Analyst Insight: Where next for rapeseed prices?

Thursday, 6 February 2020

Market Commentary

- UK feed wheat futures, both old and new crop, gained for the third consecutive day yesterday. Markets continue to follow the growth in global grain markets. May-20 futures closed up £1.25/t, at £153.75/t. Meanwhile, Nov-20 gained £1.15/t, to close at £161.85/t.

- The recent run of declines had seen both the May-20 and Nov-20 contracts move below their respective 20 and 50 day moving averages. Yesterday, gains pushed both markets back over the 50 day average.

- Global wheat markets have been supported by a couple of factors in the last couple of days. Two of the primary drivers have been weakness of the euro against the dollar, and strong French export demand. According to Refinitiv, French exports of soft wheat in January were a six year high, despite the logistical challenges presented by port strikes.

Where next for rapeseed prices?

A lot of attention has been placed on the impact of coronavirus on markets in the past fortnight, and while this is very relevant at the moment, the impact can belie the long-term direction of markets. In this Analyst Insight I explore the current drivers in the rapeseed market;

- The short term – Coronavirus

- The medium term – geopolitical conflicts, global soyabean trade and EU biofuel imports

- The longer term – decline in EU rapeseed area

Concluding, that while we have some short and medium term bearish factors (coronavirus, geopolitical conflicts, and EU biofuel imports), the longer term decline in the EU rapeseed area will keep rapeseed supported to an import ceiling.

Read on if you want to know more on these drivers, if not, click here to see what prices are doing today.

How coronavirus is affecting your rapeseed price?

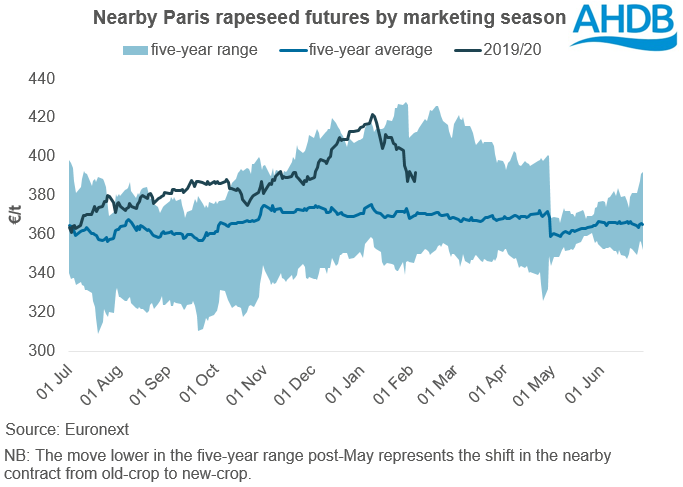

Over the past fortnight there has unsurprisingly been a lot of media and market attention on the impact of coronavirus. It is often difficult to draw links between such major global events and the domestic market. However, since the first reported death from coronavirus (11 January 2020) the Paris rapeseed futures market (May-20) have lost €34.25/t, to close on Monday 3 February at €387.25/t.

The 8.1% fall in the value of Paris rapeseed futures since 11 January is mirrored in the 11.2% in the Shanghai Stock Exchange (SSE). The drop in the SSE has taken time to filter through, with the Chinese lunar year pausing markets from 23 January to 3 February. However, the move is still significant.

Following the end of the lunar year break, China announced its biggest asset purchase since 2008. The asset purchase is akin to quantitative easing seen in the UK. Asset purchases devalue the Chinese renminbi, increasing the supply of money within the economy at a time when demand is leaving the renminbi. The Chinese stimulus is supposed to support growth by increasing funds for government investment. While this will take some time to occur, and likely support the SSE going forward, the immediate impact will see a selloff in Chinese currency based stocks.

What does this have to do with my rapeseed price?

A very relevant question – China is one of the world’s leading consumers of vegetable oils. Shifts in the value of China’s Dalian Commodity Exchange (DCE) futures for palm oil and soyabean oil often have major ramifications for the global price of the commodities.

As such a move lower in the DCE as a result of coronavirus and the subsequent government intervention in markets (asset purchasing) will pressure the vegetable oil market. With oil the predominant driver of the rapeseed crush margin, a move lower in vegetable oils will move rapeseed prices lower.

What else is driving my rapeseed price?

As crucial as it is, coronavirus is just a small part of what’s driving oilseed prices. Ongoing political discourse between the EU and Indonesia over dumping of palm oil, and between India and Malaysia over Muslim rights, have pressured oilseed prices following supply and demand related tightness.

Soyabean trade and production will also be pivotal to movements in the next couple of months. Soyabean markets will more than likely track the path of export sales between the US and China closely over the remainder of the season. The Brazilian soya harvest is currently off the pace of previous years owing to late crop development that said yields so far are reportedly positive.

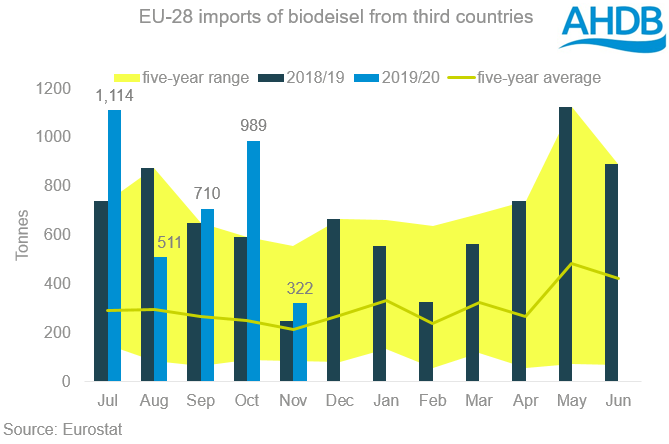

Finally, from an EU perspective, imports of biofuel are pivotal to the direction of rapeseed prices. So far this season, cumulative EU-28 biodiesel imports are ahead of last season, which was a record year. Imports will need monitoring in relation to price direction going forward.

But, you said there was long term support for rapeseed?

Markets are very reactive and the direction of support will move multiple times during the season. That said, there could still be some longer term rapeseed price support. The rapeseed crop in the EU and UK is expected to be small once again in 2020/21, this will likely lend support to the physical market next season.

The extent to which the domestic rapeseed tightness supports prices will depend on production in Ukraine, Canada and Australia. With the EU rapeseed market moving to import parity, physical prices in Ukraine will set the tone for EU prices next season.

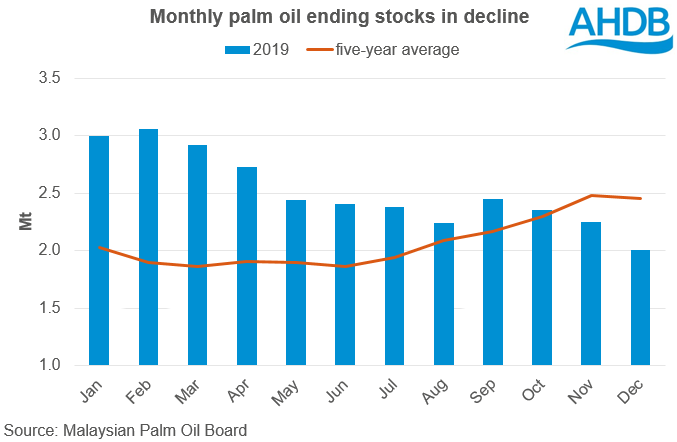

Away from rapeseed markets, there are expectations that tightness in palm oil is not yet over. The length of the current political disputes will be key to the shape of demand, but supplies are also something to watch. According to the Malaysian Palm Oil Board (MPOB) the area of palm plantations is up 0.9% year-on-year, with the immature area growing by a greater percentage than the mature area.

Demand for vegetable oils is relatively exponential and if we continue to see the growth continue, then we will need to see a greater increase in area to support demand.

With all of this taken into account, it is possible that the short-term downward move in prices is a blip in their longer term supported trajectory.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.