Arable Market Report - 09 May 2023

Tuesday, 9 May 2023

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

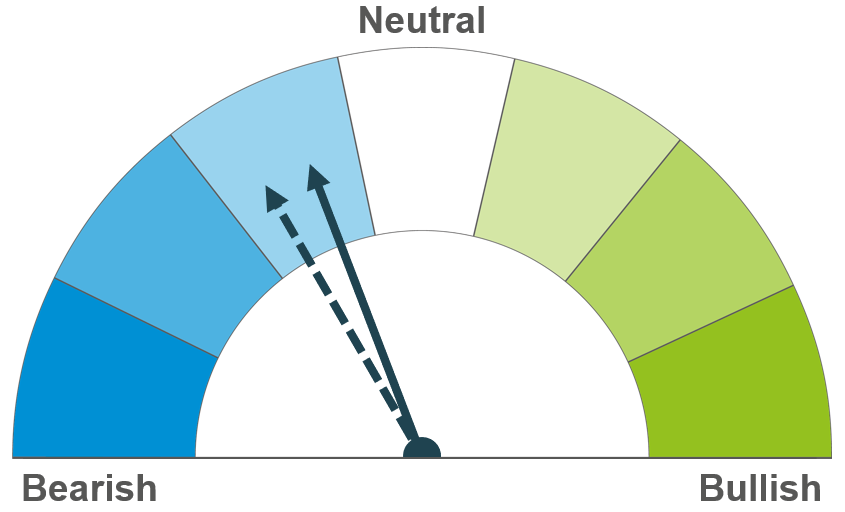

Grains

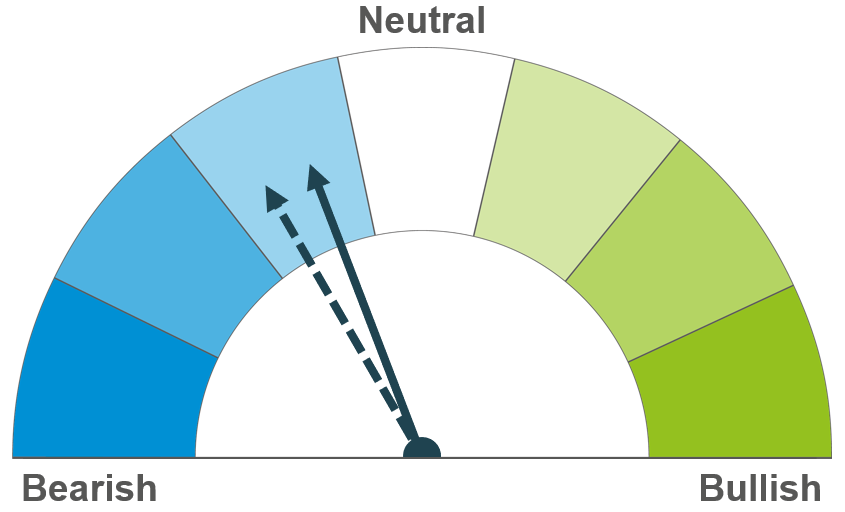

Wheat

Volatility is expected short term, especially for new crop prices, as we near the renewal date for the Black Sea Initiative. Though competitive Black Sea supplies cap old-crop wheat prices. New season supply remains in focus longer term, with the USDA’s 2023/24 WASDE estimates due on Friday.

Maize

Like wheat, volatility can be expected short term from the Black Sea Initiative. However, cheaper Brazilian supplies expected on the market and progressing US plantings boost the supply picture longer term. Demand will be key going forward, especially with slow US sales.

Barley

Global barley prices continue to follow movements in the wider grain complex. The discount of ex-farm UK feed barley to UK feed wheat stood at £16.10/t as at 27 April.

Global grain markets

Global grain futures

Global grain market movements were mixed last week. Overall many contracts gained to Friday’s close, but many lost ground on Monday. Support last week came from renewed concerns for Ukraine’s exports, especially for the new season. Though longer-term focus remains on ample supply into the new season.

The Black Sea Initiative remains a key focus for grain markets. Talks to renew the deal have not yet been successful, with the deal due to expire on 18 May. Russia is looking to ease restrictions for their own grain and fertiliser exports. The UN has confirmed that no ships were inspected on Sunday or Monday. Furthermore, according to Ukraine’s Reconstruction Ministry, Russia is refusing to register incoming vessels, with 90 ships reportedly waiting, including 62 vessels for loading. Talks are expected between Russia, Ukraine, Turkey, and the UN at the end of this week, something to watch out for.

On top of this, last week the European Commission adopted temporary measures on wheat, maize, rapeseed and sunflower seed exports from Ukraine to Bulgaria, Hungary, Poland, Romania and Slovakia. These products can only enter these countries in transit to another destination, which will last until 5 June.

However, capping gains and still weighing on old-crop wheat prices is the continued ample supply of competitive Black Sea wheat. Egypt’s state buyer GASC purchased 655Kt of wheat last Tuesday, for June/July delivery. Russian wheat was the lowest offer presented at $250/t FOB and $260/t FOB, under the semi-official minimum export price of $275/t. Romanian origin wheat also made up some of the purchase, at $260/t FOB (Refinitiv).

Rain falling across the US has been easing some concerns for their winter wheat crop. In yesterday’s USDA report, crop conditions saw a slight improvement (1 percentage point (pp)) week on week, to be rated at 29% good/excellent as at 7 May. To the same date, US maize plantings were pegged at 49% complete, ahead of last year and the five-year average by 28pp and 7pp respectively.

On Friday, the latest world agricultural supply and demand estimates are due to be released, which will bring the first estimates for next season (2023/24).

UK focus

Delivered cereals

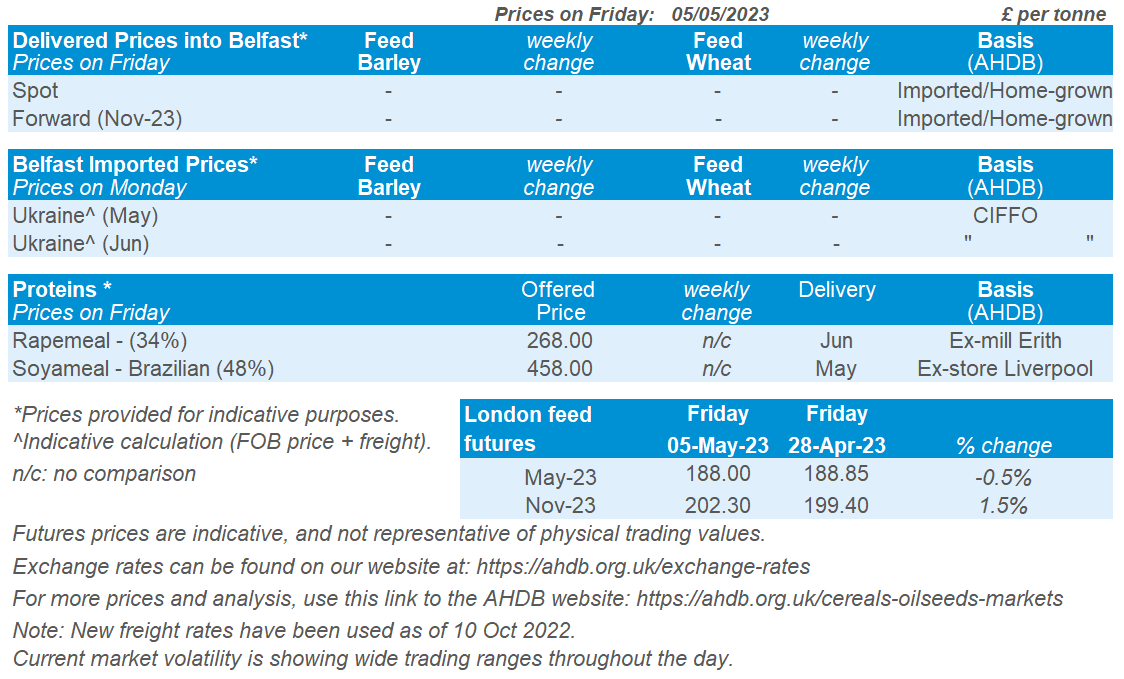

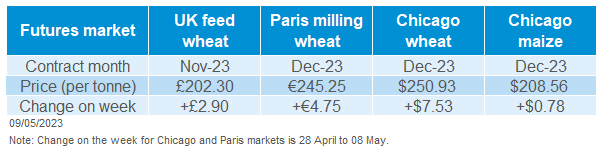

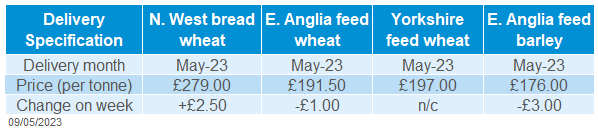

Last week, old-crop UK feed wheat futures lost ground very slightly (-£0.85/t) to close on Friday at £188.00/t. New-crop futures (Nov-23) gained £2.90/t over the same period, to close at £202.30/t, following support in global grain markets.

Domestic delivered feed wheat prices followed movements in futures contracts (Thursday to Thursday). On Thursday, feed wheat delivered into East Anglia (May delivery) was quoted at £191.50/t, down £1.00/t on the week.

Bread wheat delivered into the North West (May delivery) was quoted on Thursday at £279.00/t, up £2.50/t from the week before. Milling wheat premiums continue to firm.

Last week saw the release of the latest cereal usage data for UK human and industrial and GB animal feed production. Total barley usage by brewers, maltsters and distillers is up 5.5% season to date (Jul – Mar). Total GB animal feed and integrated poultry unit (IPU) feed production continued to decline in March at 1.292Mt, down 8% year on year, for more information follow this link to our analysis.

The latest stock data was also released last week. At the end of February, 1.009Mt of home grown wheat and 885Kt of home grown barley was held in store by merchants, ports and co-ops in the UK, down 5% and up 22% respectively on the year, according to the latest AHDB data. Farmers in England and Wales had 4.499Mt of wheat in store on farm at the end of February, up 17% on the year and the highest stocks for this point in the year since 2015, according to latest Defra data.

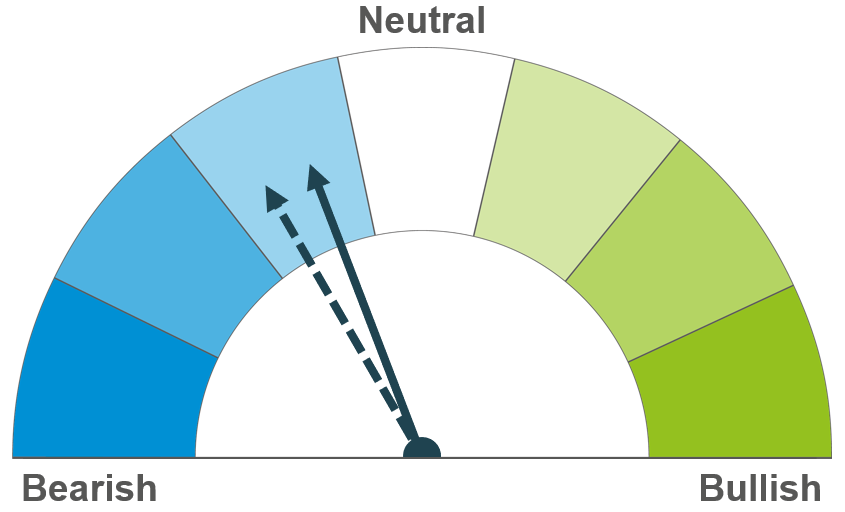

Oilseeds

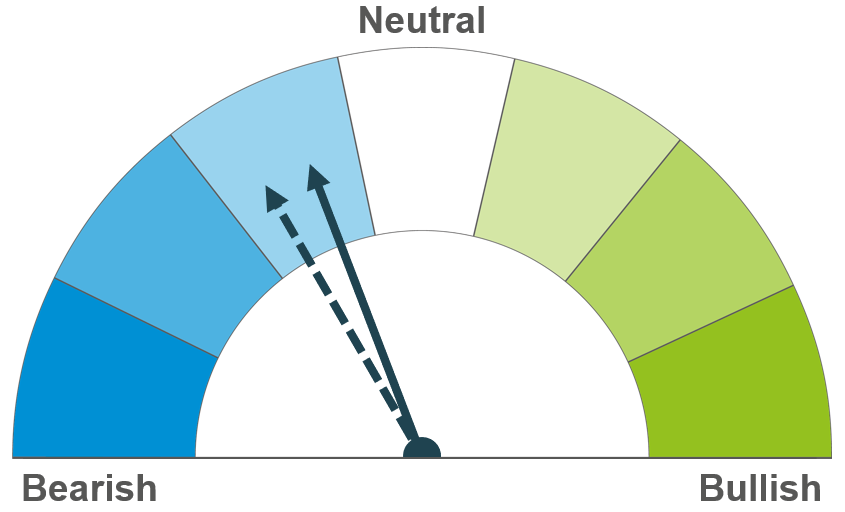

Rapeseed

Short-term, rapeseed prices could see some support from ongoing doubts over the future of the Black Sea Export Initiative. However, this will likely be capped by good EU crop prospects. Longer term, losses in the wider oilseed complex and a large Canadian canola crop will likely put pressure on rapeseed markets.

Soyabeans

Short-term, volatility will continue, gains in palm and crude oil markets could filter into soyabeans, though swift plantings in the US will likely limit any gains. Longer-term, abundant supplies from Brazil and favourable US planting conditions will continue to pressure prices.

Global oilseed markets

Global oilseed futures

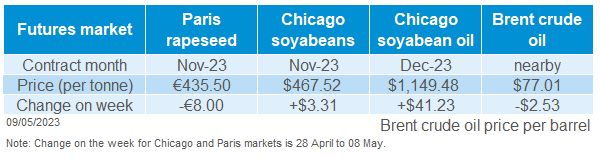

Chicago soyabean futures (May-23) were overall supported across last week, up 1.7% from Friday 28 April to Monday 8 May. Last week saw firm Brazilian exports coming onto the global market, as well as improved planting conditions in the US. However, the impact of gains in the wider vegetable oil complex, and in crude oil markets, outweighed losses. Though prices did remain volatile.

The ongoing doubt over the future of the Black Sea Initiative also saw some support filter into oilseed markets, as tensions increased further between Ukraine and Russia. Gains in crude oil towards the end of last week and yesterday, also filtered into the soyabean market. Yesterday, Brent crude oil (nearby) closed at $77.01/barrel, up $1.71/barrel over the session.

Climbs in the wider oilseed complex were supported by rising Malaysian palm oil futures. According to Refinitiv, the Malaysian Palm Oil Association (MPOA) forecast an 8% month-on-month decline in April production, adding some concerns over supply. The dry weather from an anticipated El Niño weather event expected between May and September adds further doubt over yields. The MPOA’s April supply and demand data, due to be released tomorrow, will be a key watchpoint this week for price direction in vegetable oil markets.

However, favourable US weather conditions mean soyabean plantings are progressing well, pressuring markets. The USDA reported 35% of the soyabean crop had been planted as at the week ending 7 May, up from 19% the previous week and up from the five-year average of 21%. Key soyabean production areas in the US are expected to be dry over the next few days, before turning wet towards the end of the week. This will likely allow for plantings to progress further over the next few days and remain ahead of the average for this time of year. The next WASDE due to be released by the USDA on Friday will likely influence soyabean markets this week as we will see the first estimates for the 2023/24 season, something to watch out for.

Competitive Brazilian soyabean exports also continue to weigh on global markets. According to Brazilian trade group ANEC, soyabean exports in May, based on current shipment schedules, are expected to be up 1.8Mt (17.7%) on the year at 12.1Mt.

Rapeseed focus

UK delivered oilseed prices

New crop Paris rapeseed futures (Nov-23) were up 2.4% Friday to Friday last week, following the wider vegetable oil complex. However, after losing €18.50/t during yesterday’s session, futures prices to-Monday were down 1.8%.

On Friday, agriculture consultancy APK-Inform reported that Ukraine could produce another record rapeseed crop at around 3.5Mt to 3.6Mt in 2023. While planted area saw a 9% reduction, harvested area is expected to increase 8% from last year. The consultancy’s current export forecast for Ukrainian rapeseed exports next season (2023/24) sits between 3.3Mt and 3.4Mt, down 3% on the year.

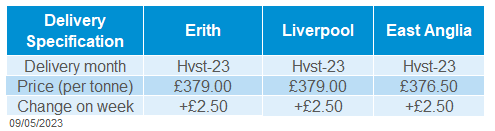

Domestic prices followed futures market movements last week (Friday to Friday). Rapeseed delivered into Erith for May delivery was quoted at £379.50/t on Friday, up £2.00/t on the week.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.