Arable Market Report – 5 January 2026

Monday, 5 January 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

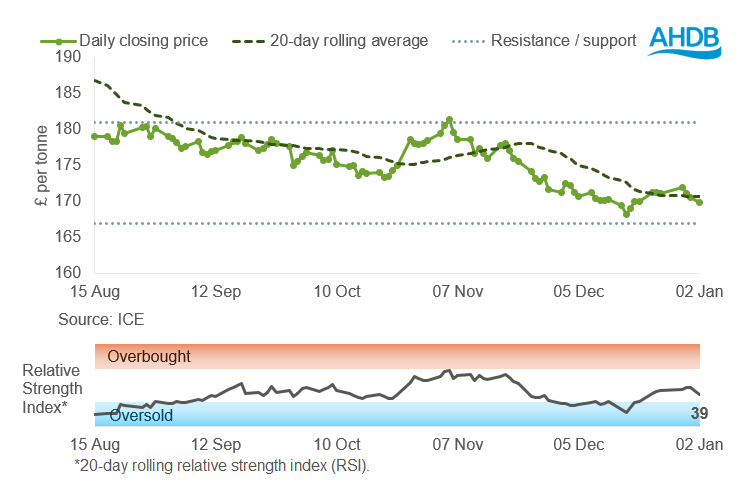

UK feed wheat futures (May-26)

UK feed wheat futures (May-26) closed slightly below the 20-day simple moving average at the end of last week, but remained above the nearest support level of £167/t.

The relative strength index (RSI) rose to 39 from 30 in the last report on 22 December, indicating a slight increase in market momentum.

Find out more about the graphs in this report and how to use them

Market drivers

The global grain market was largely quiet over the Christmas and New Year period, with reduced trading activity.

UK feed wheat futures fell in line with global trends, as abundant supplies and strong export competition outweighed concerns over ongoing conflict in the Black Sea.

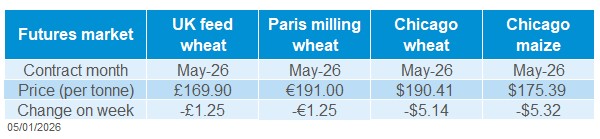

Between 24 December and 2 January, the May-26 contract fell £1.25/t (0.7%) to close at £169.90/t. Chicago wheat and Paris milling wheat futures (May-26) dropped by 2.6% and 0.7% respectively.

Weakening in both the euro and sterling against the US dollar helped soften the declines in European and domestic futures prices.

Favourable conditions in Argentina added to the bearish tone.

The Buenos Aires Grains Exchange has raised its estimate for Argentina’s 2025/26 wheat crop by 0.7 Mt to 27.8 Mt, supported by strong yields as harvest nears completion.

Maize planting is now 84% complete, slightly behind last year’s pace, while 83% of the crop is rated in good or excellent condition, well ahead of the previous year.

In the USA, the USDA is still catching up on reports after the recent government shutdown.

Data released on 31 December for the week ending 18 December showed wheat export sales at 147.8 Kt, towards the lower end of trade expectations.

However, maize sales came in strong at 2.2 Mt, beating forecasts. Meanwhile, dry conditions are forecast to persist in the US Southern Plains, which could lend some support to wheat prices.

In the Black Sea region, SovEcon raised Russia’s 2025/26 wheat export forecast by 0.4 Mt to 44.6 Mt, citing the strong shipment pace (USDA estimate: 44.0 Mt).

Meanwhile, Ukraine’s wheat exports remain slow, with 7.91 Mt shipped so far this season, down from 9.78 Mt at the same point last year.

Reports of fresh Russian attacks on the Ukrainian capital today could stall ongoing peace talks and heighten tensions, keeping the Black Sea region firmly in focus for markets (LSEG).

UK delivered cereal prices

The AHDB delivered cereals survey will recommence publication this Friday (9 January 2026).

Rapeseed

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures decreased between 24 December and 2 January and fell well below the 20-day moving average.

The strong support level of £400/t has broken down, with a new support level at £385/t.

The RSI fell from 25 to 19, indicating a strong downward trend and an oversold condition. This situation could lead to a short-term price correction.

Find out more about the graphs in this report and how to use them

Market drivers

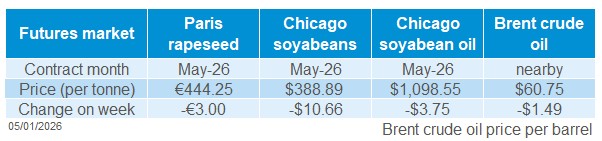

Paris rapeseed futures (May‑26) fell by €5.75/t (1.3%) on 2 January 2026 (compared to the close on 31 December 2025) to a twenty-one-month low of €444.25/t.

The price of new crop rapeseed futures (Aug-26) also fell, closing at €433.00/t, €11.25/t lower than the old crop futures (May-26).

Following this sharp decline, the Paris rapeseed futures market is attempting an upside correction at the start of the current week. Its movement is partly supported by the weaker euro against the US dollar.

Prices of US soyabeans and Canadian canola are under pressure due to uncertainty surrounding demand from major importers and a downward trend in crude oil prices.

Forecasts for global rapeseed production in the 2025/26 season indicate a record level of 94.2 Mt by LSEG (USDA WASDE December forecast 95.3 Mt), driven by strong yields in the EU-27, Canada and Australia.

Global rapeseed production is set to outpace consumption, resulting in increased ending stocks and downward pressure on prices.

The price of crude oil is currently being influenced by many unpredictable geopolitical concerns, especially in Venezuela and Iran.

The supply of crude oil from Venezuela is difficult to predict following the arrest of President Nicolás Maduro this weekend.

The $60/barrel level is now providing a strong support level for nearby Brent crude oil futures prices. If prices fall below this level, it will put additional pressure on the global oilseed complex.

USDA released the payment details for the Farm Bridge Assistance program last Wednesday, with soyabeans getting a $30.88/acre ($76.3 /hectare) one-off payment.

For now, it’s difficult to estimate the influence that this news will have on the US soyabean market, but it could affect farmers' decisions about the area to be planted in 2026.

The winter rapeseed crop in Europe is not currently causing any concerns, which is also putting pressure on the 2026 crop futures prices.

UK delivered rapeseed prices

The AHDB delivered cereals survey will recommence publication this Friday (9 January 2026).

Extra information

Jason Pole provides an overview of sowing-date information in the winter wheat recommended list in this new article.

Based on information presented at AHDB's Agronomy conference in late 2025, he also highlights the risks associated with very late sowings.

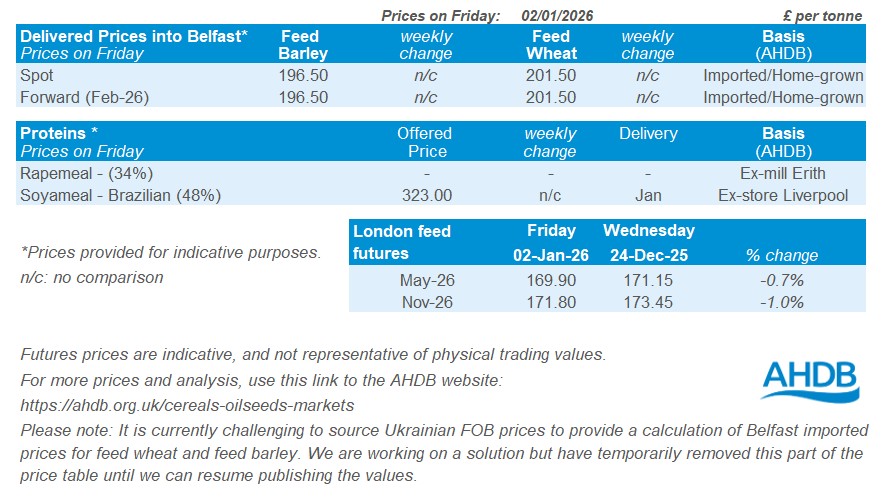

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.