Arable Market Report - 06 June 2022

Monday, 6 June 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

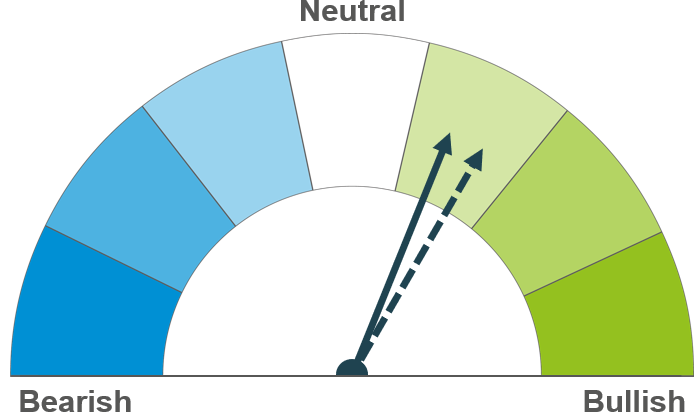

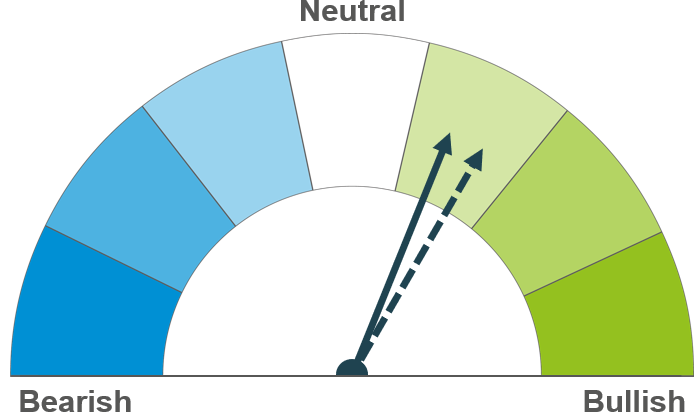

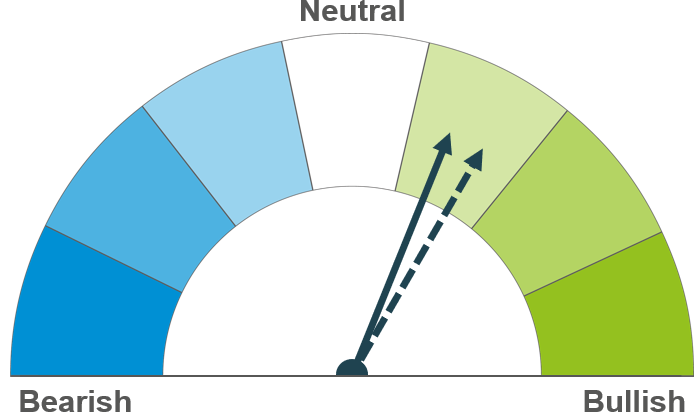

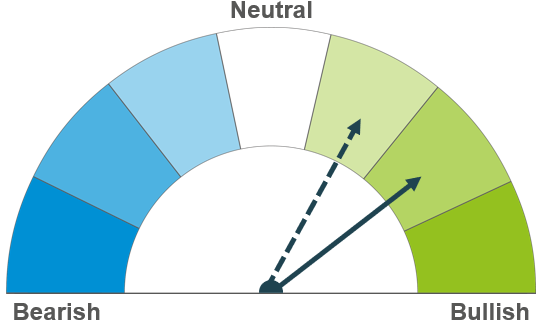

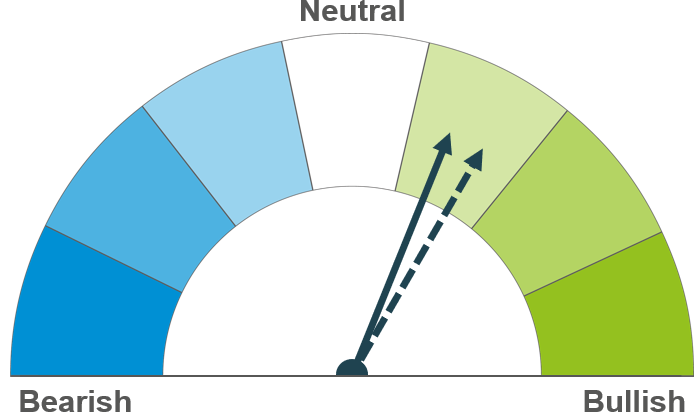

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Short term, volatility continues as the UN work to reopen the Ukrainian grain export corridor. If a deal is made, prices will see pressure, but many obstacles remain yet. US and EU weather remain watchpoints for harvest 22.

Reopening Ukrainian exports remain a watchpoint, as global supply remains tight. Like wheat, maize prices could see some pressure if realised. Longer term export and bioethanol demand will be key.

Tight global and domestic supply and demand means barley markets continue to track wheat movements closely.

Global grain markets

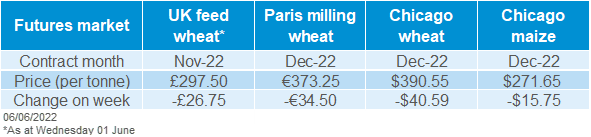

Global grain futures

Global grain markets continue to react to news of the UN attempting to establish an export corridor for Ukrainian grain.

On Friday, Russia presented a solution to transport grain through Belarus to German, Polish, Baltic, or Russian ports, though this would be in exchange for Belarusian goods shipping from there too. Progressing talks saw global supply concerns easing last week, pressuring grain prices. However, Kyiv seeing conflict for the first time in a month today has reignited worries.

This week, a meeting is due to take place between Ukraine, Russia, Turkey, and the UN to discuss an export corridor. If Ukrainian ports were to reopen and a deal made, prices will see pressure according to the UkrAgroConsult. Though de-mining may take 6 to 8 weeks.

French soft wheat condition has declined for the fifth week in a row according to consultancy FranceAgriMer. To 30 May, 67% was in good or excellent condition. This is down 2 percentage points (pp) from the previous week. Declines are down to drought conditions seen in May, although over the weekend France saw heavy hail and storms. Crop impact will be watched closely.

The latest AMIS report was released last week, showing the EU, US, Canada, and Ukraine remain watchpoints for upcoming wheat harvests. For maize, Brazil dryness and Ukrainian supply remain watchpoints.

The next USDA world agricultural supply and demand estimates are due on Friday (10 June).

On Friday, the US Environmental Protection Agency set US biofuel blending mandates for 2022 (20.63B gallons), 2021 (18.84B gallons) and 2020 (17.13B gallons). The 2022 number is below what was proposed in December. Only small refiners will be eligible for exemption from mandates if they can prove financial harm.

UK focus

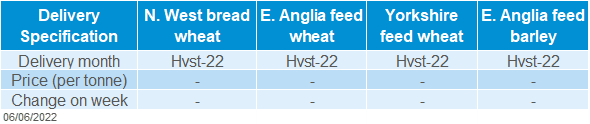

Delivered cereals

UK feed wheat futures (Jul-22) closed at £288.00/t on Wednesday (1 June), down £26.75/t from last Friday. The new crop contract (Nov-22) closed on Wednesday at £297.50/t, also down £26.75/t over the same period.

Both contracts saw an equal drop in prices last week. This followed on from the news of a potential grain corridor out of Ukraine easing global supply concerns and re-positioning ahead of the long weekend. However, this morning the new contract (Nov-22) price traded back up to £308.00/t (12:30BST), after a Russian attack in Kyiv (Refinitiv).

Due to the Jubilee Bank Holiday, the next publication of the UK delivered cereals prices is scheduled for Friday 10 June.

Last week the latest cereals usage data for GB animal feed production released. Total animal feed production season to date (Jul to Apr) is down 1.5% from last season. Read more information here.

The latest UK human and industrial cereal usage data was also updated. Total wheat milled this season (Jul to Apr) is up 5.5% from this time last year. Brewers, maltsters, and distillers saw 10.6% more barley and 21.1% more wheat usage this season (Jul-Apr) than last. More information can be found here.

No prices published last week due to extended Jubilee holiday.

Oilseeds

Rapeseed

With EU harvests approaching, the satisfactory EU crop conditions and the return of Canadian canola to import markets could provide a lid on prices, although tightness set to remain.

Soyabeans

Current high prices could limit further buying, capping gains. Favourable US weather should accelerate planting progress, the latest report is due this evening.

Global oilseed markets

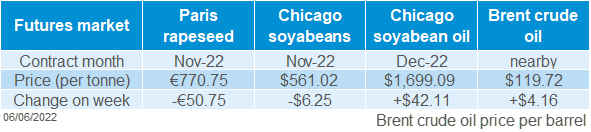

Global oilseed futures

Both old and new crop Chicago soyabean contracts steadily recovered last week, following their fall on Tuesday from the previous week’s close. However, not all ground was recovered, and they ended the week $12.68/t (nearby) and $6.25/t (Nov-22) back Fri-Fri, closing on Friday 3 June at $623.75/t and $561.02/t respectively.

Month end trading softened soyabean prices at the beginning of the week. However, the US crop progress report provided support on Tuesday, with US soyabean planting still slightly behind trade estimates. As at 29 May, planting was 66% complete versus projections of 67%. The latest US Crop Progress report is released later today.

Last Wednesday, the USDA also released its soyabean crush figures for April. Volumes were down 0.36Mt on the month, at 5.43Mt, but up 0.33Mt year-on-year and on pace to reach the USDA’s annual crush estimate.

Friday’s US export sales data showed declines on the week and four-week average for both this and next marketing year. For 2021/22, sales were down 60% on the week. While for 2022/23, sales were back 25% over the same period. As such, both old and new crop Chicago soyabean futures softened Thursday to Friday. In addition, US weather is looking more favourable in the short-term outlook, which could aid planting pace and potentially additional area.

Meanwhile, Paris rapeseed futures steadily declined on the week. The nearby (Aug-22) contract was back €52.50/t Friday to Friday, closing at €775.75/t, with Nov-22 following suit, back €50.75/t and closing at €770.75/t. Despite the dry EU conditions in recent weeks, the weather prior has led to the condition of the EU crop being mostly satisfactory, although France has been subject to heavy storms and hail over the weekend. This, and a forecast increased area, has slightly eased supply concerns for new crop, although tightness still prevails.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) closed at €770.75/t on Friday, down €50.75/t from the previous week.

Continental prices follow the global pattern, as demand weakens as a result of recent high prices and news that Ukrainian exports may resume. This is coupled with the EU crop currently in satisfactory condition and area projected to increase.

Last week saw sterling weaken against the euro, closing at £1 = €1.1707 on Friday, which may impact domestic prices. Due to the Jubilee holiday, no UK delivered prices were published last week and will resume this Friday (10 June).

No prices published last week due to extended Jubilee holiday.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.