Arable Market Report - 05 September 2022

Monday, 5 September 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

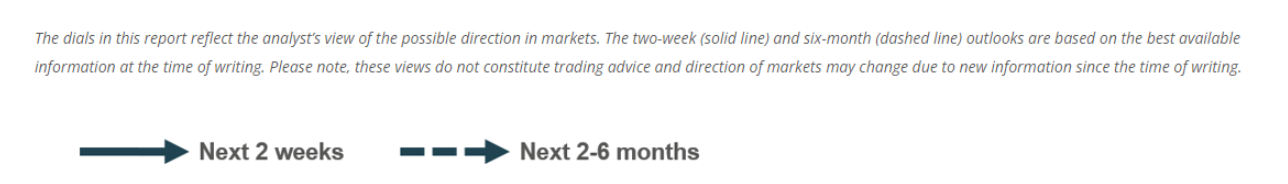

Volatility remains in the short term. Ukrainian exports are increasing but wheat markets continue to be supported by rising maize prices. Longer term limited global grain supplies continue to provide a floor of support.

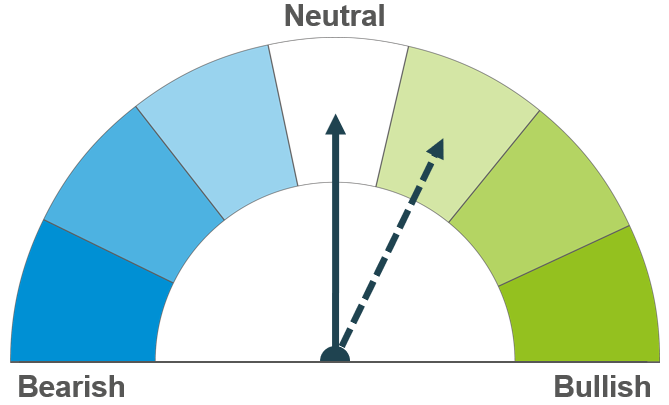

Hot and dry weather in the US and EU continues to tighten the supply outlook for maize longer term. Weather will remain a watchpoint as Northern Hemisphere maize harvest accelerates.

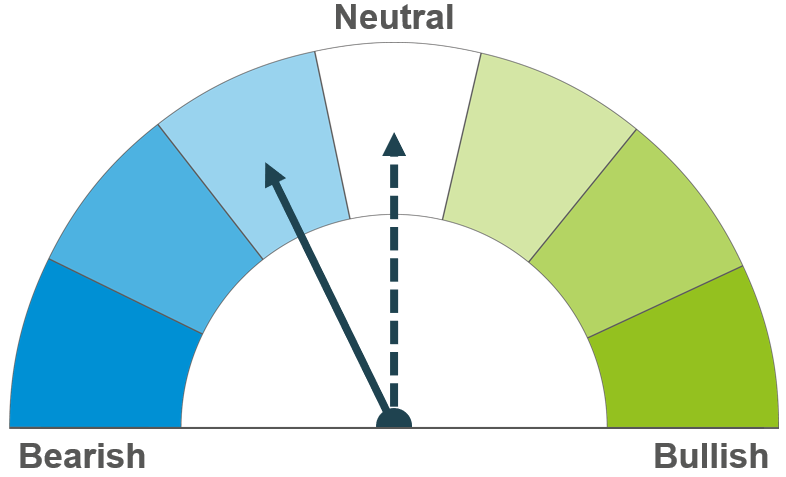

Both the domestic and global barley market remain tight, with markets following the wider grains complex.

Global grain markets

Global grain futures

Global grain futures edged higher over the last week across the complex. Despite losing some support mid- week, US maize and wheat prices strengthened on Friday on a technical rebound, ahead of the US bank holiday weekend.

Global maize conditions remain a concern, with maize prices continuing to support global grain markets. Though prices did experience some pressure mid last week due to recessionary concerns, as well as increased exports from Ukraine and competitive export prices for Russian wheat.

In France, maize harvest has begun much earlier than normal and crop conditions are said to have declined further. As at 29 August, an estimated 45% of French maize crop was in ‘excellent’ or ‘good’ condition, compared to 91% a year earlier. This score is the lowest rating in more than 10 years (FranceAgriMer).

Hot and dry weather is forecast across the US Midwest over the coming week and traders are beginning to adjust maize yield expectations ahead of the USDA’s next monthly supply and demand estimates due out next week (12 Sept). Some analysts have lowered their yield estimates in recent days, adding speculation that the USDA might do the same. Weather in the US Midwest and EU will be an important watchpoint over the next few weeks as the maize harvest accelerates.

On Thursday, the Ukrainian Agrarian Council said that the country’s 2023 wheat sowing area could fall by 30% or 40% due to a lack of funds. The organisation also said that wheat yields in 2023 would likely stay relatively low (around 4t/ha) due to a possible decline in fertiliser use. These issues mean that Ukraine’s 2023 wheat harvest is unlikely to exceed 15Mt, down from an estimated 19Mt in 2022 and 32.2Mt in 2021.

It was reported that 13 ships had left Ukrainian ports yesterday, carrying 282.5Kt of agricultural products. This brings the total number of vessels to have left Ukraine since the deal to 86 ships, totalling around 2Mt of agricultural products.

UK focus

Delivered cereals

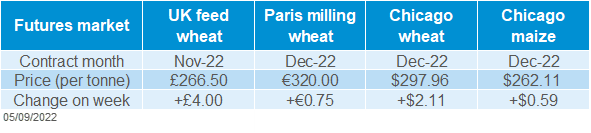

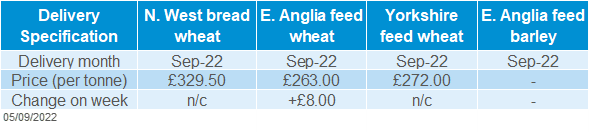

UK futures followed trends in global prices last week. UK feed wheat futures (Nov-22) gained £4.00/t over the week, closing at £266.50/t on Friday. The Nov-23 contract closed at £257.00/t, gaining £5.10/t Friday – Friday.

East Anglia delivered feed wheat prices for September delivery were quoted at £263.00/t on Thursday, up £8.00/t from the previous week. This price increase mirrors UK feed wheat futures movements (Thurs-Thurs).

Bread wheat delivered into North West for November was quoted at £331.50/t, up £9.50/t Thursday to Thursday.

Natural gas prices in the UK continue to climb. The Nord Stream 1 pipeline which had been due to reopen on Saturday is still shut as Russia’s state-owned energy firm Gazprom is said to have found a leak. As at 12.30pm today, nearby ICE natural gas prices were 525.00p/therm, up 115.58p/therm (28.23%) from Friday.

The UK Government and devolved administrations have launched a consultation seeking views on proposals to update and amend The Bread and Flour Regulations 1998 and The Bread and Flour Regulations (Northern Ireland) 1998. Details of the consultation can be found here.

The Bread and Flour Regulations lay down specific rules on the labelling and composition of bread and flour and include a requirement to fortify non-wholemeal wheat flour. The consultation includes proposals to update the regulations to ensure consistency with other food standards legislation and implements the Government’s previously agreed policy to add folic acid to the list of mandatory nutrients required to be added to flour at a specific level. The consultation runs from Thursday 1 September to Wednesday 23 November.

Oilseeds

Rapeseed

Soyabeans

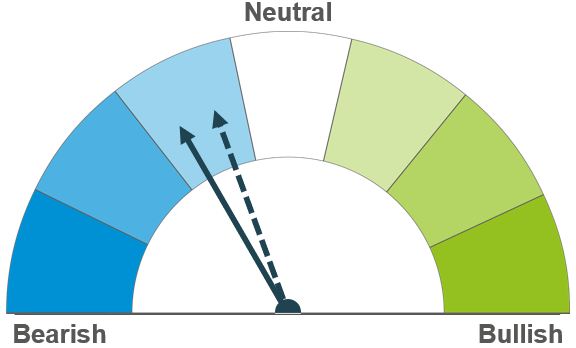

In the short-term, rapeseed shadows soyabean prices downwards, on good US crop prospects and the upcoming harvest of a large Canadian rapeseed crop. Longer term, the wider oilseed complex supply and demand balance remains tight, but a recession could alter this should demand ease.

US soyabean crop prospects are looking favourable ahead of harvest, which will pressure the market in the short-term. Longer-term large South American crops are forecasted, combined with recessional fears playing into reduced demand, could pressure the market.

Global oilseed markets

Global oilseed futures

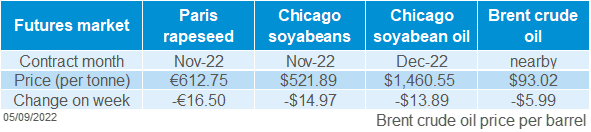

Chicago soyabean futures (Nov-22) fell 2.8% last week, to close on Friday at $521.89/t. Commodity funds were net-sellers of Chicago soyabean futures across the week.

This is despite soyabeans rising last Friday, on a short-covering bounce from crude oil strength and high interest rate fears from the Federal reserve, ahead of the three-day US holiday weekend.

Stable US soyabean crop prospects ahead of harvest, combined with worries that a global recession could constrain demand, are the main reasons for the weekly drop.

In other oilseed news, Stratégie Grains cut their production forecast for 2022/23 EU sunseed (10.35Mt to 9.17Mt) and soyabeans (2.78Mt to 2.49Mt). This is down 11.3% and 7.8% year-on-year, respectively. Recent hot and dry weather has damaged parts of the crops, leading to this downward revision. In the report, EU imports were revised up for sunseed (+500Kt) and rapeseed (+700Kt) for the 2022/23 season. Reasons for this increase were due to Ukrainian exports leaving across land and through the secure corridor out of the Black Sea.

Malaysian palm oil futures (Nov-22) closed down 6.2% across the week. This was due to key buyer China imposing fresh Covid-19 lockdown measures in select cities to conduct mass testing, raising concerns for palm oil demand. Further to that, stocks are expected to build up in Malaysia as they approach the peak harvest months.

Rapeseed focus

UK delivered oilseed prices

Rapeseed markets followed the oilseed complex down as Paris rapeseed futures (Nov-22) closed Friday at €612.75/t, down €16.50/t across the week.

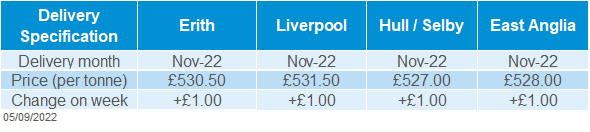

Delivered rapeseed (into Erith, Nov-22) was quoted at £530.50/t, up £1.00/t across the week. Sterling weakening (-1.89%) against the Euro sheltered our domestic market from the pressure on the continental market. Trading closed Friday at £1 = €1.1556.

Despite sunseed and soyabean EU production being revised down, Stratégie Grains raised their estimates of this year’s EU rapeseed harvest to 19.2Mt from 18.5Mt. This is 12.9% above last year’s level. Rapeseed growing conditions have been favourable and harvest results better than expected.

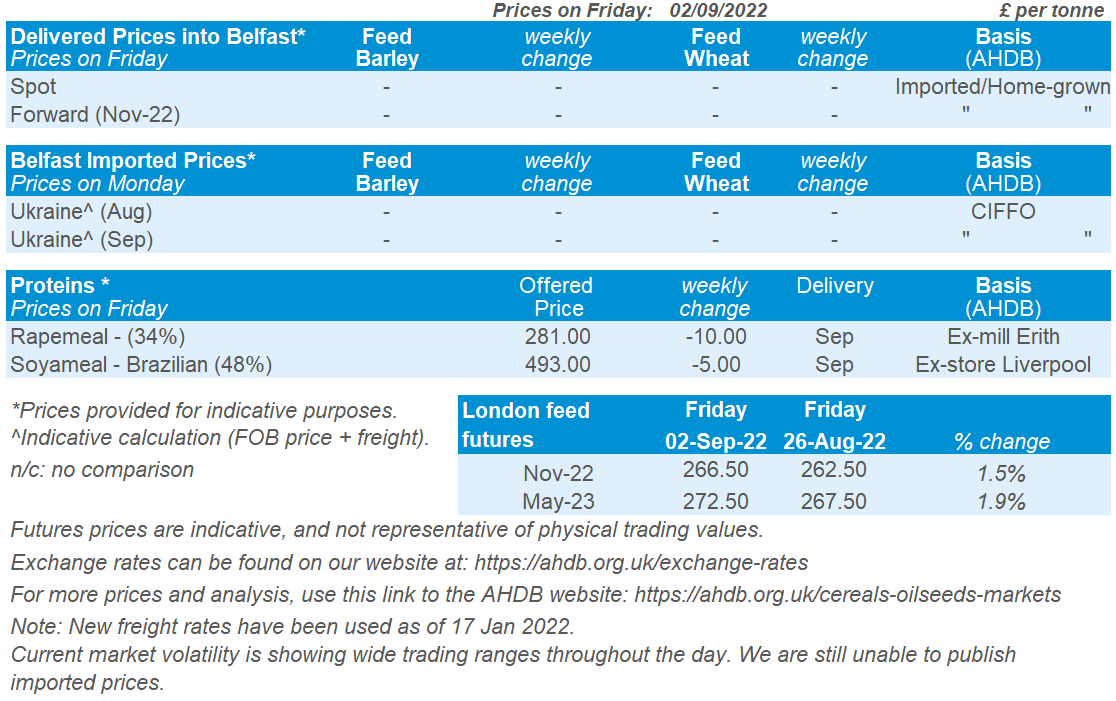

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.