Arable Market Report − 11 September 2023

Monday, 11 September 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

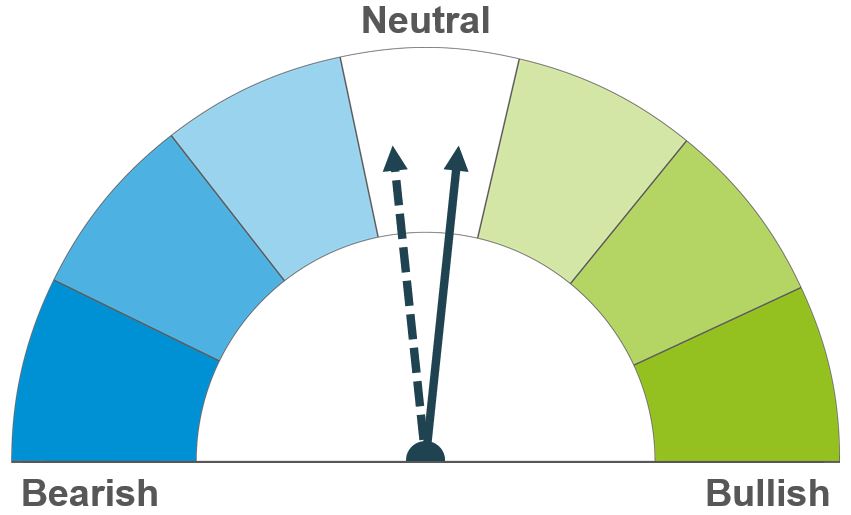

Wheat

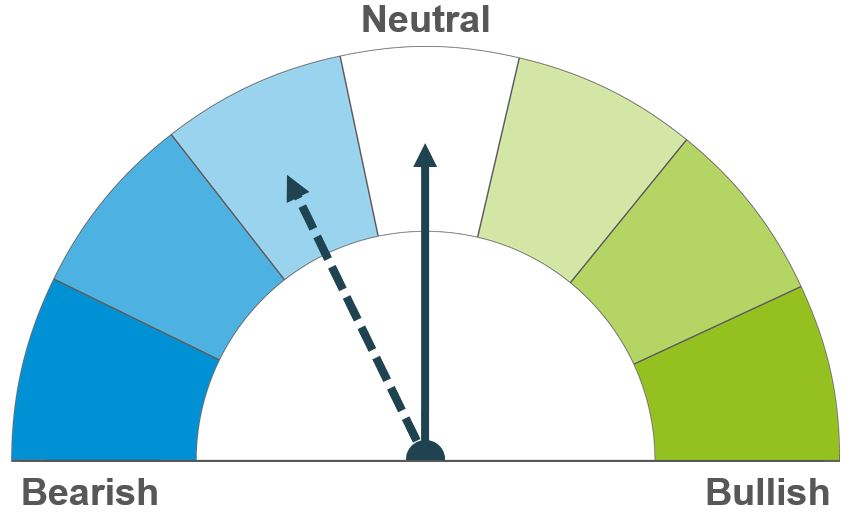

Maize

Barley

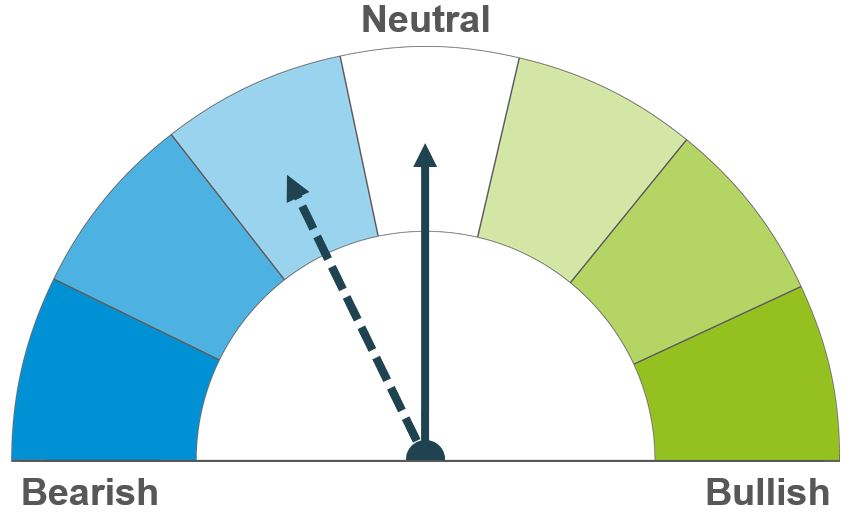

Quantity and quality of this season’s global crop remains in focus, critical for price direction – although competitive Black Sea supplies continue to cap major gains. A plentiful global maize supply, longer term, will likely pressure feed markets.

US weather and yield impact remains key for short term direction. Longer term, large US and South American crops are due to arrive, boosting global supply.

Currently the feed grain market looks well supplied, considering large maize crops due. Barley will continue to follow the wider grains market.

Global grain markets

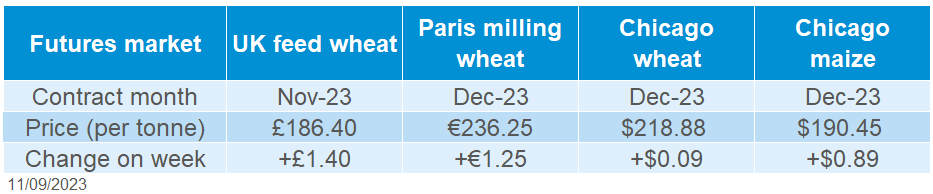

Global grain futures

Global grain markets stayed supported last week, with many contracts recording small gains. Global markets currently feel to be at a crossroads. Despite some trims to wheat crops in major exporters, and quality concerns in focus, competitive Black Sea wheat keeps a cap on global price gains. More news on the quality and quantity of Northern Hemisphere crops especially will be key for price direction, particularly for milling versus feed pricing.

Last week, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) trimmed their forecast for the 2023/24 wheat crop to 25.4 Mt, down from June’s forecast on drier weather and below the USDA’s forecast by 3.6 Mt; this provided some support to global markets last week. While the barley crop forecast was increased from June’s forecast, to sit at 10.5 Mt, this remains 1.9 Mt below the 5-year average.

The latest World Agricultural Supply and Demand Estimates (WASDE) are due to be published tomorrow (12 Sept), could we see a trim to the Australian wheat forecast? US maize yields are also in focus, after the recent hot weather. Reuters trade expectations are anticipating another trim to the US maize yields forecast (Refinitiv), following last month’s trim; though with a larger area year-on-year, the market is still expecting a large US maize crop to arrive.

Black Sea wheat continues to cap major gains for global wheat contracts. Despite Russian attacks on Ukrainian ports, Ukrainian grain continues to flow – though data released by the Farm Ministry shows a slowing of grain exports from 1–7 September from a year earlier. Work is ongoing to diversify Ukraine's export routes. On Friday, Romania was set to approve a plan to upgrade road infrastructure to the port of Constanta (Refinitiv). UN talks with Russia continue, with the aim to restore the Black Sea Initiative. Yesterday, Russia’s Foreign Minister, Lavrov told reporters at the G20 meeting that Russia will return to the deal the same day Moscow’s conditions are met for their own fertiliser and grain exports.

Russian wheat continues to be competitive on the global market. Last week Russian consultancy Sovecon raised their Russian wheat export forecast for 2023/24 to 48.6 Mt, up 500 Kt from the previous estimate. If realised, this would be the largest on record when comparing to the USDA’s historic data.

UK focus

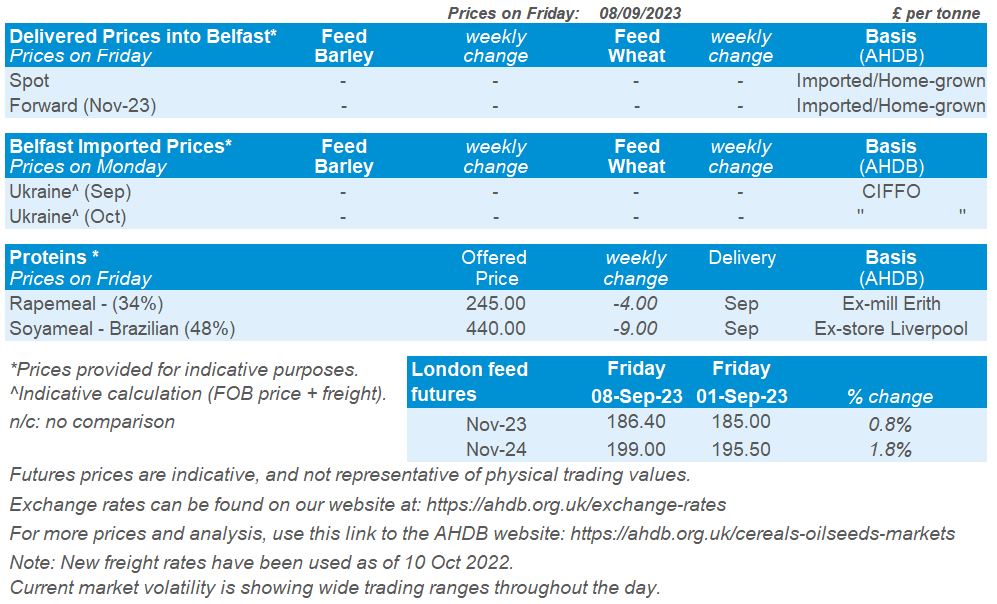

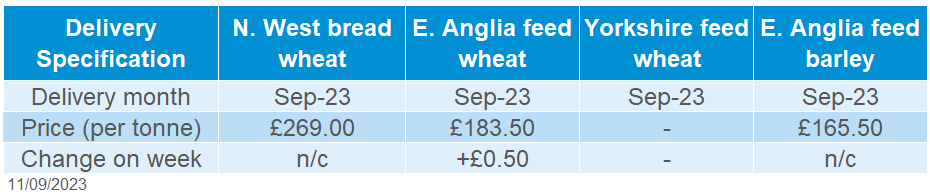

Delivered cereals

UK feed wheat futures followed overall global sentiment last week. The Nov-23 contract closed on Friday at £186.40/t, up £1.40/t over the week, whereas the Nov-24 contract gained £3.50/t over the same period, to close on Friday at £199.00/t.

On Thursday, domestic feed wheat into East Anglia (for September delivery) was quoted at £183.50/t, up £0.50/t on the week.

North West bread wheat (for September delivery) was quoted on Thursday at £269.00/t, with no comparison on the week.

We are hearing anecdotally that domestic grain markets are quieter currently. As we learn more in upcoming weeks of the quantity and quality of this season’s harvest 2023, domestically, in the EU and globally, this will be key for domestic pricing to the continent.

Oilseeds

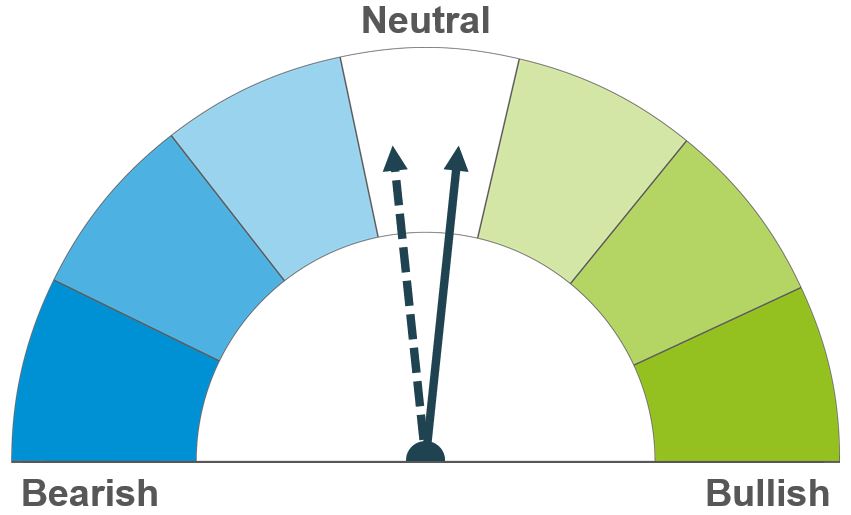

Rapeseed

Soyabeans

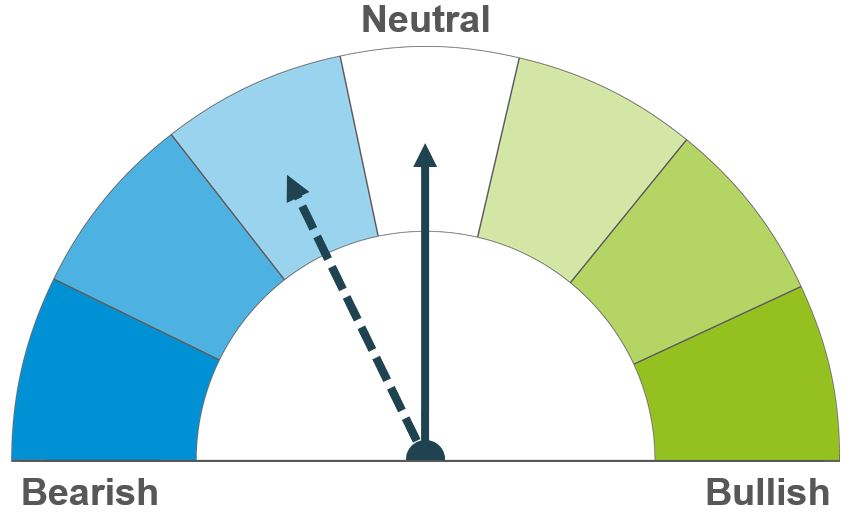

Short-term, USDA data is key for assessing damage to the US soyabean crop. Longer-term, large South American crops are expected, which will likely weigh on prices and ultimately the oilseed complex.

Short-term, USDA data is key for assessing damage to the US soyabean crop. Longer-term, large South American crops are expected, which will likely weigh on prices and ultimately the oilseed complex.

Global oilseed markets

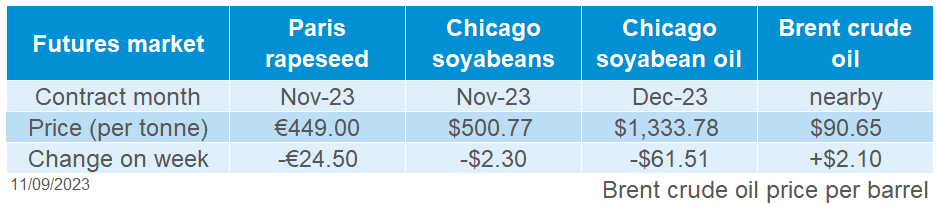

Global oilseed futures

Another week of pressure for Chicago soyabean futures (Nov-23) as the contract ended down 0.5% across the week, closing Friday at $500.77/t. Although prices on this contract seem to be subsiding from the most recent peak at the end of August, as the market digests the warm weather in the US, there is still a potential bullish sentiment in the oilseed market. This is due to the potential yield impacts to the US soyabeans following the hot weather.

On Tuesday, the USDA released their latest crop progress report (data up until 3 September), which showed that soyabean crop conditions had deteriorated worse than expected from the recent hot and dry weather in the US Midwest. Crop conditions are now at the worst point since 2012 for the respective week.

The soyabean market subsided after the price spike on Wednesday; more information is required to assess the damage to this soyabean crop, which was at its critical stages when this hot weather occurred. Further information will be available tomorrow evening in the USDA World Agricultural Supply and Demand Estimates for September. The market is expecting further cuts to soyabean yields and therefore US production (Refinitiv). There is anticipated cuts to US ending stocks, which currently are estimated at the lowest since 2015/16; however, if the data is significantly different to expectations, this could lead to either support or pressure on the market.

Brazilian soyabeans continue to come to the global market from their record crop for 2022/23, keeping a cap on price gains. China imported 9.36 Mt of soyabeans in August. This is up 31% from a year ago, with reports of large purchases of cheap Brazilian soyabeans continuing. China have taken advantage of the discounted Brazilian origin soyabeans from the record crop.

Looking to this season, large crops are expected from South America, boosting the supply outlook. In a report last week, the Buenos Aires Grain Exchange estimated Argentina’s soyabean crop at 50 Mt for 2023/24, up from 21 Mt in 2022/23. The El Niño weather event is expected to improve soil moisture in the north of Argentina, leading to large crops going into 2024.

There was pressure across the week for Malaysian palm oil futures, with anticipation of higher inventories for the month of August. Last week a Reuters survey estimated growth at over 9% month-on-month. Higher stocks were confirmed today from the Malaysian Palm Oil Board, which estimates Malaysian August stocks at 2.12Mt (a 7-month high), up 22.5% month-on-month. This was from exports reducing sharply, and higher than the Reuters survey, which has pressured the market further today.

Rapeseed focus

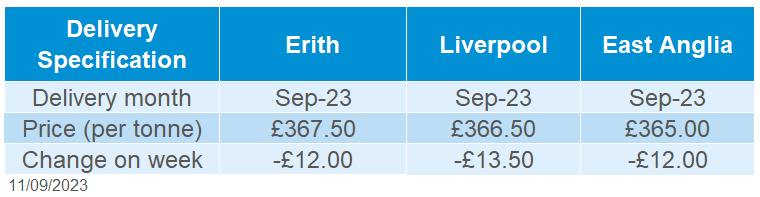

UK delivered oilseed prices

Paris rapeseed futures (Nov-23) closed on Friday at €449.00/t, down €24.50/t across the week, broadly following the pressure in the wider oilseed and vegetable oil complex.

Delivered rapeseed (into Erith, Sep-23) was quoted on Friday at £367.50/t, down £12.00/t across the week.

There was some support (+2.4%) for nearby Brent crude oil futures across the week, with the contract closing Friday at $90.65/barrel. Support came as Saudi Arabia and Russia extended their voluntary supply cuts to the end of the year. This worried investors about potential shortages especially as demand is expected to peak towards winter. However, this information seems to have been shrugged off by the oilseed complex.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.