Arable crop production ranges for 2023: Grain market daily

Thursday, 22 December 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £243.50/t, gaining £4.60/t on Tuesday’s close. New crop (Nov-23) closed at £230.50/t, gaining £3.10/t over the same period.

- Our domestic market rose yesterday in line with Paris and Chicago wheat markets. Wheat markets were supported as there is forecast for cold temperatures in the U.S. Midwest, which brings potential of winter kill given there isn’t any snow cover. Over the next three days, it is expected to get very cold but will warm up from Christmas day.

- Paris rapeseed futures (May-23) closed yesterday at €575.00/t, gaining €12.50/t on Tuesday’s close. Rapeseed was supported inline with crude oil markets and soyabeans, given a lack of soil moisture in Argentina which is underpinning the market currently. Although there have been some recent rains, there are questions over how much these crops could be revised down by from the on-going drought in the country.

Arable crop production ranges for 2023

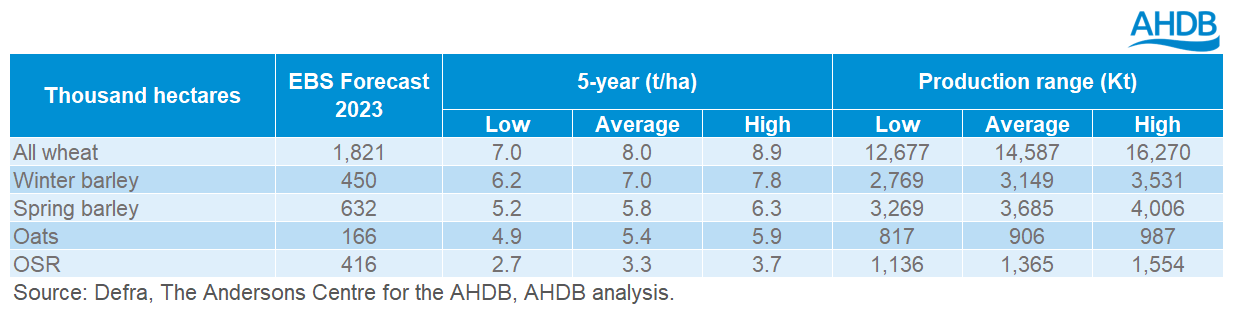

With the full release of the final DEFRA June survey and the Early Bird Survey results, an initial, estimated production range for 2023 harvest can be calculated with the latest planting intentions area and the latest crop yields.

Please note these are indicative production scenarios based on 5-year low, average and high yields (2018-2022). There has not been any large intended area changes for 2023. However, there is reduced area for spring which has just gone into winter cropping and been successfully sown (I will not remind everyone of Autumn 2019).

With winter cropping in the ground, the ultimate driver of production will be the weather as we head into 2023. I won’t bore our readership with the old farming adages such as “Wet and cold May, plenty of corn and hay” but this will not go amiss for aiding large crops, as along as we also have a “flaming June” which brings with it lots of sunshine.

Wheat

The estimated 1,821Kha of wheat sown for 2023 harvest is the highest area since 2016. The associated production scenario shows a large range of 12.7Mt – 16.3Mt for harvest 2023. If five-year high yields of 8.9t/ha are achieved, we could produce over 16Mt. In addition, five-year lows may not be a disaster based on the significant intended plantings and would put the crop at 12.7Mt. This would still be way above the 2020 crop of 9.7Mt.

Barley

Intended total barley area plantings are down 2% year-on-year at 1,082Kha. With the reduction in spring area outweighing the increase in winter. Despite the lower area, the forecasted total winter barley area is well above the previous five-year-average (398Kha) and up 4% on the year.

The estimated total barley production output for 2023 has the potential to range from 6.0Mt – 7.5Mt. The winter barley crop could have the potential to reach 3.5Mt (based on 5-year high yields), which would be the highest crop since 2019.

For spring barley, the estimated intended area has dropped to the lowest since 2012. Even if five-year high yields are achieved this would put the crop at just over 4.0Mt, which would still be the lowest crop since 2018, when spring barley production was impacted by drought.

Oats

With the oat area reducing for 2023, with intended area at 166Kha. This area is still historically high and based on yields has the potential to produce an estimated crop between 817Kt – 987Kt. This will be the first time we have produced a sub 1Mt oat crop in the UK in 4 years and has the potential to be the lowest crop since 2016.

OSR

OSR area continues to see growth for harvest 2023 with the intended area estimated at 416Kha. Although please note that this is intended area and not final harvested area. Further insight into area before harvest will be release in our Planting & Variety Survey.

Currently on paper this intended increase means we have the potential to produce a crop of nearly 1.6Mt if high yields are realised. This would be the highest crop in 4 years but still way below what we domestically produced pre-2019. Even if we recorded record yields in the UK, we would still be net-importers of OSR.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.