Arable Market Report - 04 March 2024

Monday, 4 March 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

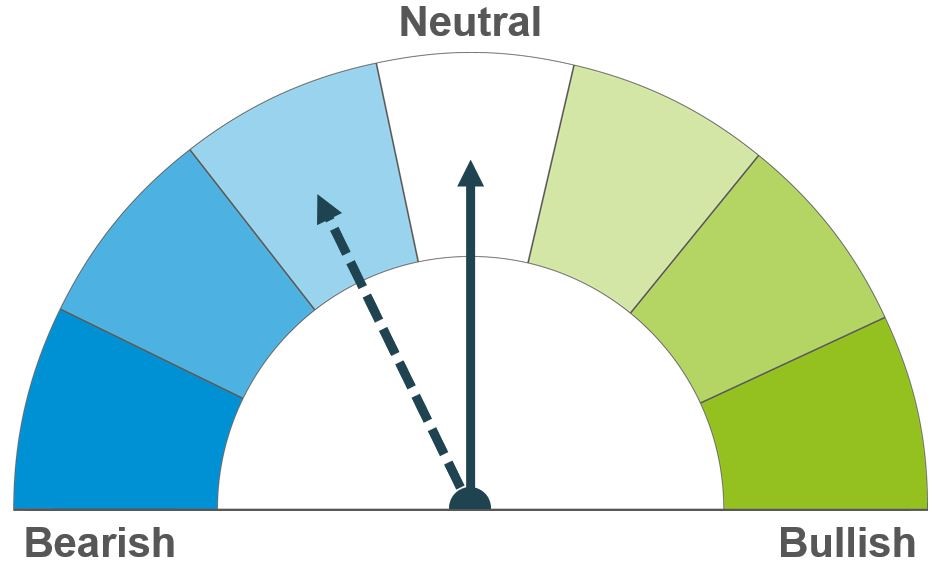

Wheat

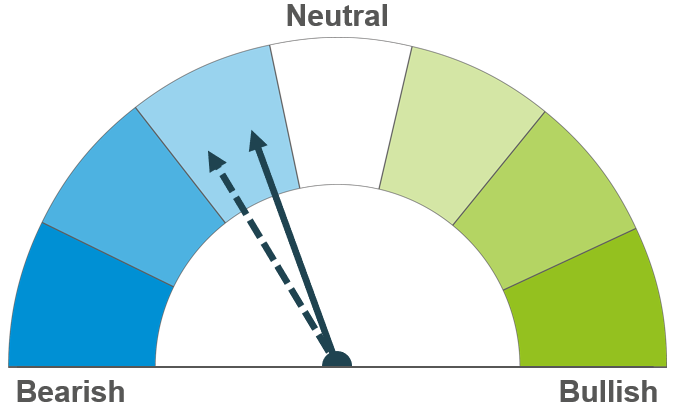

Maize

Barley

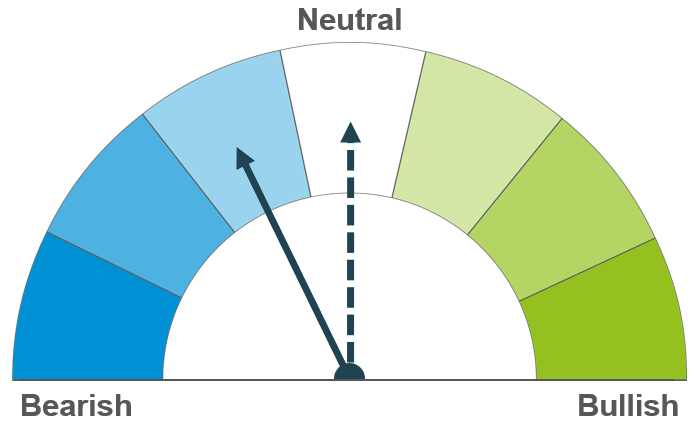

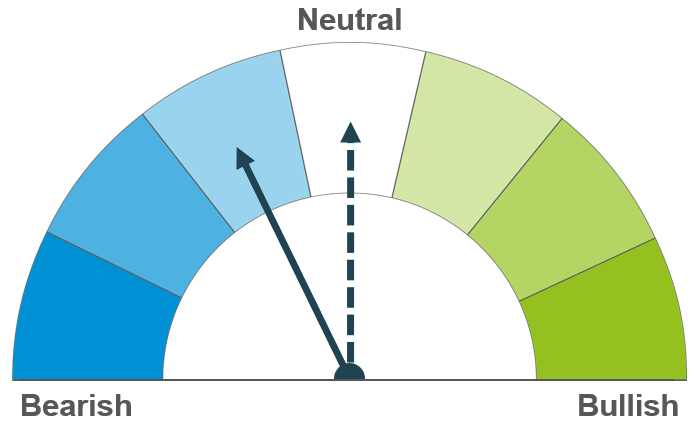

Short-term, ongoing pressure from competitive Black Sea supplies continue to weigh on prices. Longer-term, EU wheat production is expected to fall on the year, and new crop conditions are in focus.

Rapid planting in Brazil is supporting current estimates of heavy maize supplies from South America. Longer-term, these supplies are expected to continue to pressure global prices.

Barley prices continue to track the wider grains complex. Longer-term, the focus is currently on upcoming spring plantings with question marks over the size of next year’s crop.

Global grain markets

Global grain futures

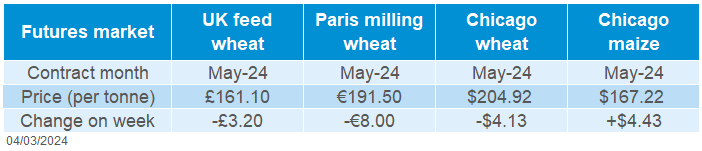

Global wheat markets were overall pressured last week. Chicago wheat futures (May-24) fell 2.0% Friday to Friday. Over the same period, Paris milling wheat futures (May-24) were pressured 4.0%, with ongoing competition from Black Sea supplies weighing on the market. On the other hand, Chicago maize futures (May-24) were supported last week, up 2.7% on the back of bargain buying and short coverings.

China purchased more than 20 cargoes of feed grain from international markets in the past two weeks. The purchases amount to more than 1.2 Mt of grain (Bloomberg). Iranian state-owned animal feed importer SLAL has also issued tenders this morning to purchase 180 Kt of maize, 120 Kt of feed barley and 120 Kt of soyameal for shipment in March and April. Global buying remains a key watchpoint in markets at the moment and could limit any major losses in global prices, though tenders still appear to be relatively minimal.

Black sea supplies continue to weigh on global prices. On Friday, Russian 11.5% protein wheat for April delivery was quoted at $200/t FOB, reinforcing a bearish sentiment. Demand for Ukrainian wheat also remains firm, as exports through the country’s Black Sea shipping corridor continue to flow. According to Ukraine’s Deputy Prime Minister on Friday, Ukraine exported a record 5.2 Mt of agricultural goods through its Black Sea corridor in February (LSEG).

European weather remains in focus as wet soils are proving challenging for winter crops and preparation of spring plantings. Initial forecasts suggest the EU-27 wheat crop will fall 2.5% on the year, while barley output is expected to rise (Stratégie Grains). However, should wet weather persist, current forecasts for wheat, and potentially barley could decline. Read more on this in Thursday’s Grain Market Daily.

Grain markets are still reactive to any updates on South American weather and supply potential. Brazilian maize plantings continue to progress rapidly, as of the week before last, the Safrinha maize crop was 73% planted, compared to 56% at the same point a year earlier. These figures will be updated later today. The Safrinha maize crop area is still uncertain, largely due to lowering maize prices. With the window for planting coming to an end in mid-March, any updates on area will be something to watch out for.

UK focus

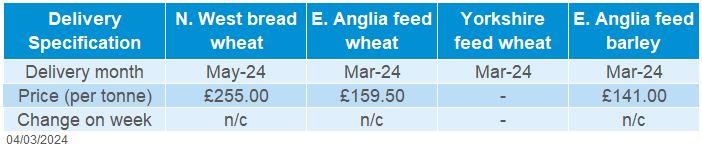

Delivered cereals

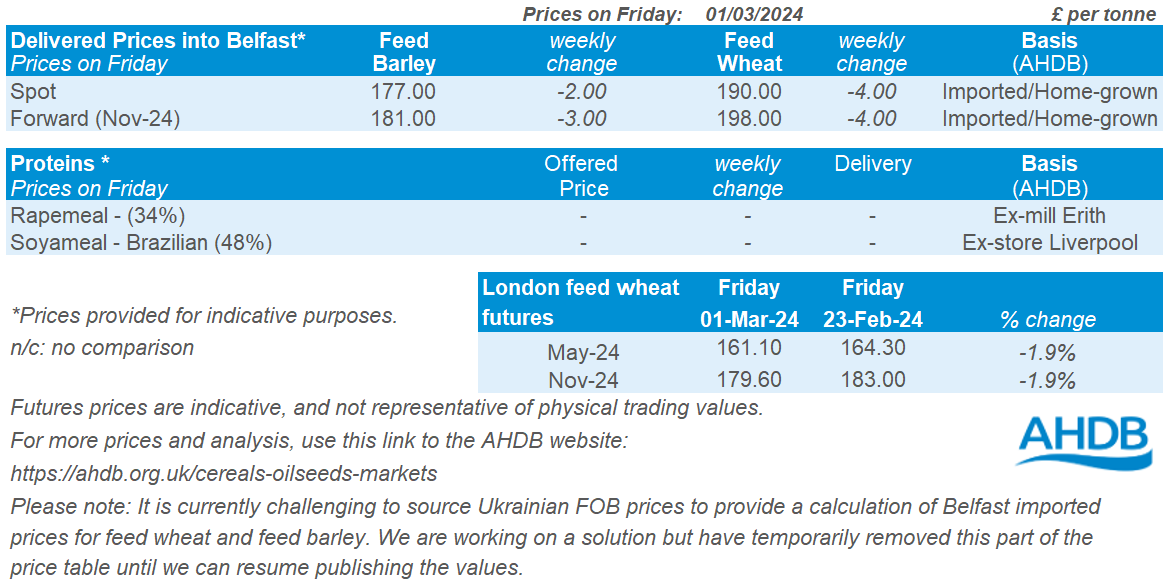

Domestic wheat futures followed global price movements down last week. UK feed wheat futures (May-24) closed on Friday at £161.10/t, down £3.20/t on the week. The Nov-24 contract was down £3.40/t across last week, closing Friday at £179.60/t.

Delivered prices followed futures movements Thursday to Thursday. Feed wheat delivered into East Anglia for March delivery was quoted at £159.50/t, with no weekly comparison. Bread wheat delivered into the North West for May delivery was quoted at £255.00/t, with no comparison on the week.

Delivered feed barley prices remain at a firm discount to feed wheat. Feed barley into East Anglia for March delivery was quoted at £141.00/t on Thursday, an £18.50/t discount to feed wheat. AHDB’s latest GB animal feed production data is due to be released on Thursday, including figures up to end of January, giving us more insight into cereal splits.

After an extremely challenging autumn, AHDB is re-running its Early Bird Survey of planting intentions to capture the potential cropped areas for harvest 2024. These results were originally due for release on Friday 8 March. However, the continued wet weather is making it difficult for farmers to finalise spring planting decisions. In these tough conditions, the survey is being delayed slightly to hopefully allow more plans to be finalised. The results are now provisionally due in mid-March, but we’ll continue to monitor the situation.

Oilseeds

Rapeseed

Soyabeans

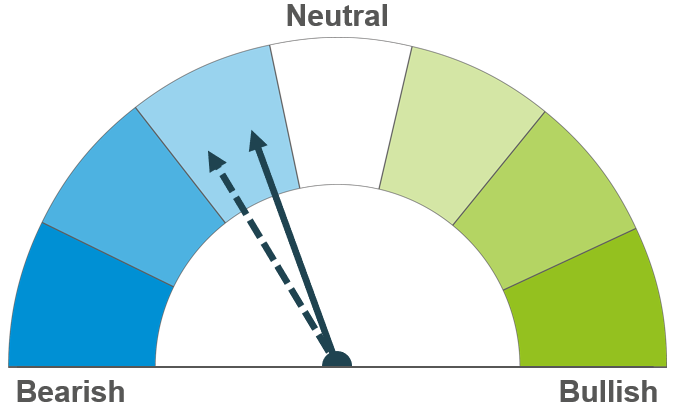

Short-term focus is on EU crop conditions with total EU production expected to reduce year on year. Longer-term, large global soyabean supplies could continue to weigh on the whole oilseed complex.

Short-term bearish outlooks for soyabeans as Brazil’s harvest is on-going. Argentina’s harvest will start next month with large supplies coming to the market and expected to further weigh on prices.

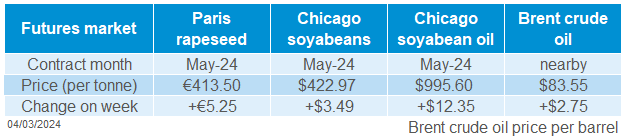

Global oilseed markets

Global oilseed futures

There was support in oilseed markets last week as Chicago soyabean futures (May-24) gained 0.8%, closing Friday at $422.97/t, although marginal, this was the first weekly gain this year for this contract. The market largely tracked sideways throughout the week, as technical buying and short covering supported the market, while the prospects of plentiful South American supplies weighed on the market.

All focus is on the South American soyabean supply coming to the global market, as recently government and private Ag agencies have notably downgraded Brazil’s crop. Ag Rural last week lowered their forecast of Brazil’s 2023/24 soyabean crop to 147.7 Mt, down from 150.1 Mt. Yield losses in key producing areas contributed to this downgrade, this is down considerably from the 164.6 Mt estimated at the start of the cycle.

However, StoneX increased their estimate to 151.5 Mt, up from 150.35 Mt previously forecast. The agency cited that there has been a good amount of rain recently which has benefitted soyabean crops. It was reported last Friday that the soyabean harvest is 46% complete in Brazil, up from 43% at the same point last year (Patria Agronegocios).

Despite the downgrades to this Brazilian crop, many forecasts are sitting around the 150 Mt mark. Further to that, Argentina is expected to produce a sizable crop, with Buenos Aires Grain Exchange keeping their soyabean crop estimate unchanged at 52.5 Mt. Despite a decline in Brazilian output, total soyabean production from these two nations is up on the year – which will continue to weigh, especially when the Argentinian harvest starts next month.

Sizable demand remains absent from the market, especially for US origin. The USDA reported US export sales (to week ending 22 Feb) at 159.7 Kt for 2023/24, this was up noticeably from the previous week, but down 30% from the prior 4-week average. It was also at the lower end of trade estimates of 100 – 600 Kt.

Rapeseed focus

UK delivered oilseed prices

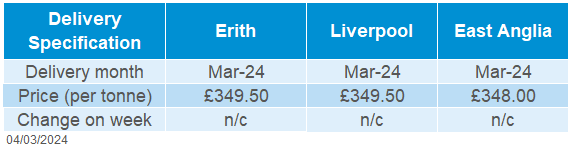

Support in Chicago soyabeans, crude oil and Malaysian palm oil futures filtered into rapeseed prices last week. Paris rapeseed futures (May-24) closed Friday at €413.50/t, up €5.25/t across the week. New crop futures (Nov-24) were also up €6.50/t, closing at €421.75/t on Friday.

Domestic delivered rapeseed into Erith (Mar-24) was quoted at £349.50/t on Friday, with no comparison on the week. Delivery for May-24 was quoted at £351.50/t, down £3.00/t across the week. The domestic delivered prices do not match the futures market movement due to the timings of the survey which is usually conducted mid-morning on Friday.

In its latest oilseeds report, Stratégie Grains revised its forecast for next year’s EU rapeseed production figure to 18.3 Mt, down from 18.4 Mt predicted last month, this is now nearly 8% below 2023 harvest of 19.9 Mt. This decline in production in the EU is likely to result in greater imports, notably from Ukraine and Australia.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.