Analyst Insight: Will dryness in South America support markets?

Thursday, 24 October 2019

Market commentary

- Nov-19 UK feed wheat futures closed up £0.75/t yesterday, at £136.15/t.

- UK feed wheat futures have been under pressure amid Brexit uncertainty and a lack of export demand. The spread between Nov-19 UK feed wheat futures and May-20 has widened throughout October. Since 1 October the spread has grown from £6.20/t to £8.95/t, by market close on 23 October.

- The value of the pound relative to the euro has been holding near to £1=€1.16 over the last week. Currency markets will be watching today’s European Central Bank Monetary Policy Committee briefing closely.

Will dryness in South America support markets?

Dryness during planting in Brazil and Argentina has caused some concern in recent weeks. While there is still time to get crops in the ground without yields being impacted, further delays could cause knock-on impacts into other crops.

Mixed picture for Brazilian soyabeans

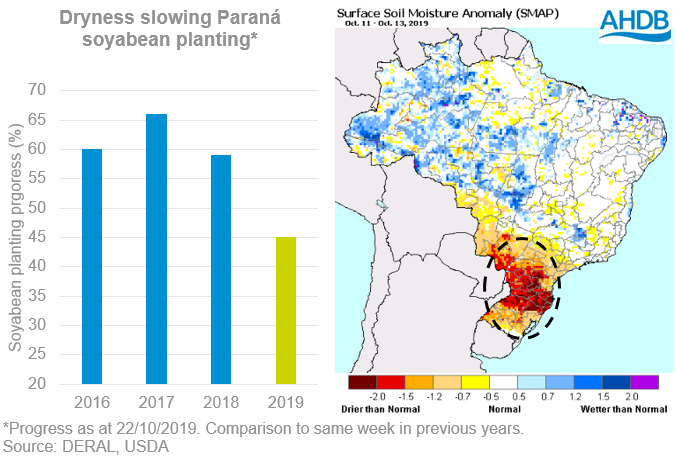

Mixed weather in Brazil has split the picture, with planting progress in the south lagging behind previous years. For those in Mato Grosso, the largest soyabean producing area in Brazil, despite a slow start, planting has caught up to average levels. However, for those in Parana and other southern regions ongoing dryness is hampering efforts to get the crop in the ground.

Paraná has received little rainfall over the past few months with soil moistures remaining depleted throughout the state. As a result only 45% of the soyabean crop is in the ground as of 22 October, 16 percentage points slower than average (2016/17-2018/19). The lack of soil moisture is also likely to prevent some of the planted crop from germinating and it may have to be re-sown later in the season. Similarly in Mato Grosso do Sul plantings have only reached 12%, 32 percentage points below average and 40 percentage points below last season.

If there is adequate rainfall for the rest of the season then there is unlikely to be a negative impact on soyabean yields. However, these delays could push planting of the safrina maize crop, which follows the soyabean harvest, past the optimal planting window.

Dry conditions and elections weigh on Argentinian maize crops

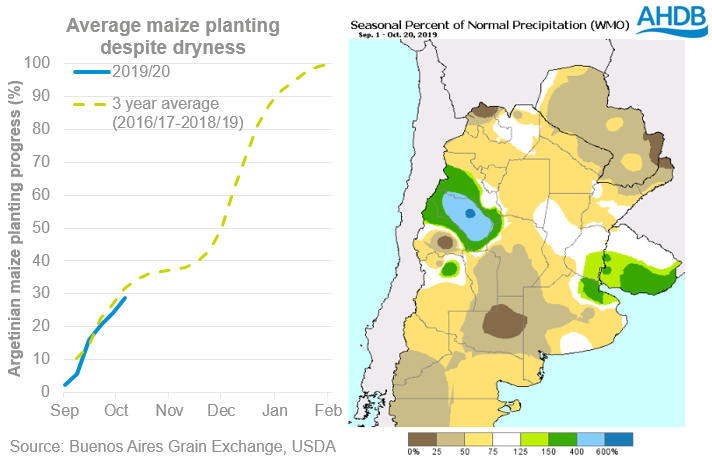

Planting of the maize crop in Argentina has been in line with average so far this season, despite a lack of precipitation in the south of the country. Nationally moisture levels in the early maize crop was rated at 37% dry to poor and 62% favourable to optimal (as at 16 October), according to a report from the Buenos Aires Grains Exchange. The percentage of the crop rated as dry to poor is above the same stage in 2017 (6 %), but below levels in 2018 (49 %).

However, across the Pampas region moisture levels have come in significantly lower with 52-70% of the crop rated as dry to poor. The low level of soil moisture since the start of September is likely to have caused some growers to reduce maize plantings in favour of soyabeans, with soyabean plantings starting in earnest over the next few weeks. As result of this the Rosario Grain Exchange to lower their maize production forecast two weeks ago to 47.5Mt, a 2.5Mt drop from its last estimate.

The current dryness is unlikely to impact yields at this stage and there has been some rainfall over the past two weeks. There is further rainfall forecast moving forward, though the extent to which this can replenish soil moistures is unknown.

Another factor which may reduce maize plantings this season is the current political situation in Argentina. Following the ongoing economic instability, there is an expectation that Mauricio Marci, the current president, will not win for a second term in government in the ongoing elections.

The current frontrunner is Alberto Fernández of the centre-left Justicialist Party. Should Fernández win the presidential race there is an expectation that his government will increase taxes on maize exports. The risk of a reduced returns for growers could incentivise a further shift away from maize to soyabeans, which are viewed as a “safe crop”.

Watch out for rain

Current conditions across South America are unlikely to impact yields at this stage and further rainfall in the region is likely to dampen support for markets. As harvests in the Northern hemisphere come to a close, markets will be increasingly driven by conditions in South America. Keep an eye out for future Grain Market Daily’s to stay updated on how conditions are shaping up during key yield formation phases.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.