Analyst Insight: Will soya drive rapeseed again?

Thursday, 3 September 2020

Market Commentary

- UK feed wheat futures (Nov-20) took a break from recent gains yesterday, closing at £169.25, a fall of just £0.10/t. With the recent gains for the Nov-20 contract a large gap has opened up over the Nov-21 contract. The gap reached £17.35/t at Tuesdays close before narrowing slightly to £16.90/t yesterday.

- Once again, Chicago wheat futures were in the driving seat for global grain markets, with the Dec-20 contract falling by $2.11/t, to close at $205.12/t.

- The next UN FAO Agricultural Market Information System (AMIS) report is due to be published today. Amongst other things, the report which will be the first since July will be watched closely for the impact of US storms on maize and soyabeans, Russian production and Southern Hemisphere crop sizes.

Will soya drive rapeseed again?

We often talk about the relationship between rapeseed and soyabean prices in Grain Market Daily, because soyabeans represent almost 87% of the world’s export trade in oilseeds. This means soyabean supply, demand and prices impact rapeseed prices.

Despite this, the relationship between the two has been somewhat clouded in recent weeks by the overwhelming weakness that we’ve seen in the dollar.

Strong demand for US products be that soya, corn or wheat has dictated a lot of the price direction in global commodities in recent weeks. However, dollar weakness has meant we have not necessarily seen the scale of these movements in domestic markets. Soyabean futures (Nov-20) gained 6.4% across august in dollar terms, but only gained 4.0% in sterling terms.

What has been happening with the dollar?

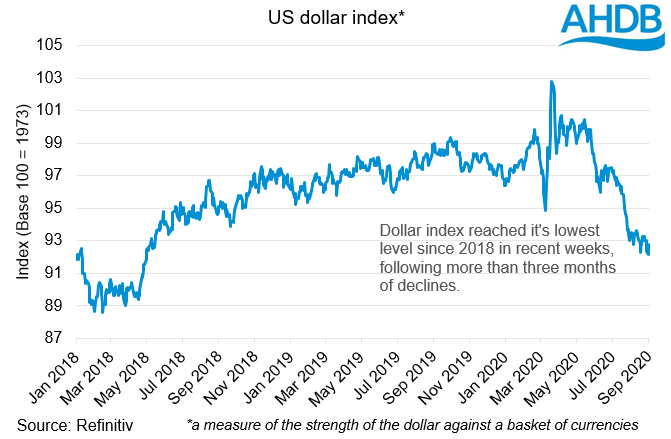

The US dollar has been on a consistently weakening trajectory against both the euro and sterling for the past month due to weak economic growth figures and poor employment statistics. These have been features of the coronavirus pandemic that all developed economies have had and arguably will continue to bear.

The developments in the US economic indicators led the US Federal Reserve Bank to take a more flexible approach to managing inflation and bolstering employment. This approach, which will likely see no raising of interest rates, will keep interest in the dollar limited.

The US dollar index is a measure of the strength of the dollar against a basket of currencies and it reached its lowest point since May 2018 on Monday. The dollar could return to strength if we start to see positive effects from the new policy approach. Equally, short-term strength may come from speculative funds who see the present weakness as an opportunity to buy dollars.

Looking ahead, data is going to be key to the path of the dollar. The US unemployment rate (published on Friday 4 September) and Q2 GDP figure (due at the end of the month) will be watched closely. Alongside this we have to keep in mind the political jousting currently underway as we move towards the US election on 3 November.

What has been happening with soya?

Whatever the dollar does, soya will be an underlying driver of prices for other oilseeds. As I mentioned above, a large part of the strength in US soyabean futures has originated from Chinese import purchases.

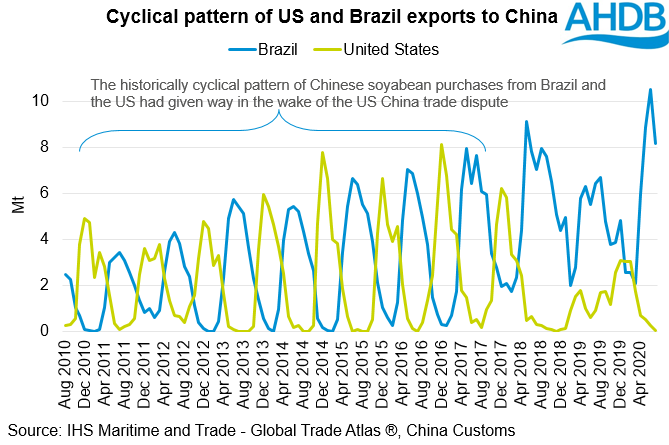

However, history tells us that China will not continue to buy US soyabeans forever, even if China is seeking to build its stocks. Up until the recent China-US trade dispute, Chinese imports of soya followed a largely cyclical pattern moving from US origin to Brazilian.

Brazilian agency Conab estimate an increase of 2.8% in soyabean area in 2020/21 and a record crop of 133.5Mt (a 7.2% increase year-on-year). Of course, it is still very early on in the planting season for Brazilian soya and the picture has a long time for change. But, if we see a large crop and weak Brazilian cash prices we could see the return of the cyclical pattern of Chinese demand. This in turn could reduce support for US soyabean futures in the medium term.

Finally, we cannot ignore the impact of US crop conditions on values. In the latest USDA crop condition report (Monday 31 August) the overall condition of soyabeans was downgraded. The proportion of the crop rated “good” or “excellent” moved from 69% to 66%, this remains ahead of the same stage last year.

A reduction in support for soya, or a firming of the dollar would pressure the soyabean market and likely reduce support for rapeseed. However, if the dollar continues to weaken soya will be supported, but the associated gain in rapeseed could be limited.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.