Arable Market Report - 05 December 2022

Monday, 5 December 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

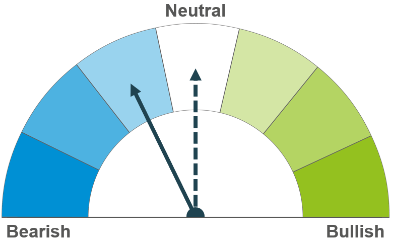

Competitive Black Sea supplies pressure global prices short-term. Recessionary concerns and questions over Chinese demand add to this pressure, remaining key areas to watch for longer-term direction too, in a tight global supply market.

Weakness in wheat markets and demand concerns are factors weighing on markets short-term. However, a tight global supply and demand balance supports historically elevated prices. Argentinian weather remains a key supply watchpoint longer term.

Barley markets continue to follow the wider grain complex. Prices remain supported by tight global supply and demand.

Global grain markets

Global grain futures

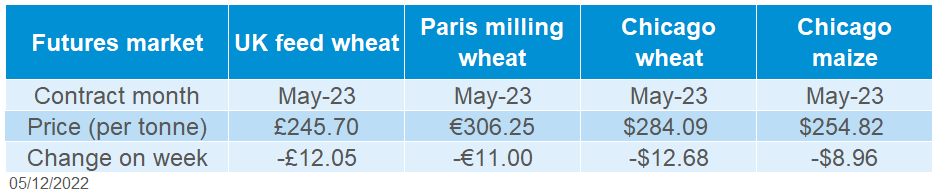

Global grain markets felt pressure last week, due to competitive Russian wheat weighing on wheat markets, and concerns for Chinese demand following COVID-19 restrictions. For maize, demand questions remain due to lower-than-expected US biofuel blending mandates.

With the Black Sea grain corridor renewed and a record Russian wheat crop projected for this marketing year (2022/23), Black Sea supplies continue to pressure global prices due to their competitiveness to European and US exports in global tenders. On Wednesday last week, Algerian state grains agency OAIC purchased between 450-500Kt of milling wheat, expected to be sourced from countries including France, Germany, Bulgaria, and Russia. Today, Pakistan’s finance ministry has approved the import of 450Kt of Russian wheat across February and March.

The US Environmental Protection Agency also surprised markets last week by proposing smaller than expected increases to US biofuel blending mandates over the next three years. This means demand may not reach as high as previously expected.

Adding to demand concerns for maize, US maize exports for the current marketing year (2022/23) are down over c.40% (to week ending 24 Nov) from last season, with sales down 51% compared to this point last year.

Chinese demand for grains remains a key watchpoint due to COVID-19 measures. Though some easing of restrictions is expected following recent protests.

Argentinian wheat production is now forecasted at 12.4Mt for the 2022/23 season, down nearly 45% on the year, impacted by recent dry weather (Buenos Aires Grain Exchange). Maize plantings are underway at 25.5% area planted to 30 November, down 5.7 percentage points (pp) on the year before and 13.9pp on the 5-year average (Buenos Aires Grain Exchange). But weather remains a watchpoint. Key producing regions Cordoba and Buenos Aires are forecasted to receive less than 2.5 inches of rainfall in most places, over the next week.

According to UkrAgroConsult, just under half of Ukrainian maize will remain in fields over the winter months. With area seeded projected to be just 4.56Mha for 2022/23, nearly 1Mha less than last season. Something to watch closely.

UK focus

Delivered cereals

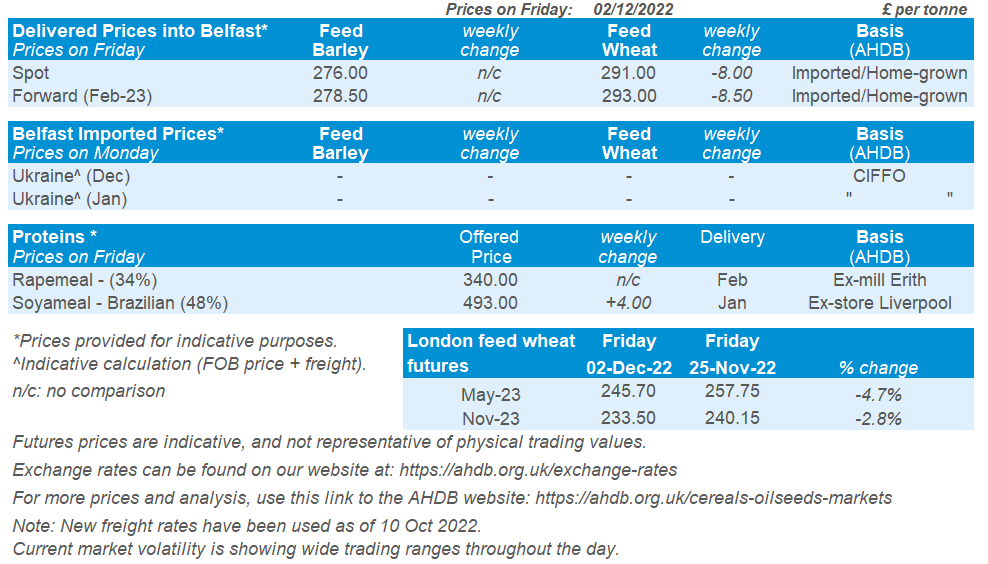

UK feed wheat futures tracked global markets down last week, with the nearby UK feed wheat contract closing at its lowest point (£240.20/t) since 25 February on Friday. The May-23 contract closed at £245.70/t on Friday, down £12.05/t Friday to Friday. The Nov-23 contract was down £6.65/t over the same period, closing at £233.50/t on Friday.

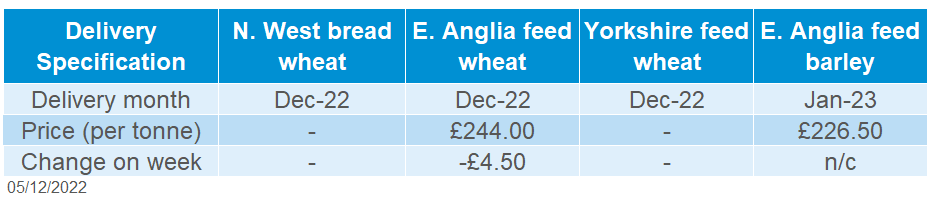

UK delivered prices followed futures market movements (Thursday-Thursday). East Anglian feed wheat for December delivery was quoted at £244.00/t on Thursday, down £4.50/t on the week.

Bread wheat, for February delivery into Northamptonshire, was quoted at £307.00/t on Thursday.

On Friday, the first GB crop development report for the 2022/23 season was published with data up to 29 November. Almost all winter crops have now been planted. The recent moisture, and mild conditions over autumn, have enabled quick crop emergence and development. Generally, crops are faring well for this time of year. 87% of UK winter wheat was in good-excellent condition, up 3pp on the same time last year. For a full crop breakdown, and information on pest and disease, follow this link.

Oilseeds

Rapeseed

Soyabeans

Rapeseed prices have been drifting lower since the start of November. On-going exports out of the Black Sea have been easing supply concerns. Longer-term, the market is well supplied and will be largely influenced by soyabeans.

US biofuel mandates pressure market sentiment due to curbed demand. Chinese demand is also a watchpoint over coming months. Longer-term, large South American soyabean crops are expected – however Argentina’s drought concerns remain a critical watchpoint.

Global oilseed markets

Global oilseed futures

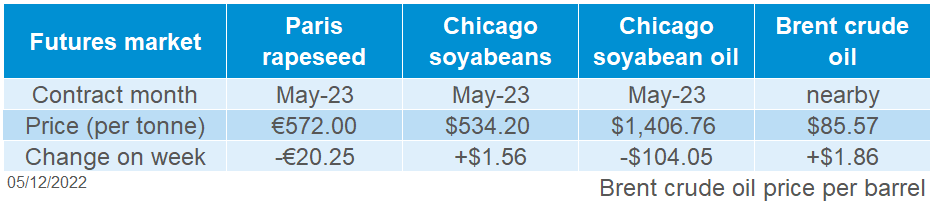

Marginal support across the week for Chicago soyabean futures (May-23) as the contract closed Friday at $534.20/t, up 0.3%. This was despite the large selloff on Thursday in response to the news of the US Environmental Protection Agency proposed US biofuels blending mandate requirements over the next three years. These were smaller-than-expected, pressuring both soyabeans and soy oil.

This filtered into other vegetable oils such as Malaysian palm oil futures (Mar-23) which were down 4.5% across the week. A stronger ringgit against the US dollar further added to pressure.

Potential underpinning factors for oilseed markets currently, are signs that China are easing COVID-19 restrictions over public protests. There have been reports of easing testing requirements and quarantine rules in some Chinese cities, as there is anticipated shift in national policies (Refinitiv).

Key watchpoint for the oilseed complex currently is Argentina’s weather. Prolonged dry weather has left one third of early planted soybeans in Argentina’s core farming region (northern Argentina) in regular to poor conditions. Further to that, plantings are estimated at 29.1% complete, to 30 November. This is significantly behind the same point last year and the 5-year average, which were at 48.2% and 50.2%, respectively. Towards the end of this week, rains are expected in the northern part of the country. Though, this is minimal and further rains will be required, this is a key watchpoint currently.

Rapeseed focus

UK delivered oilseed prices

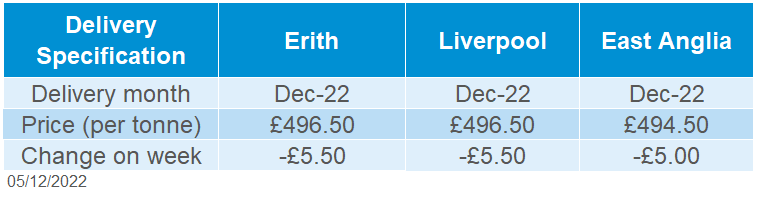

Despite a mix of bearish and bullish news, rapeseed prices felt overall pressure across the week. Paris rapeseed futures (May-23) were pressured from Wednesday despite some early week support. The contract closed at €572.00/t on Friday, down €20.25/t across the week.

Delivered rapeseed (into Erith, Dec-22) was quoted at £496.50/t on Friday, down £5.50/t across the week. Our domestic values did not see the same pressure, due to the survey being undertaken on Friday around 12:00 noon. The May-23 futures contract lost over €10.00/t after this period.

In the latest crop development report released on Friday, GB oilseed rape crops were rated 77% good-excellent at the end of November. This is down slightly from 78% at the same point last year. Drilling of OSR was complete at the end of September. Generally, the crop has established well, though certain areas struggled due to the prolonged dry conditions at the end of summer.

Statistics Canada lowered their canola crop production estimate to 18.2Mt last week, from 19.1Mt in previous reports. This crop was revised down due to dry conditions in parts of the Canadian Prairies. The previous estimate in September was from satellite images, but the current estimate was produced through farm survey conducted in November.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.