Arable Market Report - 13 March 2023

Monday, 13 March 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

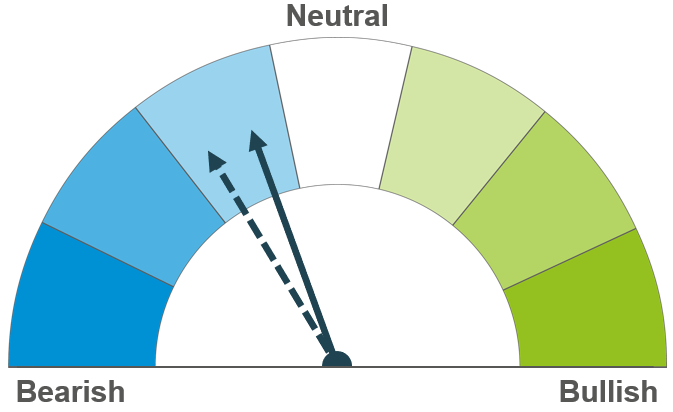

In the short-term, optimism over the Black Sea grain deal will likely continue to weigh on prices, though markets will remain volatile with the extension deadline close. Rains in the US and cheap Russian supplies also pressure prices longer-term.

Argentinian crop concerns remain a watchpoint, though rains are forecast over the next week. Weaker US demand and global export demand could see prices under pressure going forward long-term.

Barley prices continue to follow the wider grains complex.

Global grain markets

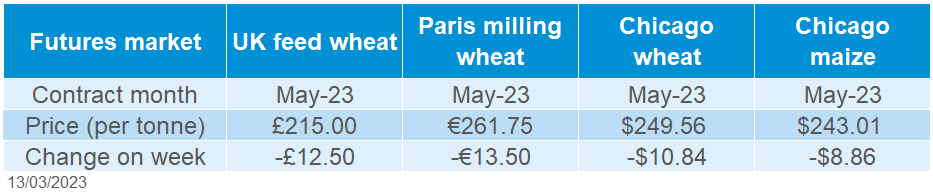

Global grain futures

Global grain markets lost more ground last week as optimism surrounding the Black Sea grain corridor grows. Competitive Russian exports, as well as a bumper Australian harvest and rains across US plains also put pressure on grain prices last week. However, futures markets are expected to remain volatile as we approach the 19 March deadline for the extension of the Black Sea Initiative (grain deal). Losses in maize markets were also limited by the ongoing drought in Argentina, leading to further cuts in production estimates.

Markets are anticipating an extension of the agreement which allows Ukraine to export grain from three of its major ports. However, Russia’s Foreign Ministry said on Sunday that Russian representatives had not yet been involved in negotiations. Though the next round of talks has begun in Geneva this morning between Russia’s Deputy Foreign Minister and a top United Nations trade official, something to watch out for throughout the day.

While down over the week, Chicago wheat and maize futures climbed 2% and 1% respectively on Friday due to a weakened US dollar. Losses in US maize markets over the week were also limited compared to losses in wheat prices, as the severe drought in Argentina remains a concern for supply. The Buenos Aires Grain Exchange are now pegging 2022/23 maize production at 37.5Mt, down from 52Mt in 2021/22. The USDA revised down their Argentinian maize production estimate more than analysts expected in Wednesday’s World Agricultural Supply and Demand Estimates (WASDE), cut 7Mt to 40Mt.

However, in Wednesday’s WASDE, consumption and trade were also revised down for maize, resulting in higher ending stocks for this season. Question marks remain over domestic maize demand for ethanol in the US and global export demand looks weaker as cheaper and abundant Brazilian supplies are expected to come onto the market.

Looking across the next seven days, there is some well needed rain forecast across key producing regions in Argentina, which could see some further pressure on global maize markets, something to monitor over the next few days.

UK focus

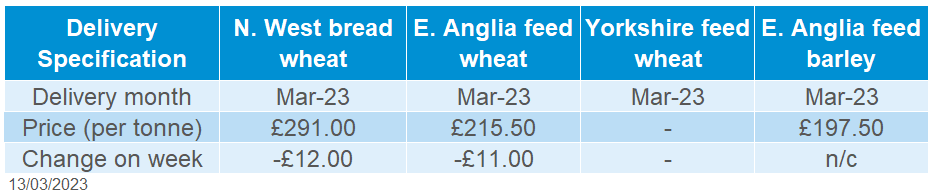

Delivered cereals

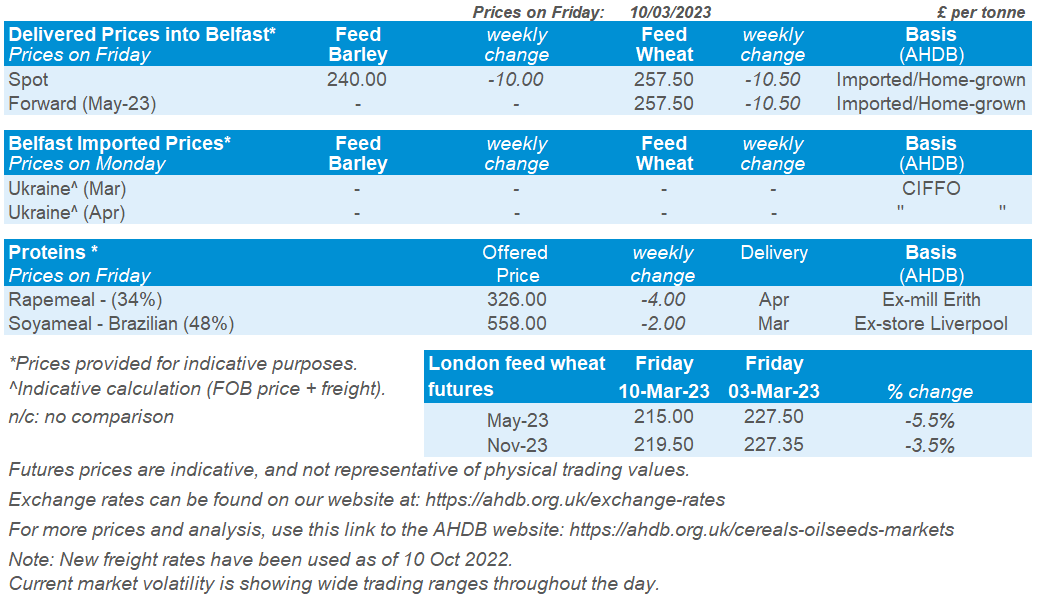

UK feed wheat futures (May-23) were down 5.5% across the week (Friday-Friday). New crop prices (Nov-23) eased 3.5% over the same period and continue to trade at a premium to old crop prices.

Domestic delivered prices followed futures movement last week (Thursday to Thursday). Feed wheat delivered into East Anglia (Mar-23 delivery) was quoted at £215.50/t on Thursday, down £11.00/t on the week. Bread wheat delivered into the North West for March delivery fell £12.00/t over the week, quoted at £291.00/t on Thursday.

On Friday, AHDB released the latest UK trade data. Wheat exports for the month of January totalled 159.5Kt and total wheat exports so far this season (Jul-Jan) are at 735.8Kt. This season to date, wheat exports are more than double where there were at the same point last season, when they totalled 265Kt.

On Thursday, AHDB published the most recent GB fertiliser prices for February. Alongside natural gas futures, fertiliser prices have eased somewhat. UK produced AN (34.5%) for spot delivery in February averaged £630/t, down £70/t from January’s price, and down £19/t from the same point last year.

Oilseeds

Rapeseed

Soyabeans

A record Australian crop is currently being exported to the global market, pressuring prices. Long term, the European new crop is faring well with the rapeseed market expected to be well-supplied.

Rains across Argentina at the end of this week will provide some relief to the damaged crop. Long term, a large Brazilian soyabean crop is going to be exported to the global market.

Global oilseed markets

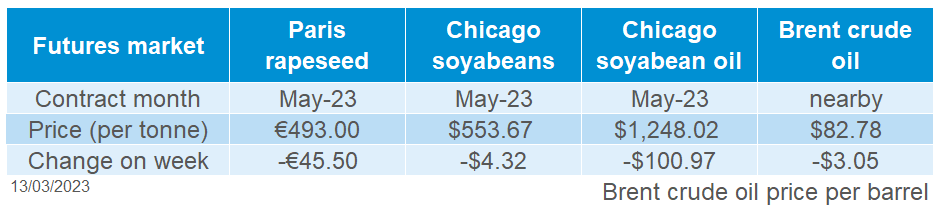

Global oilseed futures

A week of pressure in oilseed markets last week, as Chicago soyabean futures (May-23) were down 1% across the week, closing at $553.67/t on Friday. The main reasons for pressure across the week was from the ongoing Brazilian harvest and much of Argentina’s soyabean drought damage already being priced in the week before (from the week commencing 27 Feb).

The Brazilian soyabean harvest is now estimated at 48.9% complete, but this is back from 60.5% at the same point last year (Safras and Mercado). We are approaching the point where origin will switch from US to South American for global demand.

Chicago soyabeans were marginally supported last Wednesday (08 Mar), as the USDA’s cut to Argentina’s soyabean crop was greater than expected in the March World Agricultural Supply & Demand Estimate. The USDA now estimate the crop at 33Mt. While last week the Buenos Aires Grain Exchange, as expected, further revised their estimates to 29Mt, down from 33.5Mt previously estimated. Crop conditions (up until 09 Mar) continue to deteriorate, with 71% of the crop now rated “poor/very poor”, up from 67% the previous week. Further cuts to Argentina’s soyabean crop were also forecast by Rosario Grain Exchange.

Widespread rains are expected in the agricultural region of Argentina from Thursday, up to 4 inches in parts. This will alleviate some of the drought, but much of the damage to this crop is now done.

Vegetable oil contracts saw pressure across the week too, with a significant drop seen in Chicago soyabean oil (May-23) futures, down 7.5% Friday to Friday. This followed pressure on nearby brent crude oil futures which fell 3.6% across the week, to close on Friday at $82.78/barrel.

Rapeseed focus

UK delivered oilseed prices

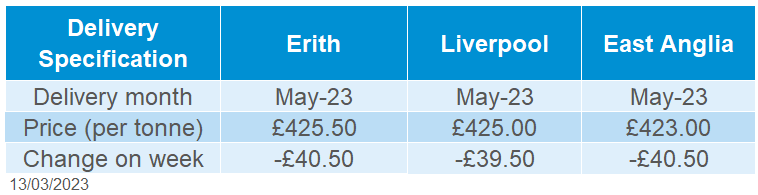

There was widespread pressure in rapeseed markets across the week as Paris rapeseed futures closed at €493.00/t on Friday, down €45.50/t across the week. Delivered rapeseed (into Erith, Mar-23) was quoted at £423.50/t on Friday, down £40.50/t across the week. ICE Canadian canola futures were down 6% too, from heavy selling by speculative funds.

ABARES announced last week that Australia’s canola crop for 2022/23 is now estimated at 8.3Mt, up 1Mt from the last estimate, with the La Niña weather event leading to record yields.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.