Arable Market Report - 12 June 2023

Monday, 12 June 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

Short-term, volatility is expected to continue as markets react to rising tensions in the Black Sea region. Longer-term, new crop wheat supplies look ample, though watchpoints remain for dry weather, in the US especially.

Maize markets will also remain volatile in line with the wider grains complex short-term. Longer-term, global supplies remain plentiful.

Global barley prices continue to follow price movement in the wider grains complex.

Global grain markets

Global grain futures

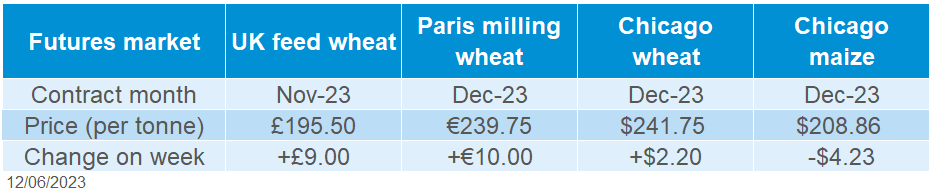

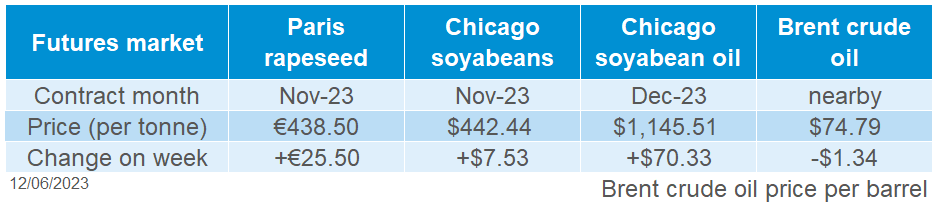

Global wheat futures saw some support last week (Friday to Friday), largely due to concerns over rising tensions in the Black Sea region. Chicago wheat futures (Dec-23) were up 0.9% over the week. Chicago maize futures were down 2% over the same period, with an improved US supply outlook weighing on prices.

According to Russia’s Deputy Foreign Minister, Russia is still not satisfied with how the Black Sea grain deal is being implemented. Russia has said that they will not agree to an extension of the deal (due to expire on 17 July) unless demands to improve its own food and fertiliser exports are met. These demands include the resumption of the transit of Russian ammonia through a pipeline via Ukrainian territory. The pipeline was damaged in a blast last week, though both Russia and Ukraine are denying responsibility.

The destruction of a dam in the Kherson region of Ukraine could also have longer term impacts on agricultural land, with an estimated 4.4 cubic miles of water heading towards the Black Sea via the Dnipro River (BBC). The damage has left 94% of irrigation systems in the Kherson region without water, an area which is among Ukraine’s most fertile and productive region. Markets will likely remain reactive to any further escalations in the area.

With winter wheat harvest now underway in certain regions of the US, and spring wheat in its heading phase, US weather remains an important watchpoint. Up to 2 inches of rain forecast in Kansas and Oklahoma over the next week will likely slow down harvest progress in the region. Though up to three inches forecast in parts of North Dakota and Montana could help improve the spring wheat crop condition. Weather will remain a watchpoint over the next few weeks.

The USDA’s latest World Agricultural Supply and Demand Estimates (WASDE) were released on Friday, with few unexpected changes. However, world wheat ending stocks for the 2023/24 season were raised more than analysts had expected, now at 270.7 Mt, up from the previous estimate of 264.3 Mt. This increase is mostly on account of higher global production forecast, despite higher global consumption expected too.

UK focus

Delivered cereals

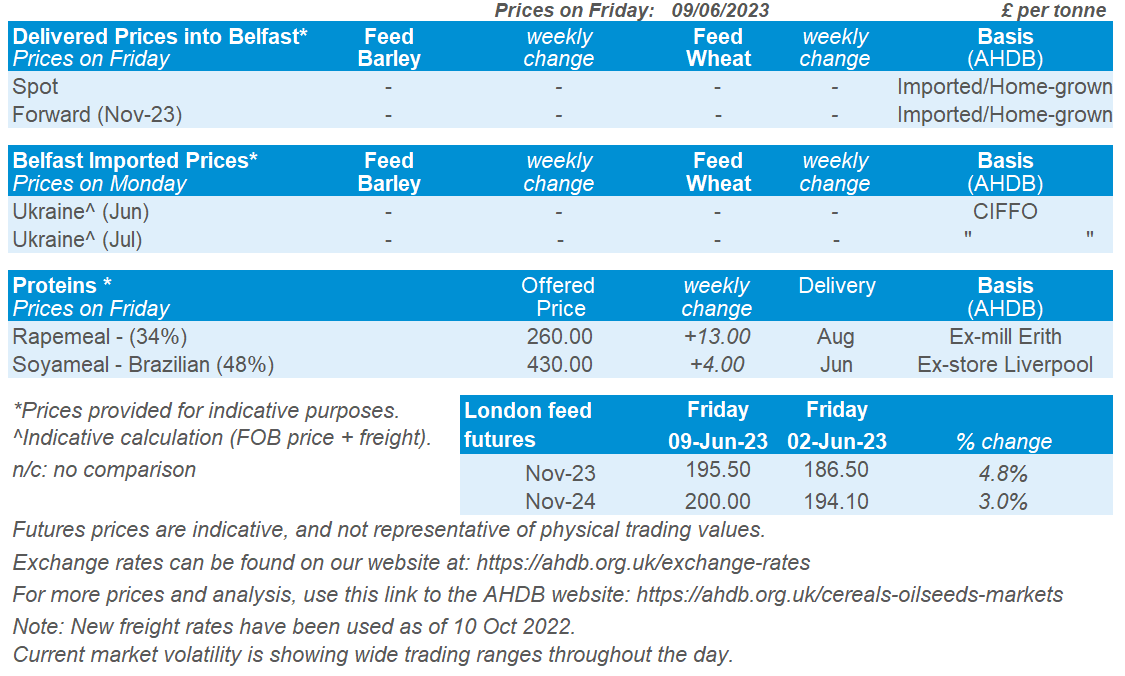

UK feed wheat futures (Nov-23) followed global price movement last week, up 4.8% Friday-Friday. Nov-24 futures were up 3.0% over the same period.

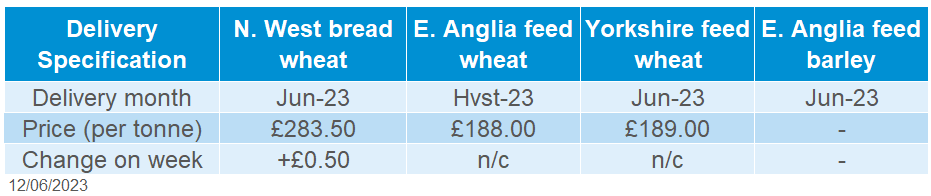

Delivered prices followed futures up last week. Feed wheat into Avonrange for July delivery was quoted on Thursday at £187.00/t, up £7.50/t on the week (Thursday-Thursday). Milling premiums came down slightly last week. Bread wheat delivered into the North West for June delivery was quoted at £283.50/t, up £0.50/t over the same period.

Last week, AHDB released the latest GB fertiliser prices. Spot prices for UK produced Ammonium Nitrate (AN) averaged £390/t in May, down 11.2% from April. This also down 45.5% from the same time last year but remains 37.2% higher than in May 2021. For more analysis on this, see Friday’s Grain market daily.

Oilseeds

Rapeseed

Soyabeans

Short-term a large EU crop is expected which is weighing on overall market sentiment. As EU harvest starts, further price pressure is expected, coming to weigh longer-term.

Short-term a large Brazilian crop is being exported which is adding to US beginning stocks for 2023/24. Long-term there is no major weather event for US soyabeans yet, though markets watch dry conditions. If realised, the record US crop could weigh on the market.

Global oilseed markets

Global oilseed futures

Support was seen across the week (+2%) for Chicago soyabean futures (Nov-23), with the contract mainly gaining at the end of the week from technical buying, concerns about supply disruptions in the Black Sea with conflict on-going, and position adjusting ahead of the USDA World Agricultural Supply and Demand Estimates.

The June USDA report released on Friday was shrugged off by the market, as Chicago soyabean futures rose despite a more bearish report. The USDA raised the US supply outlook for soyabeans for 2023/24, from larger beginning stocks forecast. This comes as demand for old-crop US soyabeans fell on increased availability of South American origin soyabeans. The Brazilian soyabean crop was revised up (+1 Mt) to now be estimated at a record 156 Mt.

Demand for Brazilian origin is increasing as the crop comes to the global export market. According to Anec (Brazilian National Association of Cereal Exporters), Brazilian soyabean exports are expected to reach 13.11 Mt in June 2023, this is up from 9.95 Mt a year earlier.

There was also support for Chicago soyabeans at the end of the week from strong demand for Chicago soyabean oil (Dec-23), which gained 6.5% across the week. This came from strong demand from the biodiesel sector, and some food end users who may have gotten caught short for spot coverage which filtered into forward futures contracts (Refinitiv).

All focus is on US weather as the soyabean sowing campaign comes to an end. Over the next 7 days much of the US Midwest is forecast widespread rain. With the majority of soyabean producing areas due to receive some rain, this will be ideal for the crop that has been planted in good time.

Rapeseed focus

UK delivered oilseed prices

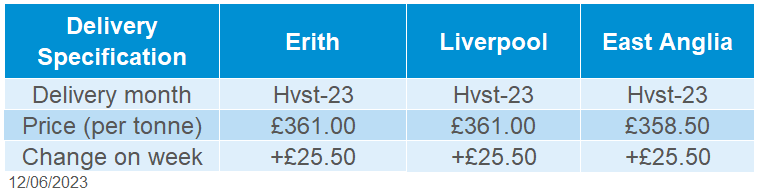

Support for soyabeans filtered into rapeseed prices. Paris rapeseed futures (Nov-23) closed Friday at €438.50/t, gaining €25.50/t across the week. Prices were also supported by dryness concerns and crop stress in northeastern parts of Germany, Poland and the Baltics (Oilworld.biz).

This filtered into our domestic prices, with delivered rapeseed (into Erith, Hvst-23) being quoted at £361.00/t on Friday, up £25.50/t across the week.

According to the latest June crop report from ABARES. Canola is forecast to fall 41% to 4.9Mt but remain 15% above the decade average. With a 70% change of the El Niño pattern developing, this is forecast to have impacts on Australian output, the development of this is a key watchpoint for rapeseed prices for the second half of the 2023/24 marketing year.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.