week, the USDA released their latest WASDE. For wheat, global production was revised higher slightly on the month, to 782.68Mt. Reductions to the Argentinian and EU crops, were outweighed by larger forecasted crops for Australia, UK, and Kazakhstan. A rise in supply outweighed a rise in demand, meaning world ending stocks were increased by 280Kt to 267.82Mt. For maize, global production was reduced this month to 1,168.39Mt, due to reductions to EU, South East Asian and South African crops. The USDA tightened world ending stocks marginally too, to 300.76Mt.

Could the global wheat production picture tighten? Well, last week the Rosario Grains Exchange cut Argentinian wheat production for the season to 11.8Mt, due to recent dry weather. This sits below the new USDA estimate at 15.5Mt. On Friday, the Exchange pegged wheat exports for 2022/23 at 7Mt. If realised, this would be less than half the number of last year’s export number.

UK focus

Delivered cereals

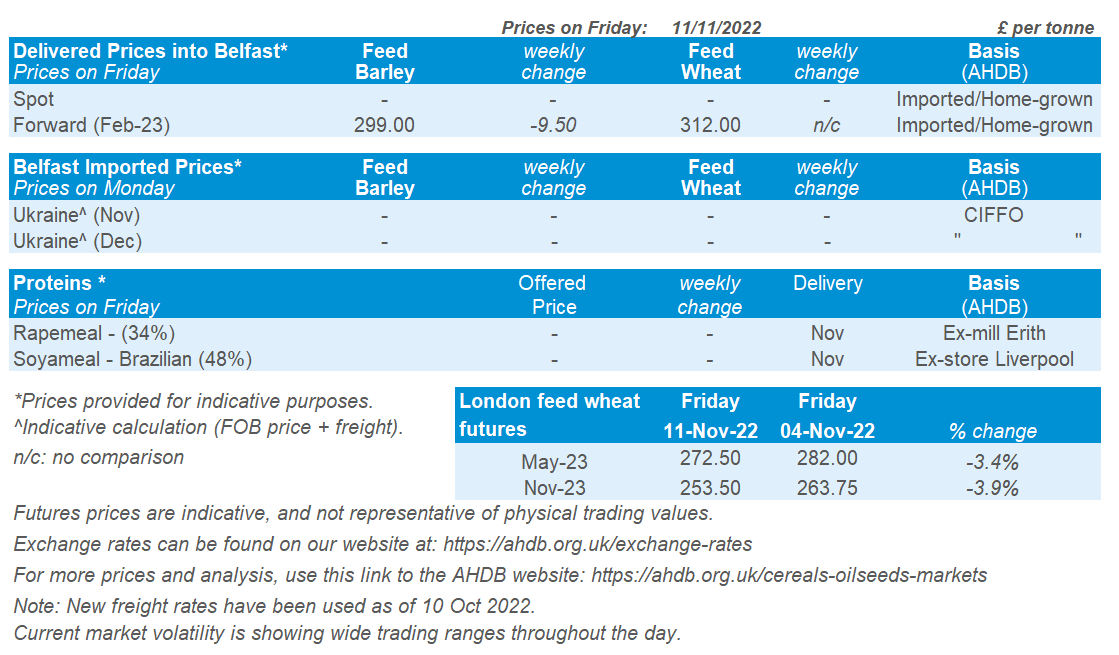

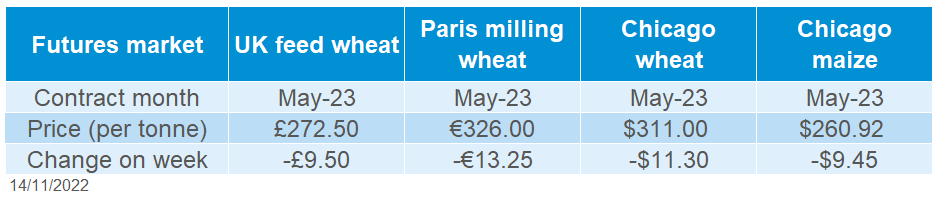

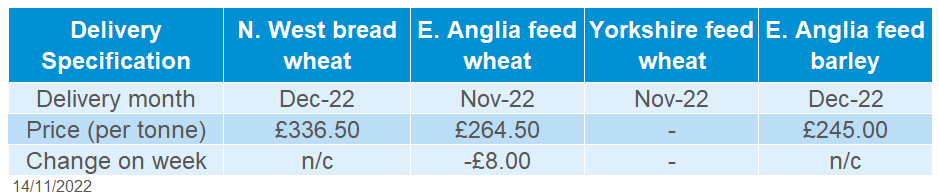

UK feed wheat futures followed global wheat and Chicago maize markets down last week. On Friday, May-23 futures closed at £272.50/t, down £9.50/t Friday to Friday. New-crop futures (Nov-23) closed at £253.50/t on Friday, down £10.25/t over the same period.

UK delivered prices followed futures market movements (Thursday to Thursday). East Anglian feed wheat for November delivery was quoted at £264.50/t on Thursday, down £8.00/t on the week.

North West bread wheat, for December delivery, was quoted on Thursday at £336.50/t.

On Friday, the pound sterling closed at £1 = $1.1835 (up 4% on a weak US dollar) and £1 = €1.1436 (near unchanged). Exchange rates and interest rates will be key to watch this week, with the upcoming domestic Autumn Statement on Thursday (17 Nov).

Oilseeds

Rapeseed

Soyabeans

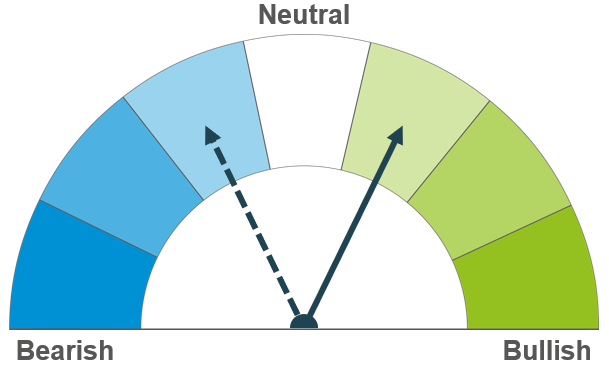

Short-term prices are expected to be reactive to whether the Black Sea grain corridor is extended. Longer-term soyabean market sentiment will weigh on rapeseed prices as Canada’s canola crop improves year-on-year.

Soyabean market outlook is bearish with large South American crops being planted. However, US soya oil demand, combined with Chinese demand as covid restrictions are eased, will be a watchpoint.

Global oilseed markets

Global oilseed futures

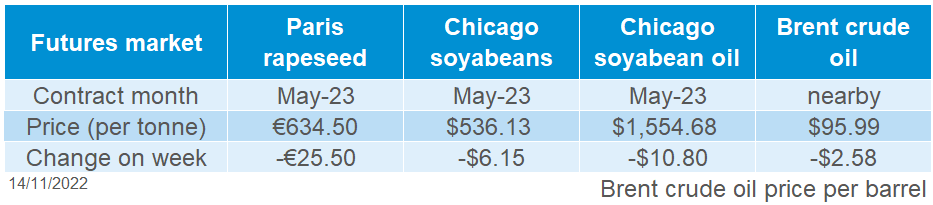

Weekly pressure was the story for oilseeds last week, as Chicago soyabean futures (May-23) closed at $536.13/t, down 1.1% across the week. The start of the week soyabean markets were pressured from profit taking and concerns over Chinese demand. However, prices felt a slight uptick on Wednesday after the release of the latest USDA World Agricultural Supply & Demand Estimates. This release revised down global soyabean production. Friday also saw some support, as markets rallied on hopes that Chinese demand would improve, as there was easing COVID-19 restrictions.

The USDA reported US soyabean exports sales (week ending 3 Nov) totalled 794.8Kt, within trade expectations of 600Kt to 1.2Mt. The US dollar weakened across last week as investors bet that peaking US inflation will prompt the Federal Reserve to hold back on interest hikes. A weakening US dollar will further aid US commodity sales and exports.

Safras & Mercado, a Brazilian consultancy, now estimate Brazilian soyabean crop at 154.5Mt, up from 151.5Mt in their previous forecast. The official USDA forecast is slightly lower at 152Mt. The Brazilian soyabean crop is over halfway sown, with productive regions such as Mato Grosso nearly completed (Conab). For Argentina, rains are expected towards the end of this week which will aid plantings of their soyabean crop.

Malaysian palm oil futures (Jan-23) were down 1.8% across last week. Data released from the Malaysian Palm Oil Council estimated October ending stocks at 2.4Mt, the fifth successive monthly rise and the highest in three years.

Despite this bearish data, Indonesia plans to raise its export tax reference price on palm oil from 16 to 30 Nov, which will lift the base palm oil price. Also, Chinese demand for palm oil products is strong. The Indonesian Trade Ministry said on Friday that nine Indonesian companies signed contracts to sell 2.5Mt of palm oil products to 13 Chinese buyers. However, the time period was not disclosed (Indonesia Trade Ministry, Refinitiv).

Rapeseed focus

UK delivered oilseed prices

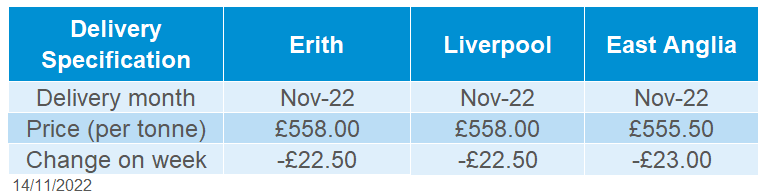

Rapeseed markets followed the oilseed complex down across the week. Paris rapeseed futures (May-23) closed Friday at €634.50/t, down €25.50/t across the week.

Domestic prices followed this and delivered rapeseed (Into Erith, Nov-22) was quoted at £558.00/t on Friday, down £22.50/t across the week. Sterling remained relatively unchanged across the week against the euro, slightly strengthened (+0.2%) to close Friday at £1 = €1.1436.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.