Arable Market Report - 04 July 2022

Monday, 4 July 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

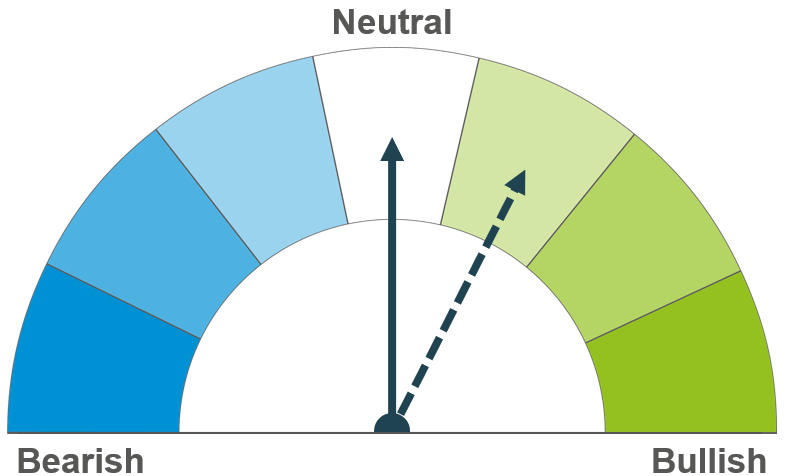

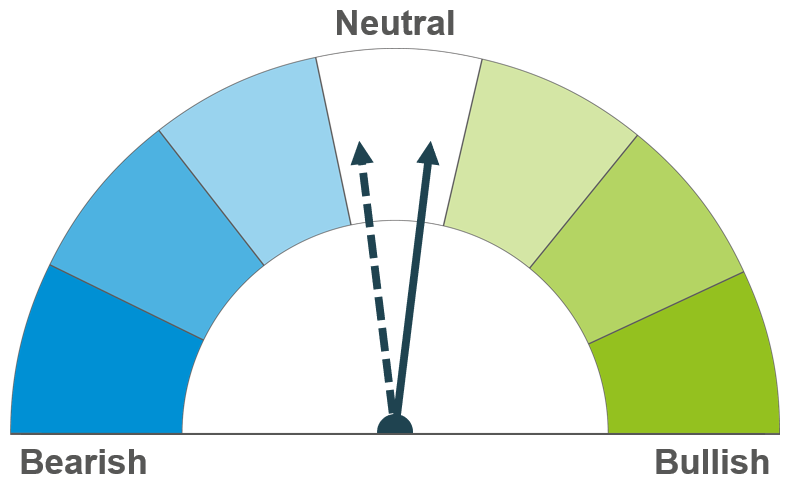

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Northern hemisphere harvests are accelerating, putting pressure on prices. Longer term, the fundamentals remain supportive with a tight supply outlook

While US production looks more optimistic with a higher acreage than anticipated, global supply remains tight. The next few weeks will be critical for crop progression and yield expectations.

Global and domestic balance remains tight and continues to follow the sentiment of international grain markets.

Global grain markets

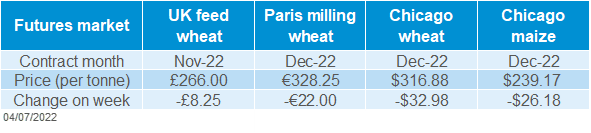

Global grain futures

Global wheat markets fell sharply at the end of last week. US wheat fell to levels seen before the conflict broke out in the Black Sea region at the end of February. Chicago wheat futures (Dec-22) ended the week at $316.88/t, down $32.98/t Friday-Friday.

Last week saw some optimism for Ukrainian grain exporters, as we saw grain shipments begin to flow from the region. This, combined with an accelerating wheat harvest across the northern hemisphere, put pressure on global prices last week.

US prices also felt pressure from a firmer US dollar and some risk-off trading on Friday before the long Independence Day weekend. Chicago maize futures (Dec-22) were down $26.18/t over the course of the week, closing at $239.17/t on Friday.

The global maize market also reacted to the revised US acreage estimates released on Thursday. Maize area was slightly higher than anticipated, also contributing to a less supported maize market. US weather will continue to be a watchpoint this week as the crop heads into the pollination phase, making it sensitive to moisture and temperature stresses.

Global maize markets also lost some support last week after Stonex increased Brazil’s 2021/22 total crop estimate to 119.3Mt, up 2.5Mt from their previous forecast. They also reported that exports for the month of June were at 1.1Mt, 960Kt higher than the previous year’s figure.

UK focus

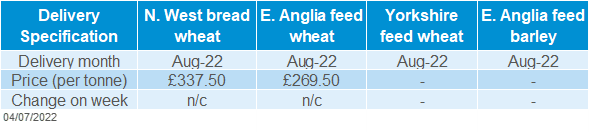

Delivered cereals

In the domestic market, UK feed wheat futures continued to edge lower last week following the global market as Northern Hemisphere new-crop harvests progress.

The Nov-22 contract closing at £266/t on Friday, down by £8.25/t on the Friday before. The May-23 contract closed at £272.40/t, down by £8.35/t during the same timeframe.

For delivered prices, the East Anglia (Hvst-22) price was quoted at £269.50/t, with no comparison on the week. The last price quoted for this location and month was published on 16 Jun at £306.50/t. Delivered harvest prices have shadowed the drop in the global market since this time.

Meanwhile bread wheat prices in the North West (Nov-22) were quoted at £342.50/t, with no comparison on the week. This is at a £66.95/t premium to the UK feed wheat futures based on Thursday’s close (£275.55/t). This price is down on the last published quote (16 Jun) for this location and month which was £377/t, with premiums over feed wheat futures slightly lower at £65.70/t.

Oilseeds

Rapeseed

Soyabeans

Rapeseed prices have been pressured with the wider oilseed complex in the short-term. Long term prices will be more influenced by other oilseeds in the 2022/23 marketing year, along with an anticipated increase in Canada’s canola crop.

Soyabean prices in the short-term will be reactive to U.S. weather, with no great concerns currently. Long-term focus will be on South American planting intentions and whether high input prices will reduce acreage.

Global oilseed markets

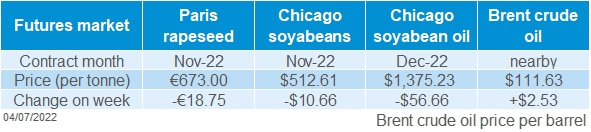

Global oilseed futures

Chicago soyabean futures (Nov-22) ended down $10.66/t across the week, closing at $512.61/t. This contract is now back down to pre-war levels.

The contract was supported over the first half of the week but under pressure in the second half of the week. Oilseed markets fell with the broader commodity markets on technical selling and risk-off liquidation ahead of the long weekend in the US.

Further fuelling the pressure in oilseeds was the continued broader economic stress of recessional fears and pressure in crude oil markets. This seemed to overshadow the US acreage report released last Thursday which estimated soyabean plantings for harvest 22 at 88.33M acres, down 2.63M acres from March’s estimate, and 2.12M acres lower than trade estimates, read more information in Olivia’s Grain Market Daily.

In other oilseed news, Indonesia announced over the weekend that it was considering a larger export quota for palm oil to reduce high domestic inventories. Companies that have sold palm oil domestically will be able to export seven times their domestic sales (Refinitiv).

Also, Russia have also reduced their sunflower oil tax after altering the formula used to calculate it This is to support shipments as the Rouble reaches multi-year highs (Refinitiv).

Over the coming week rains are forecast in much of the U.S. Midwest which could further add to price pressure as U.S. weather is current market focus.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (Nov-22) trended lower last week and closed at €673/t on Friday, down by €18.75/t on the previous week. The May-23 contract closed at €669.75/t, down by €15/t. Rapeseed prices were under pressure in-line with global soya and palm oil markets.

Domestic delivered rapeseed price changes were unable to be published last week due to insufficient quotes to calculate the published average. The last quoted was published on 24 Jun (into Erith, Aug-22) at £566/t.

Tomorrow Canadian principal field crop areas will be released by StatCan. Based on a Refinitiv poll, the trade expects canola plantings to be revised upward to 21.3M acres in this report, up from the 20.9M acres estimated in April.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.