Arable Market Report – 8 April 2024

Monday, 8 April 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

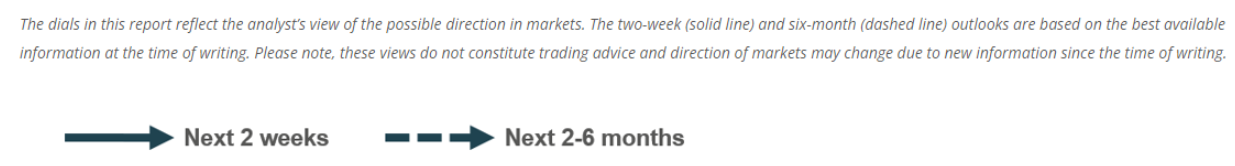

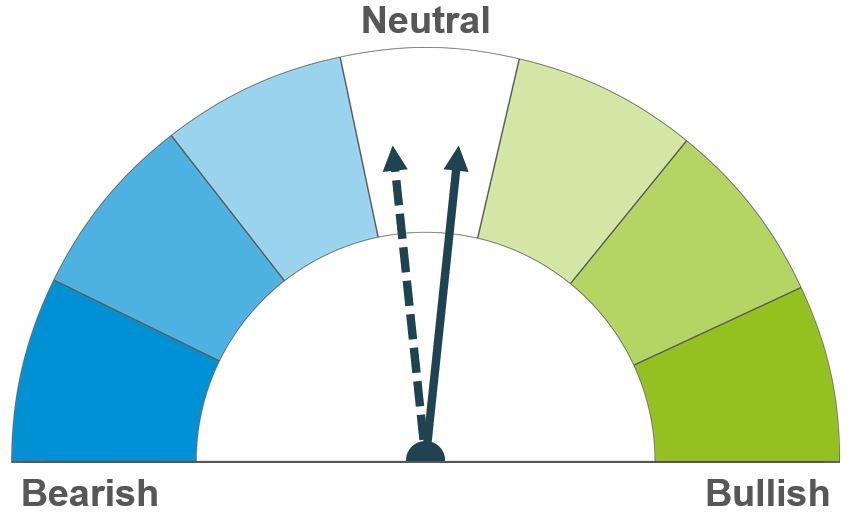

The global wheat balance looks tighter as we head towards the 2024/25 season. With mixed global crop conditions, weather remains key to price direction.

In the short term, South American conditions are a key watchpoint with reports of disease losses in Argentina. In the longer term, global forecasts continue to show a well-supplied outlook.

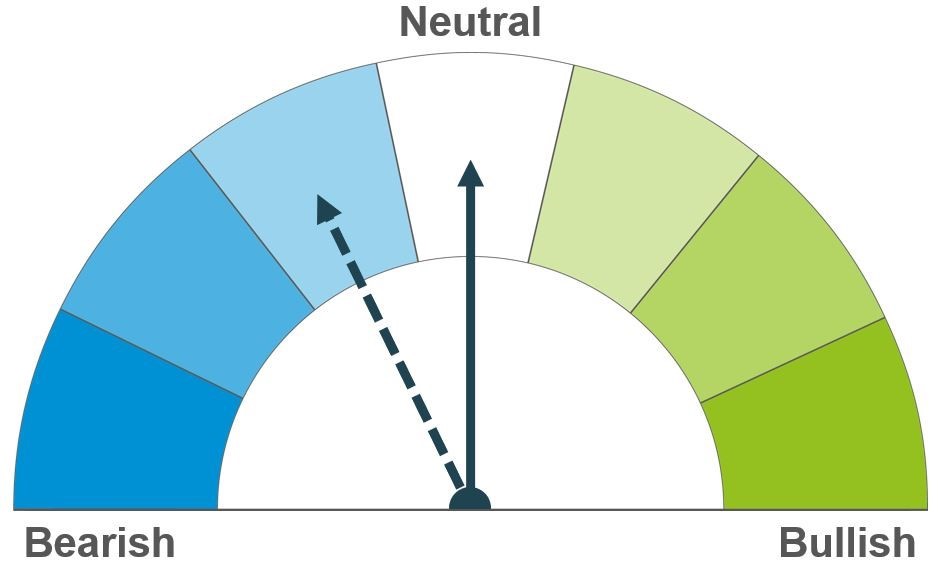

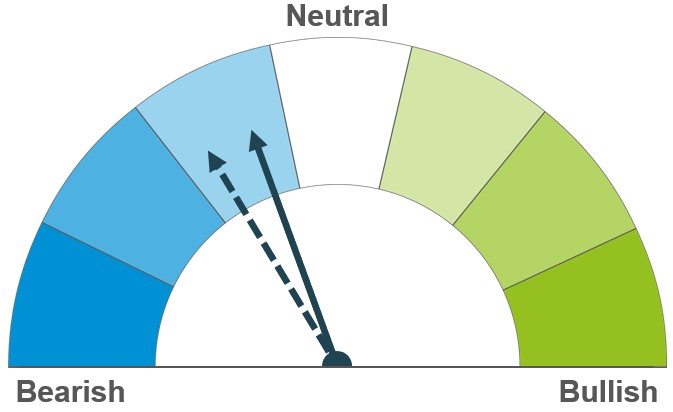

Barley markets continue to follow movements in the wider grains complex. Though European planting delays and adverse conditions are leading to uncertainty over the size of next season’s crop.

Global grain markets

Global grain futures

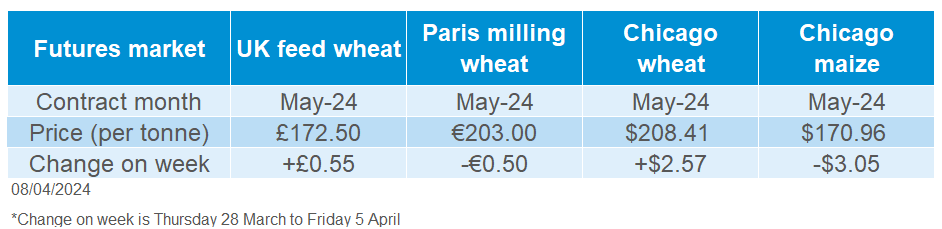

Global grain price movement was mixed last week (Thursday 28 March to Friday 5 April), with domestic and US wheat markets supported but Paris wheat futures under pressure. US and Paris maize futures also saw declines over this period. Reports over delayed and more expensive Russian shipments, as well as rising concerns over European new crop conditions, supported wheat markets, though a strong Euro underscored tough EU export competition leading to pressure in EU markets.

At the beginning of last week, Russian wheat export prices rose for the third week in a row (LSEG). The price of 12.5% Russian wheat for late April/early May delivery (FOB) was quoted at $208.00/t, up $3.50/t on the week. Sovecon has reported rising concerns over the country’s new crop conditions with abnormally dry conditions. However, current expectations are still for a large Russian crop.

On Friday, FranceAgriMer published its latest crop condition data. The state of the French soft wheat crop declined further last week, after already being at its worst in four years, with frequent rain leading to waterlogging. Spring barley conditions were also rated at their worst on record. Plantings of spring barley are now 86% complete, up from 82% the week before, but still well behind the previous five-year average, and last season, when the entire crop had been planted at this point. Conditions of crops and planting progress in Western Europe will remain a key watchpoint over the next few weeks.

Global maize markets continue to look well supplied heading into the new season. Rains across the US Midwest have improved soil moisture and improved conditions for maize plantings which should now pick up pace. However, in the short term, there is focus on South American crop conditions, with the Buenos Aires Grain Exchange reporting disease damages in Argentina’s crop and trimming the 2023/24 maize production estimate to 52 Mt, from its previous estimate of 54 Mt (LSEG).

UK focus

Delivered cereals

UK feed wheat futures gained last week, following Chicago wheat prices. May-24 UK feed wheat futures gained £0.55/t last week to close at £172.50/t on Friday. The Nov-24 contract rose by £0.40/t to close at £195.30/t. Meanwhile, Paris milling wheat futures (May-24) fell marginally (0.25%), closing at €203.00/t. Over the week (28 Mar – 5 Apr) the Euro strengthened against both the Pound Sterling and the US Dollar by 0.3%.

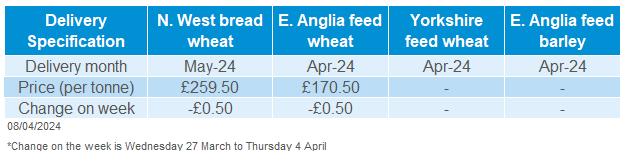

UK delivered prices followed futures price movement Thursday to Thursday last week. Feed wheat delivered into East Anglia for April delivery was quoted at £170.50/t on Thursday, down £0.50/t over the week. Bread wheat for delivery into the North-West in May was quoted at £259.50/t, down £0.50/t week-on-week.

The British Standards Institution (BSI) has launched it’s new ‘BSI Flex 701 Nature markets – Overarching principles and framework standard’. This standard outlines an overarching set of principles and a common definition of nature investments, and importantly outlines steps in provision against ‘greenwashing’.

A consultation phase has been launched alongside this new BSI standard to receive feedback on this first iteration. AHDB will be feeding into this consultation, supporting the needs of levy payers across nature markets. This closes on 1 May 2024. For more information on the consultation or to feed in, please follow this link.

Oilseeds

Rapeseed

Soyabeans

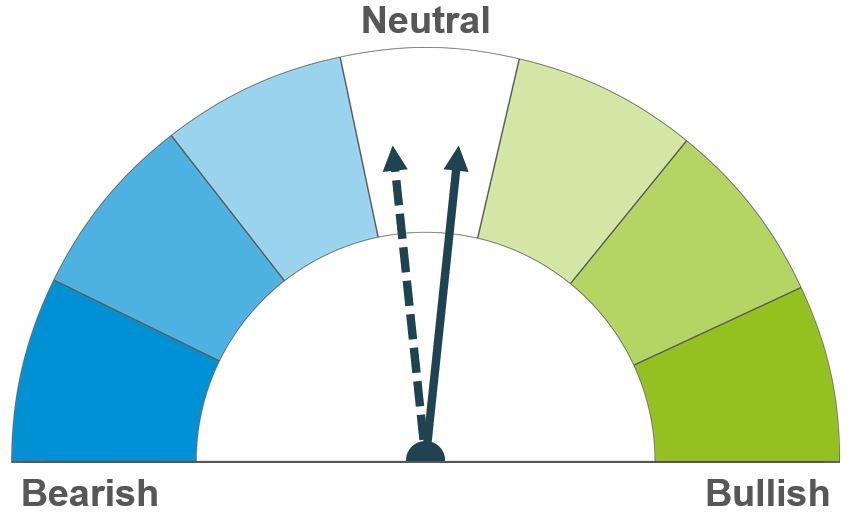

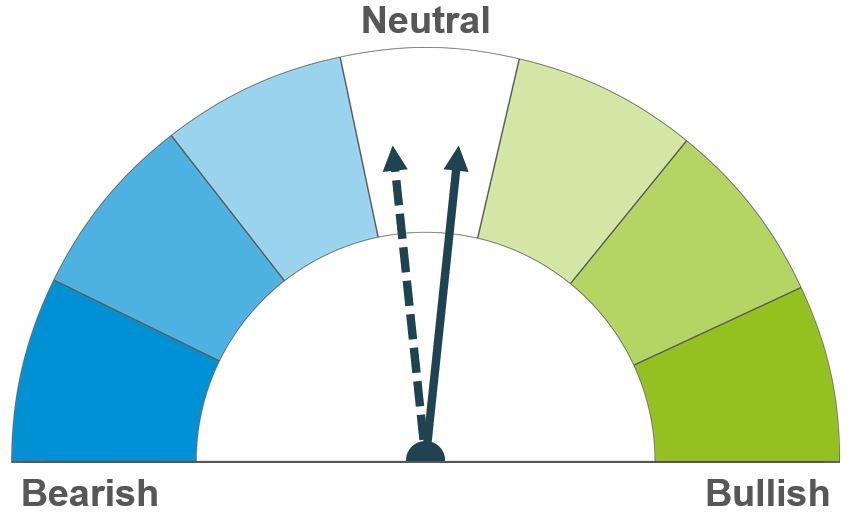

Rapeseed is at a large premium to soyabeans. Market focus will be on upcoming Canadian plantings and determining how high that premium to soyabeans could be longer term.

In the short term, the global market is being well supplied with South American beans. In the longer term, US plantings are in focus in the coming months with sown area expected to grow.

Global oilseed markets

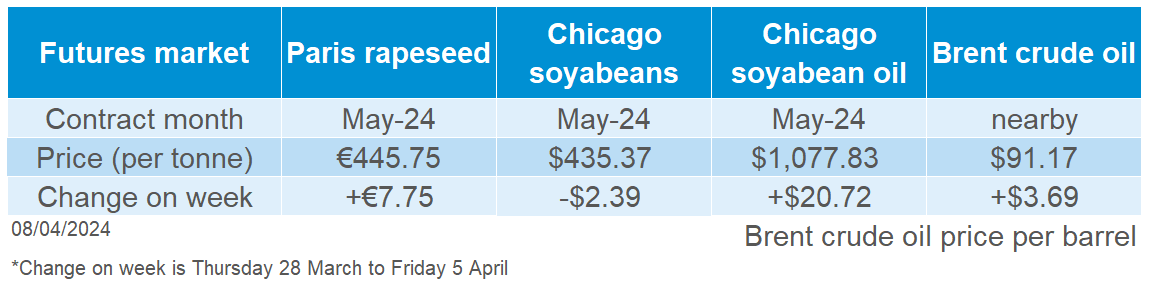

Global oilseed futures

Pressure across the week for Chicago soyabeans as the market ended down 0.5% (28 March to 5 April), closing Friday at $435.37/t. To start the week, the market was down due to Brazilian origin soyabeans coming to the global market, seasonally slow US demand and concerns of Chinese demand, in the longer term, hanging over the market.

Further to that, what pressured Chicago soyabeans was strength in the US dollar at the start of the week. The US dollar index peaked at its highest point last Monday (1 April) since November 2023, dampening the competitiveness of US grains and oilseeds.

Despite the pressure at the start of the week, the Chicago soyabean market did find some support from technical buying and short covering. With commodity funds holding such a large short position in soyabean futures, this is leaving the market open to short-covering rallies. Furthermore, support in Brent crude oil filtered into the market as geo-political tensions ensued in the Black Sea region.

With South American supplies near confirmed for 2023/24 marketing year, markets are now turning towards US spring plantings. Over the next few weeks, US soyabean plantings will kick off, so all eyes will be on the US Midwest to ensure that this annual increase in area gets into the ground.

The USDA’s April World Agricultural Supply and Demand Estimate report is out this Thursday (11 April), which will provide an update on the global picture, such as US ending stocks and adjustments to South American production estimates.

Rapeseed focus

UK delivered oilseed prices

Rapeseed markets broadly gained with both palm oil and crude oil markets last week. Paris rapeseed futures (May-24) closed at €445.75/t, gaining €7.75/t across the week. New crop futures (Nov-24) closed at €460.00/t, gaining €9.25/t over the same period.

Lower supplies are expected in Europe for harvest 2024, which is putting greater reliance on Ukrainian rapeseed supplies this summer and on Australian rapeseed supplies at the end of 2024 coming to the market.

Please note that AHDB were unable to publish UK delivered oilseed prices last week due to insufficient quotes to calculate the published average.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.